Is the global economy on the mend as everyone at least here in America is now assuming? For anyone else to attempt to answer that question, they might first have to figure out what went wrong in the first place. Most have simply assumed, and continue to assume, it has been fallout from the “trade wars.” That is a demonstrably false guess, one easily dispelled by the facts. A trade war produces winners from its losers. But we cannot find a single one. There have only been losers. The most obvious culprit, therefore, is rather the dollar. It goes up and everything else goes down. From trade volumes and economy to interest rates and even the stock market on several occasions. A rising dollar is good for no one. Even academic Economists (in certain places) have

Topics:

Jeffrey P. Snider considers the following as important: 5.) Alhambra Investments, bonds, broad trade-weighted us dollar index, Collateral, currencies, Dollar, DXY, economy, EuroDollar, eurodollar system, Featured, Federal Reserve/Monetary Policy, global trade, Markets, newsletter, offshore, offshore repo, Repo, rising dollar, securities held in custody for foreign official and international accounts, trade-weighted us dollar index, U.S. Treasuries

This could be interesting, too:

Nachrichten Ticker - www.finanzen.ch writes Die Performance der Kryptowährungen in KW 9: Das hat sich bei Bitcoin, Ether & Co. getan

Nachrichten Ticker - www.finanzen.ch writes Wer verbirgt sich hinter der Ethereum-Technologie?

Martin Hartmann writes Eine Analyse nach den Lehren von Milton Friedman

Marc Chandler writes March 2025 Monthly

|

Is the global economy on the mend as everyone at least here in America is now assuming? For anyone else to attempt to answer that question, they might first have to figure out what went wrong in the first place. Most have simply assumed, and continue to assume, it has been fallout from the “trade wars.” That is a demonstrably false guess, one easily dispelled by the facts. A trade war produces winners from its losers. But we cannot find a single one. There have only been losers. The most obvious culprit, therefore, is rather the dollar. It goes up and everything else goes down. From trade volumes and economy to interest rates and even the stock market on several occasions. A rising dollar is good for no one. Even academic Economists (in certain places) have begun to catch on. |

Rising Dollar Squeeze |

| Thus, skipping past the euphoria over “trade deals” the answer to the original question should be found here instead. The dollar. But what makes the dollar go up in the first place?

Liquidity. Eurodollar supply. Fluid bank balance sheet construction. In attempting to suggest things are getting better, of those who notice the correlation with the dollar they’ve further suggested that the dollar’s rise is over and done with. If that is indeed the case, then they might have something as far as the global economy’s ability to get back to business. If the dollar’s tendency, however, is still toward the upside, the optimistic path wouldn’t be nearly as a likely. Or likely at all. So, that leaves everything to come down to which way the dollar might be leaning. Still probably to go up, or could it now helpfully be on its way back down? Curves haven’t offered much to settle the matter. Interest rates at the back end have risen, but only a little since early September. That has had the effect of steepening the curve, but again in a vague manner that doesn’t suggest much definition either way. You can take it quite positively as the curve is moving in that direction at all; or, you can take it still more pessimistically in that despite trade deals and so much global “stimulus” there hasn’t been a much bigger move (which may yet happen). |

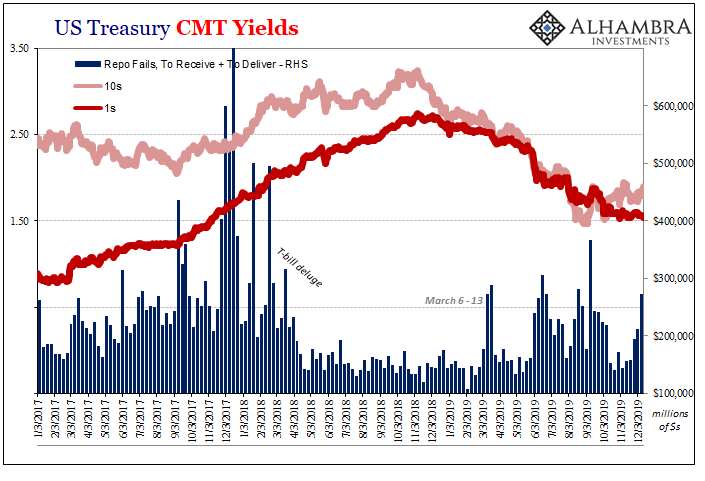

US Treasury CMT Yields, 2017-2019 |

| Outside of curves, what else could we rely on to suggest the dollar’s inclination?

