◆ Central Banks Are “Gold’s Greatest Ally” and They Will Push Gold Prices Much Higher Jim Rickards holds gold bar in Zurich vault You’re likely aware of the price action in gold lately. Gold has rallied from ,591 per ounce on April 1 to ,782 per ounce as of today. That’s a 12% gain in less than three months. My earlier forecast was that gold would hit ,776 by the Fourth of July. I guess I was a bit early! Today’s price of ,782 per ounce is the highest since 2012 and a 70% gain from the low of ,050 per ounce at the end of the last bear market in December 2015. The history of gold bull markets (1971–80 and 1999–2011) shows that the most powerful gains come toward the end of the bull market, not at the beginning. That means even if you’ve missed out on the

Topics:

Mark O'Byrne considers the following as important: 6a.) GoldCore, 6a) Gold & Bitcoin, Daily Market Update, Featured, newsletter

This could be interesting, too:

Nachrichten Ticker - www.finanzen.ch writes Die Performance der Kryptowährungen in KW 9: Das hat sich bei Bitcoin, Ether & Co. getan

Nachrichten Ticker - www.finanzen.ch writes Wer verbirgt sich hinter der Ethereum-Technologie?

Martin Hartmann writes Eine Analyse nach den Lehren von Milton Friedman

Marc Chandler writes March 2025 Monthly

◆ Central Banks Are “Gold’s Greatest Ally” and They Will Push Gold Prices Much Higher

Jim Rickards holds gold bar in Zurich vault

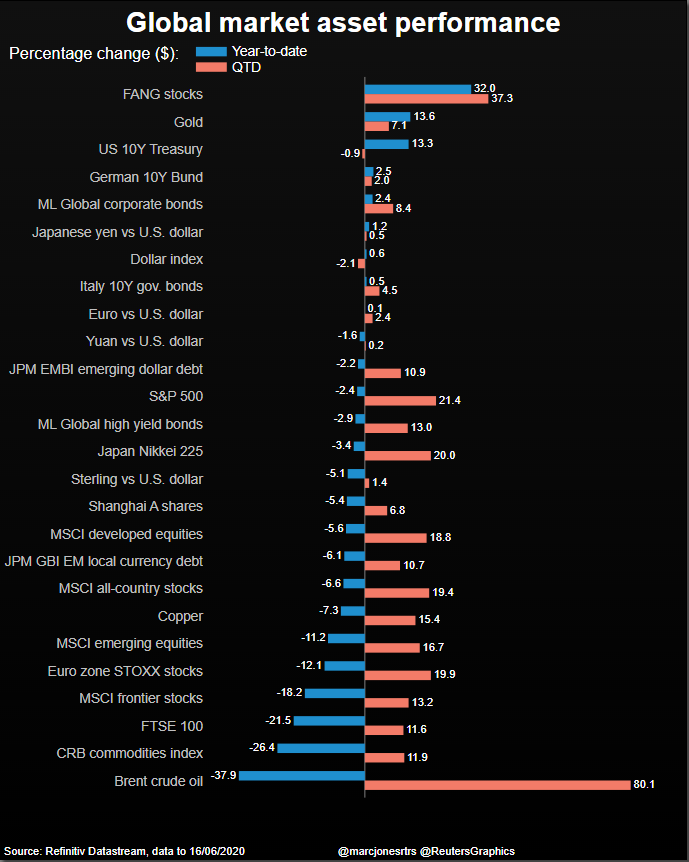

You’re likely aware of the price action in gold lately. Gold has rallied from $1,591 per ounce on April 1 to $1,782 per ounce as of today. That’s a 12% gain in less than three months.

My earlier forecast was that gold would hit $1,776 by the Fourth of July. I guess I was a bit early!

Today’s price of $1,782 per ounce is the highest since 2012 and a 70% gain from the low of $1,050 per ounce at the end of the last bear market in December 2015.

The history of gold bull markets (1971–80 and 1999–2011) shows that the most powerful gains come toward the end of the bull market, not at the beginning.

That means even if you’ve missed out on the gold rally so far, you could still score huge gains as gold trends toward $10,000 per ounce or higher over the next four years.

As I’ve stated on multiple occasions, I didn’t just come up with that number out of the blue or to be controversial.

It’s simply the implied nondeflationary price of gold based on the M1 money supply and assuming it will have a 40% gold backing.

What’s driving this bull market in gold?

It’s not retail investors (apart from a small number who understand the dynamics) and it’s not institutional investors (institutional portfolio allocations to gold are typically about 1–2%).

Instead, the steady buying is coming from central banks (especially Russia and China) and from the super-rich, who typically store their gold in private nonbank vaults in Switzerland and other good rule-of-law jurisdictions.

The drive toward larger portfolio allocations to gold (in some cases up to 10%) is coming not just from the rich themselves but from their wealth managers and portfolio advisers.

This is a sea change.

For decades, wealth managers have rejected gold and pushed their clients into stocks, corporate credit and alternative investments including private equity. Recently all of those portfolio allocations have backfired. Equity markets crashed in March and are set for another fall soon after recovering over half the losses.

Corporate credit downgrades are at an all-time high and that market is being propped up by the Fed in nonsustainable ways. Private equity looks increasingly illiquid as IPO markets dry up and most hedge fund investors have badly underperformed.

Tags: Daily Market Update,Featured,newsletter