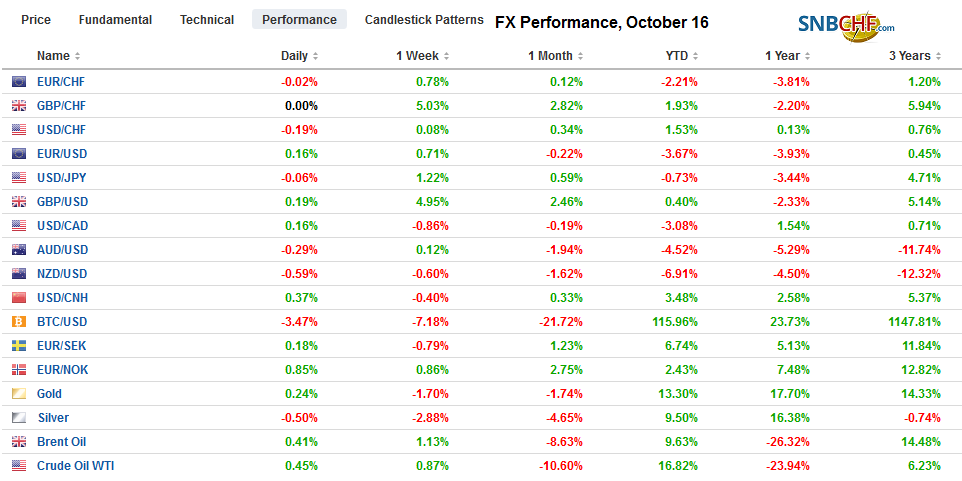

Swiss Franc The Euro has fallen by 0.06% to 1.1006 EUR/CHF and USD/CHF, October 16(see more posts on EUR/CHF, USD/CHF, ) Source: markets.ft.com - Click to enlarge FX Rates Overview: Fading hopes that a Brexit agreement can be struck is seeing sterling trade broadly lower, while China’s demand that US tariffs be rescinded in exchange for a commitment to buy - bln of US agriculture goods over two years, makes the handshake agreement less secure. At the same time, Hong Kong is becoming another front in the US-Sino confrontation. Asia Pacific stocks moved higher, except China and India. The Nikkei and Topix gapped higher for the third consecutive session and set new highs for the year today. The market appears over-extended, and with the yen firmer,

Topics:

Marc Chandler considers the following as important: $CNY, 4.) Marc to Market, 4) FX Trends, Brexit, Currency Movement, Eurozone Consumer Price Index, Eurozone Core Consumer Price Index, Featured, HK, newsletter, South Korea, trade, U.K. Consumer Price Index, U.S. Retail Sales, USD

This could be interesting, too:

Nachrichten Ticker - www.finanzen.ch writes Die Performance der Kryptowährungen in KW 9: Das hat sich bei Bitcoin, Ether & Co. getan

Nachrichten Ticker - www.finanzen.ch writes Wer verbirgt sich hinter der Ethereum-Technologie?

Martin Hartmann writes Eine Analyse nach den Lehren von Milton Friedman

Marc Chandler writes March 2025 Monthly

Swiss FrancThe Euro has fallen by 0.06% to 1.1006 |

EUR/CHF and USD/CHF, October 16(see more posts on EUR/CHF, USD/CHF, ) Source: markets.ft.com - Click to enlarge |

