Navigating the intricate landscape of banking law requires a blend of acute legal acumen, steadfast dedication, and the ability to foresee the evolving regulatory environment. Johanna Shallenberger, a distinguished attorney specializing in banking law, exemplifies these qualities with her extensive expertise and unwavering commitment to her clients. In this article, we delve into Shallenberger's illustrious career, exploring her significant contributions to the...

Read More »Revolutionizing Finance: The Rise of JN Live Online Banking

In the rapidly evolving landscape of financial technology, the term "live online banking" is becoming increasingly prevalent. As consumers demand more convenience and instant access to their financial information, banks and financial institutions are stepping up to offer real-time banking solutions. This article delves into the concept of live online banking, exploring its features, benefits, and potential challenges. We will examine how this innovative approach is...

Read More »Decoding the ‘Big Name in Banking’ Crossword Clue: Key Players and Tips for Solving

In the world of crossword puzzles, where cryptic hints and clever wordplay reign supreme, few things bring as much satisfaction as filling in that elusive final square. One common challenge that has stumped both novice and seasoned solvers alike is the clue "big name in banking." While seemingly straightforward, this clue can reference a variety of prominent financial institutions or influential figures within the banking sector, making it a perennial enigma for...

Read More »Fed’s Asset Bubbles Now At The Mercy Of The Rest Of The World’s Central Bankers

“Like watching paint dry,” is how The Fed describes the beginning of the end of its experiment with massively inflating its balance sheet to save the world. As former fund manager Richard Breslow notes, however, Yellen’s decision today means the risk-suppression boot is on the other foot (or feet) of The SNB, The ECB, and The BoJ; as he writes, “have no fear, The SNB knows what it’s doing.” As we reported previously, In...

Read More »Swiss Banks Paid Out €1 Billion In Negative Interest Rates In The First Half

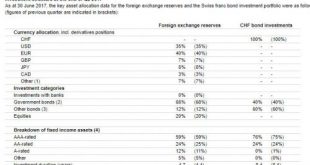

Overnight, the Swiss National Bank disclosed the composition and breakdown of its FX reserves as of June 30. There were no notable changes, as the central bank kept most of its asset allocations unchanged from the previous quarter, with equities, government bonds and “other bonds”, at 20%, 68% and 12% respectively. There were also no shifts in the currency composition as shown in the table below. There was one notable –...

Read More »Swiss Banks Paid Out €1 Billion In Negative Interest Rates In The First Half

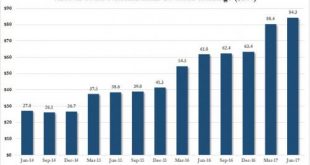

Overnight, the Swiss National Bank disclosed the composition and breakdown of its FX reserves as of June 30. There were no notable changes, as the central bank kept most of its asset allocations unchanged from the previous quarter, with equities, government bonds and "other bonds", at 20%, 68% and 12% respectively. There were also no shifts in the currency composition as shown in the table below. There was one notable - and unexpected - development, and it had to do with the SNB's -0.75%...

Read More »Necessity is the Mother of Invention – Retirees Desperate Reach for Yield

Ben Bernanke’s creativity inspired a generation of economists and central bankers. QE, ZIRP and NIRP established a new class of economics that is mathematically sound but practically disastrous. Billions of dollars were transferred from savers to investors to boost the economy, but the wizards of quant forgot that something has to give. In this case, it was the formation of a pension crisis that threatens the golden...

Read More »Credit Suisse Opens New Advisory Office in Mexico

The general economic outlook for Mexico is promising, despite the headwind it faces. Credit Suisse's newly established advisory office in Mexico City will allow its private banking clients to receive advice on-site. It also underscores the bank's growth ambitions on the continent. The outlook for...

Read More »How The US Government Let A Giant Bank Pin A Scandal On A Former Employee

The following is an excerpt from David Enrich’s nonfiction financial and legal thriller The Spider Network: The Wild Story of a Math Genius, a Gang of Backstabbing Bankers, and One of the Greatest Scams in Financial History. (Read part of the prologue here; another excerpt can be found here) This excerpt takes place shortly after the accused mastermind of the Libor scandal, Tom Hayes, is fired from his job at...

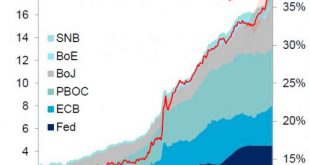

Read More »A Problem Emerges: Central Banks Injected A Record $1 Trillion In 2017… It’s Not Enough

Two weeks ago Bank of America caused a stir when it calculated that central banks (mostly the ECB & BoJ) have bought $1 trillion of financial assets just in the first four months of 2017, which amounts to $3.6 trillion annualized, “the largest CB buying on record.” Aggregate Balance Sheet Of Large Central Banks, 2000 - 2017 - Click to enlarge BofA’s Michael Hartnett noted that supersized central bank...

Read More » Swiss Economicblogs.org

Swiss Economicblogs.org