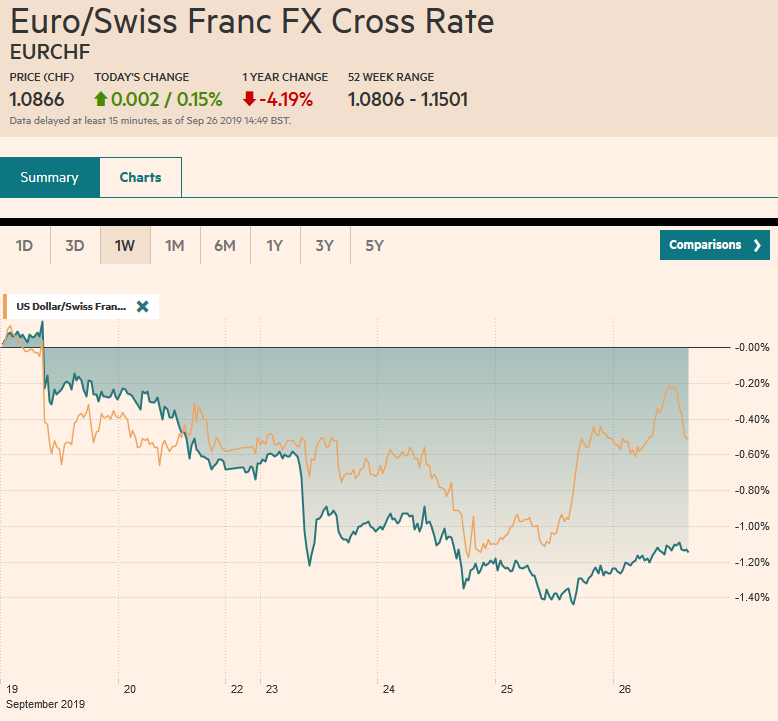

Swiss Franc The Euro has risen by 0.15% to 1.0866 EUR/CHF and USD/CHF, September 26(see more posts on EUR/CHF, USD/CHF, ) Source: markets.ft.com - Click to enlarge FX Rates Overview: A compelling narrative for yesterday’s disparate price action is lacking. A flight to safety, which is a leading interpretation, does not explain the weakness in the yen, gold, or US Treasuries. Month- and quarter-end portfolio and hedge adjustments may be at work, but the risk is that it is a black box: is difficult to verify and lends itself to misuse as a catch-all explanation. Nevertheless, the rise in US equities yesterday helped lift most Asia Pacific shares today, with China, Taiwan, and Australia the notable exceptions. European bourses are firmer, and the Dow Jones

Topics:

Marc Chandler considers the following as important: 4.) Marc to Market, 4) FX Trends, Currency Movement, ECB, Featured, Hong Kong, Mexico, newsletter, Singapore, trade, U.S. Gross Domestic Product QoQ, USD

This could be interesting, too:

Nachrichten Ticker - www.finanzen.ch writes Die Performance der Kryptowährungen in KW 9: Das hat sich bei Bitcoin, Ether & Co. getan

Nachrichten Ticker - www.finanzen.ch writes Wer verbirgt sich hinter der Ethereum-Technologie?

Martin Hartmann writes Eine Analyse nach den Lehren von Milton Friedman

Marc Chandler writes March 2025 Monthly

Swiss FrancThe Euro has risen by 0.15% to 1.0866 |

EUR/CHF and USD/CHF, September 26(see more posts on EUR/CHF, USD/CHF, ) Source: markets.ft.com - Click to enlarge |

