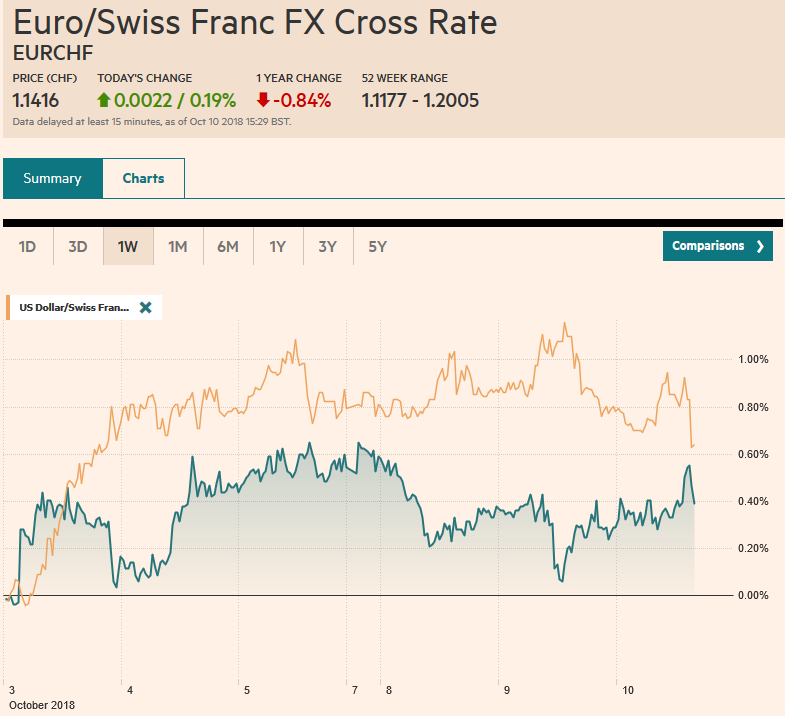

Swiss Franc The Euro has risen by 0.19% at 1.1416 EUR/CHF and USD/CHF, October 10(see more posts on EUR/CHF, USD/CHF, ) Source: markets.ft.com - Click to enlarge FX Rates US Dollar: The euro bottomed yesterday near .1430 and reached .1515 in Asia. Support is seen near .1480 and should hold if the euro’s upside correction is to continue. There are options struck .1500-.1510 for nearly 1.4 bln euros that expire today. For the third consecutive session, the dollar found bids a little below JPY113.00. There is a bln JPY113 option that will be cut today. The JPY113.40 area as blocked the upside this week and a move above there today would lift the tone. Sterling move to a new high for the month near

Topics:

Marc Chandler considers the following as important: $CAD $GBP, $CNY, 4) FX Trends, AUD, EUR, Featured, GBP, newsletter, TLT, USD

This could be interesting, too:

Nachrichten Ticker - www.finanzen.ch writes Die Performance der Kryptowährungen in KW 9: Das hat sich bei Bitcoin, Ether & Co. getan

Nachrichten Ticker - www.finanzen.ch writes Wer verbirgt sich hinter der Ethereum-Technologie?

Martin Hartmann writes Eine Analyse nach den Lehren von Milton Friedman

Marc Chandler writes March 2025 Monthly

Swiss FrancThe Euro has risen by 0.19% at 1.1416 |

EUR/CHF and USD/CHF, October 10(see more posts on EUR/CHF, USD/CHF, ) Source: markets.ft.com - Click to enlarge |

FX RatesUS Dollar: The euro bottomed yesterday near $1.1430 and reached $1.1515 in Asia. Support is seen near $1.1480 and should hold if the euro’s upside correction is to continue. There are options struck $1.1500-$1.1510 for nearly 1.4 bln euros that expire today. For the third consecutive session, the dollar found bids a little below JPY113.00. There is a $1 bln JPY113 option that will be cut today. The JPY113.40 area as blocked the upside this week and a move above there today would lift the tone. Sterling move to a new high for the month near $1.3185 in Asia. However, the momentum stalled, and Europe has been reluctant to rebuild it. Support is seen a little ahead of $1.31. The Australian dollar has recovered nearly a cent off of Monday’s lows, but resistance in the $0.7140-$0.7150 proved sufficient to keep stronger gains in check. A return below $0.7080 would be disappointing. The US dollar reversed lower against the Canadian dollar yesterday from CAD1.30 and found bids near CAD1.2930 in Asia. The CAD1.2970 may provide a near-term cap. The dollar consolidated within yesterday’s range against the Chinese yuan, which itself was inside Monday’s range. As seems often to be the case a counter-trend move began in the foreign exchange market on Tuesday and continued into Asia today. In the current context, this meant a dollar pullback. Although move seemed to falter early European activity, we expect the dollar to move modestly lower in North America today. Asian stocks snapped a seven-day slide, with the help of small gains broadly in the region, including Japan, China, and India. Of note foreign investors, foreign investors sold Philippine shares for the 30th consecutive session. The Philippine Stock Index has fallen the past five weeks, during which time it has lost about 9%, and it is off another 1% this week. European shares are struggling to extend yesterday’s gains, but Italian stocks, including bank shares, are doing a bit better. However, in the debt market, Italy remains under pressure, with yields and the premium over Germany still widening. European benchmark 10-yields are up small, and the US 10-year yield is slightly firmer at 3.22%. |

