Andréa M. Maechler, Member of the Governing Board of the Swiss National Bank News conference of the Swiss National Bank, Berne, 15.06.2017 Complete text: PDF (478 KB) I will begin by reviewing the situation on the international financial markets. I will then address some developments on the Swiss money and foreign exchange markets – specifically the establishment of SARON as the leading reference rate for interest rate derivatives and the adoption of a global code of conduct for foreign exchange market transactions. Situation on the financial markets Let me start with developments on the international financial markets. Overall, positive sentiment has continued to prevail since the beginning of the year. Economic

Topics:

Andréa Maechler considers the following as important: Featured, newslettersent, SNB

This could be interesting, too:

investrends.ch writes UBS-Prognose: Dollar tendiert seitwärts – Euro steigert sich

investrends.ch writes SNB passt Verzinsung von Sichtguthaben erneut nach unten an

investrends.ch writes Inflation 2025 auf tiefstem Stand seit fünf Jahren

investrends.ch writes Schweizer Firmen ziehen wieder Investitionen aus dem Ausland ab

Andréa M. Maechler, Member of the Governing Board of the Swiss National Bank

News conference of the Swiss National Bank, Berne, 15.06.2017

Complete text: PDF (478 KB)

I will begin by reviewing the situation on the international financial markets. I will then address some developments on the Swiss money and foreign exchange markets – specifically

the establishment of SARON as the leading reference rate for interest rate derivatives and the adoption of a global code of conduct for foreign exchange market transactions.

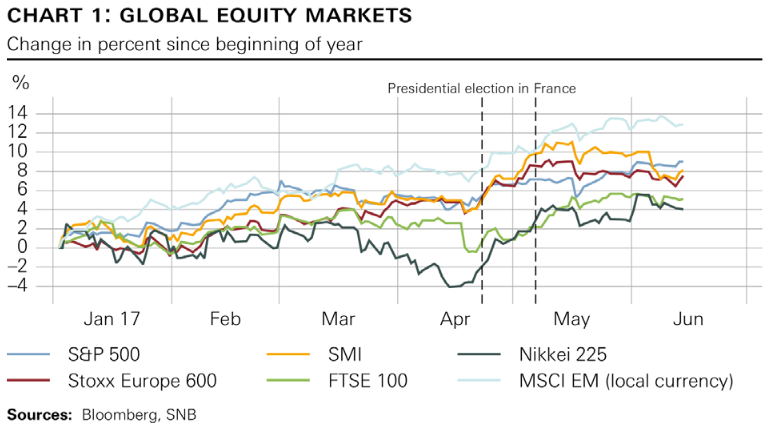

Situation on the financial marketsLet me start with developments on the international financial markets. Overall, positive sentiment has continued to prevail since the beginning of the year. Economic conditions have provided favourable momentum, with data pointing to ongoing recovery in both Europe and the US. Furthermore, companies on both sides of the Atlantic reported solid profits in the first quarter. The principal beneficiaries of these developments have been the equity markets, both in the advanced and the emerging economies (cf. chart 1). Various majorequity indices have repeatedly recorded historical highs in the year-to-date period. While the SMI has not yet hit its historical high, it too made substantial gains and recently closed up 8% on the beginning of the year. Heightened political uncertainty has had no lasting effects on the equity markets. |

Global Equity Markets Jan 2017-Jun 2017 Source: www.snb.ch - Click to enlarge |

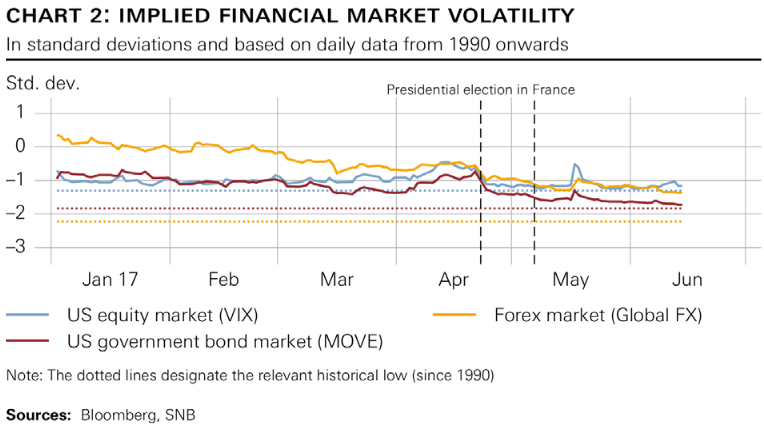

| This assertion is borne out in risk perception metrics. Volatility derived from option prices (implied volatility) once again fell substantially. On the US equity market, volatility approached historical lows at times in May and June (cf. chart 2). |

Impilied Financial Market Volatility Jan 2017 - Jun 2017 Source: www.snb.ch - Click to enlarge |

