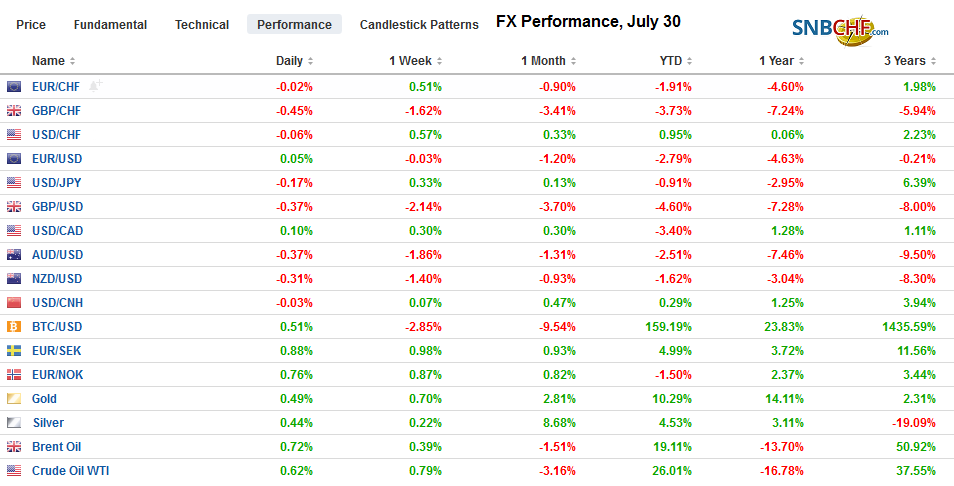

Swiss Franc The Euro has fallen by 0.10% to 1.1037 EUR/CHF and USD/CHF, July 30(see more posts on EUR/CHF, USD/CHF, ) Source: markets.ft.com - Click to enlarge FX Rates Overview: The prospect of a no-deal Brexit continues to pound sterling lower. A little more than two months ago, it was testing .32. Two weeks ago it was around .25. Today it traded near .2120 before stabilizing. On the other hand, the 10-year Gilt yield is below 65 bp, a new multiyear low, while the international-laden FTSE 100 is holding its own in the face of heavier equity prices in Europe. The major equity markets in the Asia Pacific region rose except for Taiwan, which some linked to the anticipation of Apple’s earnings later today.

Topics:

Marc Chandler considers the following as important: 4.) Marc to Market, 4) FX Trends, Brexit, Currency Movements, Featured, Japan Unemployment Rate, MXN, newsletter, Switzerland, USD

This could be interesting, too:

Nachrichten Ticker - www.finanzen.ch writes Die Performance der Kryptowährungen in KW 9: Das hat sich bei Bitcoin, Ether & Co. getan

Nachrichten Ticker - www.finanzen.ch writes Wer verbirgt sich hinter der Ethereum-Technologie?

Martin Hartmann writes Eine Analyse nach den Lehren von Milton Friedman

Marc Chandler writes March 2025 Monthly

Swiss FrancThe Euro has fallen by 0.10% to 1.1037 |

EUR/CHF and USD/CHF, July 30(see more posts on EUR/CHF, USD/CHF, ) Source: markets.ft.com - Click to enlarge |

FX RatesOverview: The prospect of a no-deal Brexit continues to pound sterling lower. A little more than two months ago, it was testing $1.32. Two weeks ago it was around $1.25. Today it traded near $1.2120 before stabilizing. On the other hand, the 10-year Gilt yield is below 65 bp, a new multiyear low, while the international-laden FTSE 100 is holding its own in the face of heavier equity prices in Europe. The major equity markets in the Asia Pacific region rose except for Taiwan, which some linked to the anticipation of Apple’s earnings later today. Led by financials, utilities, and industrials, the Dow Jones Stoxx 600 is off around 0.5% near midday. US shares are little changed. Benchmark 10-year yields are edging lower today, though the yields in the periphery of Europe are a little firmer. The US dollar is narrowly mixed. While Brexit is a drag on sterling, disappointing Swedish GDP figures (-0.1% vs. expectations of +0.3%) have weighed on the krona. The Turkish lira continues to recover and is leading the emerging market currencies higher. The dollar has fallen below TRY5.60 and is at its lowest level in nearly four months. The next important chart area is seen closer to TRY5.40. |

