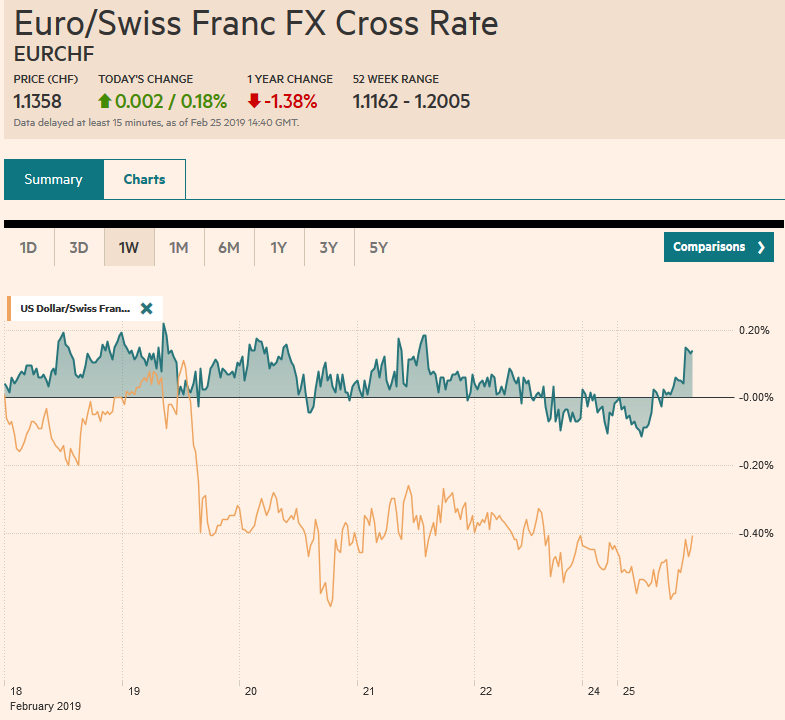

Swiss Franc The Euro has risen by 0.18% at 1.1358 EUR/CHF and USD/CHF, February 25(see more posts on EUR/CHF, USD/CHF, ) Source: markets.ft.com - Click to enlarge FX Rates Overview: The extension of the US-China tariff freeze had been telegraphed, but the confirmation is the single biggest driver of the day. Equities, led by a 5%+ advance in China, have rallied in Asia and Europe. Benchmark 10-year bond yields are mostly 1-2 basis points higher. Peripheral yields are lower. Fitch’s decision before the weekend, affirming Italy’s rating, help ease fears ahead of Moody’s (March 15) and S&P (April 26) reviews. The dollar is softer against nearly all the major and emerging market currencies. Oil and gold are firmed,

Topics:

Marc Chandler considers the following as important: 4) FX Trends, CAD, EUR, Featured, GBP, newsletter, USD

This could be interesting, too:

RIA Team writes The Importance of Emergency Funds in Retirement Planning

Nachrichten Ticker - www.finanzen.ch writes Gesetzesvorschlag in Arizona: Wird Bitcoin bald zur Staatsreserve?

Nachrichten Ticker - www.finanzen.ch writes So bewegen sich Bitcoin & Co. heute

Nachrichten Ticker - www.finanzen.ch writes Aktueller Marktbericht zu Bitcoin & Co.

Swiss FrancThe Euro has risen by 0.18% at 1.1358 |

EUR/CHF and USD/CHF, February 25(see more posts on EUR/CHF, USD/CHF, ) Source: markets.ft.com - Click to enlarge |

