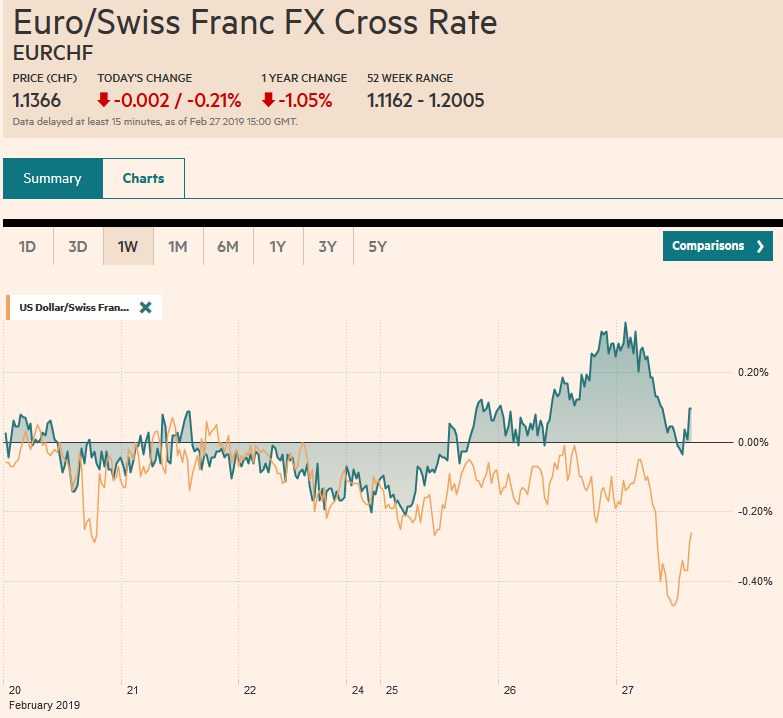

Swiss Franc The Euro has fallen by 0.21% at 1.1366 EUR/CHF and USD/CHF, February 27(see more posts on EUR/CHF, USD/CHF, ) Source: markets.ft.com - Click to enlarge FX Rates Overview: As the North American session is about to begin, the markets await developments in the UK House of Commons where a vote is expected today on Prime Minister May’s proposal to hold votes on around March 12 on the Withdrawal Bill and no deal. However, perceptions of a reduced likelihood of a no-deal exit continued to fuel sterling gains. Pakistan has reportedly shot down two Indian aircraft as the tension between these two nuclear powers intensify. The anxiety among investors may have spurred some profit taking in equities. Most

Topics:

Marc Chandler considers the following as important: $INR, 4) FX Trends, AUD, CAD, EUR, Featured, GBP, JPY, MXN, newsletter, SPX, USD

This could be interesting, too:

RIA Team writes The Importance of Emergency Funds in Retirement Planning

Nachrichten Ticker - www.finanzen.ch writes Gesetzesvorschlag in Arizona: Wird Bitcoin bald zur Staatsreserve?

Nachrichten Ticker - www.finanzen.ch writes So bewegen sich Bitcoin & Co. heute

Nachrichten Ticker - www.finanzen.ch writes Aktueller Marktbericht zu Bitcoin & Co.

Swiss FrancThe Euro has fallen by 0.21% at 1.1366 |

EUR/CHF and USD/CHF, February 27(see more posts on EUR/CHF, USD/CHF, ) Source: markets.ft.com - Click to enlarge |

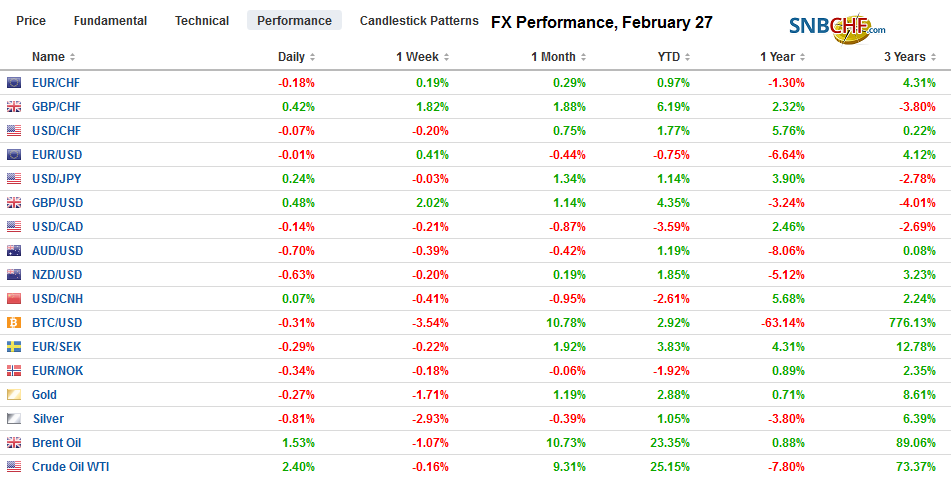

FX RatesOverview: As the North American session is about to begin, the markets await developments in the UK House of Commons where a vote is expected today on Prime Minister May’s proposal to hold votes on around March 12 on the Withdrawal Bill and no deal. However, perceptions of a reduced likelihood of a no-deal exit continued to fuel sterling gains. Pakistan has reportedly shot down two Indian aircraft as the tension between these two nuclear powers intensify. The anxiety among investors may have spurred some profit taking in equities. Most markets but Japan and Korea were lower in Asia, and while the Shanghai Composite rose 0.4%, other Chinese markets were lower. Europe’s Dow Jones Stoxx 600 is snapping a three-day advance and the S&P 500 is about 0.3% lower. Asia Pacific benchmark 10-year bond yields were pushed lower after the US rally yesterday, but European bond yields are a little firmer today, while the US 10-year yield is flat (~2.63%). The dollar is mostly lower, with the Antipodean currencies modest losses, the exception. |

