In the early throes of economic devastation in 1931, Sweden found itself particularly vulnerable to any number of destabilizing factors. The global economy had been hit by depression, and the Great Contraction was bearing down on the Swedish monetary system. The krona had always been linked to the British pound, so that when the Bank of England removed gold convertibility (left the gold standard) from its...

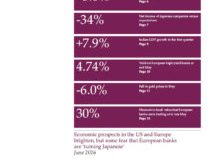

Read More »In the June 2016 issue of ‘Perspectives’

Published: 14th June 2016Download issue:Will Knut Wicksell be proved right? The Swede’s theories include the notion that there is a ‘natural’ level of interest rates, consistent with the economy operating at its full potential without overheating. But the actions of central banks have forced interest rates to artificially low levels in recent times, well below their ‘natural’ levels. If nature should reassert its predominance again, so the theory goes, then rates could shoot up, leading to...

Read More » Swiss Economicblogs.org

Swiss Economicblogs.org