FX RatesOverview: Fading hopes that a Brexit agreement can be struck is seeing sterling trade broadly lower, while China’s demand that US tariffs be rescinded in exchange for a commitment to buy $40-$50 bln of US agriculture goods over two years, makes the handshake agreement less secure. At the same time, Hong Kong is becoming another front in the US-Sino confrontation. Asia Pacific stocks moved higher, except China and India. The Nikkei and Topix gapped higher for the third consecutive session and set new highs for the year today. The market appears over-extended, and with the yen firmer, Japanese shares look vulnerable. Europe’s Dow Jones Stoxx 600 is softer as it consolidates yesterday’s 1.1% gain, while US shares are also softer. Asia Pacific bonds follow US Treasuries decline on Tuesday, but European and US benchmark yields have come back lower. The dollar is firmer against most of the majors, with the yen and Swiss franc notable exceptions. Norway is still trading heavy after yesterday’s news of the countries first trade deficit in a couple of years. After testing $1.28 yesterday, sterling came off 1.25 cents before steadying in the European morning. Oil prices are consolidating the 3.5% loss of the past two sessions. Gold is little changed but firmer. Iron ore was off 5% in Singapore trading on rising output and falling demand. |

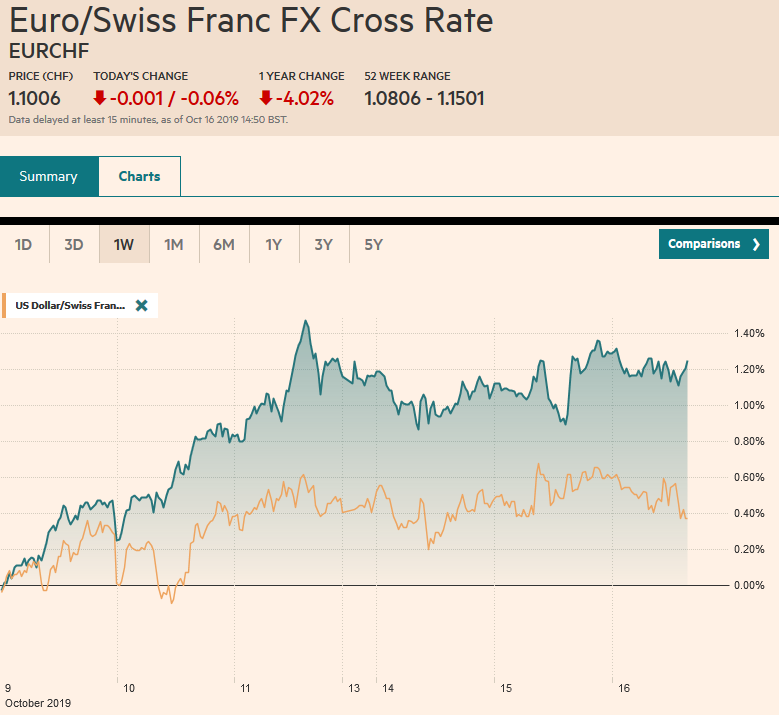

FX Performance, October 16 |

Asia Pacific

China is balking at committing to a dramatic increase in its purchases of US agriculture goods. Before the tariff conflict began, China bought almost $20 bln of US agriculture goods in 2017. If the US wants China to more than double this, then Beijing demands that the US unwind some tariffs. Suspending the threatened tariffs is not sufficient. There appear to be need of considerable more work if Trump and Xi are going to sign an agreement at next month’s APEC meeting.

Meanwhile, another front in the superpower clash is opening. The US House of Representatives passed a bill yesterday that does two things that irk China. First, it would require an annual review of Hong Kong’s special trade status, where it is not treated as the mainland. Second, it also allows sanctions on individual officials who violate Hong Kong’s “fundamental freedoms.” China threatens to retaliate if the bill (or others that are similar) becomes law. Despite its ostensibly noble intentions, we suspect that an annual review subject to the US political climate provides too unstable an environment for businesses and that it will hasten the decline of Hong Kong as a critical financial center and entrepot.

As widely expected, South Korea’s central bank cut its key seven-day repo rate by 25 bp to 1.25%. It is the second rate cut this year. his matches the country’s record low in rates. While Governor Lee Ju-yeol sees more scope to cut rates if needed, there were two dissents. Policy is likely on hold into 2020. Over the past couple of weeks, the US dollar has eased by about 2% against the South Korea won. At the start of the week, the greenback tested the KRW1180 support area, and it held. The dollar firmed slightly yesterday and is up another 0.2% today against the won.

