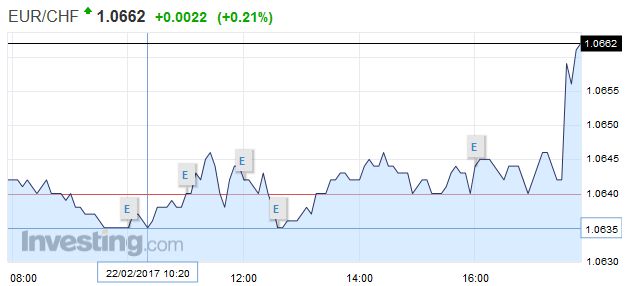

Swiss Franc EUR/CHF - Euro Swiss Franc, February 22(see more posts on EUR/CHF, ) - Click to enlarge GBP/CHF The pound has made good gains against the Swiss Franc this morning with rates for GBP CHF now sitting at 1.2650 for this pair. The pound seems to have found support as the Brexit bill is still expected to pass through the House of Lords next week when the bill comes under additional scrutiny. There is a chance it could be held up with a large number of peers already stating that they will try and amend it during next week’s more detailed discussions. Despite all the European rhetoric that Britain will face a very heft bill when leaving the EU the pound is actually making gains across a number of the major currencies. For those clients needing to buy Swiss Francs there is currently a good opportunity to buy although the next few weeks are likely to see a rocky ride for the pound. There are likely to be some big very market reactions to the political news that awaits in these next few weeks. For the moment the pound is providing very resilient although there as we approach Brexit the pound is likely to seem some shocks in the downward direction. UK Gross Domestic Product (GDP) figures are released this morning at 09:30 and could see some further reaction for the pound.

Topics:

Marc Chandler considers the following as important: AUD, CAD, Canada Retail Sales, EUR, Eurozone Consumer Price Index, Featured, FOMC, FX Trends, GBP, Germany, Germany Business Expectations, Germany Current Assessment, Germany IFO Business Climate Index, newslettersent, U.K. Gross Domestic Product, U.S. Existing Home Sales, USD

This could be interesting, too:

Nachrichten Ticker - www.finanzen.ch writes Die Performance der Kryptowährungen in KW 9: Das hat sich bei Bitcoin, Ether & Co. getan

Nachrichten Ticker - www.finanzen.ch writes Wer verbirgt sich hinter der Ethereum-Technologie?

Marc Chandler writes March 2025 Monthly

Mark Thornton writes Is Amazon a Union-Busting Leviathan?

Swiss Franc |

EUR/CHF - Euro Swiss Franc, February 22(see more posts on EUR/CHF, ) |

GBP/CHFThe pound has made good gains against the Swiss Franc this morning with rates for GBP CHF now sitting at 1.2650 for this pair. The pound seems to have found support as the Brexit bill is still expected to pass through the House of Lords next week when the bill comes under additional scrutiny. There is a chance it could be held up with a large number of peers already stating that they will try and amend it during next week’s more detailed discussions. Despite all the European rhetoric that Britain will face a very heft bill when leaving the EU the pound is actually making gains across a number of the major currencies. For those clients needing to buy Swiss Francs there is currently a good opportunity to buy although the next few weeks are likely to see a rocky ride for the pound. There are likely to be some big very market reactions to the political news that awaits in these next few weeks. For the moment the pound is providing very resilient although there as we approach Brexit the pound is likely to seem some shocks in the downward direction. UK Gross Domestic Product (GDP) figures are released this morning at 09:30 and could see some further reaction for the pound. Expectation is for GDP to remain at 0.6% on the quarter although there is a chance that number could be revised upwards. A stronger number this morning could see the pound strengthen further. There is a chance the figure could be revised up to 0.7% which would provide an instant boost for sterling exchange rates. |

GBP/CHF - British Pound Swiss Franc, February 22(see more posts on GBP/CHF, ) |

FX RatesFebruary has been cruel to the euro. Of the sixteen sessions this month, counting today, the euro has risen in four, and two of those were last week. Its new four-day slide pushed it below $1.05 for the first time in six weeks as European markets were opening. The $1.0560 area that was broken yesterday, and provided a cap today is 61.8% retracement objective of last month’s rally. Recall that the multi-year low was recorded at the start of the year a little below $1.04. |

