US Dollar rises versus Swiss Franc for the second-day in-a-row USD/CHF testing key 200-day simple moving average and 0.9950. The USD/CHF rose on Thursday, holding firm above 0.9900. The pair peaked on European hours at 0.9947 and then pulled back finding support at 0.9900. The bounced back to the upside unable to challenge daily highs and is trading at 0.9930. The move to the upside was not as strong as earlier today amid a deteriorating sentiment in markets that...

Read More »USD/CHF technical analysis: 1-week-old resistance-line, 23.6 percent Fibo. limits nearby upside

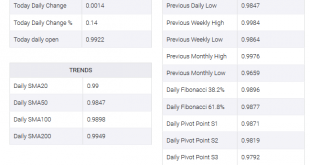

USD/CHF pulls back from a multi-day high, stays above 200-bar SMA. Trend-positive RSI increases the odds of upside. Despite bouncing off 200-bar simple moving average (SMA), USD/CHF fails to cross near-term key resistances as it trades around 0.9915 while heading into the European session open on Thursday. With this, the quote can witness pullback to 38.2% Fibonacci retracement of August-September upside, at 0.9880, ahead of highlighting the key 200-bar SMA level of...

Read More »CHF: Possible reversal? – Deutsche Bank

Deutsche bank analysts suggest that at current spot levels, risk-reward favours longs in EUR/CHF. Key Quotes “While Brexit and trade war outcomes look like coin tosses, the impact is likely to be asymmetric as the SNB caps the left tail. While a relief rally would be fully accommodated, they would likely intervene heavily and cut the policy rate in the event of no deal.” “Last week’s change to the tiering system prepared the ground for emergency rate cuts by...

Read More »USD/CHF technical analysis: Bull in control above 21-day EMA, short-term rising support-line

USD/CHF remains modestly changed above 13-day-old rising trend-line, 21-day EMA. An ascending trend-line from August 13 adds to the support. August month top, 61.8% Fibonacci retracement level challenge buyers. The USD/CHF pair’s failure to provide a decisive break above August high seems to not disappoint buyers, even for short-term, unless the quote trades below key support-confluence. Prices seesaw around 0.9910 while heading into the European open on Monday. The...

Read More »EUR/CHF risk reversals hit highest since May on call demand

EUR/CHF risk reversals have jumped to the levels last seen in May. Risk reversals indicate the demand for call options is rising. Risk reversals on EUR/CHF (EURCHF1MRR), a gauge of calls to put, jumped to the highest level since May on Friday, indicating the investors are adding bets to position for a rally in the common currency. The one-month risk reversals rose to -0.75, the highest level since May 10. The negative print indicates the implied volatility premium...

Read More »AUD/CHF technical analysis: Bears looking for a run to a 50 percent mean reversion

AUD/CHF is in the midst of a sell-off which could extend beyond a 38.2% retracement for a 50% reversion. A subsequent pull-back, however, to the resistance and another sell-off will likely make for a high probability set up. AUD/CHF is in the midst of a sell-off which could extend beyond a 38.2% retracement of the August lows to September highs, located at 0.6715, and target the 50% retracement at 0.6674 (meeting the 2019 lows) should the markets continue to...

Read More » Swiss Economicblogs.org

Swiss Economicblogs.org