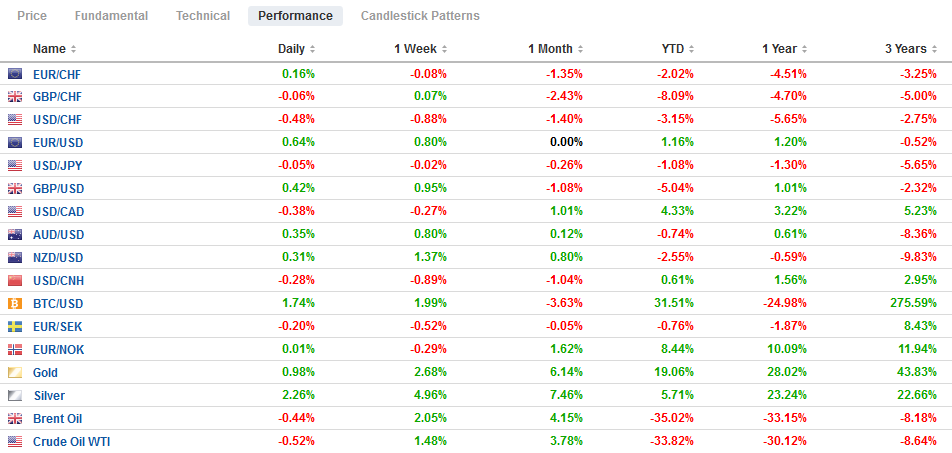

Swiss Franc The Euro has risen by 0.12% to 1.063 EUR/CHF and USD/CHF, July 8(see more posts on EUR/CHF, USD/CHF, ) Source: markets.ft.com - Click to enlarge FX Rates Overview: The S&P 500’s longest advance this year was stopped seemingly as concern that the flare-up in the virus will slow the recovery. The sell-off in airlines and hotels helped spur a broader bout of profit-taking. Most Asia Pacific bourses advanced, led by the continued rally in Hong Kong and China. Europe’s Dow Jones Stoxx 600 is posting its first back-to-back decline in nearly a month. Benchmark yields are mostly 1-2 bp softer, but China and the US are exceptions. China’s 10-year yield is pushing above 3%, while the US yield is slightly higher near 65 bp. The dollar is posting minor losses

Topics:

Marc Chandler considers the following as important: 4.) Marc to Market, 4) FX Trends, Brexit, Currency Movement, EUR/CHF, Featured, FX Daily, hkd, HKMA, Japan Current Account n.s.a., Japan Gross Domestic Product, U.K., USD, USD/CHF

This could be interesting, too:

Nachrichten Ticker - www.finanzen.ch writes Die Performance der Kryptowährungen in KW 9: Das hat sich bei Bitcoin, Ether & Co. getan

Nachrichten Ticker - www.finanzen.ch writes Wer verbirgt sich hinter der Ethereum-Technologie?

Marc Chandler writes March 2025 Monthly

Mark Thornton writes Is Amazon a Union-Busting Leviathan?

Swiss FrancThe Euro has risen by 0.12% to 1.063 |

EUR/CHF and USD/CHF, July 8(see more posts on EUR/CHF, USD/CHF, ) Source: markets.ft.com - Click to enlarge |