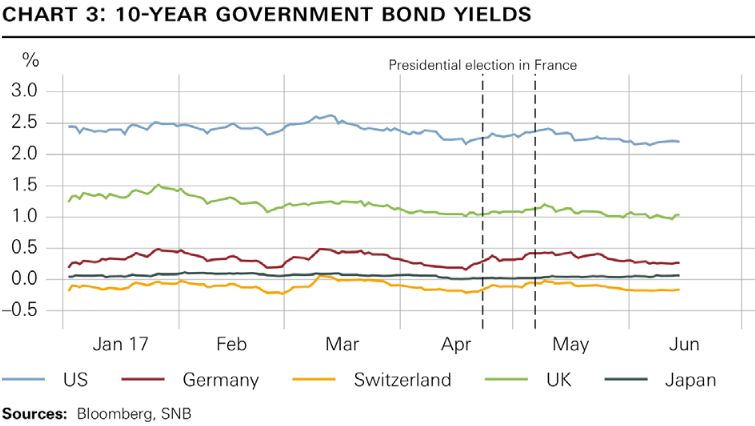

| Heightened political uncertainty has, however, occasionally left its mark on the bond and foreign exchange markets. For instance, demand for highly rated government bonds has remained strong since the start of the year . In addition, despite largely positive economic data, the inflation outlook for the major advanced economies is still muted. As a result, yields on highly rated government bonds have changed only marginally since the beginning of 2017 and have remained low (cf. chart 3). In Switzerland, too, the yield on ten-year Confederation bonds has remained essentially unchanged.

On the foreign exchange market, the Swiss franc experienced repeated episodes of upward pressure as a result of heightened political uncertainty in Europe. The elections in the Netherlands and France, as well as the UK’s upcoming Brexit negotiations with the EU, generated increased demand for currencies considered particularly safe by investors. After the presidential election in France, the euro strengthened and pressure on the Swiss franc subsided. Since the beginning of the year, the euro has gained around 3%. The Swiss franc is now trading close to where it was at the start of the year, and thus remains significantly overvalued. Despite ongoing normalisation of monetary policy in the US, the dollar has depreciated roughly 5%. |

10-Year Government Bond Yields Jan 2017 - Jun 2017 Source: www.snb.ch - Click to enlarge |

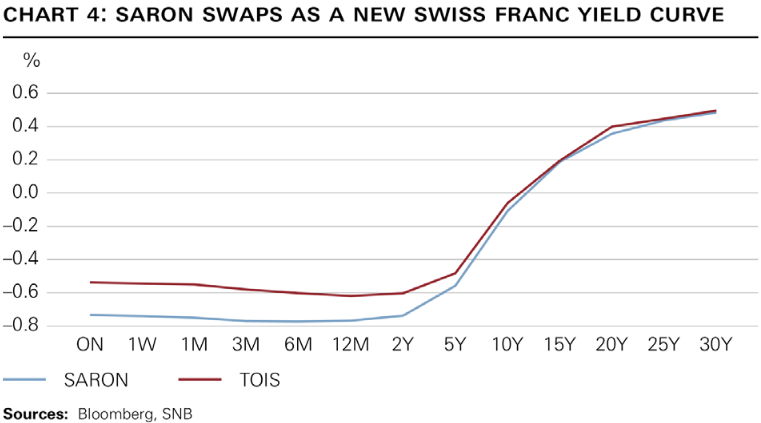

Establishment of SARON as reference rate for interest rate derivativesLet me now turn to innovations on the Swiss money market. For some time, efforts have been under way worldwide to reform major reference interest ratessuch as Libor. These reforms aim to put existing benchmarks on a more solid footing and, where necessary, to develop alternatives. In the case of Libor, these reforms are still ongoing. In the context of these reforms, a decision has already been made to discontinue the TOIS fixing on the Swiss money market and replace it with SARON at the end of 2017. This is due to the fact that, despite various reform attempts, the volume of transactions underlying the TOIS reference rate has remained too low for efficient price formation. Transaction volume is not expected to be an issue with SARON. Unlike the TOIS fixing, which is calculated using data contributed by a panel of banks, SARON is based on actual market transactions and binding quotes. This fact reinforces trust in SARON and makes it more attractive as a reference rate for all money market transactions. Progress has already been made in establishing SARON on the Swiss money market. For some weeks now, it has been used as the reference rate for interest rate derivatives; hence, quotes for SARON interest rate swaps (SARON swaps) are already being offered. We can observe this in chart 4, which plots the curves for TOIS and SARON swaps. We see that the yield curve for SARON swaps already covers all maturities. Moreover, the SARON yield curve is below the TOIS curve. This is because, unlike the unsecured TOIS fixing, SARON, as the secured overnight reference rate, is risk-free. Although the volume of SARON swaps is still small, many players are in the final stages of preparing to enter this market. Both the transaction volumes and acceptance of this market |

Saron Swaps as A new Swiss Franc Yield Curve Source: www.snb.ch - Click to enlarge |

New code of conduct for global foreign exchange market transactions

That brings me to the new global code of conduct for foreign exchange market transactions known as the FX Global Code. Published at the end of May, this new code aims to define clear rules of conduct for all those transacting business on the foreign exchange markets, with a view to enhancing efficiency. A well-functioning foreign exchange market is in the interests of all market players, not least the central banks. Various central banks, including the SNB, have therefore been working alongside private sector par tners to draft the FX Global Code.

The code of conduct affects all foreign exchange market activities – from communications with market participants to risk management and the execution of transactions. As a global set of rules, the new code replaces all existing codes of conduct for foreign exchange markets and, as such, establishes clear and uniform guidelines. It should be noted that the FX Global Code applies not just to market participants, but to market infrastructure providers as well; it thus encompasses all relevant foreign exchange market actors.

While the FX Global Code is classified as self-regulation, the SNB expects its regular counterparties to implement the new code and to abide by the agreed rules.

Tags: Featured,newslettersent