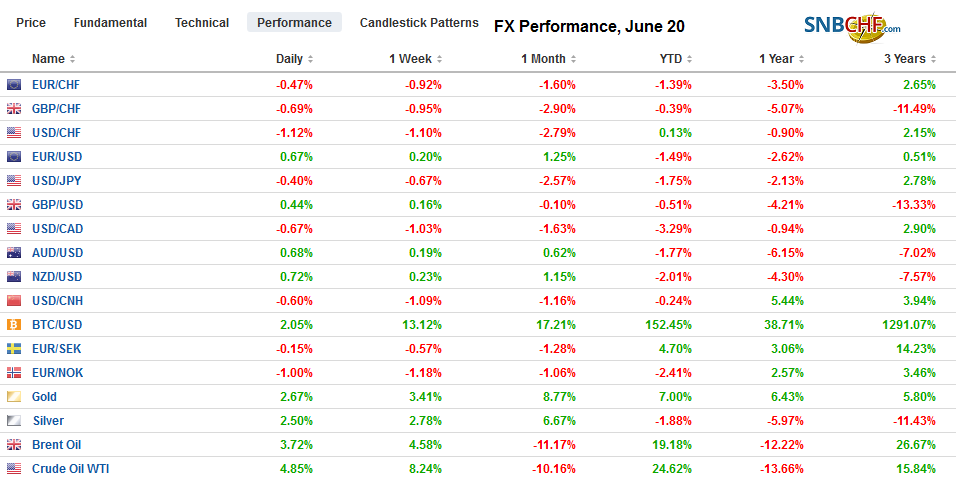

Swiss Franc The Euro has fallen by 0.48% at 1.1104 EUR/CHF and USD/CHF, June 20(see more posts on EUR/CHF, USD/CHF, ) Source: markets.ft.com - Click to enlarge FX Rates Overview: The prospect of “lower for longer” continues to fuel the bond and stock rally. The initial US equity response to the Fed was positive but not strong and closed about 0.3% higher. Asia Pacific equities followed suit with mostly modest gains, except for China and Hong Kong, where gains of more than 1% were recorded. Hong Kong’s four-day rally lifts the Hang Seng over 5% this week and set to advance for the third week. It had lost nearly 9.5% in May. Europe’s Dow Jones Stoxx 600 is up around 0.6% in late morning dealings to bring this

Topics:

Marc Chandler considers the following as important: $CNY, 4) FX Trends, Bank of England, Brexit, EUR/CHF, Eurozone Consumer Confidence, Featured, FX Daily, newsletter, Norwegian Krone, U.K. Core Retail Sales, U.K. Retail Sales, USD, USD/CHF

This could be interesting, too:

Nachrichten Ticker - www.finanzen.ch writes Die Performance der Kryptowährungen in KW 9: Das hat sich bei Bitcoin, Ether & Co. getan

Nachrichten Ticker - www.finanzen.ch writes Wer verbirgt sich hinter der Ethereum-Technologie?

