After trading overnight in Asia, Japan’s government bond market is within a hair’s breadth of setting new record lows. The 10-year JGB is within a basis point and a fraction of one while the 5-year JGB has only 2 bps to reach. It otherwise seems at odds with the mainstream narrative at least where Japan’s economy is concerned. Japan JGB, Jan 2014 - Jul 2019 - Click to enlarge Record lows in Germany, those seem to make sense. By every account, the German economy is in trouble. So obvious, even the notoriously frugal government is floating debt-stimulus trial balloons. And why not? Its factory and industrial sector are contracting at rates closer to the Great “Recession.” You know its bad when the 2012 recession becomes more of a best-case scenario. Japan

Topics:

Jeffrey P. Snider considers the following as important: 5.) Japan, 5) Global Macro, bond market, bonds, currencies, economy, exports, Featured, Federal Reserve/Monetary Policy, Germany, Government Bonds, hours worked, industry, Japan, japan inc, JGB, Labor market, leading indicators, manufacturing, Markets, newsletter, Recession, wages

This could be interesting, too:

Nachrichten Ticker - www.finanzen.ch writes Die Performance der Kryptowährungen in KW 9: Das hat sich bei Bitcoin, Ether & Co. getan

Nachrichten Ticker - www.finanzen.ch writes Wer verbirgt sich hinter der Ethereum-Technologie?

Martin Hartmann writes Eine Analyse nach den Lehren von Milton Friedman

Marc Chandler writes March 2025 Monthly

| After trading overnight in Asia, Japan’s government bond market is within a hair’s breadth of setting new record lows. The 10-year JGB is within a basis point and a fraction of one while the 5-year JGB has only 2 bps to reach. It otherwise seems at odds with the mainstream narrative at least where Japan’s economy is concerned. |

Japan JGB, Jan 2014 - Jul 2019 |

| Record lows in Germany, those seem to make sense. By every account, the German economy is in trouble. So obvious, even the notoriously frugal government is floating debt-stimulus trial balloons. And why not? Its factory and industrial sector are contracting at rates closer to the Great “Recession.” You know its bad when the 2012 recession becomes more of a best-case scenario. |

Japan JGB 10s 5s History, Jan 1996 - 2019 |

| Japan, on the other hand, while an export industrial powerhouse in the same category as Germany on the surface it seems to be withstanding the global cross currents so much better.

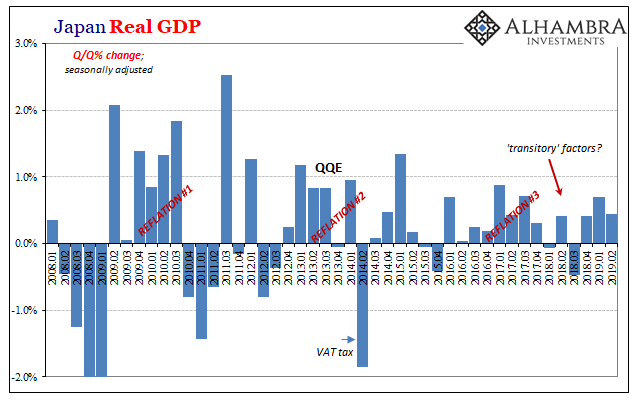

That’s what is being written up about, anyway, how the Japanese have been hanging in there when so many others are falling by the wayside. The last GDP estimates purportedly have convinced the government to push forward with another VAT tax increase. The JGB market, on the hand, isn’t pricing such resiliency. After a rough 2018, according to the GDP view the Japanese economy started out 2019 far from disastrously. Maybe it wasn’t great but by these estimates it doesn’t appear bad, either. Certainly not mere single steps from recession. Transitory factors in 2018, or is something truly negative building underneath? Is Japan set up for a better run toward 2020, or is this just a temporary calm before the real storm? The bond market, obviously, is working off both the latter options. And it’s really not difficult to see why. |

Japan JGB GDP Transitory, Jan 2008 - Feb 2019 |

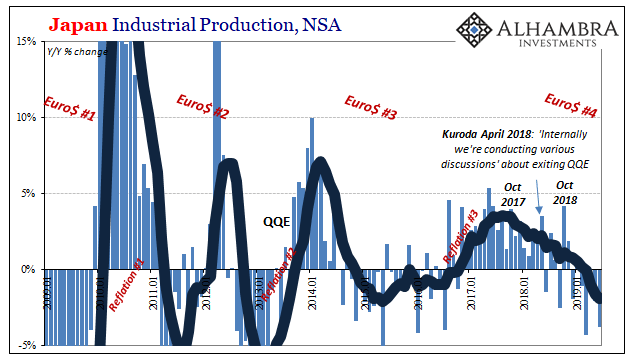

| Starting with Japanese industry, there’s been no turnaround in 2019. Japan Inc still runs the show; the Japanese unlike the Chinese never imagined they could just make up a scheme whereby they’d claim to be “rebalancing” away from manufacturing and export, and everyone would just buy it. As global trade goes, the marginal direction for Japan’s economy is set from the outside (another reason for the Bank of Japan’s historical performance).

