Swiss Franc The Euro has fallen by 0.43% to 1.1397 CHF. EUR/CHF and USD/CHF, August 15(see more posts on EUR/CHF, USD/CHF, ) Source: markets.ft.com - Click to enlarge FX Rates NY Fed President Dudley appears to have stolen any potential thunder in the July FOMC minutes that will be released tomorrow. While we put more emphasis on today’s US retail sales data and the August Fed surveys, many others argued that the minutes were the key report this week. Dudley essentially confirmed what many economists have come to expect. This is that next month; the FOMC announces that it will begin not reinvesting the entire maturing proceeds starting in Q4. The initial pace of bln Treasuries and bln MBS is sufficiently

Topics:

Marc Chandler considers the following as important: $CNY, China New Loans, EUR, Featured, FX Trends, GBP, Germany Gross Domestic Product, JPY, newslettersent, SEK, TLT, U.K. Consumer Price Index, U.K. House Price Index, U.S. NY Empire State Manufacturing Index, U.S. Retail Sales, USD

This could be interesting, too:

Nachrichten Ticker - www.finanzen.ch writes Die Performance der Kryptowährungen in KW 9: Das hat sich bei Bitcoin, Ether & Co. getan

Nachrichten Ticker - www.finanzen.ch writes Wer verbirgt sich hinter der Ethereum-Technologie?

Marc Chandler writes March 2025 Monthly

Mark Thornton writes Is Amazon a Union-Busting Leviathan?

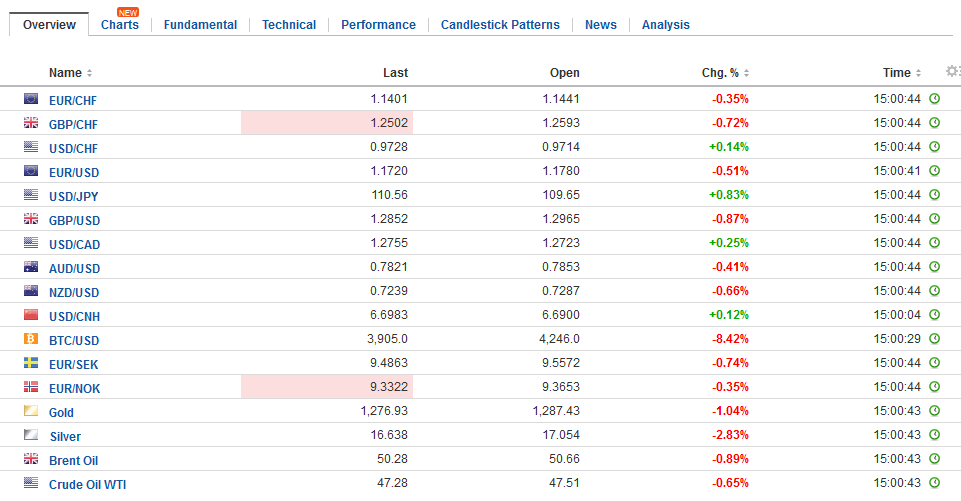

Swiss FrancThe Euro has fallen by 0.43% to 1.1397 CHF. |

EUR/CHF and USD/CHF, August 15(see more posts on EUR/CHF, USD/CHF, ) Source: markets.ft.com - Click to enlarge |

FX RatesNY Fed President Dudley appears to have stolen any potential thunder in the July FOMC minutes that will be released tomorrow. While we put more emphasis on today’s US retail sales data and the August Fed surveys, many others argued that the minutes were the key report this week. Dudley essentially confirmed what many economists have come to expect. This is that next month; the FOMC announces that it will begin not reinvesting the entire maturing proceeds starting in Q4. The initial pace of $6 bln Treasuries and $4 bln MBS is sufficiently small to be nearly inconsequential, except for the little thing; that it has never been done before. Dudley also indicated that provided the economy continued to remain on course, he could support another hike before the end of the year. This too is very much consistent with survey results, such as the recent Wall Street Journal polls of economists. If anything, the market has moved away from the this, though most of the setback spurred by last week’s CPI report has been retraced. Lastly, we also think it is important that Dudley also included an observation about the easing of financial conditions. Since the spring, and in the light of softer inflation readings, we have seen financial stability arguments have become more prominent in the comments of the Fed’s leadership. |