FX Performance, February 27 |

Asia Pacific

The economic calendar is slight and the focus has been more on politics than economics as the US-North Korea meeting in Vietnam takes place. The escalation of tensions between Pakistan and India is of rising importance to regional investors. Meanwhile, there have been no fresh developments on US-Chinese trade.

One of the few economic reports today was New Zealand’s January trade balance. As is often the case, New Zealand’s trade balance improved at the end of last year, with a small surplus being reported in December. It swung back into deficit in January (NZ$914 mln) and had an average monthly shortfall in 2018 of about NZF$509 mln. The deficit in January 2018 stood near NZD$662 mln. New Zealand’s imports rose (which is seen as a reflection of domestic demand) while exports fell (softer external demand).

The US dollar set the high for the year on Monday around JPY111.25. The dollar shed nearly a big figure and in early Europe tested the JPY110.35 area. The 20-day moving average is a little lower, and the dollar has not closed below this average since the end of January. Although today’s options expiry does not look impactful today, there is a $1.7 bln option at JPY110 that will be cut tomorrow. Resistance is seen now around JPY110.60-JPY110.75. The Australian dollar has been turned back from approaching $0.7200. Recall, last week before the China embargo story broke, the Aussie was pushing toward $0.7210. We thought that the move was exaggerated and looked for a bounce to sell into but thought it would not rise above $0.7200, Note that on March 1, there are two large option expirations. There is an A$1.3 bln option at $0.7150 and an A$1.6 bln at $0.7175.

Europe

There is only one story that resonates with investors today, and that is the Brexit drama. Later today there will be a vote in the House of Commons over May’s proposal to hold two votes on March 12–the Withdrawal Bill and leaving with no-deal. The worst for the UK would be that nothing gets majority support. A vote today may seek to force May’s hand: seek an extension if the Withdrawal Bill fails. Rees-Moog has reportedly dropped his demand that the Irish backstop gets dropped. He now says he is open to some legal language that would limit the duration of the backstop, which is not something the EC appears willing to accept. The prospect of a later and softer exit continues to fuel sterling’s recovery.

The euro is firm, but in narrow ranges near yesterday’s best level, which is the first time in three weeks it is testing $1.14. The 61.8% retracement of this month’s decline is found a little higher, closer to $1.1410. The market can push a bit higher, but caution is likely as next week’s ECB meeting approaches, where some further indication that a new long-term loan facility will be forthcoming may temper the demand for the single currency. There are also some large options that expire on March 1 ($1.1350 for 1.5 bln euros, $1.1425 for 1.8 bln euros, and $1.1450 for 1.5 bln euros). Sterling jumped above $1.32 yesterday and is testing $1.33 today. We have suggested potential toward $1.34-$1.35. Immediate support now is seen near $1.3240.

America

US factory and durable goods orders are the last data points ahead of tomorrow’s look at Q4 GDP. The median forecast is around 2.5% Q4 GDP, and weighed down by Powell’s “crosscurrents” growth is expected to have slowed more here in Q1. Housing starts reported yesterday (December) were simply horrible, but the new strength in the Conference Board’s consumer confidence should ease some concerns, though of course, the naysayers are right that consumer confidence peaks before a downturn. Canada reports January CPI figures, and the base effect warns of a large drop on the headline rate (from 2.0% to 1.4%), but the Canadian dollar may come under pressure if the underlying measures soften a bit too.

Brazil’s new central banker, Roberto Campos Neto, was confirmed yesterday. Though he does not have much of a record of papers and speeches, he is held in high regard and is understood to be well within the orthodoxy. Mexican officials are hopeful that a trade agreement with China will allow the US to lift the steel and aluminum tariffs that have been levied on it. However, the US Department of Commerce just initiated a new anti-dumping probe into fabricated structural steel from Mexico, Canada, and China.

The US dollar is holding a little above Monday’s low against the Canadian dollar near CAD1.3115. There is an option for $604 mln at CAD1.3140 that expires today. The low for the year was set earlier this month near CAD1.3070. Resistance is now pegged in the CAD1.3160-CAD1.3180 band. The dollar is near the middle of its MXN19.00 to MXN19.35 range. The Dollar Index is being pushed below 96.00 support before the US open. Recall the Dollar Index posted a key reversal on Feb 15 after setting a new high for the year (a little above 97.35). It recorded another outside down day on February 19 after reaching almost 97.10. The 96.00 area corresponds to a 61.8% retracement of the Dollar Index gains since the January 31 low near 95.15. Between that low and current prices, support is seen near 95.50.

Graphs and additional information on Swiss Franc by the snbchf team.

Tags: #GBP,#USD,$AUD,$CAD,$EUR,$INR,$JPY,Featured,MXN,newsletter,SPX