See the introduction and the video for the terms gold basis, co-basis, backwardation and contango. Silver Gets Frisky Last week, the prices of the metals had been up Sunday night but were slowly sliding all week — until Friday at 7:00am Arizona time (14:00 in London). Then the price of silver took off like a silver-speculator-fueled-rocket. It went from .68 to .25, or 3.4% in two hours. What does it mean? We don’t know. We would bet an ounce of fine gold against a soggy dollar bill that no one else does either. The old stories of silver shortage or manipulation have no power to explain this move. Why not? Because they are old. The explanation would have to say that earlier in the day there was a reason for silver to trade well under but as of that moment, it was urgent that the metal traded well over . As often occurs, once the move hits certain levels on a price or a momentum chart, that’s all it takes. It’s of no use to say that in the long run this will be just another blip of noise. In the heat of the moment, these 60-cent moves are exciting. Below, we will have an intraday silver chart that shows clearly something that is almost never available to the public. We have a plot of the basis against price. If other theories are right (e.g.

Topics:

Keith Weiner considers the following as important: dollar price, Featured, Gold and its price, gold basis, Gold co-basis, gold price, gold silver ratio, newsletter, Precious Metals, silver basis, Silver co-basis, silver price

This could be interesting, too:

Nachrichten Ticker - www.finanzen.ch writes Die Performance der Kryptowährungen in KW 9: Das hat sich bei Bitcoin, Ether & Co. getan

Nachrichten Ticker - www.finanzen.ch writes Wer verbirgt sich hinter der Ethereum-Technologie?

Martin Hartmann writes Eine Analyse nach den Lehren von Milton Friedman

Marc Chandler writes March 2025 Monthly

See the introduction and the video for the terms gold basis, co-basis, backwardation and contango.

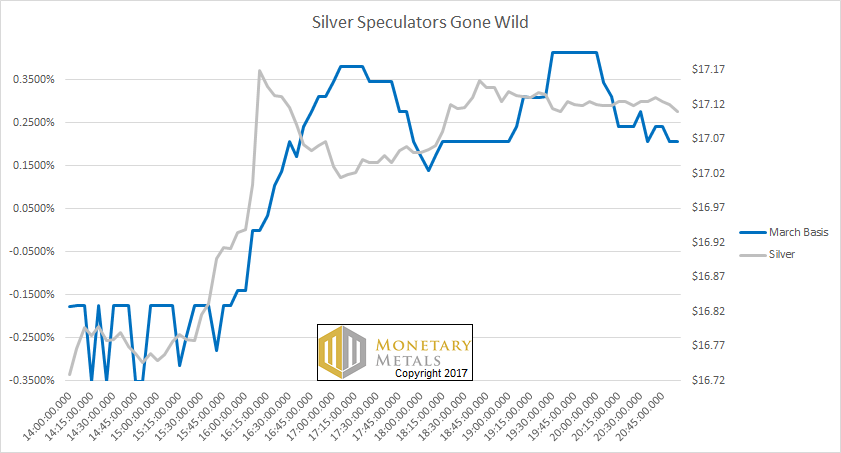

Silver Gets FriskyLast week, the prices of the metals had been up Sunday night but were slowly sliding all week — until Friday at 7:00am Arizona time (14:00 in London). Then the price of silver took off like a silver-speculator-fueled-rocket. It went from $16.68 to $17.25, or 3.4% in two hours. What does it mean? We don’t know. We would bet an ounce of fine gold against a soggy dollar bill that no one else does either. The old stories of silver shortage or manipulation have no power to explain this move. Why not? Because they are old. The explanation would have to say that earlier in the day there was a reason for silver to trade well under $17 but as of that moment, it was urgent that the metal traded well over $17. As often occurs, once the move hits certain levels on a price or a momentum chart, that’s all it takes. It’s of no use to say that in the long run this will be just another blip of noise. In the heat of the moment, these 60-cent moves are exciting. Below, we will have an intraday silver chart that shows clearly something that is almost never available to the public. We have a plot of the basis against price. If other theories are right (e.g. manipulation, shortage) this chart should show nothing of interest. We are at no risk of that. ? |