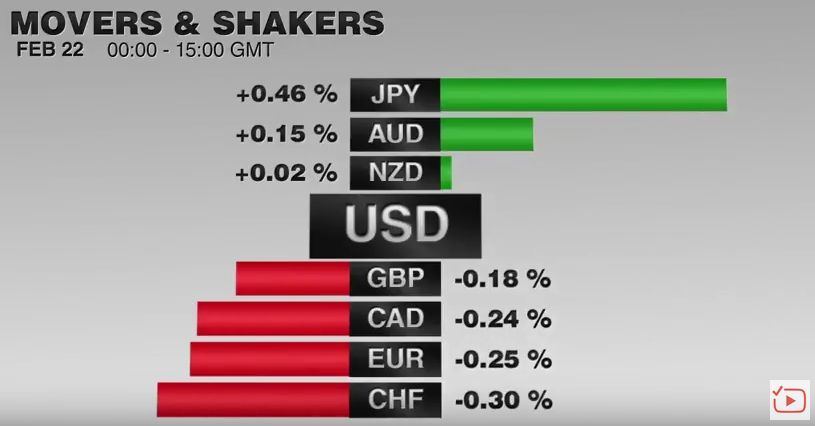

FX Performance February 22 2017 Movers and Shakers Source: Dukascopy - Click to enlarge |

| The main weight on the euro is presently not economic but political. Recent developments in France underscore our argument that the success of the populist-nationalist forces requires some sort of help from the mainstream parties. This was clearly the case in the US and UK, where no populist party was elected, but instead, the populist agenda co-opted by the center-right. The non-binding UK referendum turned into a binding decision with the smallest of majorities for such an important change. It has yet to be seen how President Trump relates with the Republican Party. However, it is strikingly different that what the Democrat leadership did in 1972. Then the left-wing of the Democrat Party succeeded in nominating McGovern, and the leadership of the party abandoned him, helping to produce a landslide victory for Nixon. |

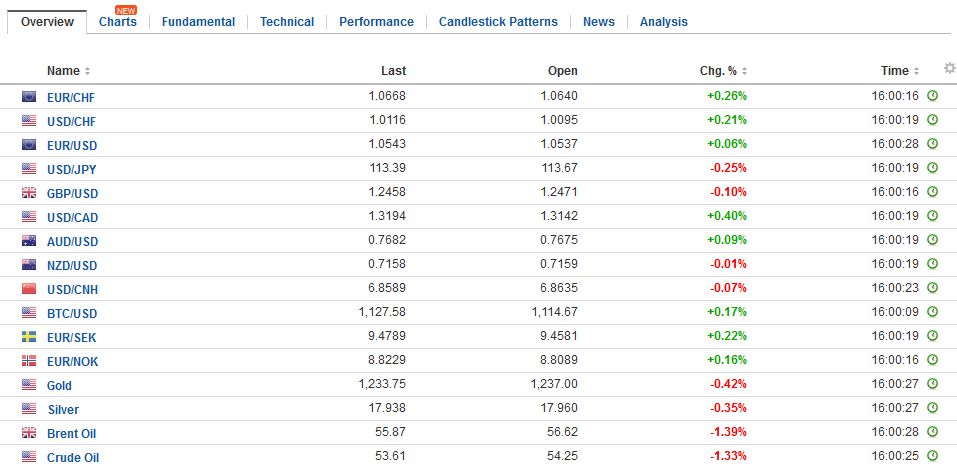

FX Daily Rates, February 22 |

| In any event, the left in France is finding it difficult to put down egos and the hubris of small programmatic differences to unite behind a single candidate. Macron appears to be doing a good jump of shooting himself in the foot, allowing Fillon, under a cloud of scandal, to recapture second place in the polls. In Italy, there is a risk that the largest political coalition in Italy, the PD, may split with the old guard and the left-wing possibly forming two new parties. This is seen working to the 5-Star Movement’s favor. The 5-Star Movement is underscoring another observation of populism-nationalism: it may work better as in opposition rather than as a governing party.

Australia’s government auctioned a record A$1.1 bln of 11-year bonds today, and the demand for the 2.75% coupon was strong. The government has been stepping up the size of the auctions in recent months. The demand appears to have helped the Australian dollar return to the upper end of its $0.7600-$0.7700 range that has confined most of the price action this month. The strong demand at the auctions is the good news, but the record size auctions reflect the fact that Australia’s budget deficit is expected to widen this year to a little over 2% this year from 1.5% last year. S&P has a negative outlook for Australia’s AAA rating since last July. The government will update its fiscal projections in May. |

