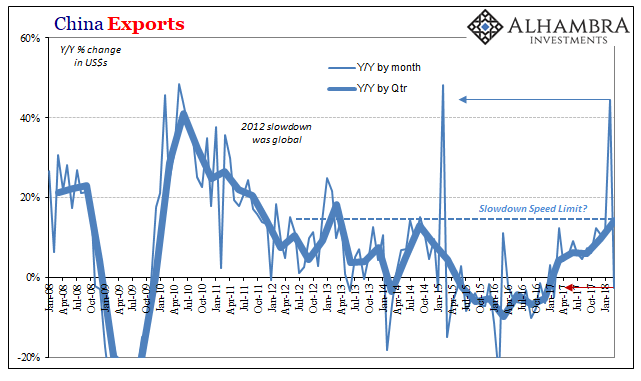

Last month Chinese trade statistics left us with several key questions. Export growth was a clear outlier, with outbound trade rising nearly 45% year-over-year in February 2018. There were the usual Golden Week distortions to consider, made more disruptive by the timing of it this year as different from last year. And then we have to consider possible effects of tariffs and restrictions at the start of what is called a trade war (but isn’t really, at least not yet). China Exports, Jan 2008 - 2018(see more posts on China Exports, ) - Click to enlarge Given those factors, Chinese exports unsurprisingly declined in March. Falling 2.7%, it was the first negative since last February and the same holiday deformation

Topics:

Jeffrey P. Snider considers the following as important: $CNY, China, China Exports, China Fixed Asset Investment, China Imports, commodities, currencies, Dollar, economy, EuroDollar, exports, fai, Featured, Federal Reserve/Monetary Policy, global trade, imports, Markets, newslettersent

This could be interesting, too:

Nachrichten Ticker - www.finanzen.ch writes Die Performance der Kryptowährungen in KW 9: Das hat sich bei Bitcoin, Ether & Co. getan

Nachrichten Ticker - www.finanzen.ch writes Wer verbirgt sich hinter der Ethereum-Technologie?

Marc Chandler writes March 2025 Monthly

Mark Thornton writes Is Amazon a Union-Busting Leviathan?

| Last month Chinese trade statistics left us with several key questions. Export growth was a clear outlier, with outbound trade rising nearly 45% year-over-year in February 2018. There were the usual Golden Week distortions to consider, made more disruptive by the timing of it this year as different from last year. And then we have to consider possible effects of tariffs and restrictions at the start of what is called a trade war (but isn’t really, at least not yet). |

China Exports, Jan 2008 - 2018(see more posts on China Exports, ) |

| Given those factors, Chinese exports unsurprisingly declined in March. Falling 2.7%, it was the first negative since last February and the same holiday deformation only then affecting the calendar in the other direction. Altogether in Q1, Chinese exports were up only 14.2% despite the otherwise huge gain in the one month. That’s better than 9.9% in Q4 2017, and 6.0% in Q3 2017, but is that acceleration or distortion? |

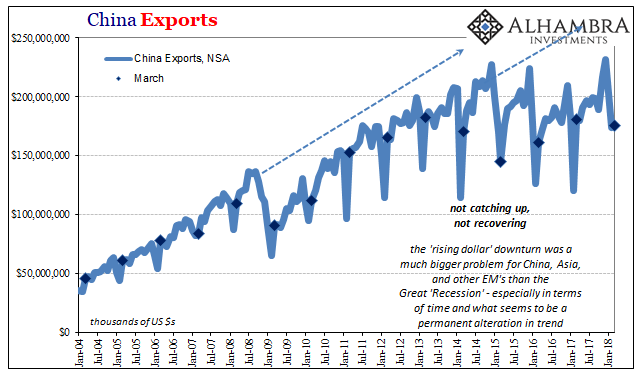

China Exports, Jan 2004 - 2018(see more posts on China Exports, ) |

| We won’t know the answer to that key question until a few months further into 2018. Even if it is acceleration, it’s still within the same post-2012 parameters (slowdown speed limit). And you have to wonder if it takes a 45% month to produce 2014 levels of growth, just how much is global trade really expanding? It wouldn’t be anywhere close to the boom/inflation narrative.

That much we can witness on the other side of China’s trade statistics. For all we make out of the export segment, with good reason, it is Chinese imports that are the real driving force in global reflation. In other words, exports tell us about the global economy while imports tell us about how China is attempting to deal with that global economy as it really is. |

