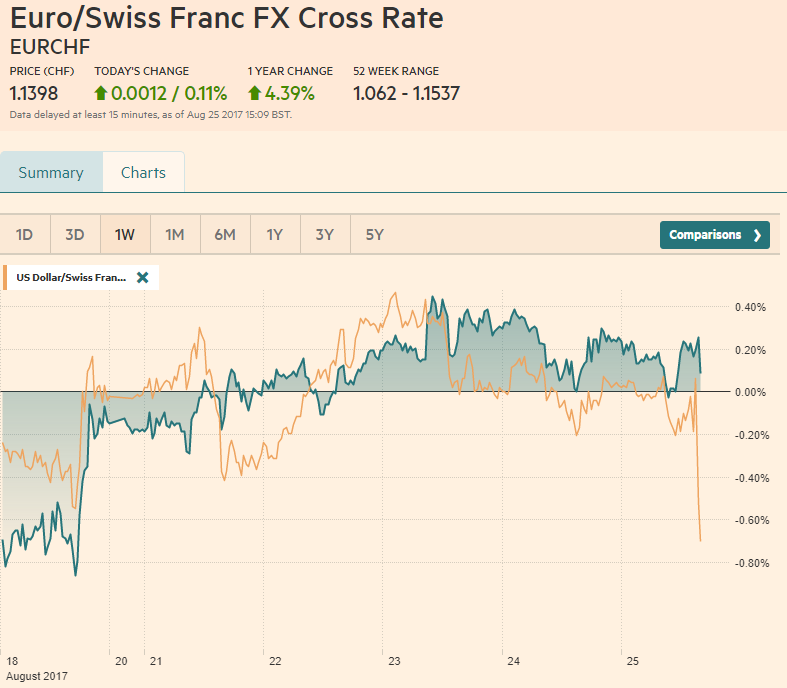

Swiss Franc The Euro has risen by 0.11% to 1.1398 CHF. EUR/CHF and USD/CHF, August 25(see more posts on EUR/CHF, USD/CHF, ). FX Rates The event that investors have been waiting for and the media frequently linked to whatever price action has taken place has arrived: Yellen and Draghi’s speeches later today. Yellen is first. She will speak at 10:00 am ET. This is toward the end of the European trading week. Draghi speaks late in the North American session–3:00 pm ET. Much of the media’s coverage seems to be playing up expectations that one or both officials will provide new insight into the likely outcome of next month’s policy meetings. We are less sanguine. There may be little that Yellen can contribute to

Topics:

Marc Chandler considers the following as important: EUR, EUR/CHF, Featured, France Consumer Confidence, FX Trends, Germany Business Expectations, Germany Current Assessment, Germany Gross Domestic Product, Germany IFO Business Climate Index, Japan National Consumer Price Index, Japan National Core Consumer Price Index, JPY, newsletter, Spain Producer Price Index, USD, USD/CHF

This could be interesting, too:

Nachrichten Ticker - www.finanzen.ch writes Die Performance der Kryptowährungen in KW 9: Das hat sich bei Bitcoin, Ether & Co. getan

Nachrichten Ticker - www.finanzen.ch writes Wer verbirgt sich hinter der Ethereum-Technologie?

Martin Hartmann writes Eine Analyse nach den Lehren von Milton Friedman

Marc Chandler writes March 2025 Monthly

Swiss FrancThe Euro has risen by 0.11% to 1.1398 CHF. |

EUR/CHF and USD/CHF, August 25(see more posts on EUR/CHF, USD/CHF, ) |

FX RatesThe event that investors have been waiting for and the media frequently linked to whatever price action has taken place has arrived: Yellen and Draghi’s speeches later today. Yellen is first. She will speak at 10:00 am ET. This is toward the end of the European trading week. Draghi speaks late in the North American session–3:00 pm ET. Much of the media’s coverage seems to be playing up expectations that one or both officials will provide new insight into the likely outcome of next month’s policy meetings. We are less sanguine. There may be little that Yellen can contribute to investors’ information set, and there may be little that Draghi is willing to reveal. As an interpretative point, we give a privileged place to the communication of the Fed’s leadership, Yellen, Fischer, and Dudley. Dudley recent comments were very clear. They were consistent with Yellen’s testimony before Congress last month. Surveys suggest that market participants have taken it on board. Next month the Federal Reserve will announce that it will begin allowing its balance sheet to shrink. The expectation for a rate hike in September, which was never very high, could not get much lower. |