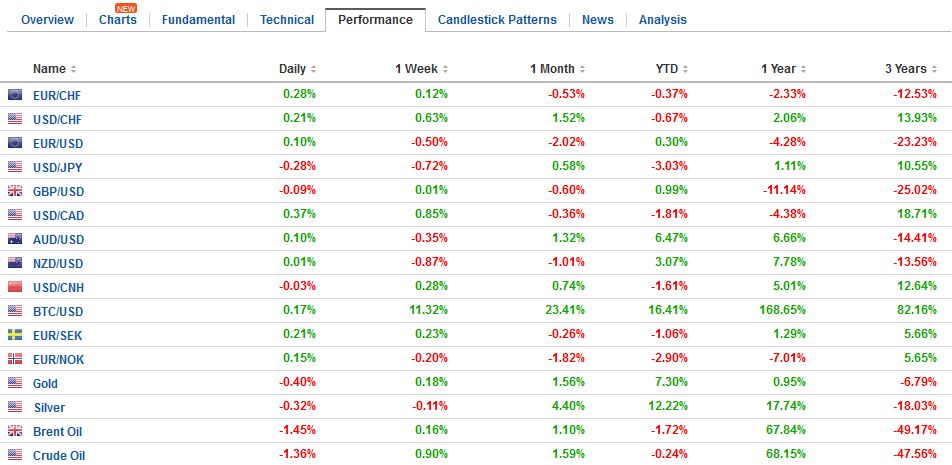

FX Performance, February 22 |

EurozoneThese concerns trump the eurozone economic data, which shows steady to stronger growth at the start of the year. This coupled with the structural shortage of a key investment and collateral vehicle, short-term German bonds, has seen the two-year yield plunge to new record lows. It stands at minus 92 bp. This is resulting in widening premiums against Germany. This is true not just within the eurozone, but of particular interest to the euro, with the US. The two-year spread is near 2.13%. It finished last month a little above 1.90%. |

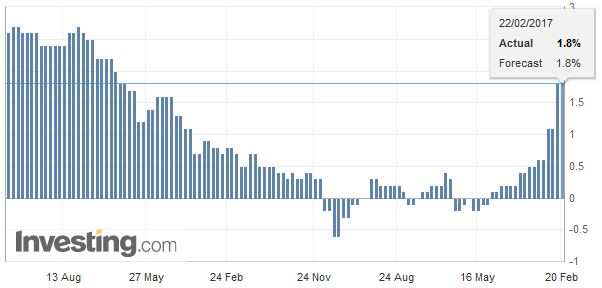

Eurozone Consumer Price Index (CPI) YoY, January 2017(see more posts on Eurozone Consumer Price Index, ) Source: Investing.com - Click to enlarge |

United StatesVery little of widening is taking place due to the US leg. The US two-year yield ended last month at 1.21%. It is now a little more than 1.22%. This may help explain the heavier dollar tone against other currencies, such as the yen and Australian dollar. The dollar-yen rate is more sensitive to the 10-year differential, which is flat near 2.33% (and also around where the 5, 20, and 50-day averages converge). |

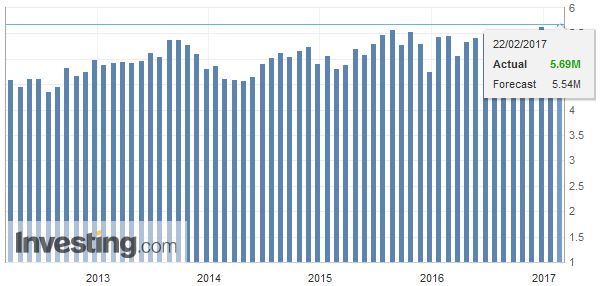

U.S. Existing Home Sales, January 2017(see more posts on U.S. Existing Home Sales, ) Source: Investing.com - Click to enlarge |

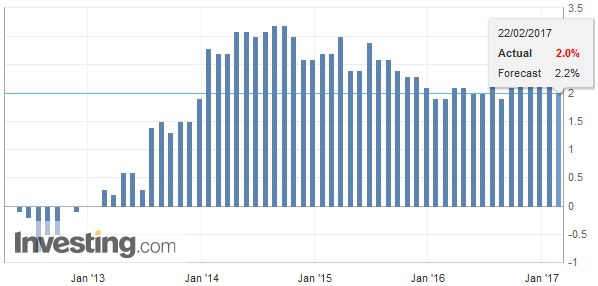

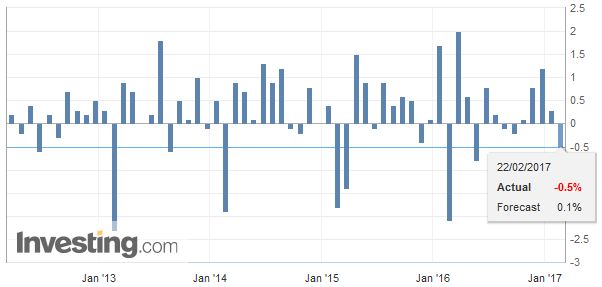

United KingdomThere were economic reports from both the UK and Germany of note. Turning to the UK, the Q4 GDP was revised to 0.7% from 0.6%, helped by better trade (weaker sterling?) and firm consumption. Exports rose 4.1% in Q4, twice the expected pace. Imports fell 0.4%. The median forecast called for a 0.3% gain. Sterling itself is uninspiring. It has chopped mostly between $1.24 and $1.25 with minor violations and has closed in that range for the past nine sessions with one exception. The House of Lords has taken up the Brexit motion, where its is working its way through the committee process. |