Silver suddenly wakes up(see more posts on silver, ) |

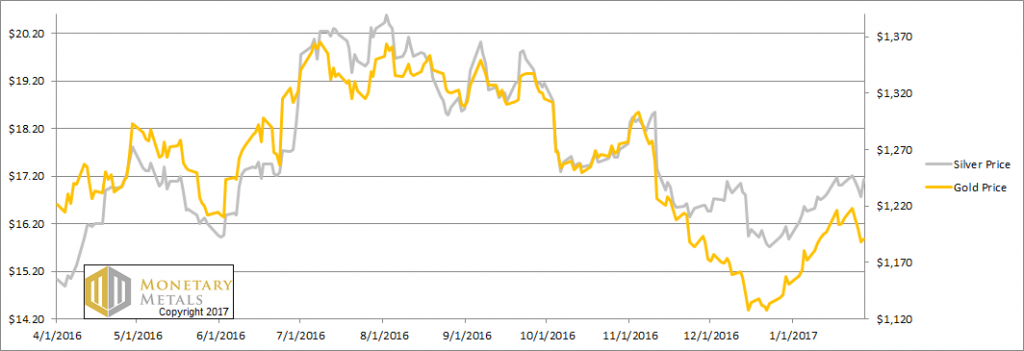

Fundamental DevelopmentsBut first, the price action and regular basis charts. |

Prices of gold and silver(see more posts on gold price, silver price, ) |

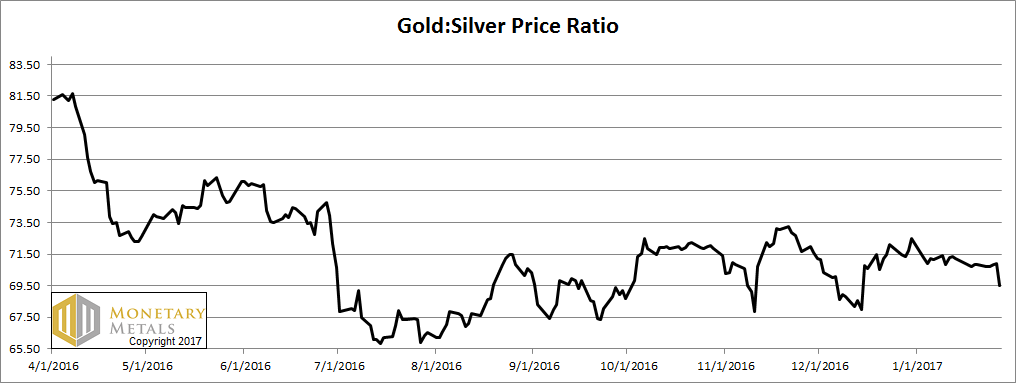

Gold-silver ratioNext, this is a graph of the gold price measured in silver, otherwise known as the gold to silver ratio. It fell this week. |

Gold-silver ratio(see more posts on gold silver ratio, ) |

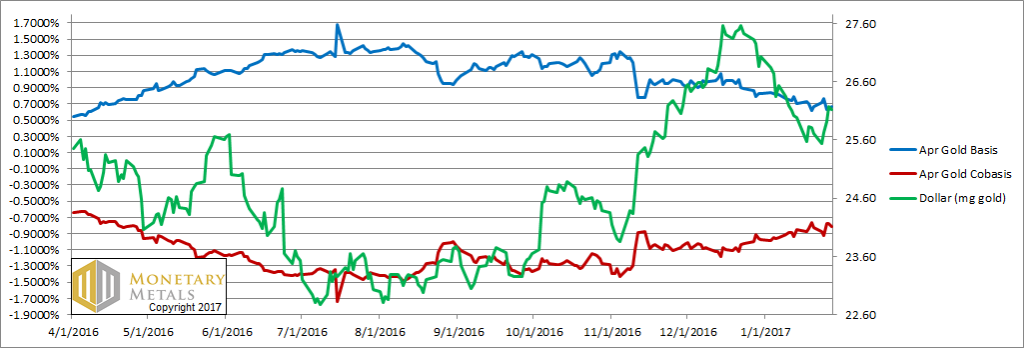

Gold basis and co-basis and the dollar priceHere is the gold graph. The pattern of the past few weeks did not continue. This week, when the price of gold went down, the co-basis (scarcity) went down on some days. When the price went up, the co-basis went down. Our calculated fundamental price fell $32 to just about $100 over the market price. |

Gold basis and co-basis and the dollar price(see more posts on dollar price, gold basis, Gold co-basis, ) |

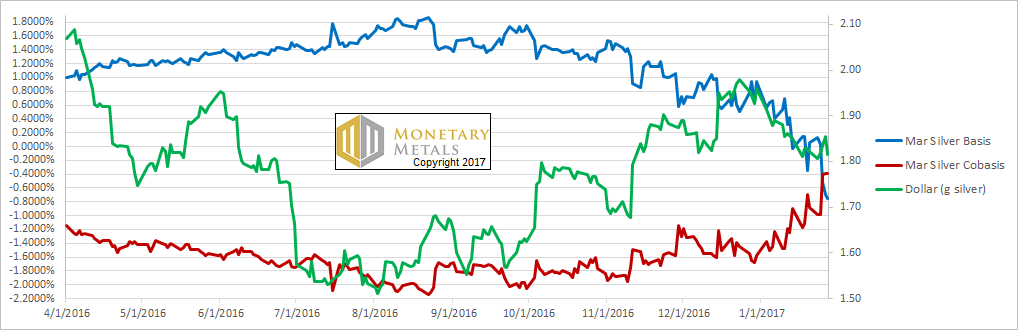

Silver basis and co-basis and the dollar priceNow let’s look at silver. In silver, scarcity increased a bit on Wednesday and stayed there through Friday (for our normal daily reading, but see below). Our calculated fundamental price moved up 20 cents from last week. It had been higher, but actually fell a bit on Thursday and Friday. It is now a dime or two above the market. |

Silver basis and co-basis and the dollar price(see more posts on dollar price, silver basis, Silver co-basis, ) |

| Below is the chart we mentioned at the top of the report.

As the price rises about 40 cents, the basis rises about 60 bps from around -0.25% to +0.35%. To understand this, picture a spread between the price of silver in the spot market — a bar — and silver in the futures market — a contract for March delivery of a bar. When the market is quiescent, this spread is consistent. If there buying pressure in spot, then the spread will compress. If there is buying pressure in futures, then the spread will widen (or if it is negative like Friday morning, it can go positive). On Friday, this spread widened about ¾ of a cent. This may not seem like much, but the market makers are fighting it all the way. They make money by buying spot and selling futures, called carrying silver. Carrying tends to compress the spread. Despite the market makers, the speculators forced this spread wider by nearly a cent. Spread is much more stable than price. This move is a big deal. Charts by: BarCharts, Monetary Metals |

Friday, silver price and March silver basis intraday (times are GMT) |

Tags: dollar price,Featured,gold basis,Gold co-basis,gold price,gold silver ratio,newsletter,Precious Metals,silver basis,Silver co-basis,silver price