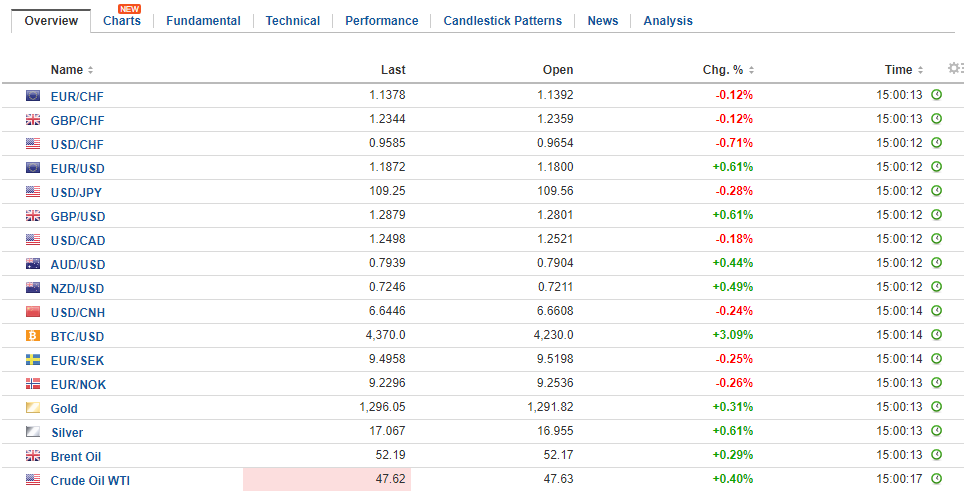

FX Daily Rates, August 25 |

| We think that the odds of a rate hike before the end of the year is higher than one-in-three chance that is being discounted by the markets. We understand the comments from the Fed’s leadership to be putting more emphasis its third mandate, financial stability, as signaling a low bar for a rate hike. Dudley suggested that he could favor a rate hike by the end of the year provided the economy does what the Fed expects. This sounds as if provided there are no significant downside shocks would be sufficient. It seems that as long as measures of inflation and inflation expectations do not deteriorate further, a rate hike would be seen as appropriate.

The Fed has judged that the economic conditions warranted the removal of some accommodation. It has been gradually lifting the Fed funds target as it operationalized its judgment. The omnipresent market has neutralized the Fed by easing financial conditions. The Fed sticks to its assessment, and this was clear to us in the FOMC minutes where the concern about asset prices was raised a notch. There might not be anything that Yellen will likely say about the conduct of US monetary policy, which in any event does not necessarily fit well with the topic of the symposium. Draghi, on the other hand, likely has an information set that the markets don’t, but he not likely disposed to share it, even if he found a way to make the nuances of ECB monetary policy the subject of “Fostering a Global Dynamic Economy.” |

