Gold Price Gains Due To Declining Dollar Rather Than Interest Rates – Investors should not be put off by higher interest rates, World Gold Council research finds they do not always have a negative impact on gold – Only short-term movements in gold are ‘heavily influenced by US interest rates’ – Correlation between US interest rates and gold is waning, with US dollar a better indicator of short-term gold price – New findings will reassure gold investors that there is no single driver of the gold price including interest rates and the myth of the “all powerful” central bank Editor: Mark O’Byrne What drives the gold price? There is no single answer to that question. It is a multiple of factors, all of which vary in

Topics:

Jan Skoyles considers the following as important: 6) Gold,Bitcoin,Austrian Economics, Daily Market Update, Featured, gold prices, newsletter

This could be interesting, too:

Nachrichten Ticker - www.finanzen.ch writes Die Performance der Kryptowährungen in KW 9: Das hat sich bei Bitcoin, Ether & Co. getan

Nachrichten Ticker - www.finanzen.ch writes Wer verbirgt sich hinter der Ethereum-Technologie?

Martin Hartmann writes Eine Analyse nach den Lehren von Milton Friedman

Marc Chandler writes March 2025 Monthly

Gold Price Gains Due To Declining Dollar Rather Than Interest Rates

– Investors should not be put off by higher interest rates, World Gold Council research finds they do not always have a negative impact on gold

– Only short-term movements in gold are ‘heavily influenced by US interest rates’

– Correlation between US interest rates and gold is waning, with US dollar a better indicator of short-term gold price

– New findings will reassure gold investors that there is no single driver of the gold price including interest rates and the myth of the “all powerful” central bank

Editor: Mark O’Byrne

| What drives the gold price? There is no single answer to that question. It is a multiple of factors, all of which vary in their influence depending on an even greater number of factors.

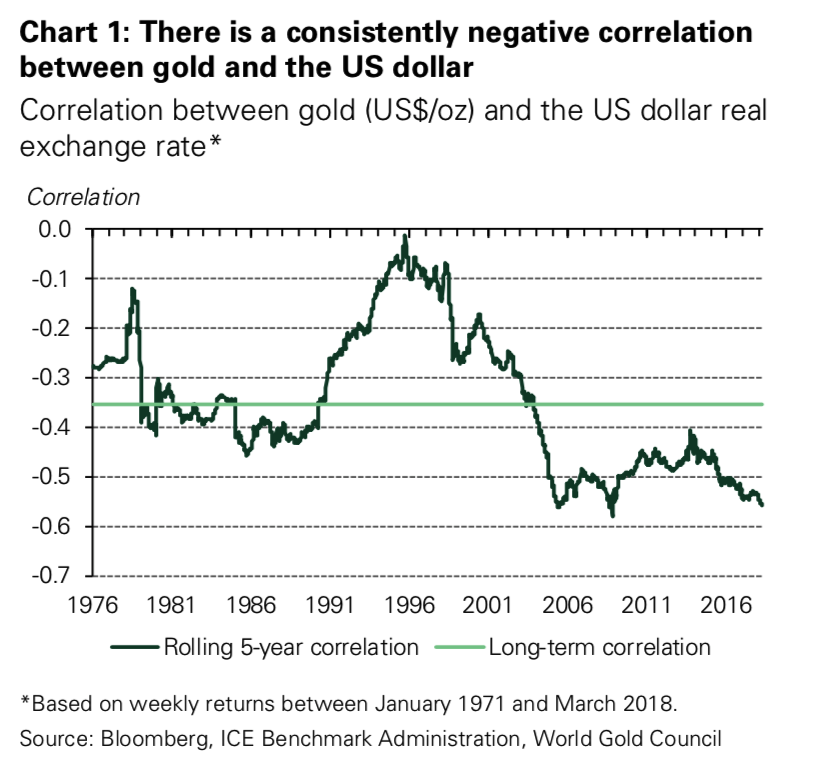

According to latest research from the World Gold Council, there are two factors in the short and medium-term that attract investors’ attention the most: the US dollar and US interest rates. One overriding belief by gold market commentators and observers is that the direction of the US dollar carries a greater impact on the gold price than US interest rates. This is understandable given gold’s consistently negative correlation to the US dollar. |

Correlation between Gold and the US Dollar Real Exchange Rate, 1976 - 2018 |

| However, we have all noticed how gold has only reacted positively since the Federal Reserve has been hiking rates since last December – increasing by 8.5%.

