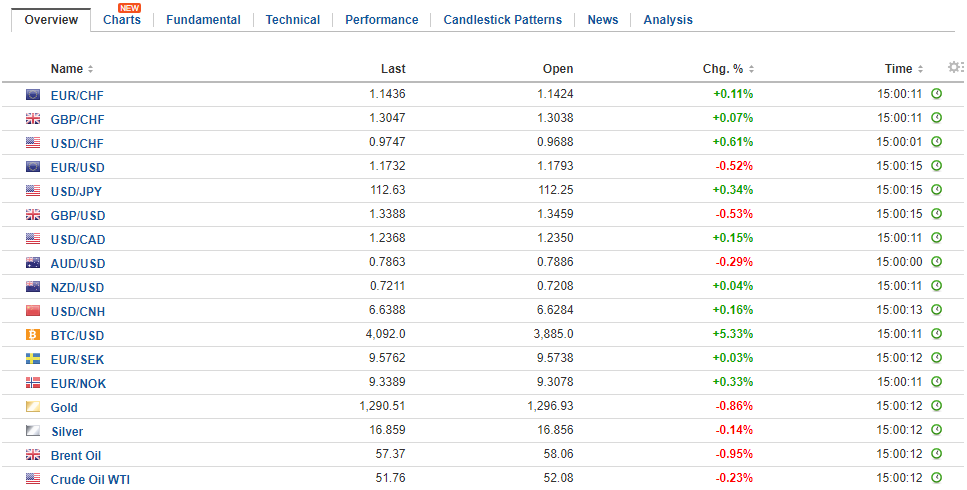

Swiss Franc The Euro has risen by 0.17% to 1.1441 CHF. EUR/CHF and USD/CHF, September 27(see more posts on EUR/CHF, USD/CHF, ) Source: markets.ft.com - Click to enlarge FX Rates The Federal Reserve may not be on a coordinated campaign to convince the markets of a pending rate hike as it did so effectively in late February and early March. But investors are getting the message. The Bloomberg calculation of the odds of a rate hike before the end of the year has risen to 70% from 53% before last week’s FOMC meeting and 33.5% at the end of last month. The CME puts the odds at 81% up from 37% a month ago. Yellen did not break new ground yesterday. She reaffirmed the impression at her recent press conference that the

Topics:

Marc Chandler considers the following as important: EUR, EUR/CHF, Featured, France Consumer Confidence, FX Trends, GBP, JPY, newslettersent, TLT, U.S. Crude Oil Imports, U.S. Crude Oil Inventories, U.S. Durable Goods Orders, USD, USD/CHF

This could be interesting, too:

Nachrichten Ticker - www.finanzen.ch writes Die Performance der Kryptowährungen in KW 9: Das hat sich bei Bitcoin, Ether & Co. getan

Nachrichten Ticker - www.finanzen.ch writes Wer verbirgt sich hinter der Ethereum-Technologie?

Marc Chandler writes March 2025 Monthly

Mark Thornton writes Is Amazon a Union-Busting Leviathan?

Swiss FrancThe Euro has risen by 0.17% to 1.1441 CHF. |

EUR/CHF and USD/CHF, September 27(see more posts on EUR/CHF, USD/CHF, ) Source: markets.ft.com - Click to enlarge |

