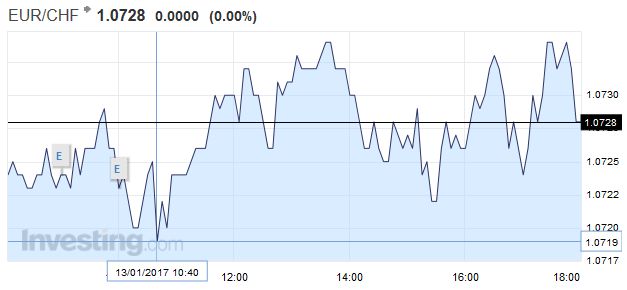

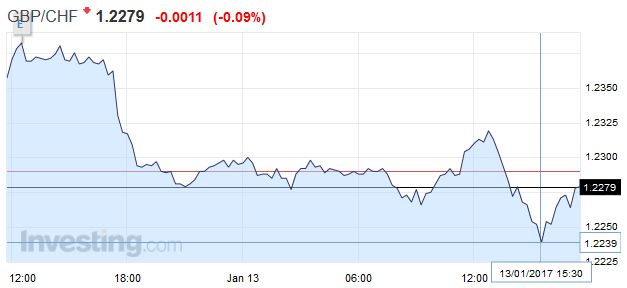

Swiss Franc EUR/CHF - Euro Swiss Franc, January 13(see more posts on EUR/CHF, ) - Click to enlarge Supreme Court Judgement expected imminently The Supreme Court Judgement on whether parliament will have to O.K the triggering of article 50 is ongoing and when the ruling is announced expect big swings on GBP/CHF. I think the likely outcome will be that parliament will get the vote, most broad sheet papers have indicated the majority of the judges are in favour of the parliamentary vote. The Guardian has seven of the eleven judges in favour of parliament voting on invoking article 50. If this is the outcome it would be positive for the pound. It would mean there is the strong possibility of a soft brexit. This would mean current or temporary trade deals will be in place while new deals are negotiated. This would give faith to investors as to the future health of the UK economy. A hard brexit will result in a serious fall in Sterling value, If the ruling comes through and Theresa May gets her way to implement article 50 without a parliamentary vote I would expect GBP/CHF to drop below 1.19. May indicated over the weekend during a Sky news interview that she would give up free trade in order to have control over immigration and the pound took a significant fall as a result.

Topics:

Marc Chandler considers the following as important: AUD, CAD, China Exports, China Imports, China Trade Balance, EUR, Featured, FX Daily, FX Trends, GBP, JPY, MXN, newslettersent, U.S. Retail Sales

This could be interesting, too:

Nachrichten Ticker - www.finanzen.ch writes Die Performance der Kryptowährungen in KW 9: Das hat sich bei Bitcoin, Ether & Co. getan

Nachrichten Ticker - www.finanzen.ch writes Wer verbirgt sich hinter der Ethereum-Technologie?

Marc Chandler writes March 2025 Monthly

Mark Thornton writes Is Amazon a Union-Busting Leviathan?

Swiss Franc |

EUR/CHF - Euro Swiss Franc, January 13(see more posts on EUR/CHF, ) |

|

Supreme Court Judgement expected imminently The Supreme Court Judgement on whether parliament will have to O.K the triggering of article 50 is ongoing and when the ruling is announced expect big swings on GBP/CHF. I think the likely outcome will be that parliament will get the vote, most broad sheet papers have indicated the majority of the judges are in favour of the parliamentary vote. The Guardian has seven of the eleven judges in favour of parliament voting on invoking article 50. If this is the outcome it would be positive for the pound. It would mean there is the strong possibility of a soft brexit. This would mean current or temporary trade deals will be in place while new deals are negotiated. This would give faith to investors as to the future health of the UK economy. A hard brexit will result in a serious fall in Sterling value, If the ruling comes through and Theresa May gets her way to implement article 50 without a parliamentary vote I would expect GBP/CHF to drop below 1.19. May indicated over the weekend during a Sky news interview that she would give up free trade in order to have control over immigration and the pound took a significant fall as a result. If a hard brexit is the outcome new trade deals will become very problematic and could take considerably longer than the two years currently targeted for a full exit from the EU. Sir Ivan Rogers recently resigned from his position as ambassador to the EU stating insufficient and unrealistic planning for an exit as the cause. He thinks a full exit could take as long as a decade. |

