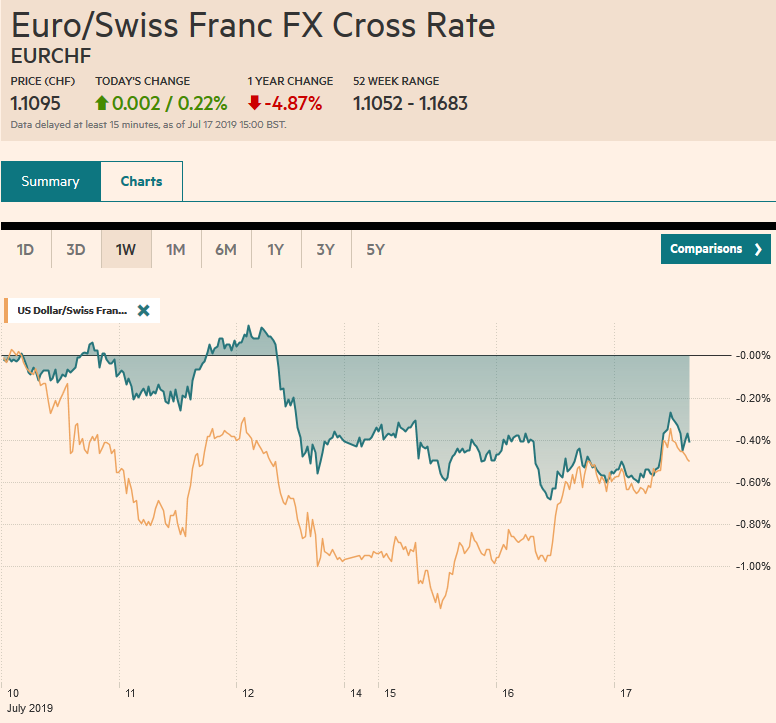

Swiss Franc The Euro has risen by 0.22% at 1.1095 EUR/CHF and USD/CHF, July 17(see more posts on EUR/CHF, USD/CHF, ) Source: markets.ft.com - Click to enlarge FX Rates Overview: After slapping punitive tariffs on structural from China and Mexico last week, US President Trump threatened to end the tariff truce with China because it is not stepped up its purchases of US agriculture products. Trump said the tariff freeze was in exchange for ag purchases, but at the time it seemed as if granting licenses to US companies to sell to Huawei was the quid pro quo. In any event, the comments helped snap a five-day advance of the S&P 500 and equities continued to trade softly in Asia. Only bourses in India, Australia, and

Topics:

Marc Chandler considers the following as important: 4) FX Trends, EUR/CHF, Eurozone Consumer Price Index, Eurozone Core Consumer Price Index, Featured, Federal Reserve, newsletter, trade, U.K. Consumer Price Index, U.K. Core Consumer Price Index, U.K. House Price Index, USD, USD/CHF

This could be interesting, too:

Nachrichten Ticker - www.finanzen.ch writes Die Performance der Kryptowährungen in KW 9: Das hat sich bei Bitcoin, Ether & Co. getan

Nachrichten Ticker - www.finanzen.ch writes Wer verbirgt sich hinter der Ethereum-Technologie?

Martin Hartmann writes Eine Analyse nach den Lehren von Milton Friedman

Marc Chandler writes March 2025 Monthly

Swiss FrancThe Euro has risen by 0.22% at 1.1095 |

EUR/CHF and USD/CHF, July 17(see more posts on EUR/CHF, USD/CHF, ) Source: markets.ft.com - Click to enlarge |

