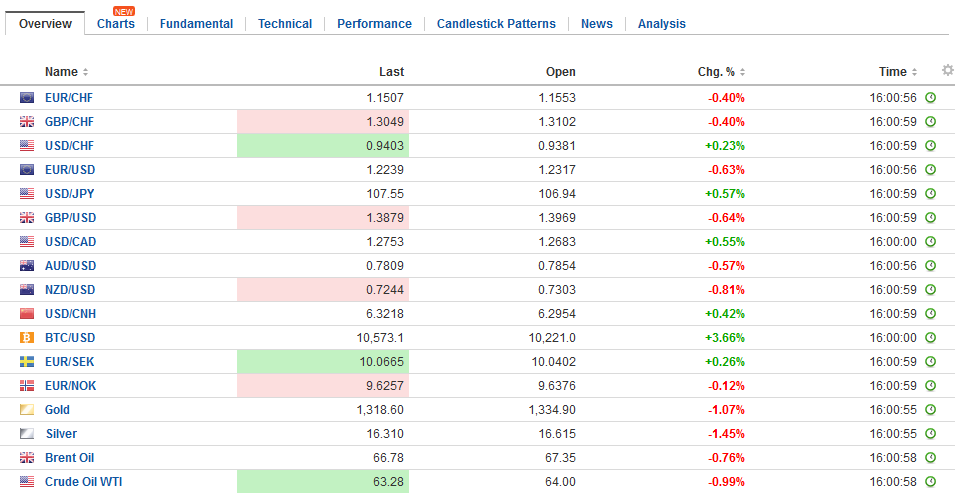

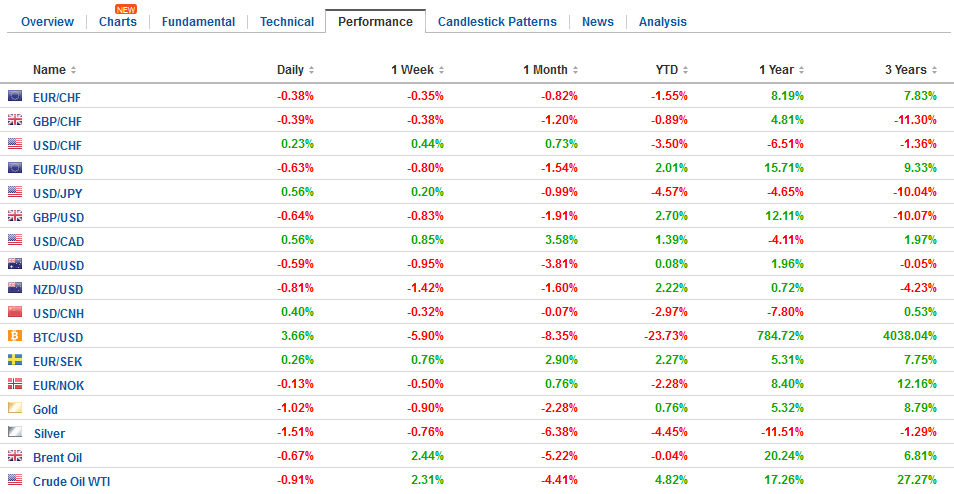

Swiss Franc The Euro has fallen by 0.29% to 1.1517 CHF. EUR/CHF and USD/CHF, February 27(see more posts on EUR/CHF, USD/CHF, ) Source: markets.ft.com - Click to enlarge FX Rates The capital markets seem unusually subdued. The US dollar is mostly slightly firmer, except against the euro and Swiss franc among the majors. The MSCI Asia Pacific Index managed to eke out a small gain (0.2%), for a third advancing session, without the help of China, Taiwan, Korea or India. It was really a Japanese story. The Nikkei rallied 1.1%, while excluding Japan the MSCI benchmark was off 0.25%. This is also borne out by the heavier tone in the MSCI Emerging Market Index (-0.2%). European bourses are nursing small losses, and

Topics:

Marc Chandler considers the following as important: AUD, CAD, EUR, Eurozone Consumer Confidence, Featured, France Consumer Confidence, FX Trends, GBP, Germany Consumer Price Index, JPY, newsletter, Spain Consumer Price Index, SPY, U.S. Durable Goods Orders, USD

This could be interesting, too:

RIA Team writes The Importance of Emergency Funds in Retirement Planning

Nachrichten Ticker - www.finanzen.ch writes Gesetzesvorschlag in Arizona: Wird Bitcoin bald zur Staatsreserve?