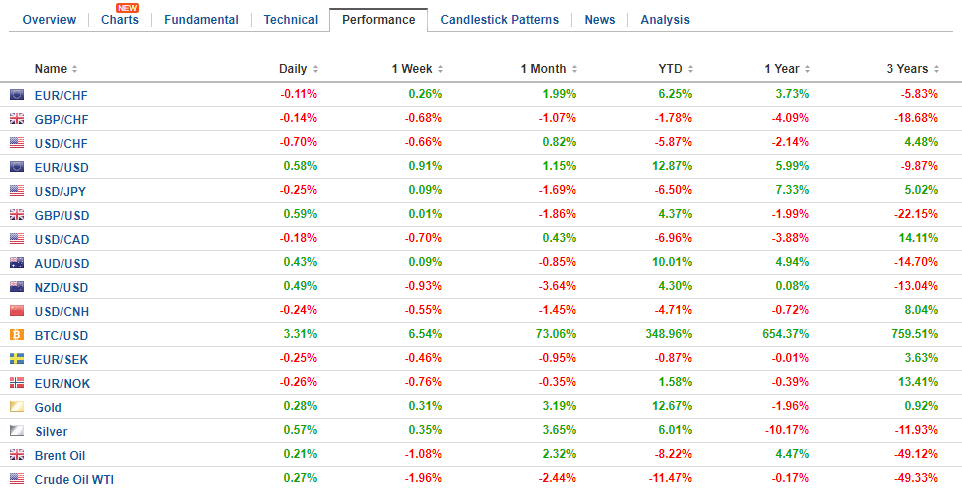

FX Performance, August 25 |

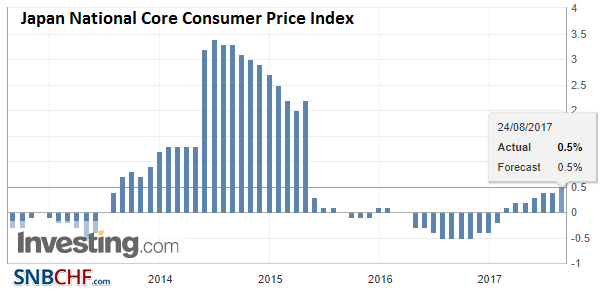

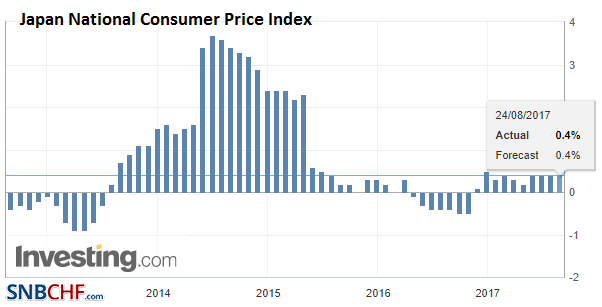

JapanEarlier Japan reported July consumer inflation data that was in line with expectations. The headline rate remained at 0.4%. The core rate, which is what the BOJ targets, excludes fresh food, and it ticked up to 0.5%. |

Japan National Core Consumer Price Index (CPI) YoY, Jul 2017(see more posts on Japan National Core Consumer Price Index, ) Source: Investing.com - Click to enlarge |

| However, at end of the day, despite extensive BOJ operations, if it weren’t were energy and fresh food, Japan would be looking at a 0.1% year-over-year rate of CPI. It is little wonder that the BOJ is and will continue to lag behind the other major central banks. At the same time, we have noted that the Swiss franc is less volatile, is backed by lower interest rates, and is less subject top change in personal as Kuroda’s term draws to an end next year. |

Japan National Consumer Price Index (CPI) YoY, Jul 2017(see more posts on Japan National Consumer Price Index, ) Source: Investing.com - Click to enlarge |

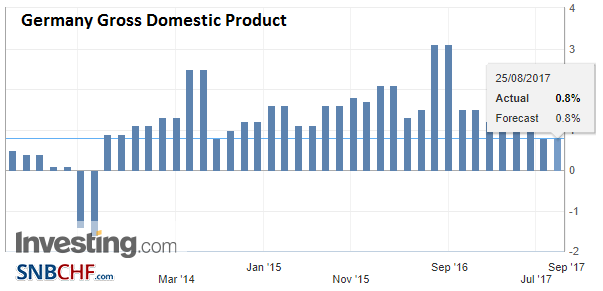

Germany |

Germany Gross Domestic Product (GDP) YoY, Q2 2017(see more posts on Germany Gross Domestic Product, ) Source: Investing.com - Click to enlarge |

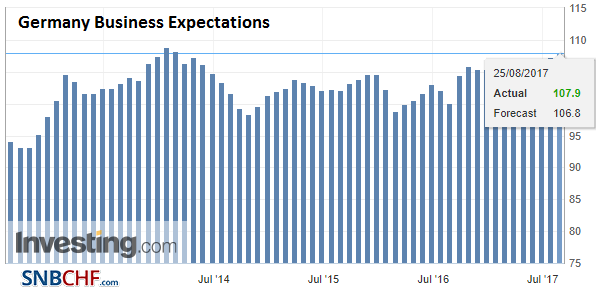

Germany Business Expectations, Aug 2017(see more posts on Germany Business Expectations, ) Source: Investing.com - Click to enlarge |

|

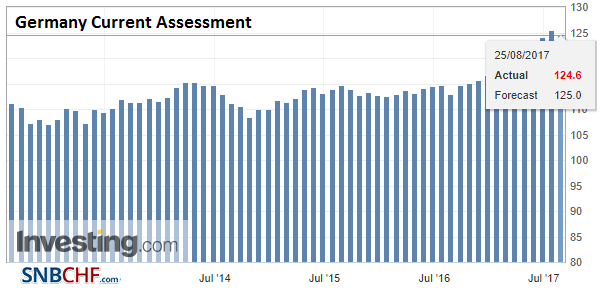

Germany Current Assessment, Aug 2017(see more posts on Germany Current Assessment, ) Source: Investing.com - Click to enlarge |

|

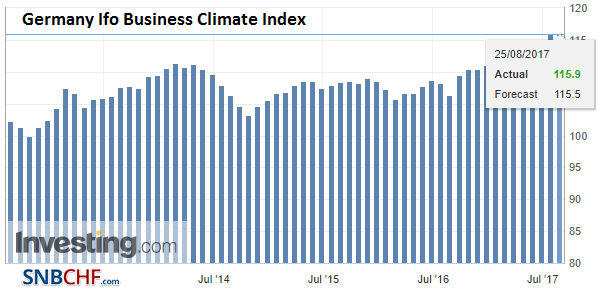

Germany Ifo Business Climate Index, Aug 2017(see more posts on Germany IFO Business Climate Index, ) Source: Investing.com - Click to enlarge |

|

Spain |

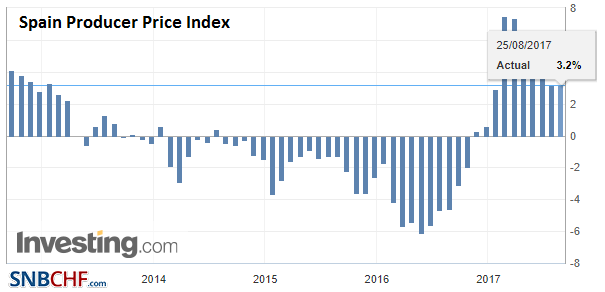

Spain Producer Price Index (PPI) YoY, Aug 2017(see more posts on Spain Producer Price Index, ) Source: Investing.com - Click to enlarge |

