US Dollar rises versus Swiss Franc for the second-day in-a-row USD/CHF testing key 200-day simple moving average and 0.9950. The USD/CHF rose on Thursday, holding firm above 0.9900. The pair peaked on European hours at 0.9947 and then pulled back finding support at 0.9900. The bounced back to the upside unable to challenge daily highs and is trading at 0.9930. The move to the upside was not as strong as earlier today amid a deteriorating sentiment in markets that offered some support to the Swissy. US data had no impact on the Greenback, that posted mix results across the board. “The market sentiment was mixed, remaining sensitive to trade news, while U.S. political uncertainty continued to add noise. The yield on the 10Y UST bond dropped 5 bps after today’s NY

Topics:

Matías Salord considers the following as important: 4) FX Trends, 4.) FXStreet on SNB CHF, Featured, newsletter, USD/CHF

This could be interesting, too:

RIA Team writes The Importance of Emergency Funds in Retirement Planning

Nachrichten Ticker - www.finanzen.ch writes Gesetzesvorschlag in Arizona: Wird Bitcoin bald zur Staatsreserve?

Nachrichten Ticker - www.finanzen.ch writes So bewegen sich Bitcoin & Co. heute

Nachrichten Ticker - www.finanzen.ch writes Aktueller Marktbericht zu Bitcoin & Co.

- US Dollar rises versus Swiss Franc for the second-day in-a-row

- USD/CHF testing key 200-day simple moving average and 0.9950.

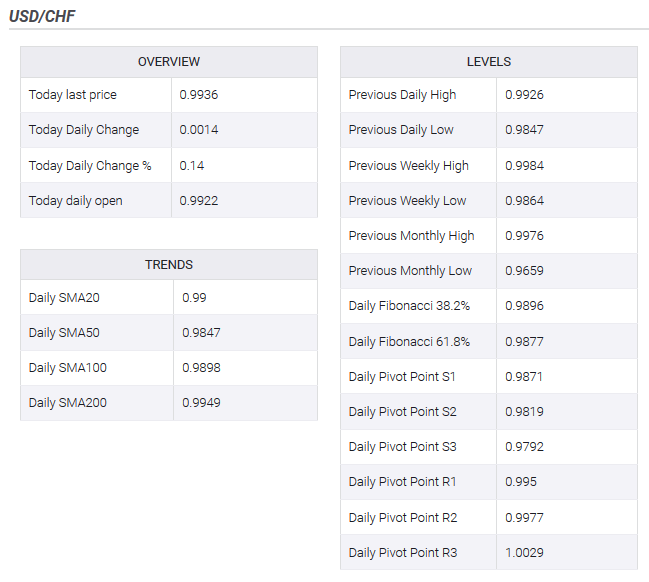

The USD/CHF rose on Thursday, holding firm above 0.9900. The pair peaked on European hours at 0.9947 and then pulled back finding support at 0.9900. The bounced back to the upside unable to challenge daily highs and is trading at 0.9930.

The move to the upside was not as strong as earlier today amid a deteriorating sentiment in markets that offered some support to the Swissy. US data had no impact on the Greenback, that posted mix results across the board.

“The market sentiment was mixed, remaining sensitive to trade news, while U.S. political uncertainty continued to add noise. The yield on the 10Y UST bond dropped 5 bps after today’s NY Fed 14-day term repo operation was oversubscribed, despite injecting an additional $30b to $60b against $72.8b of bids. An unexpected rise in U.S. wholesale inventories in August (0.4% MoM, consensus 0.1% MoM, previous 0.1% MoM) and jobless claims also contributed to the fall in the yield. In Europe, the 10Y German bund was flat, while Spanish and Portuguese risk premia widened by 2 bps”, explained analysts at BBVA.

USD/CHF between two key levelsThe upside today lost momentum near the 0.9950 that is a horizontal resistance and also the 200-day moving average. A consolidation on top could likely lead to a test of the next resistance at 0.9980 that protects the parity zone. On the flip side, 0.9900/05 has become a key support that capped the decline today twice and is where the 20-day moving average stands. A break lower could open the doors to a 45-pips slide to the bottom of the previous trading range at 0.9855. |

USD/CHF between two key levels(see more posts on USD/CHF, ) |

Tags: Featured,newsletter,USD/CHF