Summary: Coalition talks will resume in the coming days, and failing this a minority government is more likely than new elections. The is a general agreement among the political elites, and a hubris of small differences. The rate differentials and cross currency swaps show the incentive structure for holding dollars is increasing. Talks to forge a new coalition government in Germany passed the self-imposed deadline at the end last week, and the markets paid little attention. The euro finished last week a little below .18, up to a little over 1% on the week. Talks continued over the weekend and then, late yesterday, the pro-business Free Democrats, with a dramatic flair, walked out of the negotiations. The

Topics:

Marc Chandler considers the following as important: EUR, Featured, FX Trends, Germany, Germany Composite PMI, newsletter

This could be interesting, too:

Nachrichten Ticker - www.finanzen.ch writes Die Performance der Kryptowährungen in KW 9: Das hat sich bei Bitcoin, Ether & Co. getan

Nachrichten Ticker - www.finanzen.ch writes Wer verbirgt sich hinter der Ethereum-Technologie?

Martin Hartmann writes Eine Analyse nach den Lehren von Milton Friedman

Marc Chandler writes March 2025 Monthly

Summary:

Coalition talks will resume in the coming days, and failing this a minority government is more likely than new elections.

The is a general agreement among the political elites, and a hubris of small differences.

The rate differentials and cross currency swaps show the incentive structure for holding dollars is increasing.

Talks to forge a new coalition government in Germany passed the self-imposed deadline at the end last week, and the markets paid little attention. The euro finished last week a little below $1.18, up to a little over 1% on the week.

Talks continued over the weekend and then, late yesterday, the pro-business Free Democrats, with a dramatic flair, walked out of the negotiations. The CDU/CSU and Greens were surprised as the FDP appeared to get much of what it had wanted.

We had suggested earlier that Merkel and the CDU/CSU were willing to concede the much desired financial minister to the FDP. In such a situation, the international responsibilities (Europe and G20, for example), could be shifted to the economy ministry. The FDP is just returning from the political purgatory, where its strident anti-European views, alienated voters and prevented it from meeting the threshold for Bundestag representation. It is rightfully cautious about losing its identity again.

At the same time, the party’s fundos-wing appears to have prevailed over the realos wing. It seems just the opposite was the case for the Greens. There, the realos desire to share power on a national scale outweighed the fundos desire to maintain high principles at all costs.

The same three choices that Germany has faced since the election remain: Coalition government, minority government, and new elections. Some form of coalition government is the preferable solution. A minority government cannot be ruled out, but it has no precedent in Germany. The possibility of new elections is real, but it is clearly the least attractive alternative for the German political elite who fear an even stronger showing for the populist AfD.

There are also a fixed number of potential coalitions. The most straight-forward is to re-engage the FDP. Lindner, the FDP leader, seemed to shut the door new talks. He may just be positioning to raise his party’s demands. After all, his ostensible reason for walking out was the return of issues that had already been “settled.” Recall that these talks were preliminary in nature, in which broad areas of agreement and disagreement were identified.

If a coalition with the CDU/CSU, Greens, and FDP is not workable, then new overtures to the Social Democrats may be necessary. The SPD has been in a coalition with Merkel for two of her three terms. However, it has suffered in the polls, and some think that it has lost its independent identity.

Some observers talk as if Merkel’s hold on the Chancellor’s office can be pried loose if the center-left can form a coalition. The problem here is the SPD, Greens, and FDP would not be sufficient to claim a majority. A majority is possible, though if the Left Party would be included. The problem with that is the SPD has ruled it out, and its presence would likely alienate the FDP.

If a new coalition is the best alternative for investors, second best would be a minority government, led by Merkel. There is no precedent for this in modern Germany, but it would work on a vote-by-vote basis. The CDU/CSU and Greens would amount to 313 seats, which would require picking up about forty votes to reach a majority. Of course, the risk is that it is not stable and every vote becomes a mini-crisis. On the other hand, the four-party coalition that was under discussion did not seem particularly stable either.

The least desirable alternative by Germany’s political elite is a new election. The political elite is concerned that a new election could risk a better showing for the populist AfD. The AfD won about one in eight votes and secured representation in the Bundestag with 94 seats, making it the third largest party in Germany.

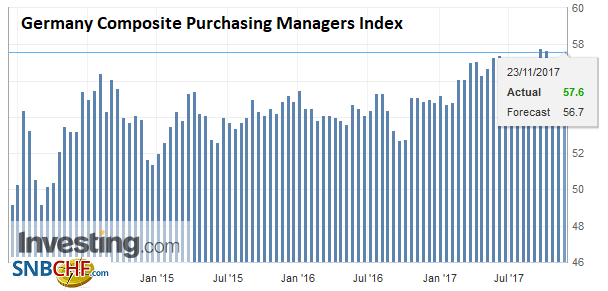

GermanyUntil the German political situation is clarified, little will change. Growth in Q3 of 2.8% (year-over-year and workday adjusted) was the pasted pace in six years. The PMIs suggest growth in Q4 may stabilize around these elevated levels. The composite PMI averaged 56.7 over the past three months. Later this week the flash November estimate will be published. It is expected to match the three-month average. |

Germany Composite Purchasing Managers Index (PMI), Nov 2017(see more posts on Germany Composite PMI, ) Source: Investing.com - Click to enlarge |

There seems to be some room to expand domestic public investment and still maintain the balanced budget goal. In order to solidify the CDU/CSU relationship, Merkel has already made concessions on immigration. There are profound differences between the FDP on the one hand and the CDU/SPD on the other hand regarding Europe. For investors, the takeaway point is that post-Cold War and post-Great Financial Crisis; one is struck by the fundamental agreements between the major political parties in Europe. Personalities, and to a lesser extent, differences on social issues rather than economic policy per se, may be the chief differences in many countries.

The euro was marked down in early Asia and found support ahead of $1.1720. It then recovered to around $1.1810 by early European activity. It has been trending lower since and reached almost $1.1740 the New York morning. Our underlying view and negative stance toward the euro is informed by the widening interest rate differential.

The US 2-year premium is making new multi-year highs at 2.45%. The spread is one measure of the cost for hedging (one is paid to sell euros for dollars) and the incentive to hold dollars. We note that the three-month cross currency basis swap is another 50 bp on top of LIBOR, the most since early January. The cross currency swap is a measure of the ease (or difficulty) to secure dollar funding. Together the interest rate differential and the cross-currency basis swap can be understood as the incentive structure for investors.

The speculative market remains net long euros in the futures market. The net long position of about 84.6k contracts is a little above the six-month average. At the end of last year, the speculative market was net short about 69.5k contracts. We suspect it will take a break of the $1.1670 area to spur another round of long euro liquidation.

Tags: $EUR,Featured,Germany,Germany Composite PMI,newsletter