Nachrichten Ticker - www.finanzen.ch writes So bewegen sich Bitcoin & Co. heute

Nachrichten Ticker - www.finanzen.ch writes Aktueller Marktbericht zu Bitcoin & Co.

Swiss FrancThe Euro has fallen by 0.29% to 1.1517 CHF. |

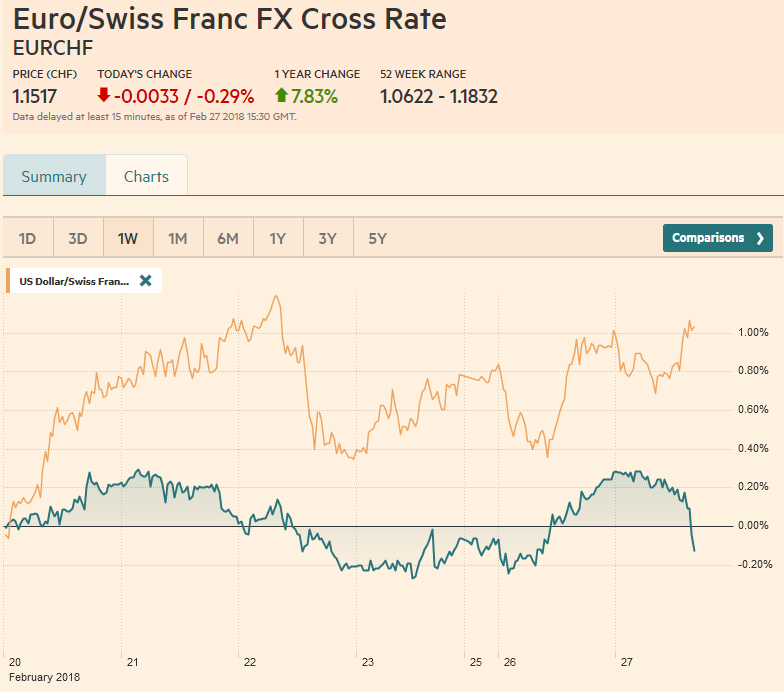

EUR/CHF and USD/CHF, February 27(see more posts on EUR/CHF, USD/CHF, ) Source: markets.ft.com - Click to enlarge |

FX RatesThe capital markets seem unusually subdued. The US dollar is mostly slightly firmer, except against the euro and Swiss franc among the majors. The MSCI Asia Pacific Index managed to eke out a small gain (0.2%), for a third advancing session, without the help of China, Taiwan, Korea or India. It was really a Japanese story. The Nikkei rallied 1.1%, while excluding Japan the MSCI benchmark was off 0.25%. This is also borne out by the heavier tone in the MSCI Emerging Market Index (-0.2%). European bourses are nursing small losses, and the Dow Jones Stoxx 600 is off 0.12% in late morning turnover. Telecom, real estate and health care are drags, but being offset by consumer discretionary, financials and information technology. US shares are trading with a heavier bias as well. Bond market are quiet, with 10-year benchmark yields edging higher. Italy is unexpectedly resilient ahead of this weekend’s election. Over the past week, the yield has slipped 5.5 bp compared with a three-basis point increase in Spain. The US 10-year yield slipped below 2.83% yesterday for the first time in nearly two weeks and is consolidating the pullback after approaching 2.96% a week ago. |

FX Daily Rates, February 27 |

| The market has responded as expected to the disappointing New Zealand trade figures. The December surplus was revised lower (NZD596 mln vs NZD640 mln), but the real disappointment was in the January figures. Rather than reporting an actual balance as expected, New Zealand reports a NZD566 mln deficit. The New Zealand dollar is testing the small shelf near $0.7270 carved in recent days. A break could open the door to another cent decline.