Since we’ve been (correctly, appropriately) focused on repo and collateral all this time, it makes sense to review at least what we can see of those things. And what we find in elements like repo fails along with their offshore related component, the data is not encouraging. To begin with, the latest repo swarm has indeed materialized. While everyone has been focused on the Fed’s upsized non-repo repo interventions via bank reserves and the related dizzied frenzy created by Zoltan Pozsar, repo fails reported by the Primary Dealers spiked to more than $270 billion during the week of December 4 (the latest data from FRBNY). As you can see above, during October and throughout much of November as the world seemed to be much quieter and maybe heading toward a better place repo fails were not much of an issue. Collateral calm. But toward the end of November and heading toward the year-end “turn”, collateral seems to add up again to a significant domestic shortfall. Outside the US, in the larger and probably more important offshore repo market, collateral concerns never did take much of a break even during October and November. We don’t have much data to tell us what’s going on out there in repo and collateral, but we do have a few data points available from which we hope to make reasonable inferences about those conditions. |

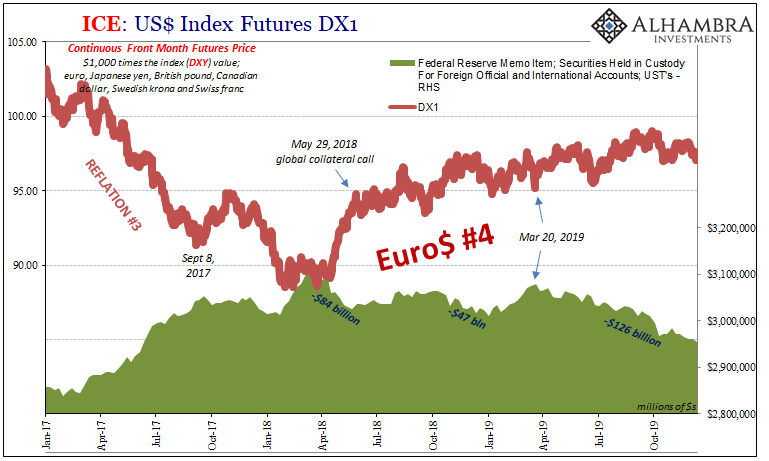

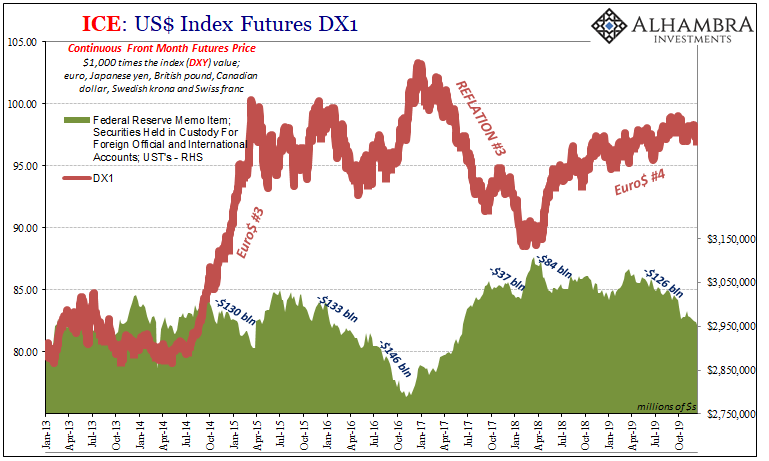

US Index Futures DX1, 2017-2019 |

| One is, an important one, the Fed’s custody of US Treasuries being held on behalf of foreign counterparties.

