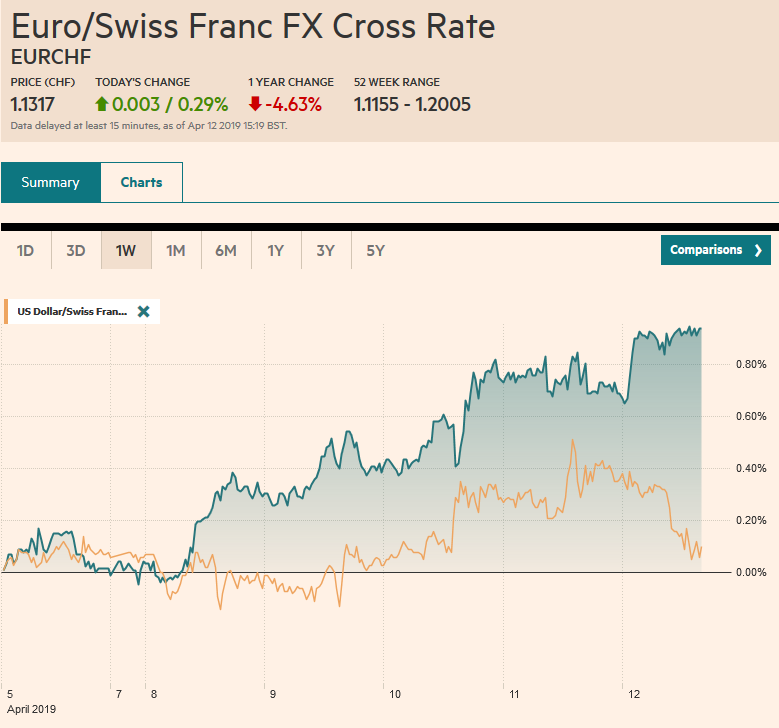

Swiss Franc The Euro has risen by 0.29% at 1.1317 EUR/CHF and USD/CHF, April 12(see more posts on EUR/CHF, USD/CHF, ) Source: markets.ft.com - Click to enlarge FX Rates Overview: The consolidative week in the capital markets is drawing to a close. Equity markets are narrowly mixed. In Asia, most indices outside of the greater China (China, Taiwan, and Hong Kong) edged higher, leaving the MSCI Asia Pacific Index slightly lower on the week. The MSCI Emerging Markets Index snapped a ten-day rally yesterday and is little changed so far today. Europe’s Dow Jones Stoxx 600 is off about 0.25% in late morning turnover, and about a 0.5% loss for the week. The S&P 500 is nursing a margin loss this week coming into today’s

Topics:

Marc Chandler considers the following as important: 4) FX Trends, China, EUR, Eurozone Industrial Production, Featured, newsletter, USD

This could be interesting, too:

Nachrichten Ticker - www.finanzen.ch writes Die Performance der Kryptowährungen in KW 9: Das hat sich bei Bitcoin, Ether & Co. getan

Nachrichten Ticker - www.finanzen.ch writes Wer verbirgt sich hinter der Ethereum-Technologie?

Martin Hartmann writes Eine Analyse nach den Lehren von Milton Friedman

Marc Chandler writes March 2025 Monthly

Swiss FrancThe Euro has risen by 0.29% at 1.1317 |

EUR/CHF and USD/CHF, April 12(see more posts on EUR/CHF, USD/CHF, ) Source: markets.ft.com - Click to enlarge |