GBP/CHF - British Pound Swiss Franc, January 13(see more posts on GBP/CHF, ) |

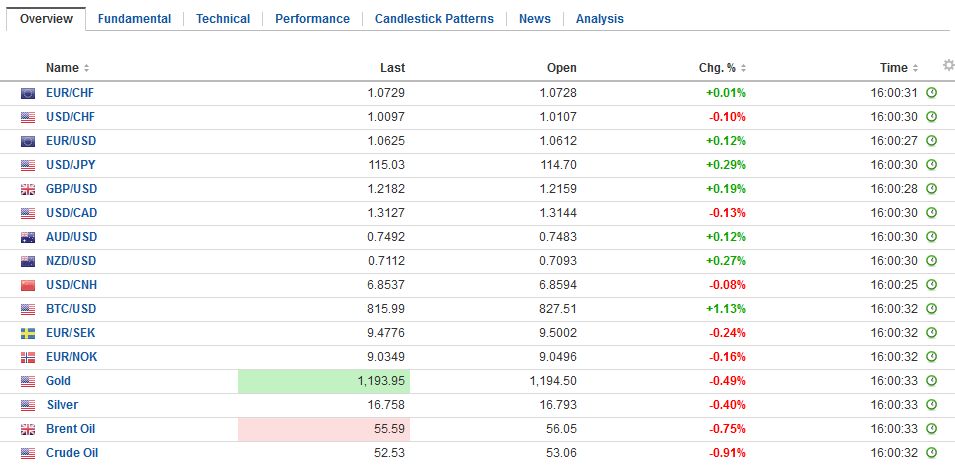

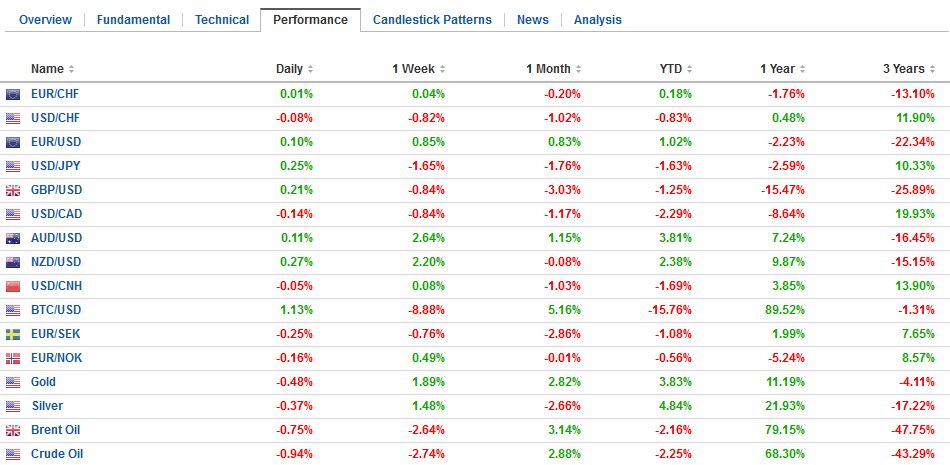

FX RatesAfter a flurry of Fed officials yesterday, only Harker returns to the podium today. There are two takeaways from yesterday’s official comments. First, Yellen’s comments at a town hall meeting suggest the Fed’s chair’s economic assessment has not changed over the past month. Second, a more importantly, the three regional Fed Presidents that spoke (Bullard, Kaplan, and Harker) all suggested that the central bank begins discussing when and how to reduce the Fed’s balance sheet. There almost $200 bln of US Treasuries that the Fed owns that will mature this year and more than twice as much next year. Some of the advisers to the President-elect have also pushed along these lines for an exit strategy. |

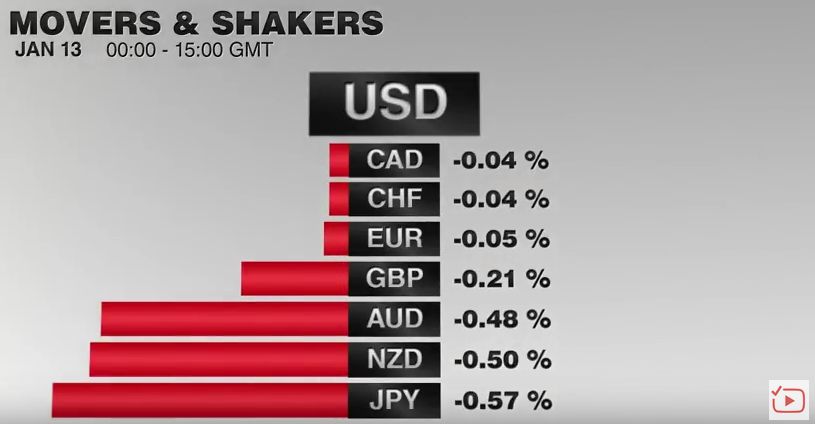

FX Performance, January 13 2017 Movers and Shakers Source: Dukascopy - Click to enlarge |

| Also during the North American session, Moody’s will announce the results of its review of Portugal’s credit rating. It currently stands at Ba1, which is comparable to S&P and Fitch. The outlook is stable. No change is expected, but if there were to be a surprise, it would be to put Portugal on credit review with negative implications. Fitch reviews Portugal next month, and S&P in March. However, it is DBRS’s review in April that may be critical. DBRS is the only rating agency recognized by the ECB that recognizes Portugal as an investment credit. If Portugal were to lose this, its bonds would no longer be acceptable to the ECB. |