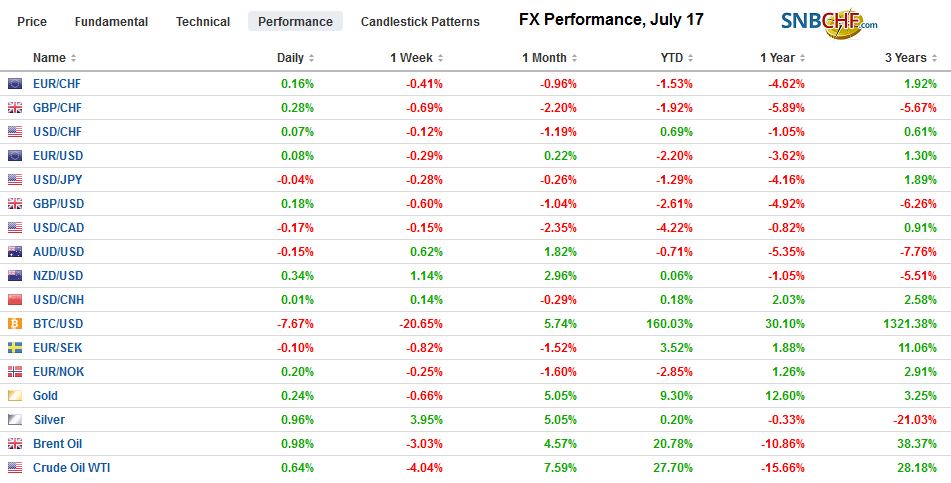

FX RatesOverview: After slapping punitive tariffs on structural from China and Mexico last week, US President Trump threatened to end the tariff truce with China because it is not stepped up its purchases of US agriculture products. Trump said the tariff freeze was in exchange for ag purchases, but at the time it seemed as if granting licenses to US companies to sell to Huawei was the quid pro quo. In any event, the comments helped snap a five-day advance of the S&P 500 and equities continued to trade softly in Asia. Only bourses in India, Australia, and Singapore found traction. European equities, perhaps anticipating stimulus as soon as next week from the ECB, are baring better and the Dow Jones Stoxx 600 is seeing its advance stretch into a fourth consecutive session today. Benchmark yields were little changed in Asia and 2-4 bp lower in Europe. The US 10-year is hugging 2.10%. The dollar has a firmer bias against most of the major and emerging market currencies. The Canadian and New Zealand dollars are exceptions and are 0.20%-0.25% stronger. |

FX Performance, July 17 |

Asia Pacific

As an entrepot, Singapore’s economic and trade performance is often seen as reflective of the broader regional forces. Today’s trade figures were dismal. Non-oil exports collapsed 17.3% year-over-year in June after a 16.3% fall in May (from -15.9% initially). The median forecast in the Bloomberg survey was for a 9.6% decline. They were off 7.6% in June after rising 5.8% in May. Electronic shipments continue to implode and are off nearly 32% from a year ago.

Japan holds the upper house election on July 21. Reports suggest shortly thereafter, the final touches on a small free-trade agreement with the US will be made. The US initially had seemed to be holding out for a significant deal, but perhaps the desire for results has encouraged it to find a quicker solution. Reports suggest the basis of the agreement may be to grant US agriculture the same terms that Japan has agreed under the TPP and in the free-trade agreement with the EU. In exchange, reports suggest reduced tariffs for Japanese auto and parts.

The WTO approved of the US policy to take action against exports from China’s state-owned enterprises but took exception of how the US calculated the duties it levied. Separately, Trump threatened to end the tariff truce. A bipartisan bill in the US Congress seeks to remove some of Trump’s discretion on Huawei. The bill, if passed, would block the removal of Huawei from the list of companies prohibited from doing business unless Congress approves.

The dollar has been confined to less than a quarter yen range through the European morning (~JPY108.1-JPY108.3). The intraday technicals suggest that resistance in the JPY108.30-JPY108.50 area, backed by the expiration of around $2 bln in options struck in that band, will likely hold. The Australian dollar reversed lower yesterday and saw some light follow-through selling today that has it near $0.7000, where an A$520 mln option will be cut today. Initial support is seen in the $0.6975-$0.6985 area. The Chinese yuan remains in tight ranges, and the dollar finished its sixth consecutive mainland session between CNY6.8700 and CNY6.8820.