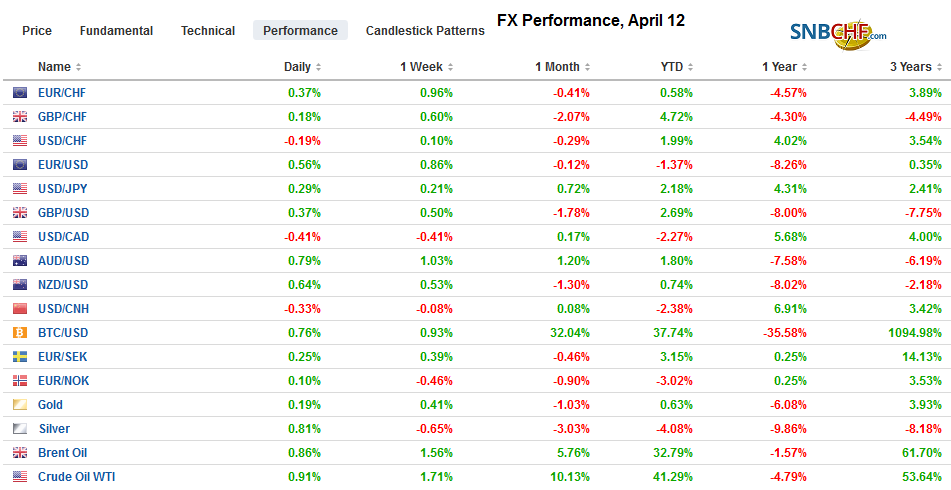

FX RatesOverview: The consolidative week in the capital markets is drawing to a close. Equity markets are narrowly mixed. In Asia, most indices outside of the greater China (China, Taiwan, and Hong Kong) edged higher, leaving the MSCI Asia Pacific Index slightly lower on the week. The MSCI Emerging Markets Index snapped a ten-day rally yesterday and is little changed so far today. Europe’s Dow Jones Stoxx 600 is off about 0.25% in late morning turnover, and about a 0.5% loss for the week. The S&P 500 is nursing a margin loss this week coming into today’s session. It has moved higher in 10 of the last 11 sessions but is continuing to knock on 2900. Bank earnings are in focus today. Bond yields in Asia were mostly higher, and China’s 10-year yield rose a couple of basis points to nose above 3.30%, a new high for the year. European yields are a little softer, while the US 10-year is hovering just below 2.50%. The dollar is mostly lower, with the Japanese yen the notable exception. On the week, the dollar has risen against only the yen and Swiss franc. |

FX Performance, April 12 |

Asia Pacific

China reported its lending and trade data for March. The lending data is flattered by the expected rebounded after the Lunar New Year distortions in February but also the shift in policy from de-leveraging to stimulating the economy. Aggregate lending jumped CNY2.86 trillion. The median estimate in the Bloomberg survey was for an increase of CNY1.85 trillion after a CNY703 bln increase in February. The aggregate lending includes the state banking system and shadow banking. State-dominated bank lending is seen in the new yuan loans. They rose CNY1.69 trillion, well above the forecast for CNY1.25 trillion after a roughly CNY886 bln increase in February. The difference between the aggregate lending and the new yuan loans is a proxy for the shadow banking. Its lending jumped to CNY1.17 trillion from contracting in February.

China’s trade surplus surged to $32.65 bln in March. It averaged nearly $33.7 bln last year. Month-to-month swings can be notoriously volatile after the Lunar New Year. The Q1 trade surplus stood at $76.5 bln compared with nearly $45 bln in Q1 18. Exports jumped 14.2% from a year ago after a 20.8% drop in February. Imports continued to fall. The -7.6% year-over-year pace in March follows a 5.2% contraction in February.

In Australia, the economy has conflicting impulses. The labor market remains strong, but housing s weak. The central bank is neutral, but the market continues to anticipate that a rate cut late this year. News today that the largest lender in Australia is considering cutting 10k jobs and closing as many as 300 branches may be the shock to the labor market that pushes the RBA out of its neutral stance. It appears that the OIS curve is discounting about an 80% chance of a cut this year compared with a little more than a 15% chance at the start of the year.

The dollar is building on yesterday’s gains against the yen and is testing the JPY112.00 area in the European morning. There is an option there for $1.1 bln that expires today. The year’s high was set a month ago near JPY112.15. This is the third consecutive week that the dollar has risen against the yen. We remain bullish the dollar against the yen and target JPY114.00 in the coming weeks. It is the third consecutive week that the Australian dollar has gained against the greenback. It was turned back from the $0.7170 area in the last two sessions but found new bids near $0.7120. It is currently straddling the $0.7150 level where an A$600 mln option expires today. The Chinese yuan appreciated by 0.14% against the dollar in the mainland session earlier today. It does not sound likely much, but it is the biggest move of the week. For six weeks now, it has been alternating between small gains and declines and net-net is fractionally changed over this period.

