Swiss Franc The Euro has risen by 0.37% at 1.1303 EUR/CHF and USD/CHF, April 11(see more posts on EUR/CHF and USD/CHF, ) Source: markets.ft.com - Click to enlarge FX Rates Overview: The S&P 500 closed higher yesterday for the ninth session in the past ten, but the coattails are short and global equities are trading with a heavier bias today. A firm CPI reading in China took a toll local shares with the Shanghai Composite, shedding 1.6%, the most in more than two weeks. European bourses are mostly in the red. After rising about 2.4% last week, the Dow Jones Stoxx 600 is off about 0.7% this week. It has closed on old gap on the daily bar charts (from April 3) and looks set to test the 20-day moving average,

Topics:

Marc Chandler considers the following as important: 4) FX Trends, Brexit, China, Featured, newsletter, USD

This could be interesting, too:

Nachrichten Ticker - www.finanzen.ch writes Die Performance der Kryptowährungen in KW 9: Das hat sich bei Bitcoin, Ether & Co. getan

Nachrichten Ticker - www.finanzen.ch writes Wer verbirgt sich hinter der Ethereum-Technologie?

Martin Hartmann writes Eine Analyse nach den Lehren von Milton Friedman

Marc Chandler writes March 2025 Monthly

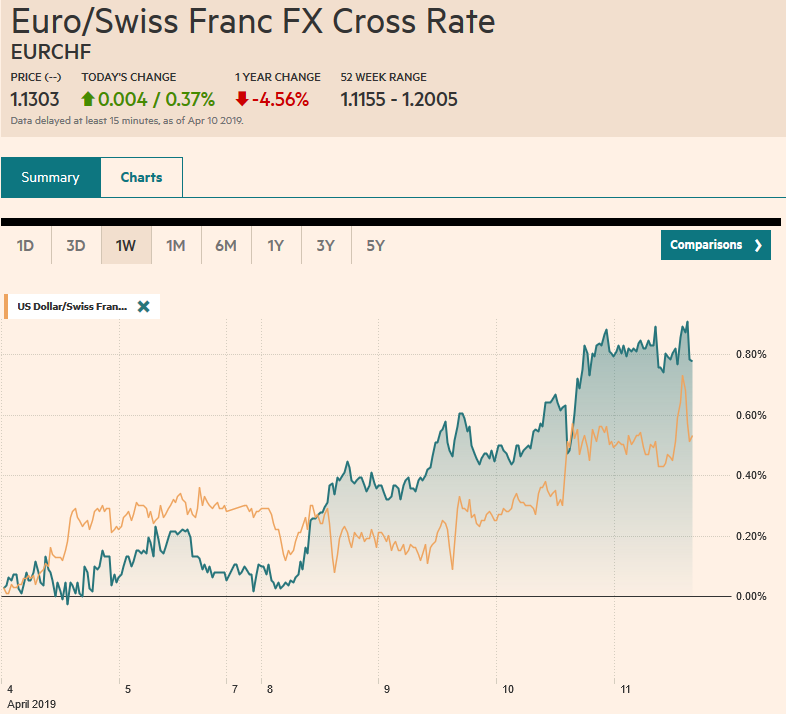

Swiss FrancThe Euro has risen by 0.37% at 1.1303 |

EUR/CHF and USD/CHF, April 11(see more posts on EUR/CHF and USD/CHF, ) Source: markets.ft.com - Click to enlarge |