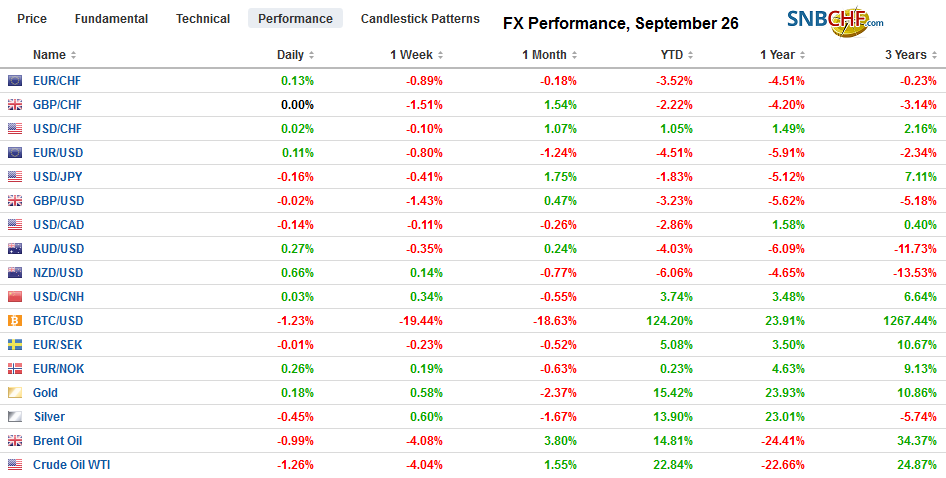

FX RatesOverview: A compelling narrative for yesterday’s disparate price action is lacking. A flight to safety, which is a leading interpretation, does not explain the weakness in the yen, gold, or US Treasuries. Month- and quarter-end portfolio and hedge adjustments may be at work, but the risk is that it is a black box: is difficult to verify and lends itself to misuse as a catch-all explanation. Nevertheless, the rise in US equities yesterday helped lift most Asia Pacific shares today, with China, Taiwan, and Australia the notable exceptions. European bourses are firmer, and the Dow Jones Stoxx 600 is recouping most of yesterday’s losses. US stocks are little changed in European turnover. A surge in US Treasury yields lifted yields in Asia Pacific as they played catch-up, but European and US benchmark 10-year yields have pulled back a bit today. The dollar is mixed against the major currencies, but it may be best understood as consolidating and/or extending yesterday’s gains. Gold is firm above $1500, while oil prices are little changed, but WTI for November delivery is threatening to extend the two-day 3.4% slide. |

FX Performance, September 26 |

Asia Pacific

A pattern has emerged whereby a sharp fall in US shares prompts the US President to play up the prospects for a trade deal with China. Following Tuesday 0.8% decline in the S&P 500 and a 1.4% drop in the NASDAQ, the largest falls in a month, Trump teased that an agreement with China may be closer than people think. However, shortly after, the US announced sanctions on Chinese firms that help Iran sell its oil. Separately, after US markets close today, FTSE-Russell will decide whether to add mainland bonds to its benchmark, which some $20 trillion track.

Two more pieces of economic data warn of continued weak economic impulses in Asia. First was the collapse of industrial output in Singapore, an entrepot that often reflects regional developments. The 7.5% decline in August contrasts sharply from the 0.5% decline the median forecast anticipated in the Bloomberg survey. It is the biggest decline in four years. The production of electronics slumped 24.4%. Second was Hong Kong’s trade figures. Exports held up a little better than expected, falling 6.3% year-over-year compared with forecasts for a 7.4% decline. However, this still reflected a further slowing of exports after a 5.7% contraction in July. Exports to China were off 5.2%, and imports fell 12.5%. Hong Kong’s exports to the US fell 8.8% while imports from the US for off a little more than 16%. Exports to Malaysia and India were off more than 30%. Imports fell too, and the 11.1% decline was a little more than expected and extends July’s 8.7% decline.

The Bank of Japan reduced the amount of 5-10 year government bonds that it bought today. It is the fourth reduction over the past six weeks. It bought JPY350 bln compared with JPY380 bln. The BOJ is trying to demonstrate its ability to control the yield curve, but it is finding it difficult to control the long-end. It wants to push up the long-end and has mostly failed to do so. The BOJ may be tempted to push the short-end of the curve lower by cutting the minus 10 bp deposit rate.

After reaching almost JPY107.90 yesterday, the dollar has gently eased to about JPY107.60 today. There are $2.1 bln in options struck between JPY107.90 and JPY108.00 that looks sufficient to cap the greenback. On the downside, we see initial support near JPY107.40. The $0.6740 support we identified in the Australian dollar yesterday provided a base, but the upside has been limited to the $0.6765 area so far today. A nearly A$880 mln expiring option at $0.6775 may be challenged, but the A$1.3 bln option at $0.6800 that also expires appears not to be in play.

Europe

For people that watch such things, it was not surprising that Italy’s Panetta will join the ECB board of directors. France’s Coeure’s term was up at the end of the year, and there is an unwritten rule that a no country should have two directors, and with France’s Lagarde succeeding Draghi, the French seat would be open and no Italian. Moreover, no other names were nominated, and the process closed yesterday. The real surprise was the resignation of Germany’s Lautenschlager. Her term extended to the end of 2021. No reason was given for her early resignation at the end of next month, but it might not be as neutral as it sounds. Given the resignations of Stark and Weber and the recent ECB decisions over her objections, many suspect this is a protest. The ECB pressed forward and renewed its unorthodox monetary policy. However, with what appears to be a favorable tiering program, which favors the banks with surplus reserves, it is not like the creditors’ interests were ignored. It is was, in fact, a protest, it has not been proven to be very effective. Also, the way such decision-making works best is not always unanimous decisions, but a healthy tension between different views sustained over time. Just like it is sometimes difficult to tell the difference between a wink and an eye twitch, unanimous decision-making and groupthink look an awful lot alike.