If there are problems in the offshore eurodollar markets, repo included, what happens is those UST’s disappear from the Fed’s reporting. It could be for reasons such as the growing unavailability of repo collateral more broadly or just the general “selling of UST’s” which foreign governments are forced into in order to (try to) manage their local dollar short. The updated figures from the Fed show an ongoing, substantial drain of these assets out of the central bank’s care. |

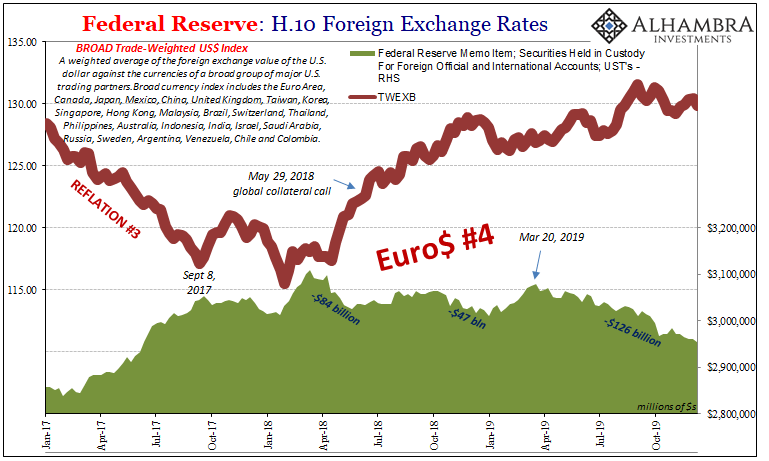

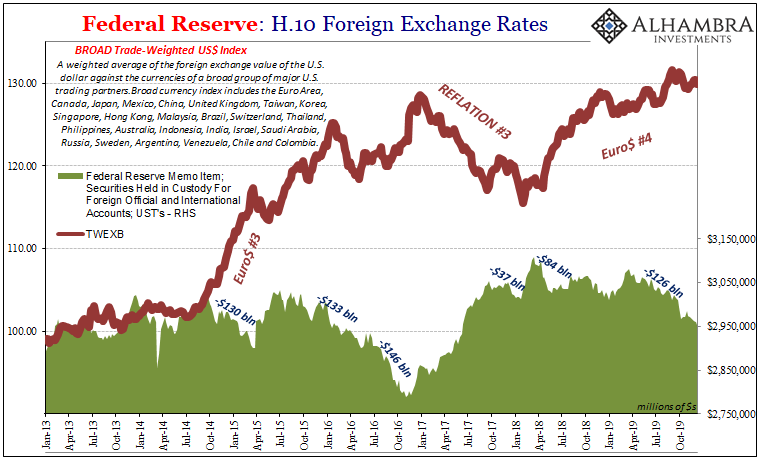

Federal Reserve: H.10 Foreign Exchange Rates, 2017-2019 |

ICE: US Index Futures DX1, 2013-2019 |

|

| And that, as you can see above, correlates very strongly with a rising dollar. In other words, UST’s vanish when a global dollar shortage erupts which is confirmed by a climb in the dollar’s exchange value.

From there, not much good for the global economy – only beginning with global trade. From repo fails to potential hidden repo problems offshore, there aren’t any signs in favor of a falling dollar and therefore the real answer to the world’s economic woes. What that ultimately means is unclear, only that the balance of risks remains unbalanced in the wrong direction. |

Federal Reserve: H.10 Foreign Exchange Rates, 2013-2019 |

Tags: Bonds,broad trade-weighted us dollar index,collateral,currencies,dollar,DXY,economy,EuroDollar,eurodollar system,Featured,Federal Reserve/Monetary Policy,global trade,Markets,newsletter,offshore,offshore repo,repo,rising dollar,securities held in custody for foreign official and international accounts,trade-weighted us dollar index,U.S. Treasuries