New Zealand’s Q3 CPI rose by 0.7%, which brought the year-over-year rate to 1.5% from 1.7%. It matches the Q1 pace. Deputy Governor Bascand noted that there was a reasonable chance of another rate cut to stimulate growth and inflation. The market had already largely priced in a 25 bp rate cut next month that would bring the cash rate to a new record low (75 bp).

The upside momentum (and optimism) that lifted the US dollar from JPY107 a week ago to almost JPY109 yesterday has faded. The greenback eased to JPY108.60 but has found a bid in the European morning. There is an option for $450 mln at JPY108.75 and another option for about $400 mln at JPY108.30, both of which expire today. The Australian dollar held support near $0.6725 and has stabilized. An option for A$510 mln struck at $0.6750 that expires today is in play. A move above $0.6785 is needed to lift the technical tone. The New Zealand dollar is trading heavily, and the N$370 mln expiring option at $0.6270 is coming into view. The Chinese yuan softened by about 0.2% in its second consecutive decline after a five-day rally.

EuropeBrexit has run into two stumbling blocks. The first is the EU. It said that more from the UK is needed to secure an agreement. The second obstacle is domestic politics. We have noted that the UK is in a scissors. The closer it comes to a deal with the EU, the more it alienates Parliament. The idea of a backstop for Northern Ireland only was formally proposed by the EU over a year and a half ago, and the UK rejected it. Prime Minister Johnson has resurrected and complicated it, but it still does not appear to pass the muster. Conservative Brexiters, including a former Tory leader, are not satisfied. Although the Democrat Unionists support is no longer sufficient to give the Tories a working majority, their support is seen as critical for other Tories. The DUP rejected a similar proposal in 2018 and have not endorsed this one. Press reports also suggest parts of the business community also are not pleased with other concessions has made. |

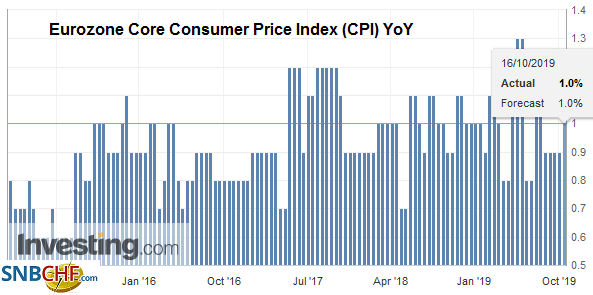

Eurozone Core Consumer Price Index (CPI) YoY, September 2019(see more posts on Eurozone Core Consumer Price Index, ) Source: investing.com - Click to enlarge |

| EU countries are to be briefed later today about the status of the talks. The EU Summit begins tomorrow. There has been some hope that the legal wording could be hammered out, and the House of Commons would have a special sitting on Saturday that would be necessary to avoid the Benn Amendment requiring Johnson to ask for a delay if there was no agreement on October 19. |

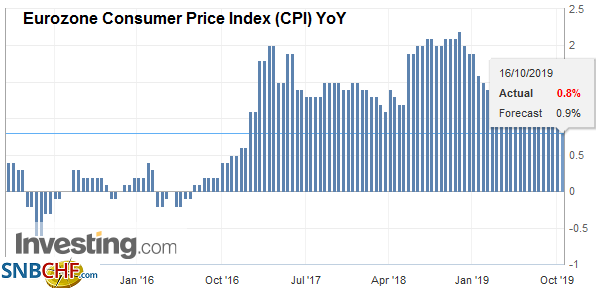

Eurozone Consumer Price Index (CPI) YoY, September 2019(see more posts on Eurozone Consumer Price Index, ) Source: investing.com - Click to enlarge |