FX Daily Rates, January 13 |

| The euro and yen are trading within yesterday’s ranges. After reaching $1.0685 yesterday, the euro pulled back to almost $1.06 where new bids were found. The dollar, which had fallen to a little below JPY114 yesterday poked above JPY115 today before being pushed back down. Like yesterday, the intraday technical readings suggest the greenback may have a better showing in North American activity. Sterling finished on its lows yesterday and saw some, albeit limited, follow through selling in Asia, but managed to resurfaces above the $1.22 level, which had been violated to the downside at the start of the week for the first time since last October. It may struggle to rise through $1.2250 now, and it may be dragged lower if the greenback recovers against the euro and yen, perhaps on the back of the retail sales report.

The dollar-bloc is consolidating this week’s gains. The Aussie is the best performer this week, with a 2.6% advance (just below $0.7500). It is the third consecutive weekly advance. The $0.7540 area is the next objective. The New Zealand dollar is up 2.4% this week (near $0.7125). Securing a foothold above $0.7130 could set the stage for a run at $0.7200. The Canadian dollar has been the laggard with a 0.7% gain this week. Still, it has risen in 10 of the last 15 sessions, and it is the third consecutive weekly gains and five of the past seven. The US dollar had fallen to near CAD1.3030 yesterday, the lowest level since October, but recovered smartly and closed a big figure higher. A move, and especially a close above CAD1.3180 could lift the tone into next week. |

FX Performance, January 13 |

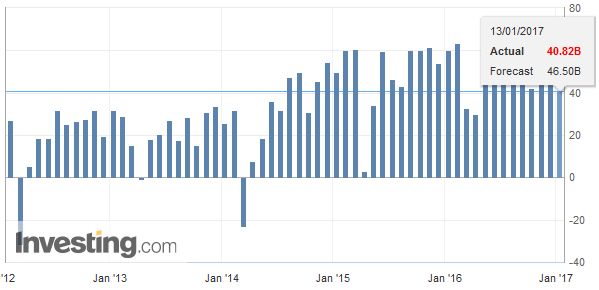

ChinaThe news stream today has been light. China’s trade figures were the main feature. Rather than expand as economists are expected, China reported a 10% reduction in its trade surplus. The $40.8 bln surplus is the smallest since April and contrasts with the $44.6 bln surplus in November and expectations for a $47.5 bln surplus. For all of 2016, China’s trade surplus fell to about $513 bln from nearly $594 bln in 2015. It is the first decline in China’s trade surplus since 2011. |

China Trade Balance, December 2016(see more posts on China Trade Balance, ) Source: Investing.com - Click to enlarge |

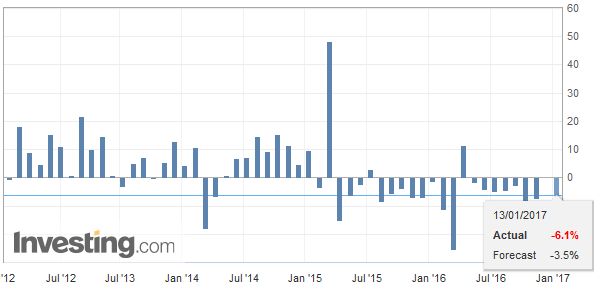

| Exports fell 6.1%, while Exports to the US rose 5.1% and to 8.3% to South Korea, but fell 4.7% to the EU. |

China Exports YoY, December 2016(see more posts on China Exports, ) Source: Investing.com - Click to enlarge |

| Imports rose 3.1% in December year-over-year. |

China Imports YoY, December 2016(see more posts on China Imports, ) Source: Investing.com - Click to enlarge |

