We could be heading for a golden age – or a return to the 1970s The cost to the US government of borrowing money for a decade came within sniffing distance of 3% yesterday. The US ten-year Treasury yield is sitting at 2.96% as I write this morning, having got to 2.99% yesterday. Does this really matter? After all, 3% is just another number. On the one hand, you’d be right to think that. On the other, it’s not so much...

Read More »“Blood In The Streets” Of U.S. Gold Bullion Coin Market

U.S. Mint American Eagle gold coin sales collapse to weakest April since 2007 giving contrarian value buyers another buy signal Sales of U.S. Mint American Eagle gold coins dropped to their weakest April since 2007, while silver coin purchases for the month rose 10 percent higher than last year, U.S. government data showed on Monday. The U.S. Mint sold 4,500 ounces of American Eagle gold coins in April, down 25...

Read More »The Oil Curse Comes to Washington

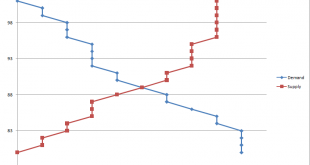

Meandering Prices Prices rise and prices fall. So, too, they fall and rise. This is how the supply and demand sweet spot is continually discovered – and rediscovered. When supply exceeds demand for a good or service, prices fall. Conversely, when demand exceeds supply, prices rise. Supply and DemandSupply and demand (the curves usually shown in such charts are unrealistic, as bids and offers in the market are...

Read More »Gold Price Increasingly Influenced By Declining Dollar Rather Than Interest Rates

Gold Price Gains Due To Declining Dollar Rather Than Interest Rates – Investors should not be put off by higher interest rates, World Gold Council research finds they do not always have a negative impact on gold – Only short-term movements in gold are ‘heavily influenced by US interest rates’ – Correlation between US interest rates and gold is waning, with US dollar a better indicator of short-term gold price – New...

Read More »Turkey and Russia Highlight Gold’s Role as a Strategically Important Asset

On 17 April, Turkish news publication Ahval published a report stating that during 2017, Turkey withdrew 26.8 tonnes of gold that it had stored in the vaults of the New York Federal Reserve, and moved this gold under the custodianship of the Bank of England and the Bank for International Settlements (BIS). The source of the Ahval report was a Turkish language article from the popular Hürriyet newspaper in Turkey....

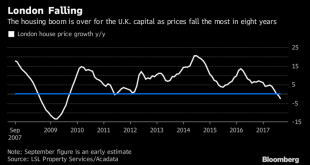

Read More »London House Prices See Fastest Quarterly Fall Since 2009 Crisis

– London house prices fell by 3.2% in the first quarter – Halifax – Brexit, financial and geo-political uncertainty lead to falls– Excluding sale of seven £10m-plus houses in London, prices were down 3.4% in the year– UK house prices climb by just 0.4% in April, the slowest increase since 2008 for same period– Sales transactions fall by 19% and asking versus selling prices show turning into buyers’ market– Homeowner or...

Read More »Wrong-Way Breakout in Silver – Precious Metals Supply and Demand

See the introduction and the video for the terms gold basis, co-basis, backwardation and contango. Unfulfilled Prophecies The price of gold fell $12 last week, but that of silver dropped 63 cents. What’s up with silver?! A prominent analyst wrote on April 19 of the “breakout” in silver. Of course, without the benefit of the basis and the Monetary Metals fundamental price, he could only see the price chart, plus the...

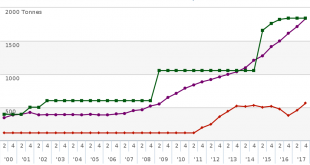

Read More »Russia Buys 300,000 Ounces Of Gold In March – Nears 2,000 Tons In Gold Reserves

– Russia buys 300,000 ounces of gold in March and nears 2,000t in gold reserves – Russia now holds just over 1,861 tonnes, more than officially reported by China at 1,842t – Both Russia and China have the power to destabilise US dollar by dumping dollar-denominated assets – Turkey has removed all gold held in the U.S. opting for Bank of England and BIS – Turkey follows trend set by both Germany, Netherlands and others...

Read More »Family Offices and HNWs Invest In Gold Again

Family Offices and HNWs Are Investing In Gold Again – Rising interest by family offices and high-net-worth (HNW) into gold bullion investments – Gold ETF assets have reached almost $100 billion due to HNWs and pension funds’ increased demand – Volatility in equities, concerns over trade wars, Trump’s Presidency and other economic worries are spurring demand for gold coins and bars – Prudent money ‘trickle’ back into...

Read More »‘New buyer found’ for ailing Monetas blockchain firm

Monetas founder Johann Gevers told investors he has found a replacement buying after an earlier deal fell through. (Nik Hunger) - Click to enlarge Troubled Swiss blockchain payments firm Monetas has found a new mystery buyer to pull it out of the mire, swissinfo.ch has learned. The company has run into major problems in the last few months, including enforced bankruptcy proceedings and the acrimonious...

Read More » Swiss Economicblogs.org

Swiss Economicblogs.org