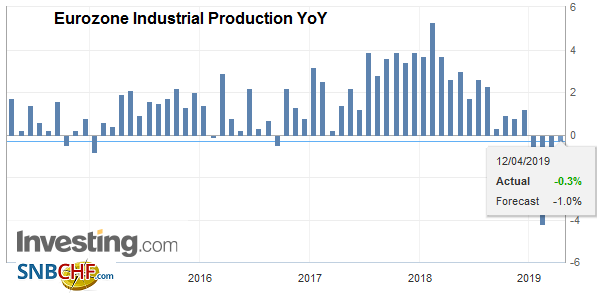

EuropeThe euro has jumped up in early Asia and follow through gains in Europe have pushed it above $1.13 for the first time since March 26. Some reports linked the euro demand in Asia to a Japanese bank’s purchase of the aviation finance arm of a German bank. It apparently helped trigger a short squeeze of the euro, where, as we have noted, speculators have their largest net and gross short position in the futures market since late 2016. Sentiment in Europe, judging from the PMIs, is weaker than the hard data. February industrial output in the eurozone fell 0.2%. The median forecast in the Bloomberg survey was for a 0.5% decline. The January series was revised to show a 1.9% increase rather than 1.4%. From a year ago, it is 0.3% lower. This is the smallest year-over-year decline since last October. The flash April PMI will be reported toward the end of next week. In March, the French manufacturing and services were both below the 50 boom/bust level, as was German manufacturing. |

Eurozone Industrial Production YoY, February 2019(see more posts on Eurozone Industrial Production, ) Source: investing.com - Click to enlarge |

Even though we suspect the worst is past for the eurozone on this soft patch, many headwinds still threaten a robust recovery. The ECB is committed to a new long-term loan facility. There is a debate over the terms of the new loans. Some suggest that it ought to be conducted closer to the deposit rate (minus 40 bp) rather than the repo rate (zero). The other element that is being debated is whether some measures need to be taken to help mitigate the impact of negative rates for longer. This usually takes the form of tiering-often seen as exempting some deposits at the central bank from the negative rate or subjecting some deposits to a less negative rate. We conceive of it within the context of a segmented market. Banks in the periphery are the largest users of the TLTRO facility. Banks in the north have the surplus of reserves and hence more exposed to the negative yields.

It seemed that UK Prime Minister May’s overture to Labour had stalled. However, now May appears to be renewing her willingness to consider a customs union type of arrangement. She will alienate her own party, where some have already tried to dump her, but this seems like a path forward. This is where to look though for a deal over the next month, which would allow the UK to avoid participating in the late May EU Parliament election.

The euro has firmed to test a retracement objective (38.2%) of the decline since the March FOMC meeting that is found near $1.1315. Above there, the next target is closer to $1.1350. The euro bears may make another stand, and if they can push it back below $1.13 on a closing basis, they may feel more confident next week. There is a 1.1 bln euro option struck at $1.13 that expires today. We anticipated this upside correction in the euro and recognize that there could be follow-through early next week, but our longer-term bearish outlook remains intact. Sterling is flat. It remains within the range seen Tuesday against the dollar (~$1.3030-$1.3120).

America

The economic calendar is light. The US reports import/export prices and the University of Michigan’s consumer confidence. To the extent that there is a focus, it is on the bank earnings that will be reported today and the Uber IPO announcement.

The US 10-year yield has moved back above 2.50% and is at its highest level in three days. It is up about three basis points this week. The two-year yield is up a little more but remains below the effective average Fed funds rates (~2.41%). Meanwhile, the price of WTI is set to post its sixth consecutive week of advances. The May contract is up 2% this week and continues to knock on the $65-level. Our technical target since the end of January is near $67. Similarly, the S&P 500 is pushing at 2900. It has fallen only once since March 27. However, coming into today’s session, it is slightly lower on the week. Last week, after the employment data, it closed at almost 2893.

The US dollar chopped between CAD1.33 and CAD1.34 this week. It is trading with a weaker bias today, but there is a large $1.3 bln option at CAD1.33 that expires today. The two-year rate differential edged a few basis points in the US favor this week. The greenback is about 0.4% lower against the Canadian dollar this week (~CAD1.3330) but has lost 1.5% against the Mexican peso. The attractive yield and risk-on sentiment have buoyed the peso, which is trading near the best levels of the year. The dollar has risen against the peso in only one session this week and one session last week, which illustrates the persistence of the peso buying. A break of MXN18.70 would target MXN18.50.

Tags: #USD,$EUR,China,Eurozone Industrial Production,Featured,newsletter