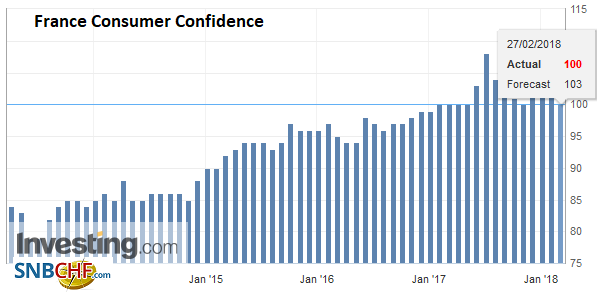

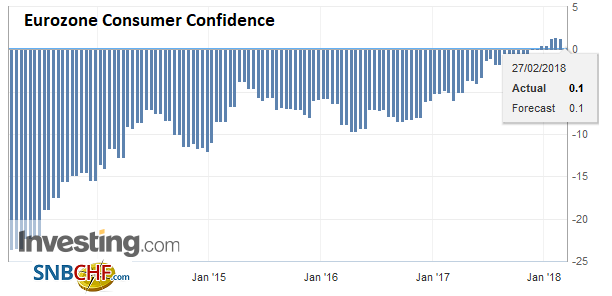

The euro has shown little reaction to the economic data. Money supply growth was steady at 4.6%, and the series of confidence surveys were either as good or better than expected. Of note, bank lending to non-financial businesses was strong but uneven (strong showing in Germany, weak in Italy). Loan growth to households was flat, mostly due to slightly weaker house-related activity. |

FX Performance, February 27 |

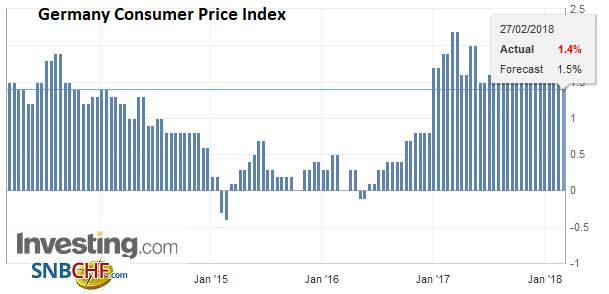

GermanyAhead of tomorrow’s preliminary CPI estimate for February, Spain and Germany have reported data today. The German states all reported slower inflation on a year-over-year basis than in January. The national figure that will be out shortly was expected to have slowed to 1.3% from 1.4%. Most of the states don’t report much detail, but Saxony’s figures may be suggestive. Core inflation there ticked up to 1.6% from 1.5%. The headline was kept in check by slower food prices (1.2% vs. 3.0%), led by a sharp drop in vegetables. This suggests the underlying pressure may be greater than the headline suggests. |

Germany Consumer Price Index (CPI) YoY, Feb 2013 - 2018(see more posts on Germany Consumer Price Index, ) Source: Investing.com - Click to enlarge |

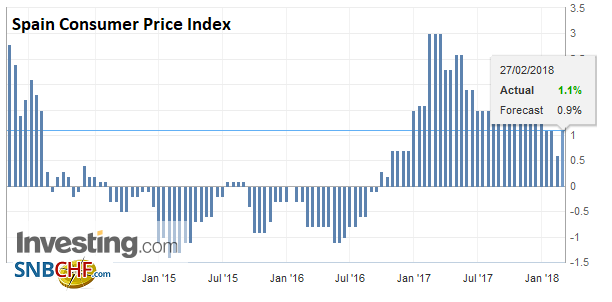

SpainMeanwhile, Spain’s CPI was firmer than expected. The headline rose 0.1%, rather than slip 0.2% as the Bloomberg survey would have it. This translates into a year-over-year rate of 1.2%, up from 0.7% in January. |

Spain Consumer Price Index (CPI) YoY, Feb 2013 - 2018(see more posts on Spain Consumer Price Index, ) Source: Investing.com - Click to enlarge |

France |

France Consumer Confidence, March 2013 - Feb 2018(see more posts on France Consumer Confidence, ) Source: Investing.com - Click to enlarge |