FX Performance, October 10 |

Federal Reserve’s Independence: Our technical reading of the market warned of a likely pullback in the US dollar after China’s markets re-opened from a week-long holiday. US President Trump’s comments, reiterating his criticism of Fed policy (moving too fast) may have helped spark the technical move. That said the price action in the fed funds futures market suggested investors do not think that the Fed will change its stance, and therefore despite appearances, the Fed’s independence is still seen as secure. The December 2019 fed funds futures contract implies an expectation for the average effective fed funds rate to be 2.925% at the end of next year. It currently is at 2.18%. The difference is nearly 75 bp or three hikes. The Fed’s projections are for one more increase this year and three next.

Japan: Tax reform in Japan appears to be spurring capital investment, It reported today that core machine orders rose 6.8% in August after an 11% rise in July. Economists had expected an outright decline. There is some speculation that Japan can be an alternative source for China of US goods that are being made less competitive through its retaliatory tariffs. Japan’s September trade figures will be reported next week. In August, exports were up 6.6% year-over-year.

Italy: Italy is showing no signs of backing down in the confrontation with the EC over its fiscal plans. Conventional wisdom puts Italy’s debt at the center of the bearish narrative. However, an alternative interpretation puts the key deficit not in fiscal excesses after all Italy runs a primary budget surplus (excluding debt servicing costs), but in the lack of growth. And this is why today’s unexpected jump in August industrial production is a welcome development. The 1.7% rise month-over-month is the largest since January. The Reuters survey found expectations for the rise to be half as much after the 1.6% decline in July (initially -1.8%). Still, one data point is hardly sufficient to indicate a turnaround, though as it is said, Rome was not built in a day. Moreover, the clash with the EC is still in its early days. The Italian 10-year premium over Germany widened to 307 bp today before easing. Recall that the May spike was to 290 bp.

France: French industrial output also surprised on the upside, in contrast to Germany, which reported an unexpected third consecutive decline last week. French August industrial production rose 0.3%. Economists anticipated a 0.1% increase and the July series was revised to 0.8% from 0.7%. Perhaps more impressively, manufacturing output rose 0.6%. This is a little above the three-month average which was 0.2% in Q2 and -0.5% in Q1. There does seem to be a shift in market share since mid-summer away from Germany. Meanwhile, to bolster support, President Macron is planning a cabinet reshuffle, which is expected to be announced shortly.

UK: Two issues continue to dominate sterling discussions. Brexit and the economy. There are developments on both fronts today. In terms of Brexit, there continues to be some movement, and there is talk that a deal can be found over the weekend, allowing the summit later this month to solidify an agreement that Prime Minister May could take back home. This is where it gets particularly tricky. The fate may rest on a rump of Labour MPs who would have to violate their own leader to support the government. It would antagonize many Conservatives. The UK’s data was mixed. The trade deficit was larger than expected and while industrial output rose a little more than forecast, manufacturing output contracted by 0.2% (instead of increasing by 0.1%). Construction spending was soft, and the August monthly GDP was flat after a 0.4% rise in July (initially 0.3%).

North America: The main US economic report is the September PPI. The headline rate may slow a little, but the core rate is expected to tick-up. Economists will look for insight into consumer goods prices, which will be reported tomorrow. The market is more sensitive to CPI than PPI. The Fed’s Evans and Bostic speak today. Neither seems as dovish as they had been. Canada report August building permits. The median of the Bloomberg survey calls for a 0.5% increase, but after yesterday’s dismal housing starts, the risk is on the downside. Instead of increasing as economists expected, Canada’s housing starts fell 10% to their lowest level in nearly two years. The IMF warned about house prices in Canada (and Australia) in its latest World Economic Outlook which also noted high asset valuation in the US.

Graphs and additional information on Swiss Franc by the snbchf team.

Tags: #GBP,#USD,$AUD,$CAD $GBP,$CNY,$EUR,$TLT,Featured,newsletter