Swiss Franc The Euro has risen by 0.10% to 1.1687 CHF. EUR/CHF and USD/CHF, November 28(see more posts on EUR/CHF, USD/CHF, ) Source: markets.ft.com - Click to enlarge FX Rates The US dollar is consolidating its recent losses with a small upside bias. What promises to be an eventful week has begun with the Bank of England stress test and the publication of the Fed’s Powell prepared remarks for his confirmation hearing to succeed Yellen as Chair. Unlike last year, this year’s BOE stress test saw all seven banks pass. The BOE also went forward with increasing the counter-cyclical buffer the large banks are too hold from 0.5% to 1.0%. It is effective next November. It may also not be capped there; the BOE said

Topics:

Marc Chandler considers the following as important: AUD, CAD, EUR, EUR/CHF, Eurozone M3 Money Supply, Eurozone Private Sector Loans, Featured, France Consumer Confidence, FX Trends, GBP, Germany GfK Consumer Climate, JPY, newslettersent, USD, USD/CHF

This could be interesting, too:

Nachrichten Ticker - www.finanzen.ch writes Die Performance der Kryptowährungen in KW 9: Das hat sich bei Bitcoin, Ether & Co. getan

Nachrichten Ticker - www.finanzen.ch writes Wer verbirgt sich hinter der Ethereum-Technologie?

Marc Chandler writes March 2025 Monthly

Mark Thornton writes Is Amazon a Union-Busting Leviathan?

Swiss FrancThe Euro has risen by 0.10% to 1.1687 CHF. |

EUR/CHF and USD/CHF, November 28(see more posts on EUR/CHF, USD/CHF, ) Source: markets.ft.com - Click to enlarge |

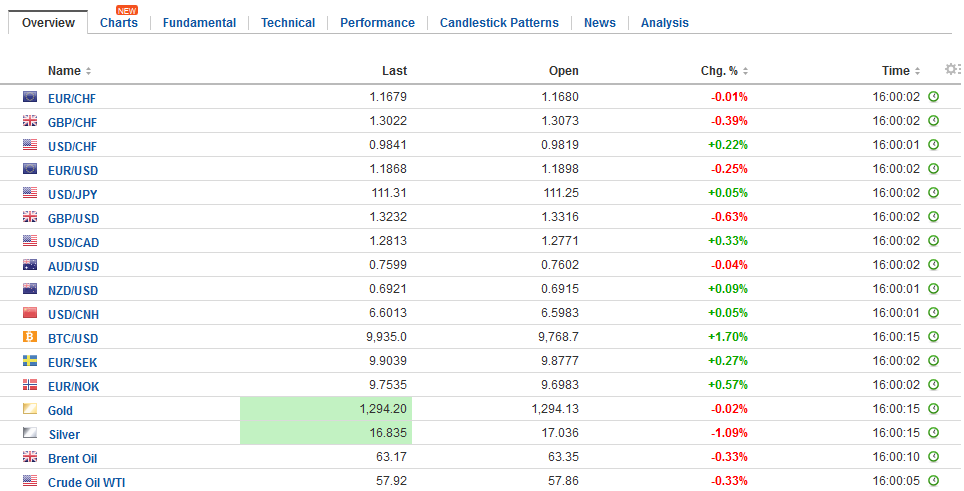

FX RatesThe US dollar is consolidating its recent losses with a small upside bias. What promises to be an eventful week has begun with the Bank of England stress test and the publication of the Fed’s Powell prepared remarks for his confirmation hearing to succeed Yellen as Chair. Unlike last year, this year’s BOE stress test saw all seven banks pass. The BOE also went forward with increasing the counter-cyclical buffer the large banks are too hold from 0.5% to 1.0%. It is effective next November. It may also not be capped there; the BOE said it would review the level again next year. The 0.5% increase costs about GBP6 bln. |

FX Daily Rates, November 28 |

| There was an area concern that the BOE drew attention. It warned that UK financial firms might constrain UK financial institutions to form servicing an estimated GBP26 trillion of outstanding (OTC) derivative contracts. The BOE said that about 25% of these positions involve a UK and EU entities. Each contract will require renegotiation and cautioned that there were no precedents for such an undertaking in eighteen months.