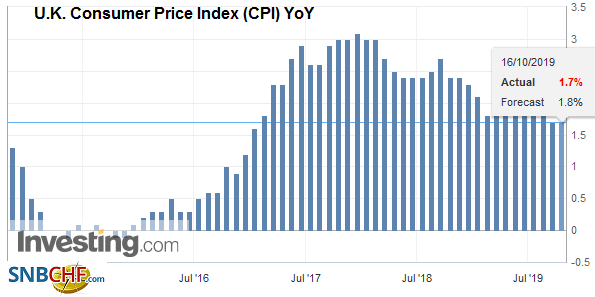

| Separately, the UK reported softer than expected CPI and PPI. The preferred measure, CPIH, which included owner-occupied housing costs, was unchanged at 1.7%, its lowest level since late 2016. The median forecast in the Bloomberg survey expected a small increase. The core rate ticked up to 1.7% from 1.5%. Input producer prices were forecast to have risen by 0.2% but instead fell by 0.8%. Output prices slipped by 0.1% and were expected to have risen by the same amount. |

U.K. Consumer Price Index (CPI) YoY, September 2019(see more posts on U.K. Consumer Price Index, ) Source: investing.com - Click to enlarge |

Stiff penalties for the Catalonian separatist leaders triggered unrest in Spain’s region. Meanwhile, Spanish parties have been unable to form a government, and new national elections will be held on November 10. The demonstrations and the government’s response will add another twist to the electoral plot. It will be the fourth election in as many years. Spanish stocks bonds are underperforming a little today.

The euro held trendline support near $1.0990 yesterday and rebounded to $1.1060 today before the buying dried up. There are 1.9 bln euros in expiring options struck between $1.1057 and $1.1075. However, it is the 1.0 bln euro option at $1.1025 that also expires today that is in focus now. A break of the $1.0990 would warn of losses toward $1.09 in the coming days. Sterling is trading heavily but found support near $1.2650, where a roughly GBP325 mln option is struck that expires today. A break of $1.2600 would boost confidence that a high is in place.

America

The US yield curve as measured by the 3m to 10-year and the 2-year to the 10-year are both positively sloped again. he former measure had been negatively sloped for several months, while the latter was inverted for about five days and no more than about five basis points. That said, many of those economists forecasting a recession continue to do so. The data focus today is on US retail sales amid an appreciation that the consumer is the one engine of the economy doing the bulk of the heavy lifting. Retail sales account for a little more than 40% of US personal consumption expenditures. Sales in September are expected to have slipped slightly from the 0.4% gain in August. Excluding autos and gasoline, a little sequential improvement is expected, and the GDP components are expected to have matched the 0.3% previous gain. That said, the market is more likely to react strongly to a negative than a positive surprise. Also, we note that consumption recently has been aided by rising consumer credit. The US also reports business inventories, TIC data, and the Beige Book that is compiled ahead of the FOMC meeting later this month. The market appears to be discounting a little more than a 75% chance of a cut.

Canada reports Septemeber CPI. It is expected to have softened for the second consecutive month and the third time in four months. Still, the year-over-year rate may tick up to 2.1% from 1.9% due to the base effect. The underlying core measures are expected to be little changed. The Bank of Canada seems comfortable with its neutrality. We point out (again) that Canada’s two-year yield has risen above the US 2-year for the first time in two years. Mexico’s calendar is light, but Argentina will report September inflation late today, and it is expected to rise by 5.5% on the month.

The US dollar is straddling the CAD1.3200 area as it consolidates the last week’s losses. Initial resistance for the greenback is seen near CAD1.3240. A break below CAD1.3170 is needed to signal the next leg lower. The dollar has found support in front of MXN19.20. With optimism in retreat, the dollar can recover against the peso. Initial resistance may be seen near MXN19.30. The week’s high is near MXN19.36, and that may offer a stronger cap.

Graphs and additional information on Swiss Franc by the snbchf team.

Tags: #USD,$CNY,Brexit,Currency Movement,Eurozone Consumer Price Index,Eurozone Core Consumer Price Index,Featured,HK,newsletter,South Korea,Trade,U.K. Consumer Price Index,U.S. Retail Sales