Eurozone |

Eurozone Consumer Confidence, Mar 2013 - Feb 2018(see more posts on Eurozone Consumer Confidence, ) Source: Investing.com - Click to enlarge |

United States |

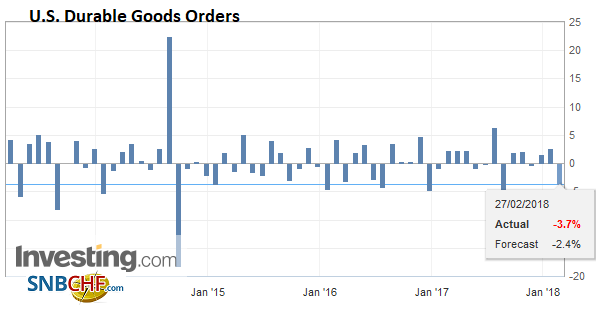

U.S. Durable Goods Orders, Mar 2013 - Feb 2018(see more posts on U.S. Durable Goods Orders, ) Source: Investing.com - Click to enlarge |

The US has a slew of economic data before Powell’s Congressional appearance. The January advanced goods balance and the inventory figures are probably the most important for GDP purposes, but there will be some relevant information in the durable goods report as well. On balance, forecasts for Q1 GDP have been pared back by the Atlanta and New York Fed trackers recently. Both are looking for a little more than 3% pace, and the risk seems to be on the downside from today’s data. S&P/Caseshiller house prices, Richmond Fed manufacturing survey and Conference Boards’ consumer confidence survey will also be released, but typically don’t have much market impact even in the best of times.

Fed Chair Powell is not an unknown figure to investors, and it would be surprising if he surprised today. His confirmation hearings and the Fed’s monetary report, released at the end of last week, leave little doubt of continuity of policy. It is not with the same degree of confidence say that Abe was able to achieve in Japan with the reappointment of Kuroda. However, despite disrupting in other ways, President Trump went with a candidate that was arguably the most likely to continue the present course. The advisers Powell has chosen also confirm this, as they too are well-entrenched in the Fed and its modus operandi. Both the CME and Bloomberg models show an 86.0-87.4% chance of a Fed hike next month is already discounted.

We argue that there is a compelling case for the Fed not to signal four hikes this year…yet. There is no reason to make that call now (or in the March forecasts). It could prematurely tie the Fed’s hands, or risk again over-promising and under-delivering. Powell is fortunate that circumstances will allow him to raise rates at the first FOMC meeting he chairs. Recall, in contrast, Draghi cut rates at his first two meetings, unwinding Trichet’s moves. Powell and the Fed are under no pressure from the market to signal a fourth hike. It still has not discount a third hike fully, let along pushing for a fourth.

One area that Powell may stand out is in his assessment of the state of “too-big-to-fail.” He seemed to suggest that the problem has been addressed or minimized. In his confirmation hearings, this view did not draw much attention. It may be going forward. We suppose that Powell may judge his testimony today as successful if there is not much of a market reaction.

There are many options that expire around the time Powell’s testimony will begin. There are 1.2 bln euros struck at $1.2350 that will be cut. There is an option for $560 mln struck at JPY107.35 and GBP649 mln struck at $1.40 that will go. There are around A$650 mln options at $0.7850 -$0.7875 that expire today.

The euro and yen are inside yesterday’s ranges. The euro is in the upper end of its five-day range, capped below the 20-day moving average (~$1.2360). The dollar continues to straddle the JPY107 level with little impetus in either direction. Sterling is flat just below $1.40. The dollar-bloc currencies are little changed, but slightly lower, also within yesterday’s ranges. After Powell’s testimony, attention may turn to the Canadian budget, which Finance Minister Morneau will deliver. Fiscal consolidation is expected.

Graphs and additional information on Swiss Franc by the snbchf team.

Tags: #GBP,#USD,$AUD,$CAD,$EUR,$JPY,Eurozone Consumer Confidence,Featured,France Consumer Confidence,Germany Consumer Price Index,newsletter,Spain Consumer Price Index,SPY,U.S. Durable Goods Orders