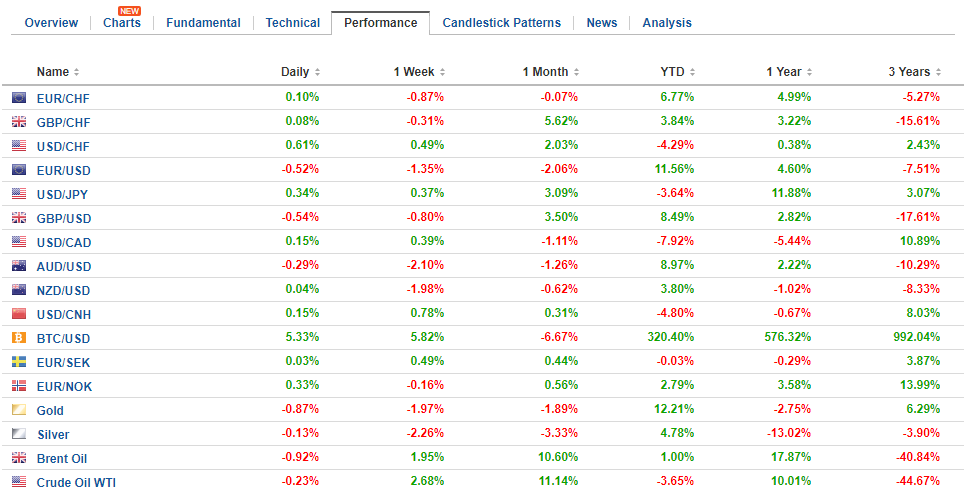

FX RatesThe Federal Reserve may not be on a coordinated campaign to convince the markets of a pending rate hike as it did so effectively in late February and early March. But investors are getting the message. The Bloomberg calculation of the odds of a rate hike before the end of the year has risen to 70% from 53% before last week’s FOMC meeting and 33.5% at the end of last month. The CME puts the odds at 81% up from 37% a month ago. Yellen did not break new ground yesterday. She reaffirmed the impression at her recent press conference that the uncertainties about inflation do not stand in the way of another hike this year. Remember the dot plots showed that 11 of the 16 Fed officials thought a December hike would be appropriate, up from eight in June. Yellen acknowledged three areas of uncertainty about inflation which she and the Fed could be wrong. But rather than read this as self-doubt, as some in the media have, we suspect the market got it right. She was sharing an intellectual honesty that is often most noticed in its absence. Some of the Fed’s critics accused of hubris and excessive dovishness. That does not seem to be the case presently, whatever the case may have previously. |

FX Daily Rates, September 27 |

| Also the developments on the monetary policy front, US fiscal policy is front and center today. President Trump is expected to provide a framework for the tax reform. Ultimately, of course, it is in the legislative branch’s hands. Much of the details have been leaked, including a 20% corporate tax schedule rate three household tax brackets (12%, 25%, and 35%), allowing businesses to write off capex immediately for around five years, and getting rid of the alternative minimum tax and estate tax. Households will lose the deduction for state and local taxes, while business’ ability to write-off debt servicing will be curbed and the tax of global activity of US companies will change, with a tax holiday of some kind to induce them to bring back the excess funds booked overseas.

Yesterday, based on our understanding of market psychology as reflected in prices, we suggested a $1.16 target for the euro, recognizing support near the mid-August low that was set near $1.1660. The euro is finding some support near $1.0730 ahead of the North American session. One of the investment themes this year has been flows into European shares. As we have pointed out, the outperformance for dollar-based investors comes from the euro, not the equity performance. Here is what it looks like now: the S&P 50 is up 11.5% year-to-date, while the Dow Jones Stoxx 600 is up 6.6% (including today’s gains which have lifted it to a two-month high). The euro, with today’s setback, is up 11.6% year-to-date. If the euro slide to a more aggressive target of $1.14, it could impact both the demand for European equities and the desire to hedge the currency. |

FX Performance, September 27 |

United StatesThe important point to remember is that this is still very early days for tax reform. The latest implosion of the effort to “repeal and replace” the Affordable Care Act (Obamacare) underscores the legislative hurdles. In additional to the distributional gains/losses, some of the debate will center around what is called dynamic scoring. This refers to taking the impact on growth (and future tax revenues) of the tax cuts/reform themselves. |

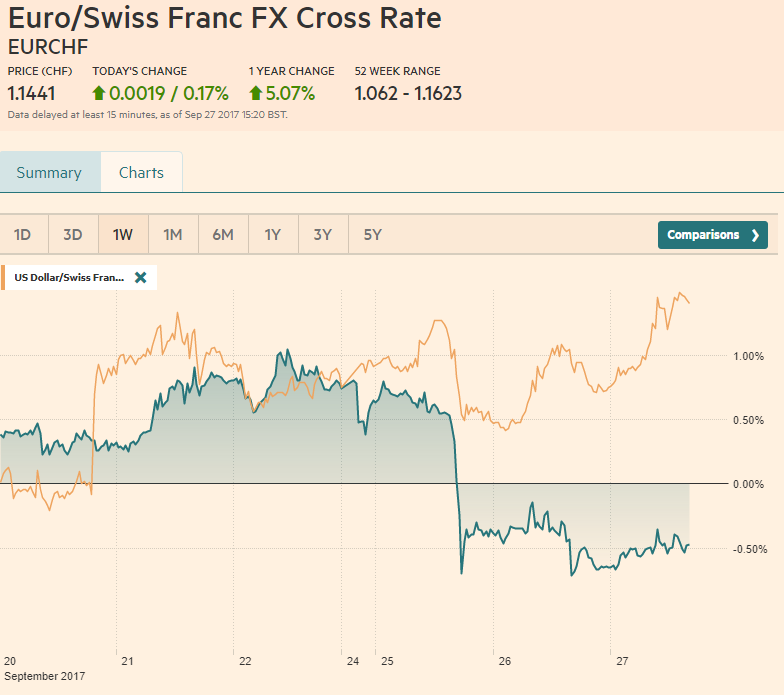

U.S. Crude Oil Inventories, Sep 2017(see more posts on U.S. Crude Oil Inventories, ) Source: Investing.com - Click to enlarge |

| The increase in US rates and the anticipation of the tax announcement is not the only thing underpinning the dollar today. First, as we noted yesterday, there does appear to be a squeeze in the dollar funding markets (dollar shortage). It is not clear that these are quarter-end pressures, and what many is the fiscal year-end.

