In 2019, we wrote about how corporate share repurchases, or “stock buybacks,” had accounted for nearly all buying in the market. A year later, that significant support for asset prices has reversed. While markets have certainly been on a tear this year, due to massive amounts of Federal Stimulus, it has been an advance solely on valuation expansion. While the decline in 2020 earnings was no surprise given the pandemic, earnings were already declining in 2019. The...

Read More »Seth Levine: How I Process Ideas Into Investments

How I Process Ideas Into Investments Investing is incredibly hard. Mapping observations to security price movements are complex. Often, the relationships governing these moves are unknown. Yet, this is the investor’s task. I’ve used this blog as a tool for exploring some of these connections. It’s been incredibly rewarding. Not only has writing brought many of my wrong ideas to light, but it refined my process for constructing an investment portfolio. I now have an...

Read More »Retirement Income Planning Truth with Jim Otar. Part 1.

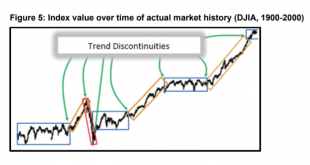

Income is the lifeblood of retirement. In Part 1, wisdom from the early chapters of Jim Otar’s new book about retiree income challenges is explored. A one-person revolutionary. In 2004, I discovered the work of Canadian-based planner and Chartered Market Technician Jim Otar. As a result of his work, I changed my approach to planning. Compared to conventional financial gurus, Jim’s research showcased how stock market cycles changed over time and negatively affected...

Read More »Consumer Mood Darkens On Employment Prospects

A Fed survey of expectations shows that the consumer mood darkens on employment and job prospects. Job Transitions This chart shows the changes in employment status of respondents who were employed four months ago. The Fed survey asks individuals currently employed (excluding self-employment) whether they are working in the same job as when they submitted their last survey. If in the past four months they have answered that they now work for a different employer,...

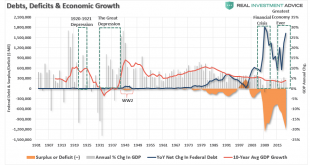

Read More »The Theory Of MMT Falls Flat When Faced With Reality (Part II)

If you missed Part-1 of our series on the “Theory Of MMT Falls Flat When Faced With Reality,” start there. In Part-2, we complete our analysis of the theory and the potential ramifications. The premise of our discussion was this recent explanation of “Modern Monetary Theory” by Stephanie Kelton. As discussed previously, economic theory always sounds much better than how it works out in reality. The reason is that in “theory,” supply and demand imbalances always...

Read More » Swiss Economicblogs.org

Swiss Economicblogs.org