As of the latest figures for June 2019 released earlier this month, Industrial Production fell by nearly 4% year-over-year. The 6-month average is now about -2%, which makes it about as bad as it was during the worst parts of Euro$ #3. More than that, there is a very clear acceleration in the downside (second derivative) picked up at the start of this year. In that sense, IP and GDP are contradictory – or they may seem to be. |

Japan Industrial Production, Jan 2000 - Jul 2019(see more posts on Japan Industrial Production, ) |

| But if Japan’s purported strength is coming from the inside, it has taken a huge hit over the last few months. The number of total hours worked has collapsed, and I mean collapsed, in May and June 2019. It’s even worse than what you see above – the chart only shows the 6-month average, which at -2.6% is already the lowest since 2009. |

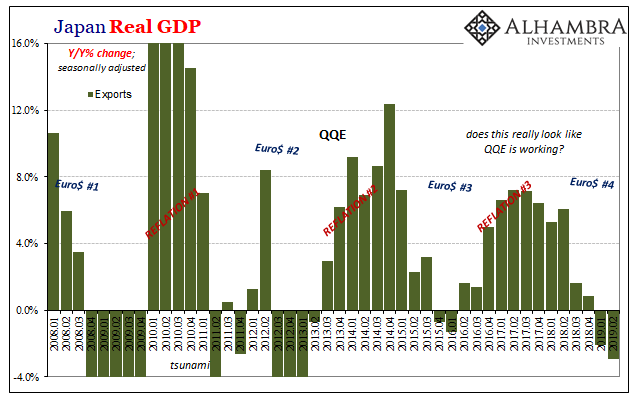

Japan GDP Exports, Jan 2008 - Feb 2019(see more posts on Japan Gross Domestic Product, ) |

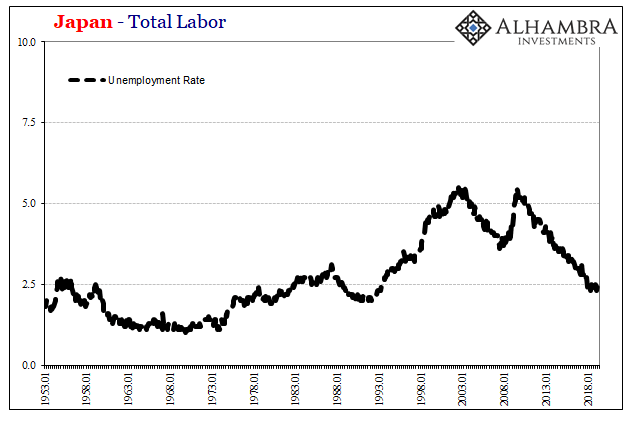

| Japan’s Ministry of Health, Labour, and Welfare estimates that hours plummeted by 4.4% during May, and then fell 3.3% in June. Those two months were preceded by -2.7% in March, and -1.8% in April. As is typical practice in Japan, the unemployment rate barely moves; Japanese businesses rarely lay off workers, they just work them a lot less when confronted by a sharp falloff in demand and activity. |

Japan JGB Hours Wages, Jan 2010 - Apr 2019 |

|

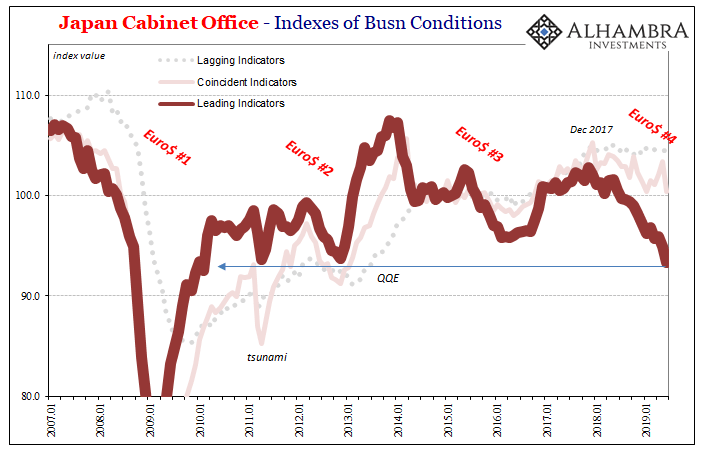

This is why despite GDP Japan’s leading economic indicators continue to move sharply lower. This doesn’t appear to be a case of “decoupling”; a strong internal economy giving the Japanese enough of a secure margin by which to withstand the external pounding evident already in Germany. Instead, the bond market, the industrial data, and now the labor figures all suggest Japan is already in the same ballpark as Germany if not quite yet displaying all those same symptoms in its headline numbers. As was pretty clear by examining the GDP data, there was a lot that was actually transitory keeping both quarters of 2019 from minus signs. |

Japan JGB Unemployment Rate, Jan 1953 - 2019 |

| The Cabinet Office’s index of leading indicators in June was the lowest since February 2010. The spread between leading, coincident, and lagging indicators is the highest since 2008 – suggesting, as JGB yields, that weakness in Japan is just now getting started. They, and perhaps we, are closer to the beginning of whatever this is than its end.

As always, the implications are not strictly Japanese in nature. The question which should be on everyone’s mind is Germany. Is Germany the global outlier? In other words, should we pity the poor Germans from the comfort of our own underlying, decoupling strength; or, do we recoil at their plight by recognizing they are us only earlier in the same process? If Japan falls all the way into the eurodollar vortex later in 2019, then that would suggest what we already see in Germany is actually typical for what we might expect for a whole lot more than Germany. The decisive tilt across the global economy is on the downside. Perhaps the most serious downside since 2009. |

Japan JGB LEI Lowest, Jan 2007 - 2019 |

German bunds have been proven right about Germany’s economy already. Should Japanese bonds turn out correct on the Japanese economy, too, it becomes even harder to ignore the same signals being sent by the US Treasury market. No matter how much Janet Yellen won’t like it.

Germany may already be there, and Japan may actually not be far enough behind. The global scales are tipping in the wrong direction. That’s exactly what’s behind falling yields.

Tags: bond market,Bonds,currencies,economy,exports,Featured,Federal Reserve/Monetary Policy,Germany,Government Bonds,hours worked,industry,Japan,japan inc,JGB,Labor Market,leading indicators,manufacturing,Markets,newsletter,recession,wages