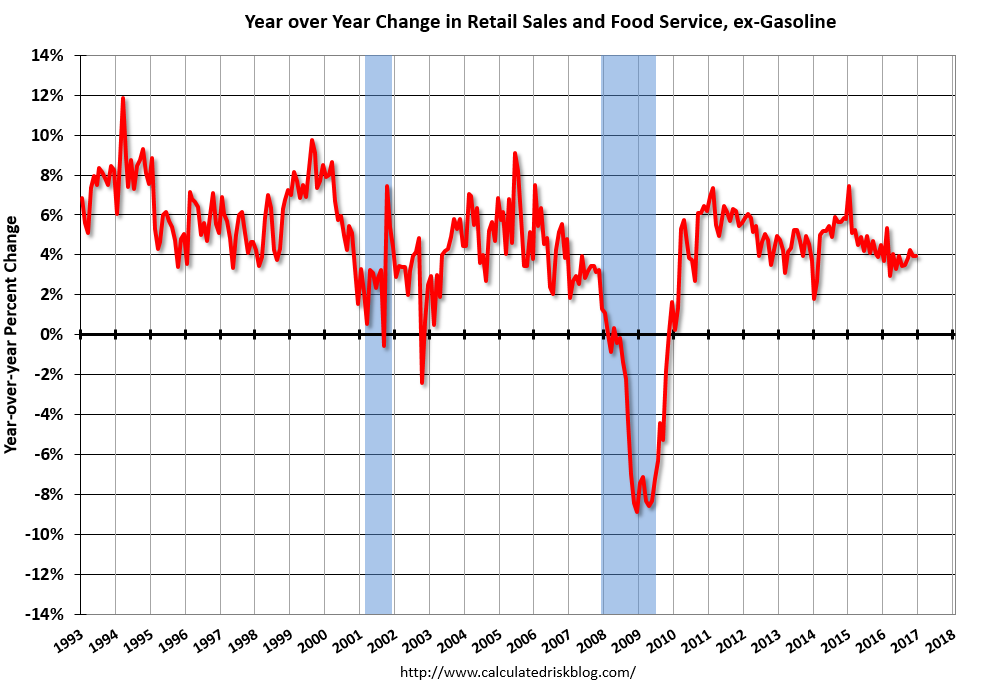

United StatesThe highlight from the US session today will be the December retail sales report. A strong report is expected. Auto sales and higher gasoline prices are expected to lift the headline 0.7%. If so, retail sales would appear to have risen more in Q4 than Q3. However, retail sales account for about 40% of US consumption expenditures, and consumption appears to have slowed a little in Q4. The University of Michigan’s consumer confidence report is not often a market mover, but today’s report may draw more attention than usual. At last month’s FOMC meeting, officials characterized the survey-based measures of inflation expectations as stable. However, a few days after the meeting, the University of Michigan revised lower its survey results and the 5-10 year inflation expectation slipped to a new low of 2.3%. A market-based measure, the 10-year breakeven (conventional yield minus the 10-year TIPS) has been stable since early November around 2.0%. |

U.S. Retail Sales YoY, December 2016(see more posts on U.S. Retail Sales, ) Source: macro.economicbolgs.org - Click to enlarge |

The kind of momentum seen throughout the capital market in most of the fourth quarter last year has yet to return. With the lack of new details about the new US Administration’s economic policies, some are characterizing the activity as “dump the Trump trade,” but that does not seem particularly convincing.

There is a recognition that the momentum began flagging in the middle of December. What is missing from this narrative is a recognition that the move in trends in the capital markets began before the US election and seemed to end the day after the FOMC decided to hike rates. The “dump the Trump trade” narrative, like the one the Wall Street Journal does not even mention the Fed hike.

It was clear to many by last September 2016 that the Fed would raise rates in December. The signals from the Fed’s leadership were unmistakable, and the US economy was accelerating in what later proved to be a 3.5% pace in Q3. The Fed’s hike was preceded by dollar and equity buying and bond selling. A day or two after the FOMC decision, profit-taking ensued, augmented by year-end considerations.

The unconventional style of the US President-elect is challenging for investors and foreign policymakers to get their heads around. However, the bluster and tweet impact has not diminished. Clearly, the pharmaceutical sector this week, like the auto sector recently would not see evidence of that Trump’s impact has diminished. Nor has Mexico experienced a waning influence of the next US President.

The US has a trade treaty with Mexico. A treaty has among the highest legal statuses. The treaty says that output in Mexico counts as domestic content for the US. Between threatening individual car companies, to promising to build a fence between the two countries, and the sometime derogatory characterization of Mexican immigrants into the US, it is as if the President-elect has declared an economic war against Mexico. It has been a significant drag on the Mexican peso, which counting this week has five weeks in a row and nine of the past 12 weeks. Interest rates have risen sharply. The tension with the US may deter global companies from expanding operations in Mexico.

Graphs and additional information on Swiss Franc by the snbchf team.

Tags: #GBP,$AUD,$CAD,$EUR,$JPY,China Exports,China Imports,China Trade Balance,Featured,FX Daily,MXN,newslettersent,U.S. Retail Sales