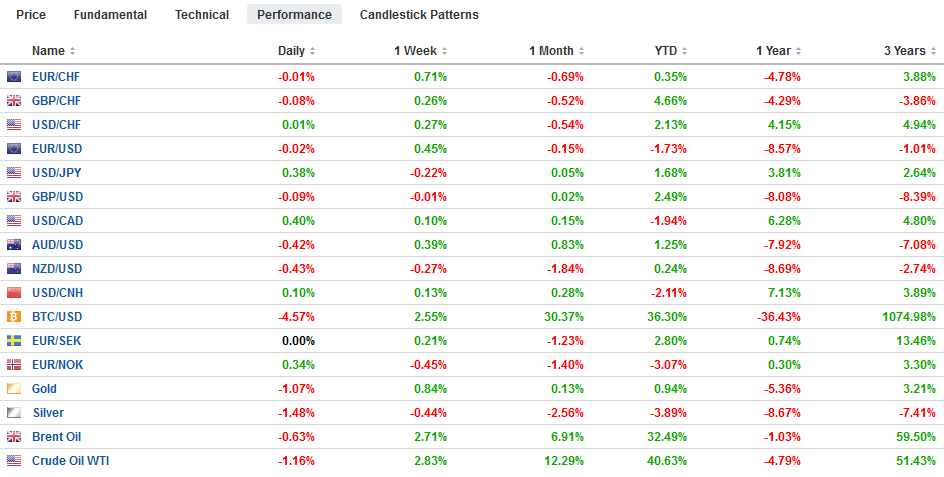

FX RatesOverview: The S&P 500 closed higher yesterday for the ninth session in the past ten, but the coattails are short and global equities are trading with a heavier bias today. A firm CPI reading in China took a toll local shares with the Shanghai Composite, shedding 1.6%, the most in more than two weeks. European bourses are mostly in the red. After rising about 2.4% last week, the Dow Jones Stoxx 600 is off about 0.7% this week. It has closed on old gap on the daily bar charts (from April 3) and looks set to test the 20-day moving average, another percentage point lower. US shares are little changed. Bond markets are subdued. The US 10-year yield has fallen five basis points over the past two sessions and pressured Australian, and New Zealand yields lower. The benchmark JGB was little changed with a yield of minus 6 bp. The German benchmark is also little changed at minus 2 bp. The yield of the US 10-year note is a basis point higher but still below 2.5%. Sterling has shown little reaction to the extension of Brexit until the end of October. It has been confined to less than a third of a cent range today, which is the twice the range of the euro (15 ticks through the European morning). The dollar has been confined to less than a quarter of a yen range, while the Australian dollar is in a fifth of a cent range. |

FX Performance, April 11 |

Asia Pacific

If the Chinese economy is to find traction, it needs to show that deflationary pressures are ebbing. Earlier today it reported a jump in CPI to 2.3% from 1.5% in February. However, the composition is wrong, and that means that the cut in reserve requirements that we expect later in Q2 is still on the table. The rise in Chinese CPI was due primarily to food. The core rate was unchanged at 1.8%. Vegetable price pressures appeared to be weather-related, while the 5.1% rise in pork prices, the first increase in two years, was a function of the swine disease and herd culling. Producer prices ended higher to 0.4% year-over-year from 0.1.% in February, which also illustrates the deflationary pressures remain even if moderating slightly. It was the first increase since last June when the PPI was 4.7% above year-ago levels.

The Australian dollar barely reacted to Prime Minister Morrison’s snap election call (May 18). The Liberal-Nationals are seeking a third term, but party-infighting and policy paralysis have seen Labor run ahead in the polls for the last couple of years. Labor leader Shorten is ahead in the latest poll by about four percentage points. Neither the election call nor the date is surprising. Speculators have been anticipating a more dovish central bank and a weaker Australian dollar. They have built a large gross short position in the futures market in recent weeks. It has risen from 54.5k contracts (A$100k each) at the end of February to 82.3k contracts as of April 2.

The weekly portfolio report from Japan’s Ministry of Finance is interesting. Japanese investors sold JPY1.7 trillion of foreign bonds last week. It was the most since August and unwinds more than half of its purchases in the last two weeks of March. We suspect that this is still part of the fiscal-year end window-dressing flows. On the other hand, foreign investors, who sold around JPY4.5 trillion of Japanese shares in March, returned to the buy side in a big way. They bought roughly JPY1.45 trillion of Japanese equities last week, the most since last October.

The dollar poked through JPY111.80 at the end of last week but pulled back the first three sessions this week and briefly traded below JPY111.00. It appears to be finding support in front of JPY110.85, where an $895 mln option that expires today is struck. On the upside, the JPY111.30 area may offer sufficient resistance today to check the greenback. The Australian dollar reached $0.7175 yesterday, its best level in more than a month. It is in a tight range today, consolidating its recent gains. The short-term technical indicators warn of the likelihood of another run at $0.7200. The Chinese yuan has barely changed this week (CNY6.7170). It has not moved more than 0.1% net-net in any of the week’s four sessions.