France |

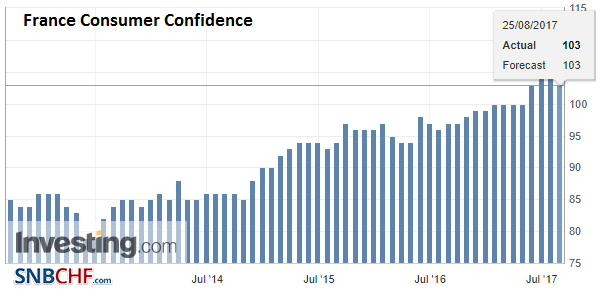

France Consumer Confidence, Aug 2017(see more posts on France Consumer Confidence, ) Source: Investing.com - Click to enlarge |

The US reports July durable goods orders. The optics will be considerably worse than the details. The headline is expected to fall 6.0% after a 6.4% rise in June. This is noise. It is largely the non-defense aircraft orders from the Paris Airshow running though the calculations. Non-defense non-aircraft orders are expected to bounce back after the flat reading in June. These core orders are considerably stronger than last year. The 2016 average month change was a 0.1% gain. Through June, this year’s monthly average is 0.4%. Shipments of those core goods, which feeds into GDP calculations, fell an average of 0.2% in 2016 and have risen 0.3% a month this year.

Investors generally expect ECB policy to continue to normalize. Arguments that divergence is over seem to be exaggerating the pace of normalization. It is not just about the asset purchase program, though we point out that the ECB’s balance sheet is far from peaking. With conservative but reasonable assumptions, the balance sheet will expand by more than 400 bln euros by the middle of next year. The ECB’s extraordinary measures include the minus 40 bp deposit rate. How many times will the Fed raise its target before the deposit rate is no longer negative?

If the US financial conditions have eased in defiance of the Fed, the financial conditions in the eurozone have tightened more than is arguably desirable. While growth is likely to ratchet down slightly after a strong first half, the tightening of financial conditions has barely bitten. This includes the euro’s appreciation, which the recent flash PMI showed has not deterred strong export orders.

That said, the euro’s appreciation may help dampen price increases. Next week, the flash August CPI figures will be announced. Headline inflation spiked to 2.0% in February, and Draghi cautioned that it was due to transitory factors. In June and July, CPI stabilized at 1.3%. It may have risen to 1.4% in August. However, the increase is likely due to food or energy as the core rate likely remained unchanged at 1.2%, which matches the high from April. It has not been above it since 2013. The core rate averaged 1.0% in the first seven months of the year, and 0.9% in 2016.

Expectations are for the ECB to announce in September that it will inflation has still not achieved a self-sustaining, durable path toward the target. What follows from this assessment is that the asset purchases must be extended, but given the reduction of downside risks to the economy and the defeat of deflationary forces, the pace of purchases can slow. We suggested that the current (and through year-end) pace of 60 bln euros is likely to cut in half for the first half of next year.

Draghi may stick to his catechism: patience, prudence, and persistence. He may offer it as advice to other policymakers to ensure that the economies weather the storms that seem inevitable. His audience would not only be the central bankers, policy wonks, economists and fly fishers in Jackson Hole but his colleagues in Europe.

One of the most important issues for investors is the approaching country limits the ECB is approaching, and not just for Germany. The ECB has already introduced some flexibility into its purchases, like non-state institutions and corporate bonds, but more flexibility may be needed. Either some of the current self-introduced guidelines may have to be relaxed, or the capital key must be sacrificed.

The capital key is an important principle that from the creditors’ point of view. Eschewing it would make a dangerous precedent, and it would likely lead buying lower rated bonds (e.g., Italian BTPs and Spanish Bonos instead of German Bunds). However, don’t expect Draghi to address this until perhaps the Q&A that follows his next press conference.

Graphs and additional information on Swiss Franc by the snbchf team.

Tags: #USD,$EUR,$JPY,EUR/CHF,Featured,France Consumer Confidence,Germany Business Expectations,Germany Current Assessment,Germany Gross Domestic Product,Germany IFO Business Climate Index,Japan National Consumer Price Index,Japan National Core Consumer Price Index,newsletter,Spain Producer Price Index,USD/CHF