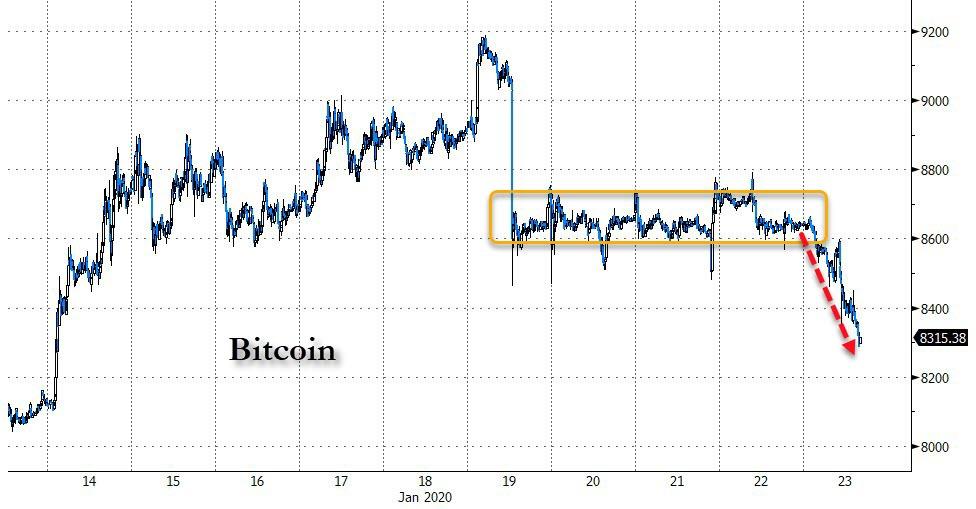

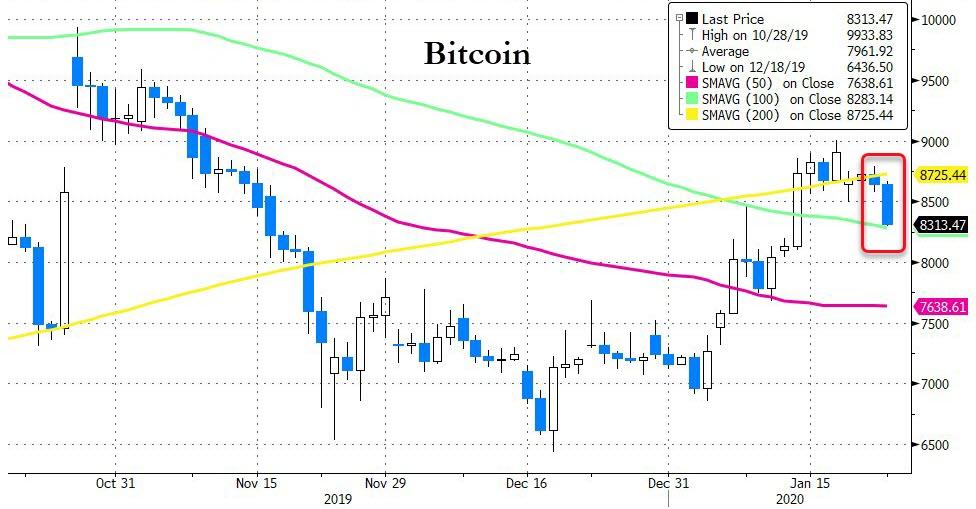

After pushing up to two-month highs over the weekend, Bitcoin is accelerating lower this morning… Bitcoin, January 2020 Source: Bloomberg - Click to enlarge Breaking down from the 200DMA and testing the 100DMA… Bitcoin, 2019-2020(see more posts on Bitcoin, ) Source: Bloomberg - Click to enlarge Cryptos are all lower today (and this week)… Crypto currencies Source: Coin360 - Click to enlarge …but remain notably higher on the year… There was no immediate catalyst for today’s drop but we note that CoinTelegraph’s Andrey Shevchenko reports that Bridgewater Founder Ray Dalio warned against holding Bitcoin, saying that it’s neither a medium of exchange nor a store of value. Crypto currencies, Jan 2020 Source: Bloomberg - Click to enlarge Dalio was

Topics:

Tyler Durden considers the following as important: 6a) Gold & Bitcoin, Featured, newsletter

This could be interesting, too:

RIA Team writes The Importance of Emergency Funds in Retirement Planning

Nachrichten Ticker - www.finanzen.ch writes Gesetzesvorschlag in Arizona: Wird Bitcoin bald zur Staatsreserve?

Nachrichten Ticker - www.finanzen.ch writes So bewegen sich Bitcoin & Co. heute

Nachrichten Ticker - www.finanzen.ch writes Aktueller Marktbericht zu Bitcoin & Co.

| After pushing up to two-month highs over the weekend, Bitcoin is accelerating lower this morning… |

Bitcoin, January 2020 Source: Bloomberg - Click to enlarge |

| Breaking down from the 200DMA and testing the 100DMA… |

Bitcoin, 2019-2020(see more posts on Bitcoin, ) Source: Bloomberg - Click to enlarge |

| Cryptos are all lower today (and this week)… |

Crypto currencies Source: Coin360 - Click to enlarge |

| …but remain notably higher on the year…

There was no immediate catalyst for today’s drop but we note that CoinTelegraph’s Andrey Shevchenko reports that Bridgewater Founder Ray Dalio warned against holding Bitcoin, saying that it’s neither a medium of exchange nor a store of value. |

Crypto currencies, Jan 2020 Source: Bloomberg - Click to enlarge |

|

Dalio was interviewed at the World Economic Forum in Davos, Switzerland, where he advised investors to hold a global and diversified portfolio in this market, while increasing their stake in stock markets. While Dalio acknowledged recession concerns, he argued that “cash is trash” due to the government’s ability to print it at will — something he believes they will be forced to do during a market downturn. Due to this, jumping into cash just before the eventual market fall is ill-advised, according to Dalio. The billionaire still cautions balance, advising investors to hold “a certain amount of gold” in their portfolios. His stance on Bitcoin (BTC) was far more negative, however, noting that it is not currently functioning as money:

He added that the volatility of Bitcoin makes it unattractive for serious investment, while something like Libra could be a better option. Elaborating on his preference of gold as a store of value, he noted that central banks are some of the largest metal holders:

|

Bitcoin and the global economy

Bitcoin is often touted as “digital gold,” a reserve asset independent from government control.

But while many believe in the store of value thesis of Bitcoin, its performance so far has not indicated meaningful correlation with global markets. While it does appear to have slightly positive correlation to gold, the indexes are small enough that they can be attributed to coincidence.

These may still be teething problems due to the relative novelty of cryptocurrencies. As noted by Duke University professor Campbell Harvey, the sample size is still too small. Over thousands of years of history, even gold was not always a reliable safe-haven asset.

Tags: Featured,newsletter