|

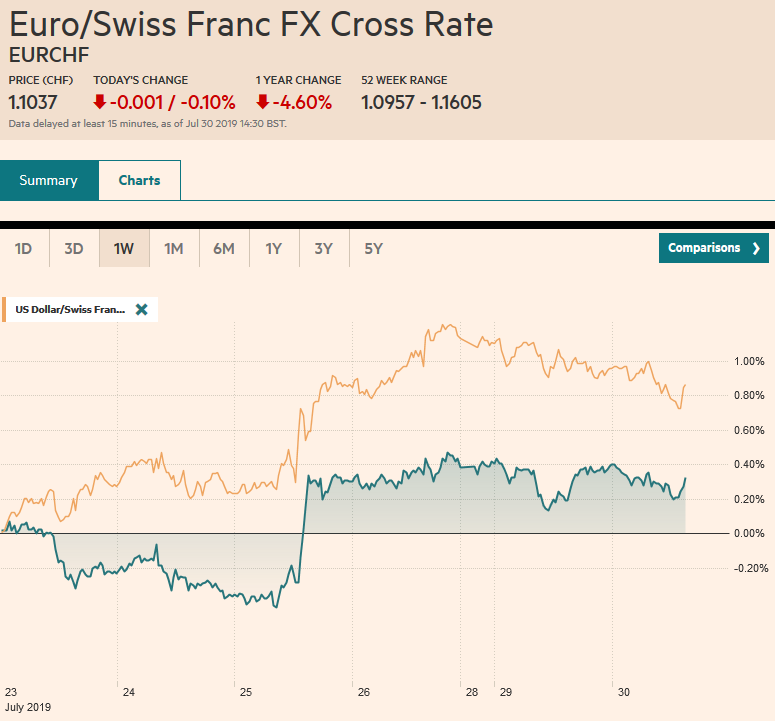

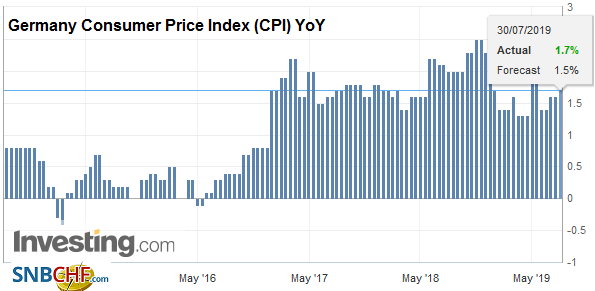

Asia PacificJapan reported disappointing industrial output figures and an unexpected decline in unemployment before the BOJ met and left policy unchanged. Industrial production slumped 3.6% in June, which was twice what the median forecast anticipated in the Bloomberg survey and the third-largest decline since the natural disasters in 2011. The year-over-year contraction deepened to 4.1% from 2.1% in May. On the other hand, the unemployment rate edged down to 2.3% (from 2.4%), and the job-to-applicant ratio slipped. The BOJ was unimpressed. It shaved its GDP forecast for the fiscal year to 0.7% from 0.8%. The government had cut its forecast in recent days as well. It stands at 0.9% now down from 1.3%. The BOJ has all but given up on its inflation target, now forecasting CPI to be at 1.6% at the end of FY21. The BOJ acknowledged that risks to growth and inflation remain on the downside. The window of opportunity for the BOJ to take new measures is seen later this year after the sales tax hike (from 8% to 10%). Although the BOJ does not target the yen, the strengthening of the yen would likely be seen as a risk to both inflation and growth. |

Japan Unemployment Rate, June 2019(see more posts on Japan Unemployment Rate, ) Source: investing.com - Click to enlarge |

Australia’s building approval slump deepened in June and although the central bank is not expected to cut rates next week (August 6), after reducing them at the previous two meetings, a rate cut in Sept-Oct is anticipated. Economists had been looking for a small uptick as building approvals were to stabilize after dropping a sharp 13.1% in March and 3.2% in April. Instead, May’s 0.7% gain was more than halved to 0.3%, and June dropped 1.2%. Tomorrow, Australia reports Q2 CPI figures. The small increase that is expected (1.5% year-over-year from 1.3%) will not stand in the way of expectations for lower rates.

US Trade Representative Lighthizer stepped up the pressure on Vietnam. He warned that Vietnam to reduce its bilateral surplus with the US, which is growing in part as companies move production and/or shipping out of China. Lighthizer wants Vietnam to open its markets more to US goods and services. Much of the Trump Administration’s regional trade efforts appear to be still playing catch-up after pulling out of the Trans-Pacific Partnership. Vietnam, like signatories, has reduced trade barriers, but US companies do not benefit.

The JPY109 level, which is important technically, was again successfully tested and it held. Initial support is seen near yesterday’s low around JPY108.40. A break of JPY108.30 likely signals short-term players are giving up on the JPY109 level, at least for now. Before today, the dollar had gained in six of the past seven sessions against the yen. Tomorrow’s FOMC meeting may be injecting a note of caution. Yet, the caution is not preventing participants from extending the Australian dollar’s slide for an eighth consecutive session. The Aussie fell to $0.6890 in the European morning. The low since the flash crash back in January was set in the middle of last month near $0.6830. The technical indicators are stretched, but that is the next important chart point. The Chinese yuan’s three-day pullback ended with a minor gain onshore today.