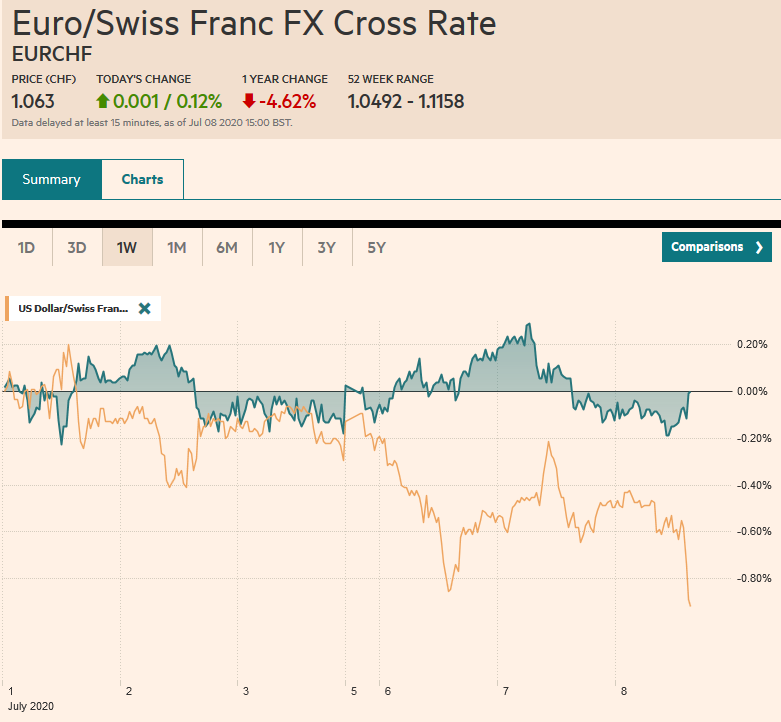

FX RatesOverview: The S&P 500’s longest advance this year was stopped seemingly as concern that the flare-up in the virus will slow the recovery. The sell-off in airlines and hotels helped spur a broader bout of profit-taking. Most Asia Pacific bourses advanced, led by the continued rally in Hong Kong and China. Europe’s Dow Jones Stoxx 600 is posting its first back-to-back decline in nearly a month. Benchmark yields are mostly 1-2 bp softer, but China and the US are exceptions. China’s 10-year yield is pushing above 3%, while the US yield is slightly higher near 65 bp. The dollar is posting minor losses against most of the major currencies in the European morning but largely confined to yesterday’s ranges. The Antipodean currencies and sterling are underperforming. The Mexican peso and South African rand are leading most of the emerging market currencies higher, though Turkey, India, Taiwan, and several central European currencies are nursing small losses. Gold is pushing above $1800 for the first time in nine years. Rising inventory (API estimated 2 mln barrel increase) and concern that the coronavirus will reduce demand faster than supply, weighs on oil prices for the third day. Losses are minor but a break of the $40-level could spur more selling. |

FX Performance, July 8 |

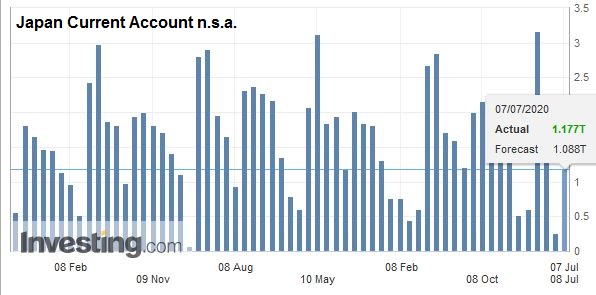

Asia PacificJapan reported May’s current account. It was in line with expectations with a surplus of 18 almost JPY1.18 trillion. Contrary to what appears as conventional wisdom, the Japanese current account surplus is not driven by its trade balance, which in deficit for the second consecutive month and the third this year. It is not simply the pandemic, as Japan had a trade deficit on a balance-of-payments accounting basis in six months last year too. The key is Japan’s primary income (return on investments–dividend, interest, profits, etc). Separately, Japan reported strong lending and deposit growth as businesses draw down credit lines and the government’s two lending programs (~JPY90 trillion). |

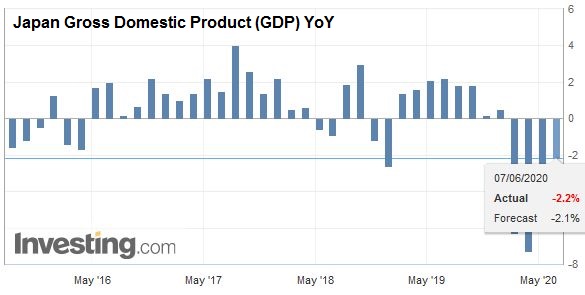

Japan Gross Domestic Product (GDP) YoY, Q1 2020(see more posts on Japan Gross Domestic Product, ) Source: investing.com - Click to enlarge |

| The more provocative talking point today comes from reports that suggest the US may consider efforts to undermine the Hong Kong dollar peg in light of China’s new national security laws. Apparently, it was discussed at the State Department, not Treasury. It appears to be a relatively low-level discussion when brainstorming often generates ideas that will be rejected. Still, that it is not clear why it was leaked to the press. Most observers seemed to dismiss the likelihood and even the practicality. Indeed, investors did not attach much significance to the report and took the Hong Kong dollar higher, forcing the HKMA to intervene to protect the band. It bought the most amount of dollars in its intervention in a month. |

Japan Current Account n.s.a., May 2020(see more posts on Japan Current Account n.s.a., ) Source: investing.com - Click to enlarge |

Australia is going to extend its deferral of loan repayments for up to another four months. Around 10% of mortgages and 15% of small business loans have been deferred. S&P warned that the new shutdown in Victoria pressures its economic recovery. In a couple of weeks, Treasurer Frydenberg will provide a fiscal and economic update that may include a new phase of income support.