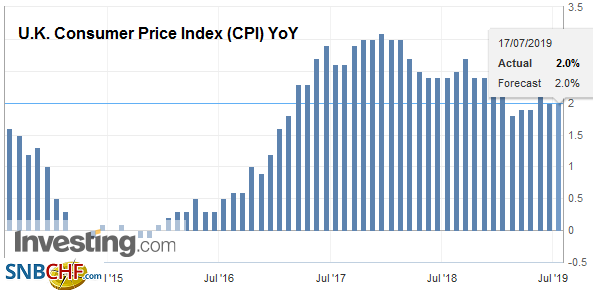

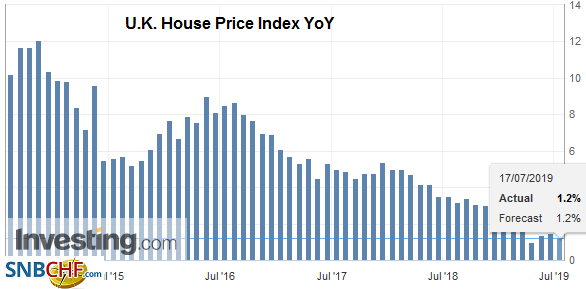

EuropeThe UK’s June CPI readings were as expected with the headline CPIH unchanged at 19% and CPI flat at 2.0%. Producers prices were softer than expected, and input prices on a year-over-year basis fell into negative territory (-0.3%) for the first time in three years. |

U.K. Consumer Price Index (CPI) YoY, June 2019(see more posts on U.K. Consumer Price Index, ) Source: investing.com - Click to enlarge |

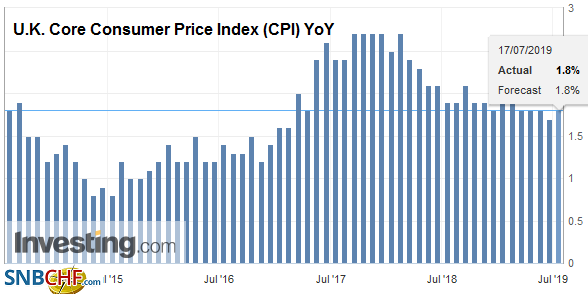

| Output prices were also the weakest in three years but remained in positive territory(1.6%). However, sterling has shown little reaction to the economic news this week. The focus remains on Brexit, and perceptions that the risk of a no-deal exit at the end of October has increased and this drags sterling lower. |

U.K. Core Consumer Price Index (CPI) YoY, June 2019(see more posts on U.K. Core Consumer Price Index, ) Source: investing.com - Click to enlarge |

| Von der Leyen secured a slim parliamentary majority and will succeed Juncker as EC President. Back in Germany, Kamp-Karrenbauer (AKK), who was Merkel’s heir apparent before falling out, will replace Von der Leyen as the German defense ministry. The German defense ministry is a challenging post and will test AKK, especially as the confrontation with the US over NATO spending may escalate in over the period ahead. |  |

| While the semiconductor industry in Asia remains under pressure, the European equivalent may be the auto sector. Auto registration in the EU fell 7.9% in June, which is the largest decline since December. Auto registrations (a proxy for sales) fell around 8% in France and Spain, and closer to 5% in Germany and the UK. Few workdays may help explain the weakness but only at the margins. Auto registrations are expected to decline for the second consecutive year, but the 1% decline projected may be too optimistic. In the first half, registrations are off a little more than 3%. |

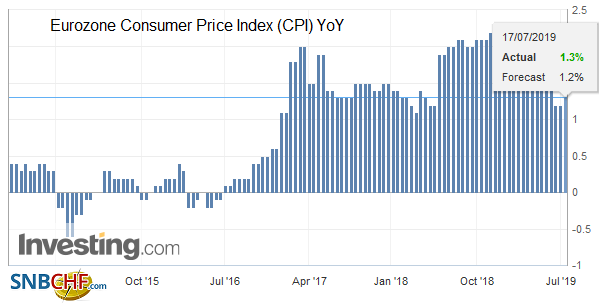

Eurozone Consumer Price Index (CPI) YoY, June 2019(see more posts on Eurozone Consumer Price Index, ) Source: investing.com - Click to enlarge |