So should we therefore assume that US interest rates do in fact matter more to the direction of the gold price? There is no straight forward answer says the World Gold Council. ‘Generally’ the US dollar matters most to the precious metal’s price movements, ‘but there are exceptions to this rule’. |

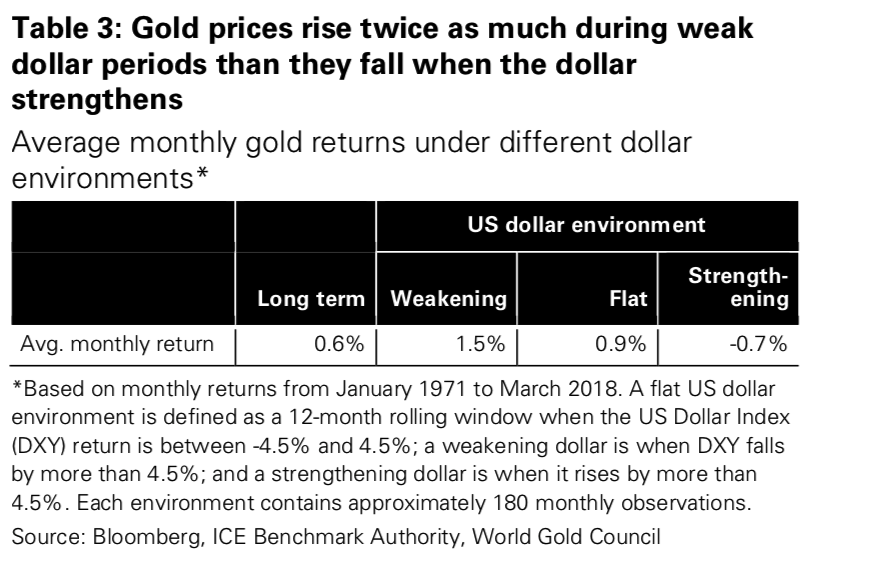

Average Monthly Gold Returns |

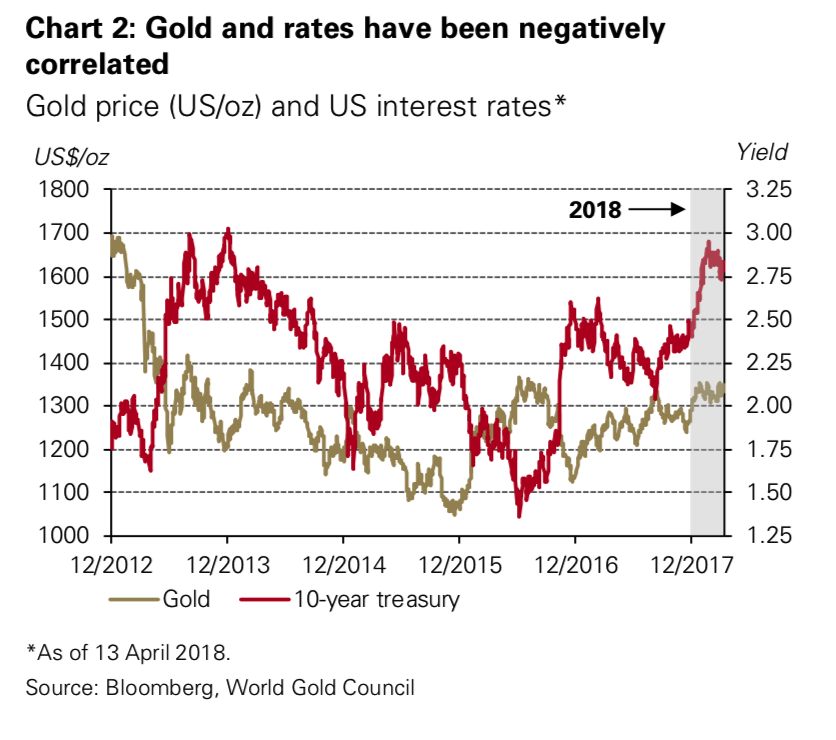

Gold and interest rates: a negative correlationIt makes sense that gold and interest rates should be negatively correlated. One is seen as the opportunity cost of another. Between 2013 and 2017 the negative correlation was strong: ‘[This] was likely a result of the strong influence that US monetary policy was exerting across global markets. This period coincided with a shift in investor expectations of US monetary policy from being very accommodative to moving towards normalisation.’ |

Gold Price and US Interest Rates, Dec 2012 - Apr 2018(see more posts on Gold prices, ) |

