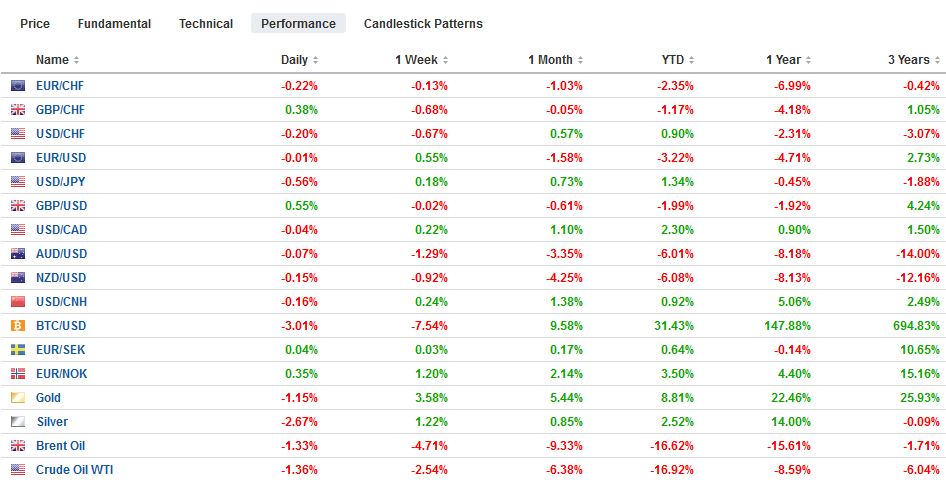

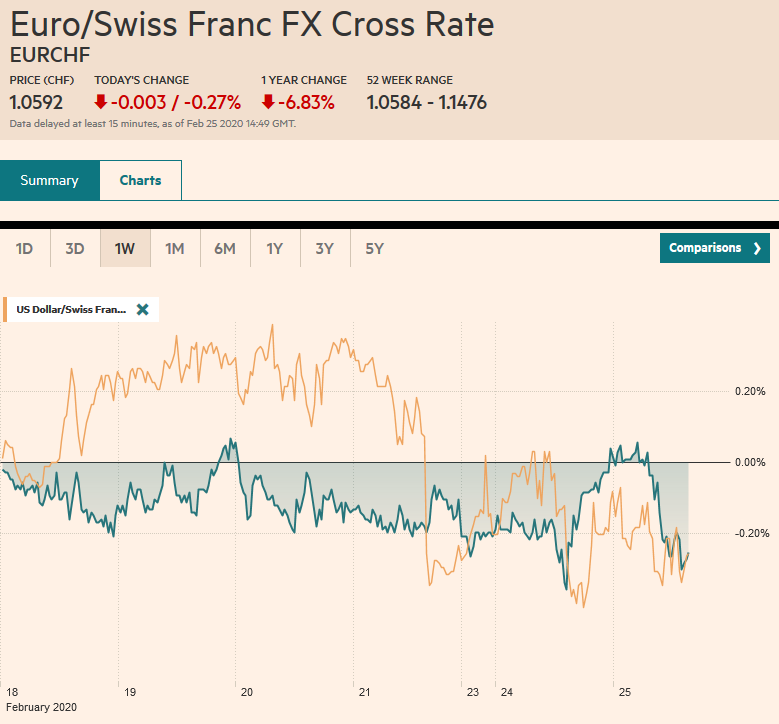

Swiss Franc The Euro has fallen by 0.27% to 1.0592 EUR/CHF and USD/CHF, February 25(see more posts on EUR/CHF, USD/CHF, ) Source: markets.ft.com - Click to enlarge FX Rates Overview: Yesterday’s bloodletting in global equities has calmed, but investors remain on edge. Despite all the concerns that the markets were under-appreciating the implications of the new coronavirus, there is a sense that yesterday’s moves were in excess. Japanese markets, which were closed on Monday, played catch-up today, and the Nikkei shed 3.3%. Australia’s market fell another 1.6% today after a 2.2% slide yesterday, but many of the other regional markets stabilized, including South Korea, Hong Kong, and Singapore. Financials and consumer discretionary are have sent Europe’s Dow

Topics:

Marc Chandler considers the following as important: 4.) Marc to Market, 4) FX Trends, China, coronavirus, Currency Movement, Featured, Germany, Mexico, newsletter, USD

This could be interesting, too:

Nachrichten Ticker - www.finanzen.ch writes Die Performance der Kryptowährungen in KW 9: Das hat sich bei Bitcoin, Ether & Co. getan

Nachrichten Ticker - www.finanzen.ch writes Wer verbirgt sich hinter der Ethereum-Technologie?