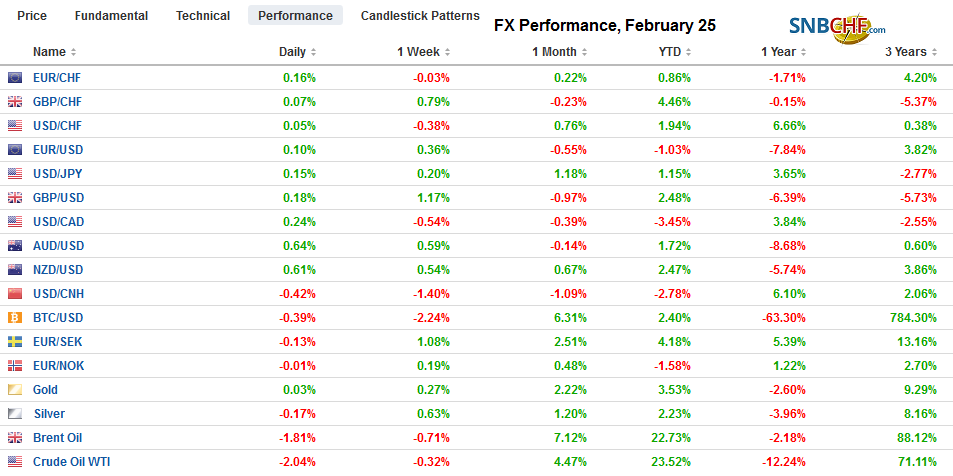

FX RatesOverview: The extension of the US-China tariff freeze had been telegraphed, but the confirmation is the single biggest driver of the day. Equities, led by a 5%+ advance in China, have rallied in Asia and Europe. Benchmark 10-year bond yields are mostly 1-2 basis points higher. Peripheral yields are lower. Fitch’s decision before the weekend, affirming Italy’s rating, help ease fears ahead of Moody’s (March 15) and S&P (April 26) reviews. The dollar is softer against nearly all the major and emerging market currencies. Oil and gold are firmed, while the threat of expanding strike activity in South Africa is lifting the platinum group metals, with palladium at new record highs. |

FX Performance, February 25 |

Asia Pacific

An extension of the tariff freeze that was supposed to end on March 1 was widely expected but the confirmation late yesterday one of the most important developments. It is not clear how long the extension will be, though it will obviously be sufficient to cover the Trump-Xi meeting, which could be a month away. Before the weekend, many got excited with Mnuchin’s claim that a currency agreement was struck, though no details were available and the weekend press suggested that the enforcement mechanism had yet to be agreed. Among other things, the tension between the US Trade Representative and the President seemed to reveal that Trump’s desire for an agreement is palpable. Ironically, former economic adviser, Cohn seemed to have resigned over Trump’s commitment to the tariff strategy, but now appears to be antagonizing his trading representative by being too willing to cut a deal.

With today’s gains, Chinese shares are now 20% above last month’s lows. Recall that the Shanghai Composite posted a bullish outside up day before the weekend to close above the 200-day moving average. The Composite gapped higher and closed on its highs. While trade was a major consideration, there is another force at work. There is a key Politburo meeting at the end of the week. The focus is expected to be capital market reforms. Securities firms were among the best performers today.

The Nikkei is testing the 21500 level. This level has seen as key to the near and medium-term outlook. Reports indicate that the calls struck there have been a popular vehicle to hedge against losses and if stocks continue to rally, the short call positions will have to be bought back. That said, the Nikkei is about 2.5% below its 200-day moving average. Meanwhile, the 10-year generic JGB yield of nearly minus 4 bp is holding just above a two-year low.

Even without the tariff freeze extension, the Australian dollar looked set to recoup some of the ground lost last week on the reports of disruptions in coal shipments to China. The Australian dollar hit a low last week near $0.7070 and finished the week near $0.7130. Today it reached $0.7165. There is scope for it to recover a little more before it runs into technical resistance and is once again an attractive sale. The dollar remains stuck in a narrow trading range against the yen. Last week, it did not move off the JPY110-handle and three-month implied volatility fell to its lowest level in five years (almost 6%). The intraday technicals hint that if the day’s range is to be extended, the downside may be favored, though there is a $430 mln option struck at JPY110.50 that rolls off today. Note the chunky expiration tomorrow for $1.4 bln at JPY109.70.