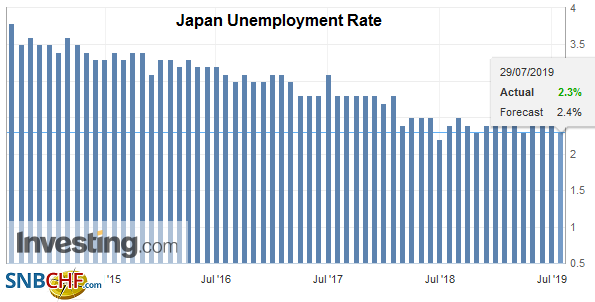

EuropeFears of a no-deal Brexit have led sterling to a near free-fall. Against the dollar, with today’s losses, it has fallen in seven of the past eight sessions. As we noted before, it has only risen for four weeks since the middle of April. It appears to be headed for its 13th consecutive weekly decline against the euro. Prime Minister Johnson refuses to even talk to the EC unless it drops the Irish backstop, which it cannot do. Johnson is wagering that the EC blinks before the UK Parliament can stop him. France disappointed investors with a 0.2% Q2 GDP. The median forecast was for a 0.3% growth the same as in Q1. Despite Macron’s 17 bln euro of fiscal stimulus, consumer spending slowed. The aggregate Q2 GDP for EMU will be reported tomorrow. Prior to the French data is was expected to have slowed from 0.4% in Q1 to 0.2% in Q2. The risk is on the downside. Germany does not report its Q2 GDP until closer to the middle of August. The Bundesbank has warned of a possible contraction. Separately, German inflation is being reported ahead of the EMU figure that also will be released tomorrow. German’s harmonized CPI is poised to slow to 1.2% in July from 1.5% in June. |

Germany Consumer Price Index (CPI) YoY, July 2019(see more posts on Germany Consumer Price Index, ) Source: investing.com - Click to enlarge |

The increase in Swiss sight deposits reported yesterday lend credence to ideas that the Swiss National Bank likely intervened recently-selling Swiss francs and buying euros. The SNB, which was quite active in 2017 (intervention around CHF48.2 bln), appeared to pullback considerable in 2018 (intervention estimated ~CHF2.3 bln). The recent operation may have been more about CHF1.7 bln. The SNB is expected to follow any ECB rate cut, which is expected in September.

The euro is in less than a 20-tick range below yesterday’s high near $1.1150. The failure to extend yesterday’s gains may encourage a re-test of the $1.1100 support, but the market may lack much enthusiasm ahead of tomorrow’s FOMC decision. Sterling is trying to stabilize after Asia pushed it to $1.2120. The bounce appears to be running out of steam in front of $1.22. The euro had dipped briefly below GBP0.8900 last week approached GBP0.9200 earlier today. In 2017, the euro traded above GBP0.9300 and the 2016 high was nearer GBP0;9500.

America

With a light Canadian and Mexican economic diary today, the focus remains on the US. The US reports June personal income and consumption data. The preliminary estimate of Q2 GDP released at the end of last week incorporated today’s data. The market may still trade on the headlines, but there will be limited new information. The rate cut, which nearly everyone expects tomorrow, is not so much based on current data as it is being cast as an insurance policy that is cheap to take, so the argument goes, because price pressures are low. The PCE deflator is expected to be unchanged at 1.5%. The Fed’s target is 2%. Although it is not targeted, Fed officials often emphasize the core rate. The core PCE deflator is expected to edge to 1.7% from 1.6%. It would be the highest since January. Former Fed chief Yellen endorsed a 25 bp cut, citing worries about global growth. She too sees low inflation give the Fed room to take out an insurance policy.

Mexico President AMLO made a greater attempt that the US President to recognize the independence of the central bank. However, AMLO also called on Mexico’s central bank to cut interest rates. The high real and nominal interest rates are squeezing the economy, and tomorrow, Mexico is expected to report its second consecutive quarterly contraction in GDP. AMLO’s decision to halt the construction of the airport last year and the discouragement of private investment in the energy sector is also taking an economic toll. AMLO appears to want a rate cut sooner rather than later. The central bank meets in mid-August and then late September. The market is not pricing in better than a 50 % chance of a cut until the November meeting.

The US dollar is firm against the Canadian dollar and appears poised to challenge last week’s high near CAD1.3200. Technically, we see a band of resistance extending toward CAD1.3220. Support is seen near CAD1.3155, where a $970 mln option is set to expire today. The dollar is chopping within its well-worn range against the Mexican peso and continued sideways movement is likely today. The Dollar Index is nudging higher to try to extend the advance for the eighth consecutive session, but the momentum has waned, and the market struggles to extend the gains ahead of the FOMC meeting.

Graphs and additional information on Swiss Franc by the snbchf team.

Tags: #USD,Brexit,Currency Movements,Featured,Japan Unemployment Rate,MXN,newsletter,Switzerland