Martin Hartmann writes Eine Analyse nach den Lehren von Milton Friedman

Marc Chandler writes March 2025 Monthly

Swiss FrancThe Euro has fallen by 0.48% at 1.1104 |

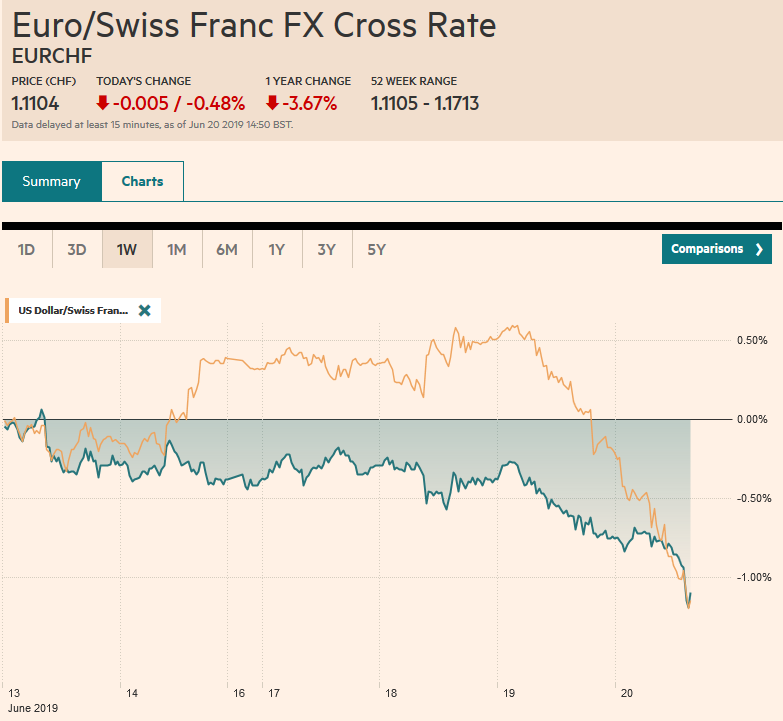

EUR/CHF and USD/CHF, June 20(see more posts on EUR/CHF, USD/CHF, ) Source: markets.ft.com - Click to enlarge |

FX RatesOverview: The prospect of “lower for longer” continues to fuel the bond and stock rally. The initial US equity response to the Fed was positive but not strong and closed about 0.3% higher. Asia Pacific equities followed suit with mostly modest gains, except for China and Hong Kong, where gains of more than 1% were recorded. Hong Kong’s four-day rally lifts the Hang Seng over 5% this week and set to advance for the third week. It had lost nearly 9.5% in May. Europe’s Dow Jones Stoxx 600 is up around 0.6% in late morning dealings to bring this week’s advance to a little more than 2%. The S&P 500 is poised to gap higher toward the record high set at the start of last month. Yields are tumbling, with new record lows in Australia and New Zealand. The minus 16.5 bp yield of the generic JGB is a fresh three-year low. Italian and Greek bond yields are off 8-9 bp today extending their impressive run, while other peripheral European and UK yields are 3-4 bp lower, and core yields are off 1-2 bp. The US 10-year pushed below 2% but is slightly above there now. The dollar is falling against nearly all the world’s currencies today. Among the majors, the Japanese yen is the weakest with around a 0.35% gain, while the Norwegian krone has been lifted nearly 1.7% on the back of the rate hike and signal of another one likely this year. The Chinese yuan rose almost 0.8% against the dollar (to ~CNY6.85), which appears to be the largest gain of the year. |

Asia Pacific

The Bank of Japan left policy steady as widely expected. BOJ Kuroda recognized rising external risks. The cautionary words are not likely sufficient to deter the Abe government from lifting the sales tax in October. Government officials have indicated that only something on the magnitude of the fall of Lehman or the Great Financial Crisis would deter it. That bar may be somewhat high, and any dilution may be favorable for Japanese stocks.

Other regional central banks that met–Philippines, Indonesia, and Taiwan also left rates steady. However, policy is expected to ease in several countries in the coming months, including South Korea, the Philippines, and China. The Reserve Bank of New Zealand meets next week. The market appears to be pricing in around a one-in-four chance of cut but is more confident that a reduction (which would bring the cash rate to 1.25%) in August is more likely. The Reserve Bank of Australia meets on July 2, and the market has nearly 2/3 of a cut discounted.

After meeting persistent resistance around JPY108.65, the dollar turned decisively lower today and dipped below JPY107.50, for the first time since the January 3 flash crash. We suspect the JPY108 area will now act as resistance. There is a $1.8 bln option struck there that expires today, The JPY107-area was the technical target we suggested, but today and tomorrow there is are $1 bln options that roll-off. The Australian dollar is rising for the third consecutive session. After recording a five-month low near $0.6830 two days ago, the Aussie is pushing back above $0.6900. It is nearing the lower end of a band of resistance seen in the $0.6930-$0.6950 area. The dollar eased against the Chinese yuan for the third day. It briefly traded below CNY6.85 for the first time in over a month. The price action reinforces the importance of CNY7.0 as a potential inflection point should it be violated.