The euro is approaching initial support seen in the $1.1840-$1.1865 area. It peaked yesterday near $1.1960. A break of $1.1800 would be technically important. Sterling, like the euro, appears to have traced out a reversal candlestick pattern-shooting star-and there is also follow modest follow-through selling today. Sterling briefly poked above $1.3380 yesterday and is off nearly a cent from it. However, the intraday technical studies suggest the $1.3280 may offer reasonable support. Note that there is a GBP248 mln option struck at $1.33 that expires today. The greenback initial slipped against the yen on Kyodo reports that some radio signals that Japan detected may signal that North Korea is preparing another missile launch soon. However, the dollar did not spend much time below JPY111.00. It has been holding above JPY111.20 in Europe. Yesterday’s high is a distant JPY111.70. A close above it would lift the technical tone. The US dollar posted an outside update on the Canadian dollar yesterday, and today it is pushing back toward last week’s highs near CAD1.2840. Last month’s high was near CAD1.2920. The trendline connecting those highs intersects today near CAD1.2820. The Australian dollar slipped to four-day lows just below $0.7590. Note that the Australian two-yield is now below the US two-year yield. |

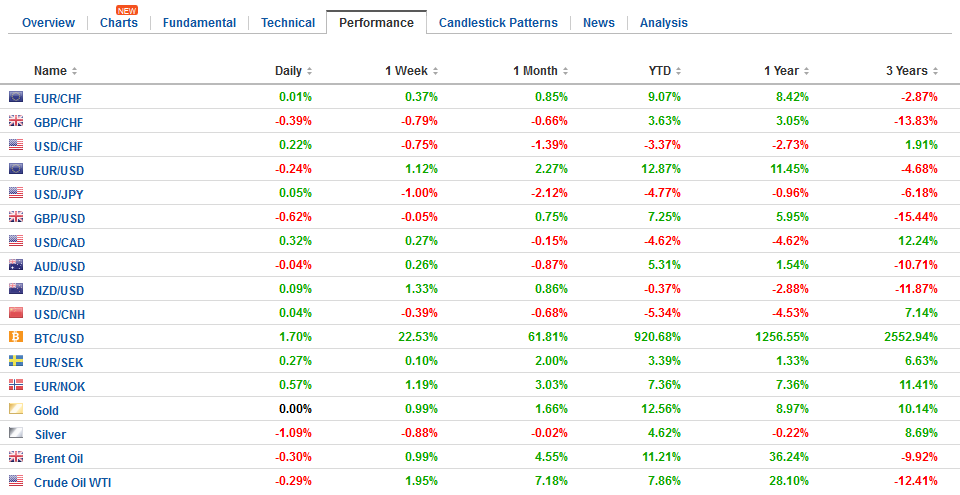

FX Performance, November 28 |

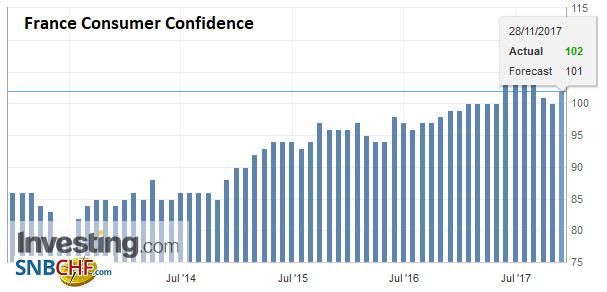

France |

France Consumer Confidence, Nov 2017(see more posts on France Consumer Confidence, ) Source: Investing.com - Click to enlarge |

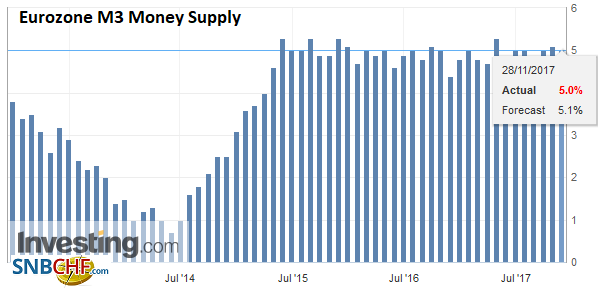

Eurozone |

Eurozone M3 Money Supply YoY, Oct 2017(see more posts on Eurozone M3 Money Supply, ) Source: Investing.com - Click to enlarge |