Second, there are some idiosyncratic factors too. Consider that the dollar was bid to nearly JPY113 today, a level not seen in two months, and extending the rally from JPY107.30 on September 8. The rise in US yields (US 10-year yield is up nearly six bp today almost 2.30%) helps, but one might have anticipated the 0.5% fall in the Topix to lend the yen support. However, the decline of Japanese shares seemed to be a technical factor related to the fact that more than half of the Topix went ex-dividend. |

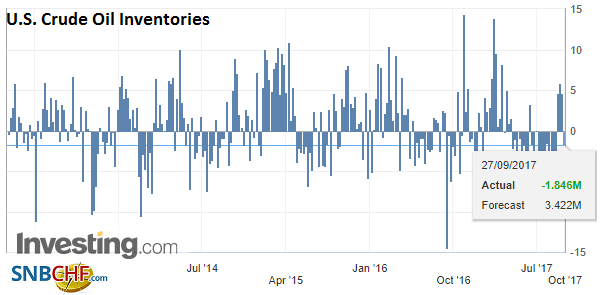

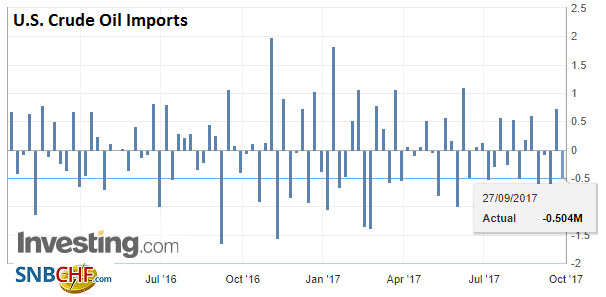

U.S. Crude Oil Imports, September 27(see more posts on U.S. Crude Oil Imports, ) Source: Investing.com - Click to enlarge |

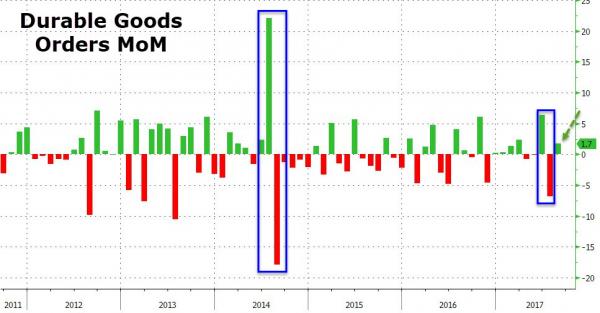

| The US reports durable goods orders, which are expected to bounce back after a slide (6.8%) in August. Aircraft, in particular, make the time series volatile. The details will likely be better than the headline, as the core orders (excluding military and aircraft) may have grown after July’s 1.0% increase. Shipments likely slowed.The weather distortions may also be evident. Among the four Fed officials slated to speak, Brainard’s speech this afternoon (2:00 pm ET) is the most important. The views of the regional Federal Reserve Presidents are well known. The DOE oil inventory report may also be watched closely following API’s estimate of a drawdown, the first since the Texas storm. |

U.S. Durable Goods Orders, Aug 2017(see more posts on U.S. Durable Goods Orders, ) Source: zerohedge.com - Click to enlarge |

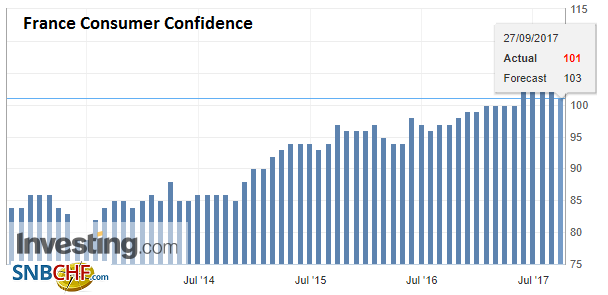

France |

France Consumer Confidence, Sep 2017(see more posts on France Consumer Confidence, ) Source: Investing.com - Click to enlarge |

Consider too a report in the Nikkei Asian Review that Norway’s sovereign wealth fund said that it would reduce its exposure to illiquid bonds including sovereigns. Japanese Government Bonds fall into this bucket apparently. JGBs account for about 6% of its bond portfolio or about $21.5 bln. The issue of liquidity has become an important talking point among fund managers.

Sterling is trading heavily. It is now back within the range seen on September 14 when the BOE surprised with a hawkish twist on the benign decision. Indeed sterling has approached the 61.8% retracement of the gains scored from the low the day BOE meet. A break of that level (~$1.3345) or maybe a bit lower ($1.3320) could signal another cent drop.

There seem to be two weights on sterling besides a broad dollar recovery. First is the apparent confirmation from the EC that the Brexit negotiations have not progressed far enough to be to discuss the post-divorce relationship. Also, despite claims by some journalists in the UK that because of May’s evolving Brexit position that Labour’s Corbyn in charge, comments from the Labour Party Conference, and especially the shadow chancellor spooks investors.

Graphs and additional information on Swiss Franc by the snbchf team.

Tags: #GBP,#USD,$EUR,$JPY,$TLT,EUR/CHF,Featured,France Consumer Confidence,newslettersent,U.S. Crude Oil Imports,U.S. Crude Oil Inventories,U.S. Durable Goods Orders,USD/CHF