U.K. Gross Domestic Product (GDP) YoY, January 2017(see more posts on U.K. Gross Domestic Product, ) Source: Investing.com - Click to enlarge |

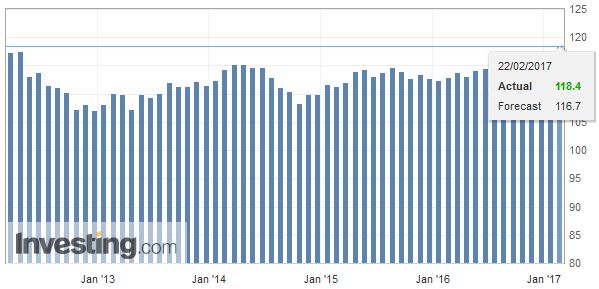

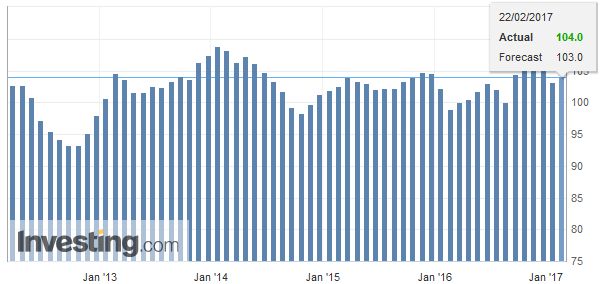

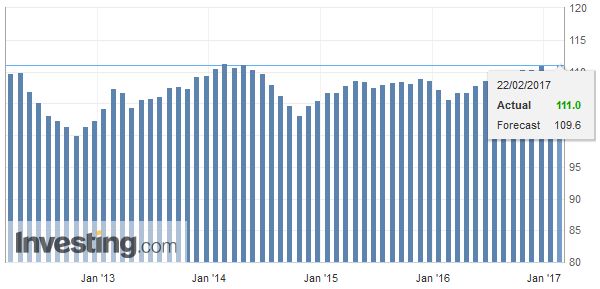

GermanyGermany reported stronger than expected business confidence in the form of the February IFO survey. The assessment of the overall climate improved to 111.0 from 109.9. |

Germany Current Assessment, January 2017(see more posts on Germany Current Assessment, ) Source: Investing.com - Click to enlarge |

| This was a reflection of improved expectations (104.0 vs. 103.2) and improved assessment of current conditions (118.4 vs. 116.9). |

Germany Business Expectations, January 2017(see more posts on Germany Business Expectations, ) Source: Investing.com - Click to enlarge |

| Low German interest rates, a euro that serves as frosting on an already competitive cake, and a DAX that is up 4.3% so far this year (the most among the large European bourses), coupled with a government that is tilted toward the right to blunt the appeal of the AfD, may encourage the confidence. |

Germany Ifo Business Climate Index, January 2017(see more posts on Germany IFO Business Climate Index, ) Source: Investing.com - Click to enlarge |

CanadaCanada reports December retail sales today. Soft auto sales may weigh on the headline, where a flat report is expected after a 0.2% increase in November. However, excluding the auto sector, a 0.5% rise is expected. Oil prices closed at eight-week highs yesterday, but the Canadian dollar is finding little succor. The US dollar continued to recover from the successful test on CAD1.30 last week. The months high is a little above CAD1.32 and offers a nearby cap. |

Canada Retail Sales, January 2017(see more posts on Canada Retail Sales, ) Source: Investing.com - Click to enlarge |

The focus in the US is on the FOMC minutes, before which January existing home sales will be reported. A small gain after a 2.8% decline in December is expected. In some ways, the FOMC minutes have been superseded by Yellen’s recent testimony and the comments by numerous officials, including Fischer and Dudley. Our general takeaway is that mid-March may be too soon, but June is too long. The prospect of a May move is increasingly appealing.

In terms of other issues, there is still a lack of clarity on fiscal policy, but this is normal and will likely be clarified in the coming period, with some insight likely from Trump’s speech to Congress next week. The balance sheet discussions appear very preliminary. Yellen suggested in her testimony that she does not want use reducing the balance sheet to affect the broader economy (that is as a policy tool). The discussions will evolve over the course of the year.

Graphs and additional information on Swiss Franc by the snbchf team.

Tags: #GBP,#USD,$AUD,$CAD,$EUR,Canada Retail Sales,Eurozone Consumer Price Index,Featured,FOMC,Germany,Germany Business Expectations,Germany Current Assessment,Germany IFO Business Climate Index,newslettersent,U.K. Gross Domestic Product,U.S. Existing Home Sales