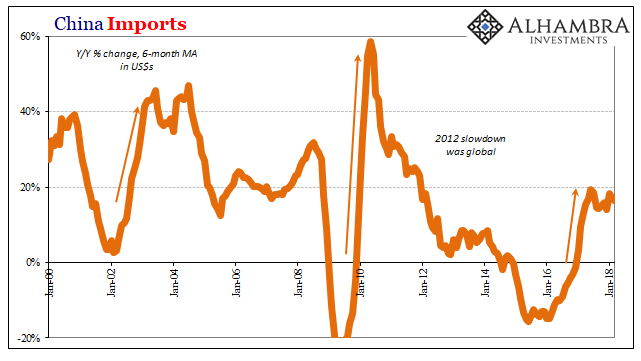

China Imports, Jan 2008 - 2018(see more posts on China Imports, ) |

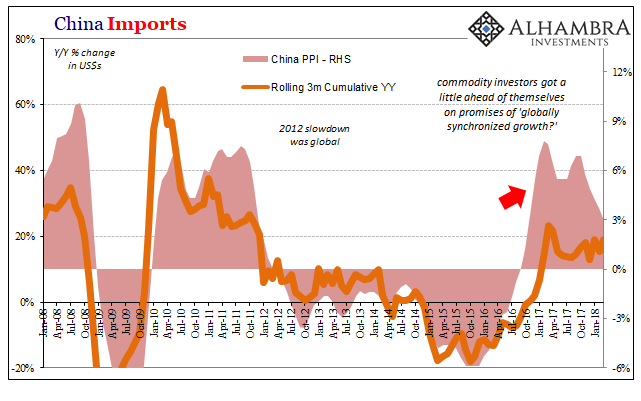

| Considering distortions here, too, after 37% growth in January 2018 China’s imports rose just 6.3% in February and now 14.3% in March. For Q1 as a whole, that’s a year-over-year change of 19.1%. That’s better than the 13% rate achieved in Q4 in absolute terms, but not meaningfully better. Chinese import growth has stalled. |

China Imports, Jan 2000 - 2018(see more posts on China Imports, ) |

| And it has done so at a rate far below other recovery type situations; or, more accurately, what has been presumed to be a recovery circumstance by the idea of “globally synchronized growth.” We know that according to two of the big three internal economic statistics (IP, retail sales) China’s economy is running at pretty much the same rate as it had been going back to 2015 and the “rising dollar.” No real improvement at all.

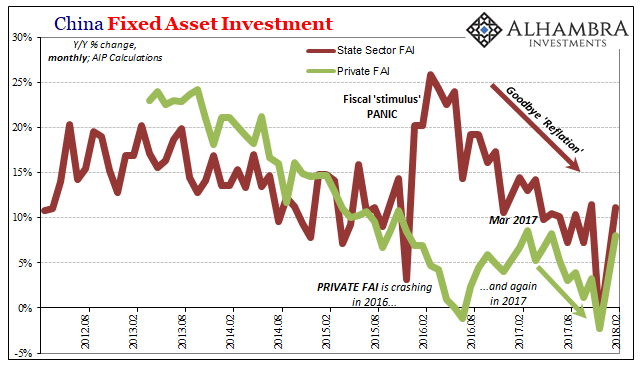

It was the third, FAI, which had materially changed in early 2016 as a concerted fiscal (state-owned FAI) effort to avoid what many feared could have been a so-called hard landing. But in 2017, rather than have ignited a cyclical wave first in private FAI spreading through the whole of China’s economy, it all fizzled. Not just in the private segment, either, as state-owned investment growth was scaled back, too. |

China Fixed Asset Investment, Aug 2012 - Feb 2018(see more posts on China Fixed Asset Investment, ) |

| But in many markets particularly those related to commodities the baseline assumption had remained cyclical. In other words, investors began to bet that the big early 2016 “stimulus” would either work on its own in bringing about actual economic acceleration in China and beyond, or, failing that, was just the first step toward more forceful official action along the same lines as 2009 or 2012.

Since China’s economy sets the world order in terms of material and commodities, which the country has to import in large part, many important commodity prices are dependent upon economic projections of how China’s economy will be dealing with the global economy. From the more realistic view of Q1 2018, it isn’t at all cyclical. Again, import growth has stalled because 2017’s disappointment may have been as good as it gets. |

China Imports, Jan 2008 - 2018(see more posts on China Imports, ) |

This unnatural tension is similar and related to what we find in the divergence between China’s PPI and CPI. The latter continues to show restraint as a consequence of chronic and unrelenting “dollar” issues (giving us a sense of another important constraint on the global economy). The former displayed the enthusiastic embrace of “reflation.”

Is this all just a temporary pause before China kicks into another, higher gear? Nothing ever goes in a straight line, but there’s an entire year of import growth stalled out at the same ceiling (and export growth being able to manage no better than 2014). Commodity prices have likewise paused as investors have been over the last six or nine months recalibrating expectations to this disappointment. They haven’t totally rebuked reflation, but it does appear to be rolling over, however.

Part of that is how we have to consider the political situation in this economic context. Since the 19th Communist Party Congress, leadership actions in particular don’t leave us with the impression 2016 was just the first round of several attempts to further boost growth. They, in fact, have been pretty explicit and consistent on this score.

These appear to be the consequences of recognizing a global “L.” Not everyone got the message, though, especially here in the West, but many are starting to at least consider that’s what the Chinese are thinking. Reflation or inflation hysteria, global growth and a possible boom, those are 2016 assumptions that didn’t really make it too far into 2017 and just aren’t present in 2018.

Tags: $CNY,China,China Exports,China Fixed Asset Investment,China Imports,commodities,currencies,dollar,economy,EuroDollar,exports,fai,Featured,Federal Reserve/Monetary Policy,global trade,imports,Markets,newslettersent