See the introduction and the video for the terms gold basis, co-basis, backwardation and contango. Fundamental Developments Last week, the prices of the metals mostly moved sideways. There was a rise on Thursday but it corrected back to basically unchanged on Friday. This will again be a brief Report, as Monday was a holiday in the US. Below, we will show the only true picture of the gold and silver supply and demand fundamentals. But first, the price and ratio charts. Gold and Silver Prices(see more posts on gold price, silver price, )Prices of gold and silver - Click to enlarge Gold:Silver Ratio Next, this is a graph of the gold price measured in silver, otherwise known as the gold to silver ratio. It moved sideways last week. For each metal, we will look at a graph of the basis and co-basis overlaid with the price of the dollar in terms of the respective metal. It will make it easier to provide brief commentary. The dollar will be represented in green, the basis in blue and co-basis in red. Gold:Silver Ratio(see more posts on gold silver ratio, )Gold-silver ratio - Click to enlarge Gold Basis and Co-basis and the Dollar Price Here is the gold graph. The price was unchanged, but the basis is up slightly and cobasis is down (i.e. gold became slightly more abundant).

Topics:

Keith Weiner considers the following as important: dollar price, Featured, Gold and its price, Gold and silver prices, gold basis, Gold co-basis, gold price, gold silver ratio, newslettersent, Precious Metals, silver basis, Silver co-basis, silver price

This could be interesting, too:

Nachrichten Ticker - www.finanzen.ch writes Die Performance der Kryptowährungen in KW 9: Das hat sich bei Bitcoin, Ether & Co. getan

Nachrichten Ticker - www.finanzen.ch writes Wer verbirgt sich hinter der Ethereum-Technologie?

Marc Chandler writes March 2025 Monthly

Mark Thornton writes Is Amazon a Union-Busting Leviathan?

See the introduction and the video for the terms gold basis, co-basis, backwardation and contango.

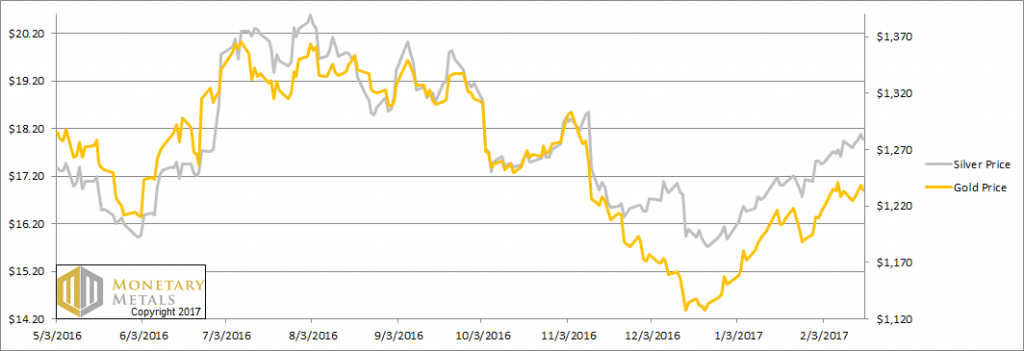

Fundamental DevelopmentsLast week, the prices of the metals mostly moved sideways. There was a rise on Thursday but it corrected back to basically unchanged on Friday. This will again be a brief Report, as Monday was a holiday in the US. Below, we will show the only true picture of the gold and silver supply and demand fundamentals. But first, the price and ratio charts. |