Europe

After failing to get House of Commons support for the Withdrawal Bill, not once or twice, but now three times, Prime Minister May was compelled to seek an extension. She requested an extension until the end of June and the EU27 granted until the end of October. It is a shorter extension than what was previously floated by Tusk and others. There will be a formal review in June. Press reports suggest that Macron insisted on the pressure of a near-term deadline. Recall that after the UK decided to join the EU, France fought it bitterly. Merkel seemed to also favor a relatively short extension.

The logic of the end of October may be that it is around when the new European Commission will take office, though of course, few can resist the allusions to Halloween. May said that if an agreement would be reached by May 22, the UK would not have to participate in the European Parliament election. Tomorrow was supposed to be the deadline to declare one’s intentions. October is also far enough away to buy the UK time to sort out what they want to do. If it was much longer, it would risk UK elections, which would slow things down even further and potentially bring in a less competent and more strident prime minister. That said, it is not clear what is next for the UK. May has reluctantly and belatedly reached out to Labour but outside of staking out views, little has been achieved.

The ECB did not appear to break new ground yesterday. The economic risks were still on the downside, and incoming data, especially from the manufacturing sector, continues to be weak. Draghi suggested some headwinds were easing, but other temporary factors (Brexit? Trade uncertainty?) were lasting longer. The December 2020 Euribor futures contract saw its yield fall to match last month’s contract low of 25 bp. It is consolidating just above there today. It has fallen ten basis points since March 21.

The $1.1285 level corresponds to a Fibonacci retracement (38.2%) of the euro’s decline since the March 20 high near $1.1450. The next retracement target (50%) is closer to $1.1315. A 500 mln euro option is struck just below there and will be cut today. The intraday technicals favor an upside range extension today. Sterling is trading inside yesterday’s range, which was inside Tuesday range. The intraday technicals also favor the upside. Initial resistance is seen near $1.3120, ahead of the ~GBP430 mln option expiry at $1.3130.

America

We saw how Euribor eased after the ECB meeting, but the Fed funds futures (January 2020) was virtually unchanged after the FOMC minutes. It is unchanged on the week at an implied effective Fed funds rate of 2.23%. Currently, the effective average Fed funds rate is 2.41%. It had been flat at 2.40% from last December but turned a bit more volatility as the quarter end approached and remains slightly elevated (through the interest paid on reserves, a rate though apparently not perfect). If our broad economic assessment is correct, the softer growth in Q4 18 and Q1 19 will likely give way to somewhat stronger growth in the middle two quarters of the year, and disinflation pressures also should ease. Other cross currents should also ease, and the Fed officials may have more confidence in the resilience of the economy.

When Trump first suggested he would nominate Moore, a bombastic financial journalist to the Board of Governors of the Federal Reserve, most professional economists howled. However, the White House has found a way to make Moore’s candidacy more acceptable. It nominated Cain, who has even less support. It would be unseemly for the Senate to object to both candidates. Cain’s candidacy was in trouble from nearly day one, and it should not be surprising to see Cain pullout of consideration.

The US reports March Producer Prices. The year-over-year pace is expected to be little changed at 1.9% at the headline and 2.4% at the core. Even in the best of times, the PPI is typically not a market mover. Weekly jobless claims will attract attention after last week’s report showed a new cyclical low (and 50-year low, though qualifications have changed, making long-term comparisons risky). Canada reports new home prices. They are likely little changed month-over-month and year-over-year. Housing market concerns are concentrated in Vancouver, where existing home sales are off by nearly a third and prices (detached homes) are off more than 10%, and Toronto, where sales have fallen by 40% and prices by almost 15%. Mexico reports February industrial output figures. The year-over-year contraction is likely to have extended into the fourth month, but the month-over-month activity may have increased for the second consecutive month.

The US dollar briefly dipped below CAD1.33 earlier in the week but it continues to find support near there. The greenback is testing the 20-day moving average near CAD1.3355 today. At the end of last week, after contrasting employment data, it had been closer to CAD1.3400. A return toward it should not be surprising. The Mexican peso has appreciated about 4.3% year-to-date, making it one of the strongest currencies. The dollar approached the low of the year (~MXN18.75) yesterday but found support ahead of MXN18.80. The peso-bulls may step back and look to sell a dollar bounce toward MXN18.90. Separately, the Dollar Index is finding support by the 20-day moving average, around 96.85 but there seems to be little enthusiasm to the upside presently.

Graphs and additional information on Swiss Franc by the snbchf team.

Tags: #USD,Brexit,China,Featured,newsletter