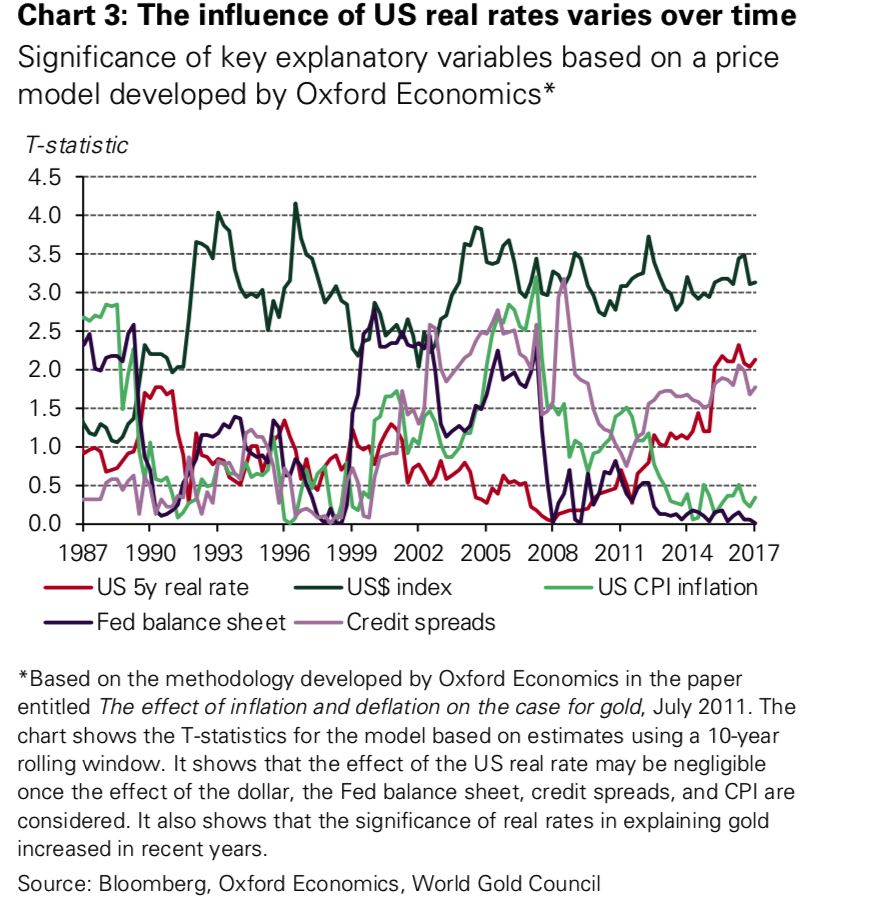

Conversely, higher rates are not always linked to higher pricesWe are always quick to assume that US interest rate changes will begin to affect the price of gold. But consider the variety of demands involved in the gold market: jewellery, or technological demands- are they all influenced by US interest rates? The chances are, no. ‘US interest rates do not necessarily influence the behaviour of global consumers of gold jewellery or of technology demand. Nor do they affect the behaviour of investors outside the US for whom local interest rates matter more than US rates’ Interestingly the WGC research finds that whilst gold does react best to negative US interest rates, they can remain below 2.5% (significantly higher than today) and average gold returns remain positive. ‘Falling rates are generally linked to higher gold prices; yet rising rates are not always linked to lower prices.’ Take the above with a pinch of salt These findings with a pinch of salt. There are so many factors that affect the price of gold that investors should not focus on the policies and currency of one country to determine their buying and selling decisions. The WGC finds four broad categories which affect the price of gold. It is interactions between these categories that affect the performance of the precious metal. Wealth and economic expansion: periods of growth are very supportive of jewellery, technology, and long-term savings Market risk and uncertainty: market downturns often boost investment demand for gold as a safe haven Opportunity cost: the price of competing assets such as bonds (through interest rates), currencies and other assets influence investor attitudes towards gold Momentum and positioning: capital flows and price trends can ignite or dampen gold’s performance. When it comes to gold’s long-term trend, the lobbying group finds that: ‘drivers related to wealth and economic expansion are generally more relevant for gold’s long-term trend. And drivers linked to the other three categories play a significant role in gold’s countercyclical behaviour.’ The US dollar will overtake rates when it comes to influence on gold price In our view, one of the reasons the dollar will overtake rates to explain the direction of the gold price, is that movements in the dollar already reflect inflation expectations of monetary policy in the US. At the same time, they also reflect expectations of interest rate differentials between the US and major economies, as well as investors’ views on trade imbalances – all factors that are currently relevant for gold. |

US Real Estate Rates, 1987 - 2017 |

| Listen on SoundCloud , Blubrry & iTunes. Watch on YouTube below |

There is an ‘asymmetric correlation’ between gold prices and the US dollar. Why? Because not everyone pays for their gold in US dollars. Local currency movements impact demand more.

Thus, gold’s behaviour is best understood as a broad fiat currency hedge rather than simply a dollar hedge. This is apparent in periods when major currencies weaken, and investors buy gold to hedge that risk – for example, during the European sovereign debt crisis. In such instances, gold and the dollar have tended to move in sync, with both benefiting from safe haven inflows.

This further explains why the uncertain times ahead due to heightened geopolitical risk are likely to see further gold price gains. Even if the dollar strengthens on announcement of war in Syria (for example) we may still see the price of gold rise.

Tags: Daily Market Update,Featured,Gold prices,newsletter