Europe

Ahead of the eurozone inflation and employment reports later this week and the ECB meeting next week, there is little to distract attention from Brexit. Here is where it sits: May has pushed back the “meaningful vote” in Parliament until March 12. The argument is that the negotiations with the EC are continuing and there has been some suggestion (Gove) that a new concession from Brussels over the backstop may be close (color us skeptical or any substantive change). Meanwhile, Parliament is still moving toward a vote in the middle of the week that could limit the government’s options. In particular, at least three cabinet officials (Rudd, Clark, and Gauke) have threatened to vote against the government to remove the risk of no-deal exit, which is part of May’s brinkmanship tactics.

Newswires report that May has informed Merkel that she does not desire an extension, though we suggest this is a negotiating position. Everyone seems to want closure, so not wanting a delay is not the same thing as not accepting a delay. Parliament could force May’s hand. At first, it looked like a couple month delay was possible. The idea is that as long as the UK is out around the EU Parliament elections at the end of May, a short delay would not be disruptive. However, it is not clear what a two-month delay would accomplish, and reports suggest that the EC is considering a longer delay–say into 2021.

Another important moving part trying to anticipate the evolving situation is Labour. Labour’s position is also developing, and it appears to be moving toward formally endorsing a second referendum. A second referendum is seen as potentially bullish for sterling on ideas that among the choices that would be presented would be to remain in the EU. While we have highlighted the dangerous precedent and the lack of legitimacy in the eyes of the Leave Camp if the first referendum is overturned, but investors would likely respond to a second referendum by taking sterling higher. We could envisage a move toward $1.35 or a little higher if a second referendum were called.

Sterling is firm though a little below last week’s high near $1.3110. Initial support is seen near $1.3050 now. Similarly, the euro found support just ahead of last week’s lows near GBP0.8065. As it did for most of last week, the euro is pushing against its 20-day moving average (~$1.1360). We have been looking for the euro to return to the middle of the $1.13-$1.15 range that has largely confined the price action. The $1.1375-$1.1410 band houses several near-term term important technical levels. Although today’s option cut ($1.13 and $1.1440) are not in play, a 1.4 bln euro expiry tomorrow at $1.1450 may be of interest, and for those short-term participants trying to pick a euro top, the stop is clear.

North America

A subdued North American session is likely on this Monday. The US economic data is light and features the Chicago Fed’s National Activity Index for January and the Dallas Fed Manufacturing Index for February. The focus this week is on the delayed release of Q4 GDP and Powell’s testimony before Congress beginning tomorrow. The market looks for around 2.4% growth, and the risk appears to be on the downside, especially given that downside surprises through the quarter. After struggling to find the right pitch, Powell and the Fed have found the words that resonate. Patience and flexible. From last week’s FOMC minutes, investors learned that nearly all officials want to finish the reduction of the balance sheet this year but are less sure that the interest rate cycle is over. Canada’s calendar is light until Wednesday’s CPI. Mexico report Q4 GDP and current account balance. Growth is expected to be little changed from Q3 1.8% year-over-year pace, while the current account deficit likely fell.

The US dollar is slipping lower against the Canadian dollar. The low from earlier this month (~CAD1.3070) is beckoning. A break of that area would target CAD1.30. The greenback’s losses are negating what had been a more constructive technical outlook. At the same time, risk-on, such as rising equities, and rising commodity prices, are offsetting the movement of interest rate differentials against the Canadian dollar. The US dollar was turned back from MXN19.50 in the middle of the month and now is poised to test MXN19.00. There are sufficient momentum and enthusiasm for emerging markets, which Mexico is sometimes a proxy, to re-test the dollar’s lows for the year near MXN18.88. The Dollar Index is poised to take out last week’s low near 96.25. The next area of support is 96.00. The 20-day moving average is found 96.40 today, and it has not closed below it since February 4.

Graphs and additional information on Swiss Franc by the snbchf team.

Tags: #GBP,#USD,$CAD,$EUR,Featured,newsletter