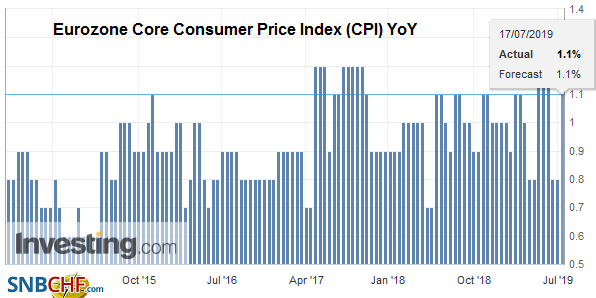

| The euro held the $1.1200 level. It has traded below there once this month (July 9, low ~$1.1195). Initial resistance is seen in the $1.1220-$1.1230 area. There is a nearly 780 mln euro option at $1.1250 that expires today. Sterling began the week testing $1.26 and was pushed briefly through $1.24 today. There is a modest (~GBP205 mln) option there that will be cut today. Nearby resistance is pegged around $1.2440. Meanwhile, the euro is holding above GBP0.9000 that is finally broke yesterday. The high for the year was set in early January near GBP0.9110, and that is the next important technical area. |

Eurozone Core Consumer Price Index (CPI) YoY, June 2019(see more posts on Eurozone Core Consumer Price Index, ) Source: investing.com - Click to enlarge |

North America

Consider the recent string of US data. The tone was set by the 224k rise in non-farm payrolls, half again as much as expected. Core inflation measures (PPI and CPI) were stronger than expected. Consumption (retail sales) and production (manufacturing) rose more than economists forecast. And yet, the market is discounting about a 30% chance of a 50 bp rate cut by the Fed at the end of the month, according to the CME’s model. This is nearly a ten-fold increase from a week ago. The US will report its first estimate of Q2 GDP next week. Something near what the Fed considers as the non-inflationary pace or long-term rate (1.8%) seems reasonable. But even an upside surprise would not be sufficient to deter expectations fo a cut, though it may dampen expectations for a third cut, having already fully priced in two and was split for another.

The US reports June housing starts. They are expected to have slipped 0.7% after a 0.9% decline in May. It would be the first back-to-back decline this year. Permits are faring better. They fell every month in Q1, and with a June increase, they would have risen every month in Q2. In Q1 the average decline was 1.0% and with a small increase in June, the Q2 average maybe about 0.3%. The Beige Book ahead of the July 30-31 FOMC meeting will also be released later today. It is unlikely to elicit much of a market response. The Fed’s George speaks today, and she is among the more hawkish members. Some suspect she could dissent against a rate cut, and her comments will be scrutinized in that light. Canada reports June CPI. The month-over-month pace is expected to slip (-0.3% after +0.4% in May), which would see the headline pace ease to 2.0% from 2.4%. The underlying measures are expected to be steady. The G7 finance minister and central bankers meet, and there is some headline risk in the North American session, but cooperation and coordination appears to be at a low ebb.

The US dollar recovered from near CAD1.30 yesterday but ran out of steam near CAD1.31. That seems to be a comfortable range. The pullback back may find initial support near CAD1.3040. The dollar also rebounded against the Mexican peso yesterday, but it has held on to its gains better than it has against the Canadian dollar. Initial resistance for the US dollar is seen in front of MXN19.13 and then nearer MXN19.20. The Dollar Index advance has stalled near 97.50 (last week’s high was almost 97.60), but as long as it holds above its 200-day moving average (~96.80), the near-term bullish sentiment will remain intact.

Graphs and additional information on Swiss Franc by the snbchf team.

Tags: #USD,EUR/CHF,Eurozone Consumer Price Index,Eurozone Core Consumer Price Index,Featured,Federal Reserve,newsletter,Trade,U.K. Consumer Price Index,U.K. Core Consumer Price Index,U.K. House Price Index,USD/CHF