Martin Hartmann writes Eine Analyse nach den Lehren von Milton Friedman

Marc Chandler writes March 2025 Monthly

Swiss FrancThe Euro has fallen by 0.27% to 1.0592 |

EUR/CHF and USD/CHF, February 25(see more posts on EUR/CHF, USD/CHF, ) Source: markets.ft.com - Click to enlarge |

FX RatesOverview: Yesterday’s bloodletting in global equities has calmed, but investors remain on edge. Despite all the concerns that the markets were under-appreciating the implications of the new coronavirus, there is a sense that yesterday’s moves were in excess. Japanese markets, which were closed on Monday, played catch-up today, and the Nikkei shed 3.3%. Australia’s market fell another 1.6% today after a 2.2% slide yesterday, but many of the other regional markets stabilized, including South Korea, Hong Kong, and Singapore. Financials and consumer discretionary are have sent Europe’s Dow Jones Stoxx 600 through yesterday’s lows. US stocks are trading slightly firmer but off their best levels. Bond markets are also stabilizing with most benchmark yields little changed, though here too, Japan is playing some catch-up, and the 10-year yield is off four basis points to minus 10 bp. The 10-year German Bund is near minus 50 bp, while the 10-year US Treasury yield is near 1.36%. The dollar is trading with a firmer bias against most of the major currencies. Sterling, the yen, and Swiss franc are edging higher. Emerging market currencies are mixed. The South Korean won is rebounding to recoup most of yesterday’s loss. Russia, which was also on holiday yesterday, sees the rouble lead on the downside with a little more than a 2% loss. Oil is little changed today after the light sweet crude for April delivery tumbled 3.65% yesterday. It is confined to a roughly $51-$52 range so far today. Gold’ s five-day rally is at risk. It closed yesterday’s gap and fell to near $1633 after poking through $1689 yesterday. |

FX Performance, February 25 |

Asia Pacific

China’s clinical trials for Gilead’s drug, which the World Health Organization officials have suggested may be an effective treatment, are underway (~760 people in Wuhan), and the results of the remdesivir drug will be reported in two months. Meanwhile, Moderna is reportedly shipping its first vaccine to US government researchers to study. In Tokyo, Fujifilm shares rallied as the Japanese government praised Avigan tablets as a potential treatment. Separately, Apple reportedly is re-opening half of its stores in China. On the other hand, Hong Kong is extending its school shutdown until mid-April.

South Korea’s central bank meets later this week, and a rate cut expected. Earlier today, it reported, unsurprisingly, that consumer confidence fell sharply this month (96.9 vs. 104.2). The January reading was the highest since June 2018, and the decline brings it back to August 2019 levels. A 25 bp that would bring the key seven-day repo to 1%.

Doubts about yen’s safe-haven status that emerged last week were squashed yesterday as the yen rose sharply yesterday. Recall that the dollar pushed above JPY112 last week, reaching almost JPY112.25. By late yesterday, it was testing JPY110.25, which is a (50%) retracement objective of this month’s rally that began a little below JPY108.50. The greenback has not been above JPY111.05 today, and the next downside target is near JPY109.80. The Australian dollar is inside yesterday’s range, which was inside the pre-weekend range (~$0.6585-$0.6640). This coiling, if that is what it is, tends to be associated with a continuation pattern rather than a reversal. That said, the lower Bollinger Band (set two standard deviations below the 20-day moving average) is near $0.6600 today. The PBOC set the dollar’s reference rate earlier today at CNY7.0232, which was slightly higher than the bank model’s suggested. There is increased speculation that the PBOC will ease policy further as soon as this week, with a cut in reserve requirements seen as the most likely tool

Europe

Germany provided some details to its Q4 19 GDP, which showed that the largest economy in Europe stagnated. Exports fell, and businesses cut capital expenditure by the most in more than three years, and consumption was flat. Government spending edged up 0.3% after a 1.3% increase in Q3 (revised from 0.8%). Economists are forecasting 0.1%-0.2% quarterly expansion in Q1 20.

