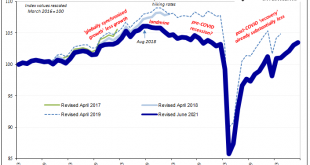

The first time I can consciously remember using the term landmine was probably here in February 2019. I had described the same process play out several times before, I had just never applied that term. There was all sorts of market chaos in the final two months of 2018, including a full-on stock market correction, believe it or not, leaving the inflation and recovery narrative in near complete tatters. All that was missing by then was the economic data to confirm...

Read More »White-Hot Cycles of Silence

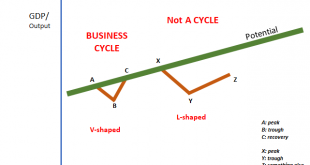

We’re only ever given the two options: the economy is either in recession, or it isn’t. And if “not”, then we’re led to believe it must be in recovery if not outright booming already. These are what Economics says is the business cycle. A full absence of unit roots. No gray areas to explore the sudden arrival of only deeply unsatisfactory “booms.” Every once in a while, however, even the mainstream media meanders closer to the actual economics (small “e”) of the...

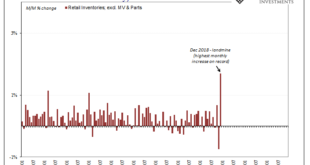

Read More »An Economy Dividing By Inventory And Labor

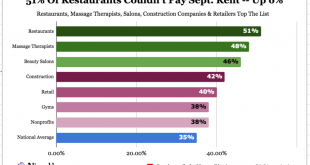

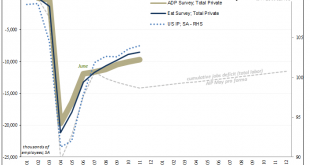

Is it delta COVID? Or the widely reported labor shortage? Something has created a soft patch in the presumed indestructible US economy still hopped up on Uncle Sam’s deposits made earlier in the year. And yet, there’s a nagging feeling over how this time, like all previous times, just might be too good to be true, too. To start with, the rebound from last year’s recession is decidedly, maybe even uniquely uneven. Not just explosive goods sector vs. moribund...

Read More »Revisiting The Last Overhang

One reason why I still believe the US most likely would have entered a recession at some point in 2020 even without COVID wasn’t just the yield curve inversion that popped up several months before then. In August of 2019, the small part of the Treasury curve most people pay attention to (2s10s) did send out that dreaded signal, suggesting already to expect contraction in the intermediate term ahead of then. But there was more to it than that, much moving in the...

Read More »FX Daily, July 20: Doom and Gloom Takes Toll

Swiss Franc The Euro has risen by 0.16% to 1.0846 EUR/CHF and USD/CHF, July 20(see more posts on EUR/CHF, USD/CHF, ) Source: markets.ft.com - Click to enlarge FX Rates Overview: The capital markets have begun stabilizing after yesterday’s dramatic moves. The MSCI Asia Pacific Index did, though, see follow-through selling, and the third consecutive loss saw the benchmark close below its 200-day moving average for the first time in a year. Europe’s Dow Jones...

Read More »Consumers, Too; (Un)Confident To Re-engage

There is a lot of evidence which shows some basis for expectations-based monetary policy. Much of what becomes a recession or worse is due to the psychological impacts upon businesses (who invest and hire) as well as workers being consumers (who earn and then spend). Once the snowball of macro contraction begins rolling downhill, rational prudence dictates some degree of caution on all parts (pro-cyclicality). Bathed in the unearned glow of the Great “Moderation”,...

Read More »US Sales and Production Remain Virus-Free, But Still Aren’t Headwind-Free

The lull in US consumer spending on goods has reached a fifth month. The annual comparisons aren’t good, yet they somewhat mask the more recent problems appearing in the figures. According to the Census Bureau, total retail sales in January rose 4.58% year-over-year (unadjusted). Not a good number, but better, seemingly, than early on in 2019 when the series was putting out 3s and 2s. As has been the pattern in these things, global synchronized downturns, the...

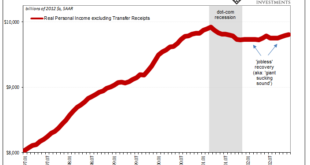

Read More »You Will Never Bring It Back Up If You Have No Idea Why It Falls Down And Stays Down

It wasn’t actually Keynes who coined the term “pump priming”, though he became famous largely for advocating for it. Instead, it was Herbert Hoover, of all people, who began using it to describe (or try to) his Reconstruction Finance Corporation. Hardly the do-nothing Roosevelt accused Hoover of being, as President, FDR’s predecessor was the most aggressive in American history to that point, economically speaking. Roosevelt just took it a step (or seven) further....

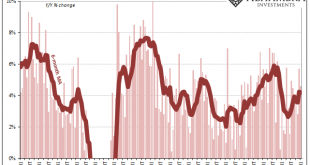

Read More »Focus Is On The Pre-recession Condition

Before the Great “Recession” ended the business cycle as we once knew it, there was a widely accepted concept known as stall speed. In the US, if GDP growth decelerated down to around 2% it suggested the system had reached a danger zone of sorts. In a such a weakened state, one good push, or shock, could send the economy plunging into recession. Any economy which might slow down into a weakened state for whatever reasons becomes susceptible. What might be a minor,...

Read More »Green Shoot or Domestic Stall?

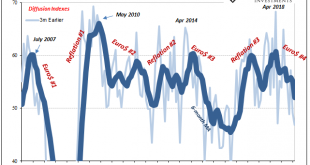

According to revised figures, things were really looking up for US industry. For the month of April 2018, the Federal Reserve’s Diffusion Index (3-month) for Industrial Production hit 68.2. Like a lot of other sentiment indicators, this was the highest in so long it had to be something. For this particular index, it hadn’t seen better than 68 since way back in March 2010, back when the economy looked briefly like it...

Read More » Swiss Economicblogs.org

Swiss Economicblogs.org