The response to the virus has added a new mechanism of capital consumption to the many we have documented over the years. Businesses are shut down, yet they continue to incur expenses. There is a popular misconception out there that this is merely a paper loss. One can almost picture a neutron bomb that somehow wipes out only paper, leaving all the physical assets and plant unscathed. It’s a pleasant fantasy. And it’s quite a popular one—not only amongst all the...

Read More »The Economic Singularity, Report 11 Aug

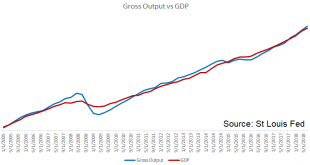

We have recently written several essays about the fallacious concept of Gross Domestic Product. Among GDP’s several fatal flaws, it goes up when capital is converted to consumer goods, when seed corn is served at the feast. So we proposed—and originally dismissed—the idea of a national balance sheet. It’s easy (conceptually) to add up all the assets and the liabilities. But the problem is that the falling interest rate...

Read More »Obvious Capital Consumption, Report 28 Jul

We have spilled many electrons on the topic of capital consumption. Still, this is a very abstract topic and we think many people still struggle to picture what it means. Thus, the inspiration for this week’s essay. Enterprise Car Service Suppose a young man, Early Enterprise, inherits a car from his grandfather. Early decides to drive for Uber to earn a living. Being enterprising, he is up at dawn and drives all day....

Read More »The Fake Economy, Report 21 Jul

Folks in the liberty movement often say that the economy is fake. But this does not persuade anyone. It’s just preaching to the choir! We hope that this series on GDP provides more effective ammunition to argue with the Left-Right-Wall-Street-Main-Street-Capitalists-Socialists. We frame it that way, because nearly everyone loves to tout GDP (though some do so only when it suits their political agenda). It is fashionable...

Read More »What Gets Measures Gets Improved, Report 23 June

Let’s start with Frederic Bastiat’s 170-year old parable of the broken window. A shopkeeper has a broken window. The shopkeeper is, of course, upset at the loss of six francs (0.06oz gold, or about $75). Bastiat discusses a then-popular facile argument: the glass guy is making money (to which all we can say is, “plus ça change, plus c’est la même chose”). Bastiat says it is true, and this is the seen. The glazier does...

Read More »Is Capital Creation Beating Capital Consumption? Report 3 Mar

We have written numerous articles about capital consumption. Our monetary system has a falling interest rate, which causes both capital churn and conversion of one party’s wealth into another’s income. It also has too-low interest, which encourages borrowing to consume (which, as everyone knows, adds to Gross Domestic Product—GDP). What Is Capital At the same time, of course entrepreneurs are creating new capital. Keith...

Read More »Who Knows the Right Interest Rate, Report 3 Feb 2019

On January 6, we wrote the Surest Way to Overthrow Capitalism. We said: “In a future article, we will expand on why these two statements are true principles: (1) there is no way a central planner could set the right rate, even if he knew and (2) only a free market can know the right rate.” Today’s article is part I that promised article. Let’s consider how to know the right rate, first. It should not be controversial to...

Read More »Rising Interest and Prices, Report 13 Jan 2019

For years, people blamed the global financial crisis on greed. Doesn’t this make you want to scream out, “what, were people not greedy in 2007 or 1997??” Greed utterly fails to explain the phenomenon. It merely serves to reinforce a previously-held belief. Far be it from us to challenge previously-held beliefs (OK, OK, we may engage in some sacred-ox-goring from time to time), but this is not a scientific approach to...

Read More »Illicit Arbitrage Cut by Tax Cuts and Jobs Act, Report 3 Sep 2018

This week, we are back to our ongoing series on capital destruction. Let’s consider the simple transaction of issuing a bond. Party X sells a bond to Party Y. We will first offer something entirely uncontroversial. If the interest rate rises after Y buys the bond, then Y takes a loss. Or if the interest rate falls, then Y makes a capital gain. This is simply saying that the bond price moves inverse to the interest...

Read More »Monetary Paradigm Reset, Report 5 August 2018

See the introduction and the video for the terms gold basis, co-basis, backwardation and contango. Explaining a new paradigm can be both simple and impossible at the same time. For example, Copernicus taught that the other planets and Sun do not revolve around the Earth. He said that all the planets revolve around the Sun, including Earth. It isn’t hard to say, and it isn’t especially hard to grasp. Indeed, one of its...

Read More » Swiss Economicblogs.org

Swiss Economicblogs.org