Separately, the contest to head German’s CDU, and by implication, to replace Merkel, took a turn as the moderate premier from North Rhine-Westphalia Armin Laschet, struck a deal with some of from the more conservative wing of the party, to emerge as the main rival to Merz, a long-time Merkel rival. The jockeying for position will take place over the next two months before a special party conference in late April will make the decision.

Italy is suspending tax payments in the affected areas (10 towns in the Lombardy region and one in Veneto). The government is also spearheading the effort to get banks to suspend mortgage payments in the area. Italy’s economy was stagnating, if not worse before the virus hit. The health emergency will likely trigger clauses in treaties that will allow Italy greater fiscal space. A local paper suggested that 2-4 bln euros may be needed.

The euro recovered from about $1.08 yesterday to reach a seven-day high near $1.0870 in North America. It is in a little more than a quarter-cent range below yesterday’s high. There are three option expires today to note. One is struck at $1.0875 is for almost 820 mln euros. Another is for nearly 570 mln euros at $1.0850. The last is at $1.08 for about 945 mln euros. Initial chart support is seen near $1.0820. Sterling has held below $1.30 for the past three sessions but is knocking on it in late London morning turnover. Still, it requires a move above $1.3050-$1.3070 to signal anything important.

America

The Trump Administration has asked Congress for a supplemental budget of $2.5 bln to combat the virus, including funds for research, manufacturing, and distributing a vaccine. The House of Representatives pushed back, arguing the request was inadequate. Meanwhile, more corporations (e.g., United and Mastercard) are warning of disruptions to revenues. Separately, a report suggested iPhone sales in China fell by 28% in January, and February may be worse. The Port of Los Angeles reportedly has seen a 25% drop in cargoes this month.

Cleveland Fed’s Mester, a voting member on the FOMC, was the latest official to pushback against deepening market expectations for a rate cut. Her words were cautious, and she did not seem to pull ahead of the last month’s statement. The effective average fed funds rate, which is what the futures contract settles at, is steady at 1.59%. The December futures contract is implying a yield of 1.035%. The Fed’s Vice Chairman Clarida speaks toward the end of the North American session and is unlikely to break new ground. Today’s data (house prices, Conference Board’s consumer confidence, and the Richmond Fed manufacturing survey) are unlikely to move policymakers’ or investors’ needle.

The Bank of Canada meets next week (March 4). The market has gradually increased the odds of a rate cut. Recall that the Bank of Canada remained on hold last year while the Fed cuts rates three times. The Bank of Canada has softened its neutral stance and signaled it was prepared to ease policy if necessary. Two weeks ago, the market had about a 10% chance discounted. It now is closer to 30%. US rates have fallen faster, and the 2-year differential is near 10 bp. A week ago it was at five bp. The support to the Canadian dollar offered by the rate differential is offset by the decline in commodity prices and oil in particular, and the risk-off sentiment, illustrated by the equity sell-off.

Mexico will update its assessment of Q4 19 GDP. The risk is that what was once a 0.3% contraction becomes 0.4%. The peso relative strength has not been a function of a booming economy, but of the high real and nominal interest rates that are choking the economy. That means that if the downward revision does materialize, the impact on peso could be marginal. The broader risk appetite is more significant.

The US dollar closed above MXN19.00 yesterday for the first time since mid-December. The carry-trades that favor the peso require a low volatility, which is not the case now, and an unwind is taking place. A trendline from last August, which was violated intraday yesterday, though not on a closing basis, is found near MXN19.10 today. Yesterday’s spike high was near MXN19.26, but the close was near MXN19.07. The US dollar is straddling CAD1.33 today, and hugging yesterday’s high set just shy of CAD1.3310. The month’s high is closer to CAD1.3330, and the high from last October is near CAD1.3350. The US dollar has entered the upper end of its six-month trading range. Unless one felt confident of a cut next week, the risk-reward seems to be moving against the establishment of new CAD shorts.

Graphs and additional information on Swiss Franc by the snbchf team.

Tags: #USD,China,coronavirus,Currency Movement,Featured,Germany,Mexico,newsletter