EuropeNorway is marching to a beat of a different drummer. The central bank hiked rates for the second time this year and by nudging up its anticipated rate path, has signaled the likelihood of another rate increase later this year. It noted the economy was a little stronger than previously projected. Norway’s deposit rate now stands at 1.25%. The divergence between the Norges Bank on the one hand and the Fed and the ECB on the other is stark and has sent the greenback and euro down the most against the krone in several years. |

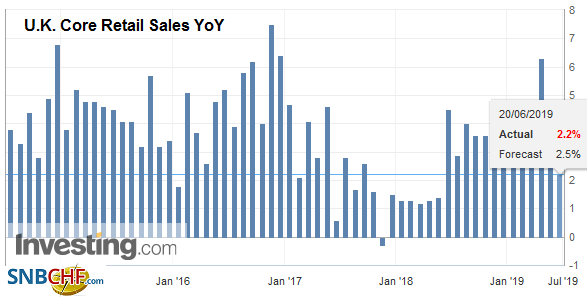

U.K. Core Retail Sales YoY, May 2019(see more posts on U.K. Core Retail Sales, ) Source: investing.com - Click to enlarge |

| Three issues are the focus in the UK. First, UK households pared by consumption and retail sales fell for a second month in May. Excluding petrol, sales were off 0.3%, the same as in April. Recall that retail sales rose an average of 0.9% in Q1. At the headline level, retail sales fell 0.5%, while the April series was revised to -0.1% from flat. |

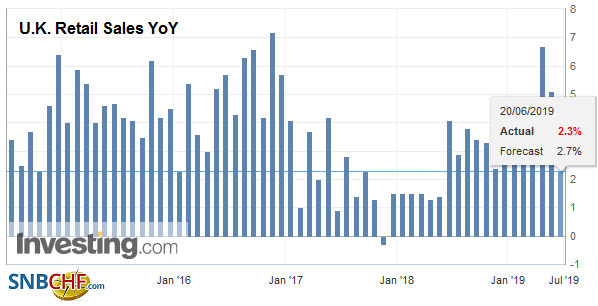

U.K. Retail Sales YoY, May 2019(see more posts on U.K. Retail Sales, ) Source: investing.com - Click to enlarge |

| Second, the BOE meets, and this is little chance of a move, despite the BOE’s warnings that rates will have to go up to ensure inflation remains near the target. Given some hawkish comments by the BOE’s Saunders and Haldane, there are some thoughts that one may dissent. The BOE says that its economic forecasts are based on the idea that Brexit will be smooth. While it may be the politically correct position, it does not seem like the most likely scenario and makes (at least one) wonder about its independence. Thirdly, in two votes today, the Tories will narrow the leadership challenge to two candidates. As has been the case throughout the process, the real question is who will join Johnson on the ballot that the rank-and-file members will choose between in the coming weeks. |

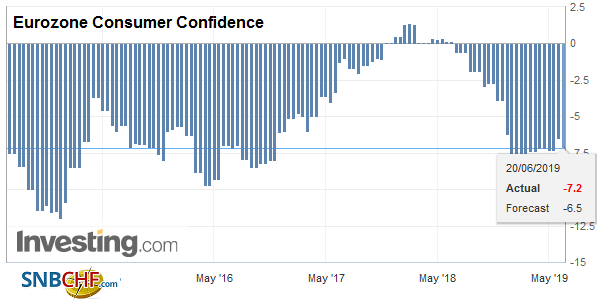

Eurozone Consumer Confidence, June 2019(see more posts on Eurozone Consumer Confidence, ) Source: investing.com - Click to enlarge |

After dipping below $1.12 earlier this week, the euro is probing the $1.13 area now. There may be some mild resistance near $1.1310, the highs seen earlier this month just shy of $1.350 is the real target and hurdle. A move above there would lift the technical tone. Sterling tested $1.25 earlier this week and has now pushed through $1.27. There is a modest option (~GBP300 mln) struck at $!.2720 that expires today. On the downside, there are about GBP800 mln in options between $1.2680 and $1.2690 that will also roll off today. Recall that high from earlier this month was near $1.2760.