The attitude toward fiscal policy in Europe is changing. The configuration of the new EC suggests a less rigid line. Of course, Draghi has long called for this, but now with the German economy apparently experiencing its second consecutive quarterly contraction, it may be encouraging a more pragmatic attitude. The Dutch have announced an investment program. One of the reasons that the SPD in Germany appears to have lost its identity among voters is arguably because it embraces the CDU’s “black zero” policy of no new debt. However, the architect of “black zero,” Schaeuble has suggested that it may be worth re-thinking the policy given climate change and digitalization.

Separately, the ECB reported strong money supply growth. The 5.7% pace was the fastest since 2009. Loans to non-financial businesses also strong. This keeps our idea that the low takeup of the TLTRO may have been due to technical reasons and that the December offering may be utilized more. At the same time, we don’t think it means that the ECB’s policy response was disproportionate, as some are claiming. Instead, it seems to reflect that the transmission mechanism is working.

The euro managed to recover to $1.0965 before coming under renewed selling pressure that accelerated in the European morning. The euro is testing the ~$1.0925 lows seen earlier this month. There is a 1 bln euro option at $1.0925 that expires today. There are options for nearly another 1 bln euros at $1.0950 that also expires. Sterling is being sold through its 20-day moving average (~$1.2350) for the first time in more than three weeks. In the European morning, it is set to challenge the option for almost GBP730 mln at $1.2300. The $1.2270 area would be the immediate target and represents the (50%) retracement of the rally off the September 3 low of about $1.1960.

America

The Federal Reserve drew the same conclusion we did on the signal from the demand for cash by the banking system. Its operations were too small. Yesterday, the banks wanted more than $90 bln, and the Fed was offering only $75 bln. The Fed announced the 14-day repos would double in size to $60 bln and the overnight repos will increase by a third to $100 bln. No fewer than five regional Fed presidents are speaking today and the mix seems neutral to dovish, lead by Bullard and Kashkari. Barkin, Daly, and Kaplan are seen as more neutral. Fed Governor Clarida also at the “listening” event with Daly.

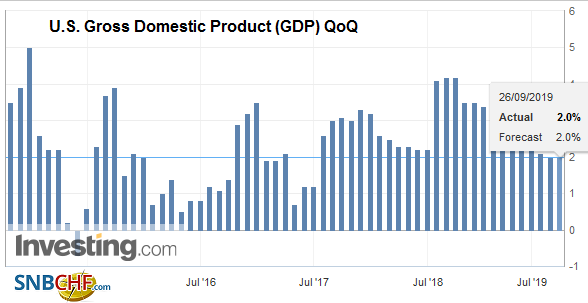

| Today’s North American events highlight also includes another look at Q2 US GDP and a likely cut by Mexico’s central bank. US growth in the April-June period is expected to have held steady at 2.0%. Revisions are too dated to matter to most investors who are looking forward to Q3 GDP. It appears to be tracking close to 2.0% as well. Banxico is expected to follow-up the surprise 25 bp cut in August with another one today. That would bring the overnight rate to 7.75%. However, there are a few who are looking for a larger 50 bp move. Given that government policy does not appear to have convinced investors and the weakness of the peso, which feeds through into prices relatively quickly, we suspect the central bank will err on the side of caution with a quarter-point cut. |

U.S. Gross Domestic Product (GDP) QoQ, Q2 2019(see more posts on U.S. Gross Domestic Product QoQ, ) Source: investing.com - Click to enlarge |

While there has been so to-and-fro, the US dollar is virtually unchanged against the Canadian dollar this week. It finished last week a little below CAD1.3265 and is now trading a little above CAD1.3255. The pair are in a fairly clear trading range of about CAD1.3230 and CAD1.3300. The lower end of the range has been tested, and the rule of alternation suggests a test on the upper-end. The US dollar rose from almost MXN19.40 to about MXN19.60 yesterday and is consolidating roughly in an MXN19.55-MXN19.60 range now. It is bumping against the 20-day moving average (~MXN19.58), which it has not closed above since September 3. We look for a near-term test on the MXN19.65 area, which holds the (38.2%) retracement of the dollar’s decline since the September 3 high (~MXN20.1650). The Dollar Index is extending yesterday’s gains, and the next target is the September 3 high a little above 99.35, which is the highest level since June 2017.

Tags: #USD,Currency Movement,ECB,Featured,Hong Kong,Mexico,newsletter,Singapore,Trade,U.S. Gross Domestic Product QoQ