US Dollar Index tumbles to fresh weekly lows at 98.73, down 4% from the top.

US data: Consumer Sentiment Index suffers second-largest monthly decline in March.

The USD/CHF pair is falling for the fourth consecutive day amid an ongoing sell-off of the US dollar. The DXY approached earlier on Friday the 100.00 area and recently bottomed at 98.73, the lowest level since March 17.

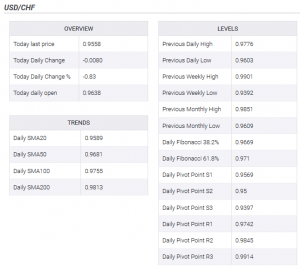

The US dollar remains under pressure, affected by lower US yields. After a short-lived recovery, the greenback resumed the decline. USD/CHF rose to 0.9655 and reversed. The slide gained speed after falling below 0.9585.

Recently the pair bottomed at 0.9545, the lowest in ten days. It is hovering near the lows, consolidating a weekly loss of 300 pips. Despite rising against the US dollar,

Articles by Matías Salord

USD/CHF recovers but finds resistance at 0.9500

March 17, 2020Swiss franc losses strength versus USD, EUR despite risk aversion.

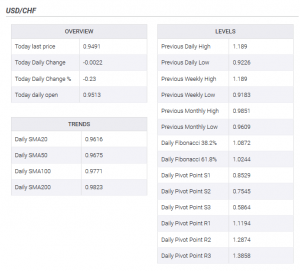

USD/CHF modestly lower for the day after finding resistance at 0.9500.

The USD/CHF was trading around 0.9470, modestly lower from the level it closed on Friday. The pair bottomed during the European session at 0.9390, following rate cuts from many central banks. It then rebounded as the DXY turned positive, trimming losses.

The 0.9500 area capped the recovery of the US dollar. From a fundamental perspective, the Swiss continues to be a safe haven but the greenback has strengthened over the last session. Analysts at Citibank explained: “CHF’s safe-haven status has helped maintain its strength against the EUR and USD. But, CHF strength is still a key worry for the SNB (Swiss National Bank) and they

CHF appears well placed to extend its advance in the near-term – MUFG

January 20, 2020Analysts at MUFG Bank, point out that the Swiss franc has strengthened alongside the price of gold, perhaps reflecting debasement fears. They argue market participants are also questioning Swiss National Bank’s appetite for maintaining negative rates and intervening to dampen CHF strength.

Key Quotes:

“Market participants are also questioning whether the SNB will still has the same appetite to continue intervening in the FX market to dampen CHF strength. It follows the announcement earlier this week from the US Treasury that it has placed Switzerland on their currency “watch list”, and recommended that the Swiss government boosts domestic demand through looser fiscal policy. The market is now testing our assumption that the SNB is unlikely to materially alter

USD/CHF extends rally to 0.9975, highest since mid-October

November 8, 2019Swiss Franc amid the worst performers on Thursday amid positive trade headlines.

US dollar rises supported by higher US yields; Wall Street hits a new record.

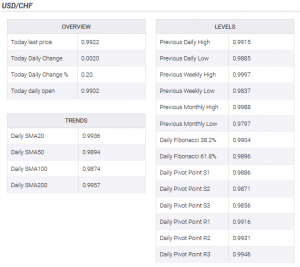

The USD/CHF pair broke to the upside after trading sideways around 0.9925 for hours. It climbed to 0.9975, reaching a three-week high. Near the end of the session, it is consolidating gains, holding above relevant short-term technical levels.

Equity prices are higher in Wall Street amid reports that the US and China have agreed to rescind some existing tariffs on a “phase one” deal. It has not yet been finalized, but all suggest they are getting closer.

US yields have been rising all day.

The 10-year rose to 1.96%, highest since early August; a week ago was under 1.70%. The dramatic move in yields offered

USD/CHF rises to one-week highs at 0.9930

October 25, 2019US Dollar strengthens during the American session after US data.

Swiss Franc fails to benefit from the demand for safe-haven assets.

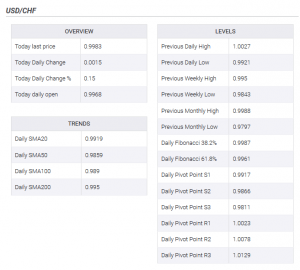

The USD/CHF pair rebounded at 0.9890 and climbed to 0.9930, the highest level since October 17. As of writing, trades at 0.9920, up almost 20 pips for the day, on its way to the fourth daily gain in-a-row.

The key event today was the European Central Bank meeting but it had a limited impact on currencies. “In a relatively relaxed press conference- Draghi’s last one as ECB President- , he provided a dovish tone, in line with his entire presidency. He did not give any hints about action to be taken in the short term, trying not to tie the hands of his successor, Mrs Lagarde. We expect the ECB to remain on hold”, explained BBVA

USD/CHF capped again by 1.0025, retreats below parity

October 4, 2019Swiss Franc flat versus US Dollar, down against its European rivals.

Another weak economic report from the US keeps the Greenback and markets under pressure.

The USD/CHF pair again was capped by the 1.0025/30 area and pulled back. Near the end of the session it is hovering around 0.9980/85 after falling to 0.9950.

The Greenback weakened after US data and then recovered ground modestly. Despite rising against the US dollar, the Swiss Franc was the worst during the American session among European currencies. The bounce in equity prices favored other currencies.

“The highlight of the session was the US ISM services, which dropped more than expected to

a three-year low in September (52.6, consensus 55, prior 56.4). Growth in orders and business activity slowed

USD/CHF consolidates gains above 0.9900, limited by 0.9950

September 27, 2019US Dollar rises versus Swiss Franc for the second-day in-a-row

USD/CHF testing key 200-day simple moving average and 0.9950.

The USD/CHF rose on Thursday, holding firm above 0.9900. The pair peaked on European hours at 0.9947 and then pulled back finding support at 0.9900. The bounced back to the upside unable to challenge daily highs and is trading at 0.9930.

The move to the upside was not as strong as earlier today amid a deteriorating sentiment in markets that offered some support to the Swissy. US data had no impact on the Greenback, that posted mix results across the board.

“The market sentiment was mixed, remaining sensitive to trade news, while U.S. political uncertainty continued to add noise. The yield on the 10Y UST bond dropped 5 bps after today’s NY