The dollar is in about a 30 pip range against the Japanese yen above JPY107.45. There are nearly $3 bln in options that expire today between JPY107.45 and JPY107.55. Yesterday the dollar traded between roughly JPY107.25 and JPY107.80. The Australian dollar peaked a little shy of the $0.7000-mark yesterday. This is the upper end of the range that has prevailed since mid-June. The lower end of the range is closer to $0.6800. A break of $0.6920 could see $0.6880. The PBOC set the dollar’s reference rate at CNY7.0207, while models suggested something closer to CNY7.0230. The dollar stabilized against the offshore yuan after falling below CNH7.0 yesterday for the first time since mid-March.

Europe

The UK is center stage in Europe today. Chancellor of the Exchequer Sunak is expected to unveil a new program (~GBP2 bln) to pay wages for around 200k young workers. Currently, the government is subsidizing the pay of nearly 12 mln workers. In a separate attempt to support the housing market, the government will suspend the stamp tax on transactions of over GBP500k, according to press reports. Over the past week or so, UK’s Treasury has announced initiatives of around GBP4 bln to support green initiatives and job support (e.g., training, outplacement, etc).

UK Prime Minister Johnson reiterated his threat to leave the trade talks with the EU unless it is more willing to compromise. Although fishing rights and the role of EU courts are important issues, the key stumbling block may prove to be ‘equivalence in regulations that protect workers, the environment, and corporate governance. Accelerated talks this month may be helpful, but last week’s negotiations ended early with both sides showing little flexibility.

Next week’s ECB meeting is coming into view. No new initiatives are expected but the debate has reportedly shifted toward the capital key. Past asset purchase programs enjoyed some flexibility around the capital key but were anchored to it. The Pandemic Emergency Purchase Program is considerably looser. This has allowed the ECB greater flexibility in buying peripheral bonds to ensure that its transmission mechanism is working properly. Several creditor countries want to curb this discretion as soon as possible, but do not seem to have a majority.

For the first time this week, the euro has been unable to trade above $1.13 and a 1.9 bln euro option that expires today and another for a billion euros there tomorrow stand in the way. Although the euro is recording lower highs for the second day, it is also recording higher lows. That said, support seems softer than resistance, and a break of $1.1260 could spur a test on the week’s low near $1.1240. Sterling is consolidating today, as well. It reached almost $1.26 yesterday, which is the (61.8%) retracement objective of the decline since the June 10 high a little above $1.28. It met a wall of sellers and is now threatening support near $1.25. Support below there is seen near $1.2465.

America

There is a light economic calendar for North America today. The main feature is the May consumer credit report. After dropping by about $68 bln in April, a more modest ($15 bln) decline in expected. The Fed’s Bostic speaks again, but his views were made clear yesterday. He cautioned that economic activity might be leveling off at a slower than expected pace. Bostic acknowledged that the disruption is lasting longer than many businesses had anticipated, and he encouraged people to focus on the level of economic activity not the change. The change may appear to be more “V” shaped than the level. Mexico President AMLO is in Washington today. A joint statement with President Trump is anticipated but not a joint press conference.

The highlight of the week for Canada will be the employment data on Friday. The median forecast in the Bloomberg survey is for a 550k increase in employment after 290k in May. The unemployment rate is expected to fall back to 12.5% from 13.7%. Mexico’s highlight is tomorrow’s June CPI report. Headline inflation may tick up from 2.84% in May to around 3.2%. The month-over-month core rate is expected to be steady at around 0.3%, which is in line with this year’s average and is little changed from the first five months last year. With the overnight interest rate target at 5%, we still see scope for additional Banxico rate cuts though at a slower pace than H1. Brazil reports May retail sales today. After the 16.8% drop in April, economists project a modest bounce (6%). There may be scope for disappointment as the pathogen continues to slow economic activity. President Bolsonaro has been confirmed with the virus.

The US dollar tested a six-day high near CAD1.3625 in the late Asian turnover and has consolidated above CAD1.3580 in the European morning. It does not appear to be going anywhere quickly. The greenback appears to have carved out a bottom near CAD1.3500, around where the 200-day moving average is found. The upper end of the range seems to be around CAD1.3700-CAD1.3720. Being in the middle of the range suits neither bull nor bear. The US dollar is also consolidating against the Mexican peso. It reached almost MXN22.87 yesterday and has pulled back a bit today to test the MXN22.68 area. Last month’s high was set at the end of the month near MXN23.23.

Graphs and additional information on Swiss Franc by the snbchf team.

Tags: #USD,Brexit,Currency Movement,EUR/CHF,Featured,FX Daily,hkd,HKMA,Japan Current Account n.s.a.,Japan Gross Domestic Product,U.K.,USD/CHF