America

The ECB’s Draghi and the Federal Reserve were dovish but in different ways. Draghi was clear: in the absence of inflation moving toward the target, further accommodation is necessary. The Fed’s attitude seems to be if the economy were to weaken, it would respond. While the FOMC statement dropped the reference to patience, the dot plots did not pick up a material change in the economic outlook. The median GDP forecast for this year was unchanged at 2.1%, which is above their understanding of the sustainable long-term pace of 1.9%. The median dot shaved the unemployment forecast to 3.6%, well below the 4.2%, what they think is full-employment. Without using the word cues that signal a July hike, the extent of the shift of the dot plot without seeing a substantive change in the economic conditions is remarkable.

The previous Fed argument that the softness of price pressures was transitory seemed less convincing and the median forecast now expected headline PCE, which is the official targeted rate, was reduced to 1.5% from 1.8%. Their estimate for the core was cut to 1.8% from 2.0%. The Fed acknowledged that the uncertainties around the outlook had increased. In contrast, Draghi argument that the uncertainty itself was the materialization of the risk. There is good reason for the market to be uncertain. The Fed itself is quite divided. Chairman Powell experienced his first dissent–Bullard was the only one that wanted an immediate cut. The dots, however, showed a different picture. Eight anticipated no need to change rates this year, while another eight thought at least one cut would be necessary (of which seven saw the likelihood that two cuts would be appropriate). One official thought a hike would be appropriate (most think this was KC Fed President George).

While the central banks of most high-income countries worry about too low of inflation, Canada has a different experience. May CPI rose 0.4%, well above economists’ forecasts, and lifted the year-over-year rate to 2.4% from 2.0%. The underlying measures on average, were also firmer. The Canadian dollar rallied on the news and nearly 0.75% gain on the day was the most in almost four months. Initially, the market pushed short-term Canadian rates higher, but after the Fed, they softened, and the implied yield of the December BA futures closed less than a basis point higher on the day. The US premium on two-year money fell 11 basis points to 35 bp, which is the smallest since February 2018. Interpolating from the OIS, the collective wisdom of the market is that there is around a 35% chance that the Bank of Canada cuts rates this year. At the end of last week, there was about a 40% chance priced in, and at the end of last month, it was closer to 50%.

The Fed’s declaratory policy is that is it data dependent, but operationally it does not appear to be the case. As we noted, the Fed’s macro view has not changed, but uncertainty has. Today’s data includes Q1 current account, weekly jobless claims, and the Philadelphia Fed survey. More importantly, over the coming days (starting tomorrow), Fed officials will return to the public spotlight, and their comments will be closely watched for clues into where the bar is for a potential July move that has been fully discounted. The greenback pushed above CAD1.34 earlier this week and is now testing CAD1.32, its lowest level since March 1. There is not much chart-based support until closer to CAD1.31, but short-term technicals are stretched. The US dollar is also being sold below MXN19.0 for the first time in a month. Indeed, near MXN18.92, the dollar is at its lows since May 3. The low for the year was set in March a little below MXN18.75.

Graphs and additional information on Swiss Franc by the snbchf team.

Tags: #USD,$CNY,Bank of England,Brexit,EUR/CHF,Eurozone Consumer Confidence,Featured,FX Daily,newsletter,Norwegian Krone,U.K. Core Retail Sales,U.K. Retail Sales,USD/CHF