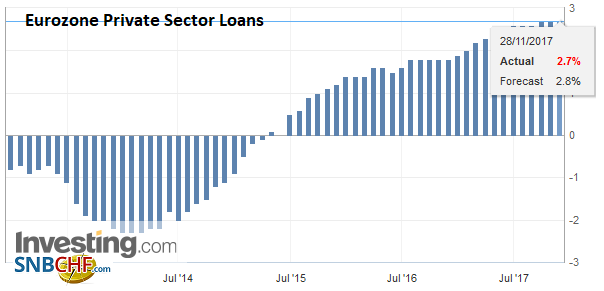

Eurozone Private Sector Loans YoY, Nov 2017(see more posts on Eurozone Private Sector Loans, ) Source: Investing.com - Click to enlarge |

|

Germany |

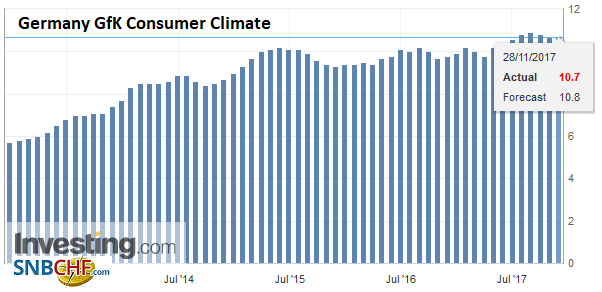

Germany GfK Consumer Climate, Dec 2017(see more posts on Germany GfK Consumer Climate, ) Source: Investing.com - Click to enlarge |

Meanwhile, the Brexit negotiations may become even more difficult if the Irish government collapses. There is a no-confidence vote on the Deputy Prime Minister scheduled for tonight in Ireland. The latest email revelations suggest Fitzgerald may have known more about the potential legal strategy of discrediting the police whistleblower that has been acknowledged. If a new election is necessary, it would likely be next month, and during which time, there will be little scope to compromise, which in this context means allowing the negotiations to proceed with a promise of it (open border with Northern Ireland) being resolved later.

In the US, Powell’s confirmation hearing starts. His prepared statement underscored the continuity that his candidacy represents. He endorsed the gradual increase of interest rates and the shrinking of Fed’s balance sheet. While he is open to refining the post-crisis regulation, he endorsed the capital and liquidity provisions, stress tests, and living wills. Powell also defended the institutional structure of broad thrust of the Federal Reserve.

The US Senate Finance Committee may steal whatever thunder there may be in Powell’s confirmation hearing. The tax bill must be formally voted to by committee (12 Republicans and 11 Democrats) to set the expected floor vote late this week. However, two Republican Senators are balking. Johnson from Wisconsin wants a greater pass-through tax break. Corker, retiring from Tennessee, wants to include a tax increase that would be triggered if subsequent growth is insufficient to cover the $1.4 trillion in revenue over the next decade. Reports suggest that at least two other Senators who are not on the committee favor Corker’s amendment, which could jeopardize the bill even if it gets out of committee.

The market seems nonplussed. The US 10-year yield is steady to slightly firmer, but with the pullback in Asian and European yields, the spreads have edged more into the dollar’s favor. After last week’s poor close, the dollar saw follow-through buying in Asia and Europe yesterday, but North American participants were less enthusiastic, and the greenback finished well. A bit more short-covering is seeing the dollar enjoy a firmer tone across the board.

After a weak start in Asia, global equity markets are advancing. The MSCI Asia Pacific Index slipped fractionally, for the second day of losses after closing last week with a four-day advance in tow. European shares are recouping yesterday’s losses. The Dow Jones Stoxx 600 is up 0.45% in late morning activity. Energy and consumer staples are leading the advance. Industrial metals are lower as expected weaker Chinese demand weighs on prices. This is pressing the material sector lower.

The US reports merchandise trade, inventories, house prices and Conference Board’s measure of consumer confidence. The data are unlikely to alter general perceptions that the US economy is continuing to experience above-trend growth. The Atlanta Fed’s GDP tracker suggests the economy is expanding at an annualized pace of more than 3% for the third consecutive quarter, after the disappointing Q1 performance (1.2%).

Graphs and additional information on Swiss Franc by the snbchf team.

Tags: #GBP,#USD,$AUD,$CAD,$EUR,$JPY,EUR/CHF,Eurozone M3 Money Supply,Eurozone Private Sector Loans,Featured,France Consumer Confidence,Germany GfK Consumer Climate,newslettersent,USD/CHF