Gold and Silver Prices(see more posts on gold price, silver price, ) |

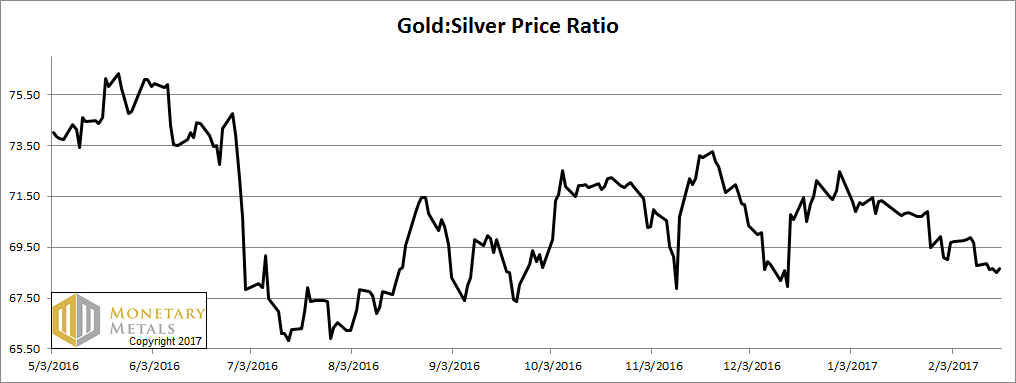

Gold:Silver RatioNext, this is a graph of the gold price measured in silver, otherwise known as the gold to silver ratio. It moved sideways last week.

|

Gold:Silver Ratio(see more posts on gold silver ratio, ) |

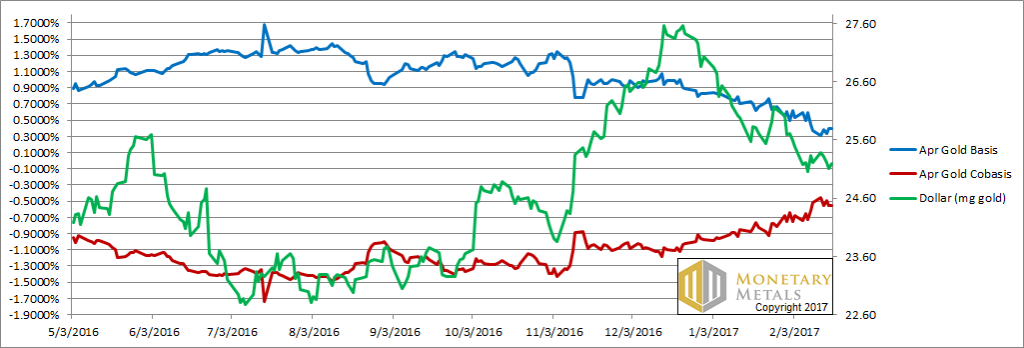

Gold Basis and Co-basis and the Dollar PriceHere is the gold graph. The price was unchanged, but the basis is up slightly and cobasis is down (i.e. gold became slightly more abundant). This is not the news dollar shorters (i.e. those betting on the gold price) want to see. Our calculated fundamental price is all but unchanged around $1,360. |

Gold Basis and Co-basis and the Dollar Price(see more posts on dollar price, gold basis, Gold co-basis, ) |

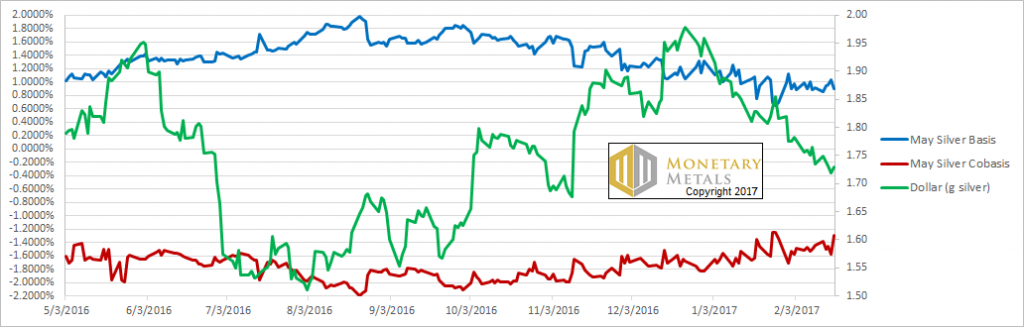

Silver Basis and Co-basis and the Dollar PriceNow let’s look at silver. In silver, the basis is basically unchanged but the co-basis went up a bit. The silver market got just a bit tighter, and our calculated fundamental price is up more than 30 cents to about a quarter above the market price. Not exactly “bet the farm with leverage territory”, but definitely not “short this dog” either. Watch this space. We have some exciting data science to reveal soon. |

Silver Basis and Co-basis and the Dollar Price(see more posts on dollar price, silver basis, Silver co-basis, ) |

Charts © 2016 Monetary Metals

Tags: dollar price,Featured,Gold and silver prices,gold basis,Gold co-basis,gold price,gold silver ratio,newslettersent,Precious Metals,silver basis,Silver co-basis,silver price