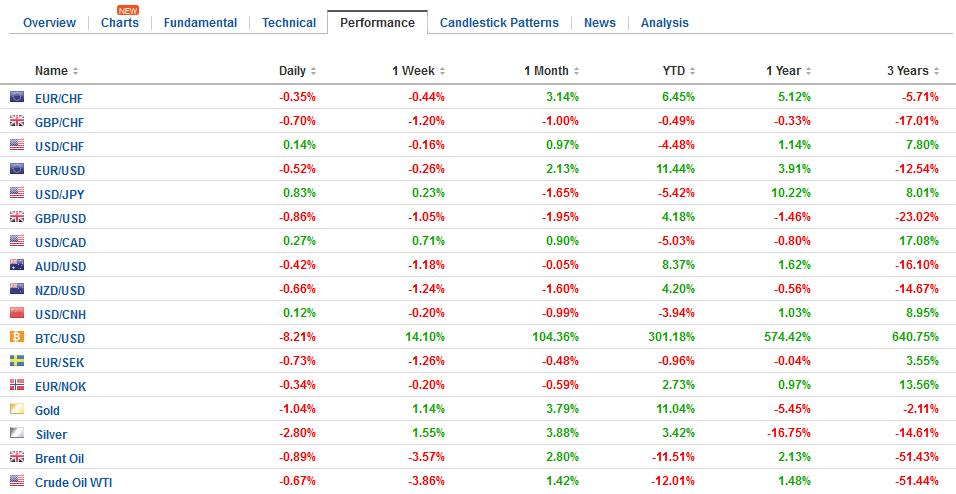

FX Daily Rates, August 15 |

| Dudley’s comments underpinned US interest rates and the dollar. The US dollar is rising against most of the major and emerging market currencies. A chief exception is a Swedish krona. Firmer than expected inflation has sent the krona higher. Headline CPI rose 2.2% in July from 1.7% in June, and the underlying rate rose to 2.4% from 1.9%. Given Sweden’s growth (Q2 4% year-over-year) and the higher inflation, its monetary policy (minus 50 bp repo rate) seems out of kilter. The krona is at its best level against the euro since March. It is on a trend line drawn off the 2013 and 2016 lows (~SEK9.46).

The rise in US yields, recovery in stocks, and the step back from the brink in Korea lifted the dollar to almost JPY110.50 after having slipped briefly below JPY109 at the end of last week. The 20-day moving average, which the dollar has not traded above in nearly a month is found near JPY110.65, and a move above JPY111.00 would lend support to ideas that a bottom is in place. The near-term potential would extend toward the JPY112.30 area. |

FX Performance, August 15 |

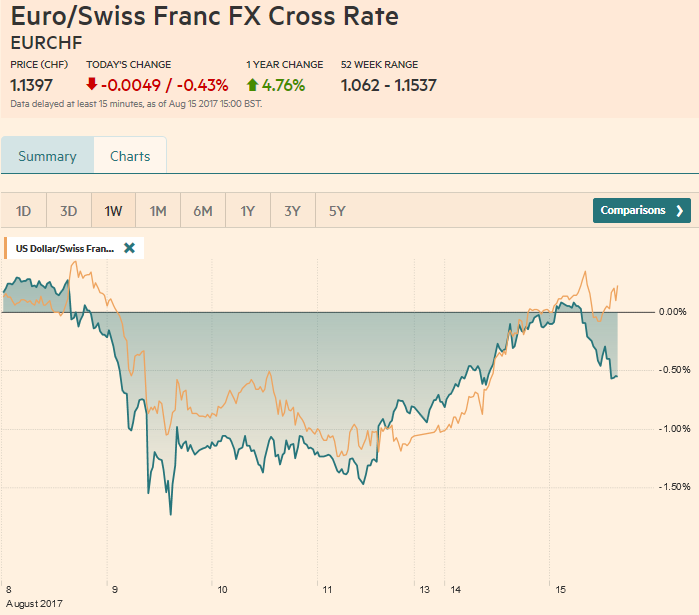

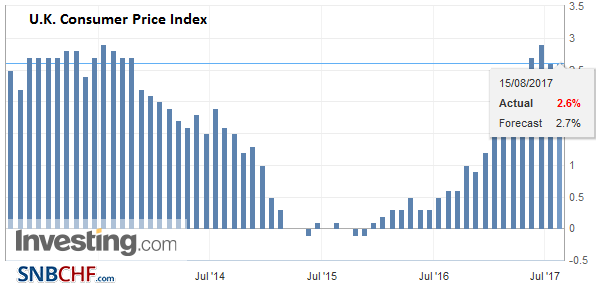

United KingdomDefying expectation for an increase, UK inflation was softer than expected. The preferred measure (CPIH) was unchanged at 2.6^, while the month-over-month pace slipped 0.1%. The core rate was unchanged at 2.4%. It appears that softer fuel prices offset the increase in clothing, household goods, and food prices. RPI, which is used for transportation prices did tick up to 3.6% from 3.5%. Input prices for businesses fell to 6.5% from 10.0%. This is the largest decline in five years. It is not entirely clear that UK inflation has peaked. Many expect it to peak in a couple more months. However, this would seem to reinforce ideas that BOE is on hold. |

U.K. Consumer Price Index (CPI) YoY, Jul 2017(see more posts on U.K. Consumer Price Index, ) Source: Investing.com - Click to enlarge |

| Sterling, which saw no follow through buying yesterday after the favorable price action before the weekend, is at one-month lows today, as it approached $1.29. Recall that on August 3 it had reached nearly $1.3270. A five-month trend line comes in near $1.2840. The euro is recording an outside up day against sterling and is trying to establish a foothold above GBP0.9100, where a 510 mln euro option expires today. |

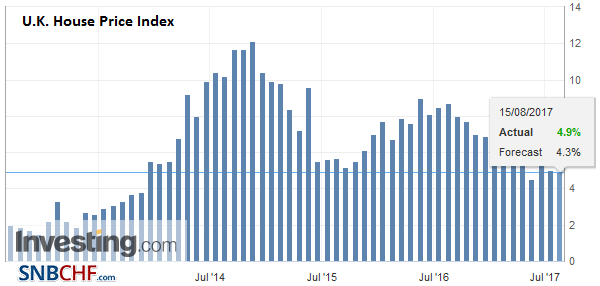

U.K. House Price Index YoY, Jul 2017(see more posts on U.K. House Price Index, ) Source: Investing.com - Click to enlarge |

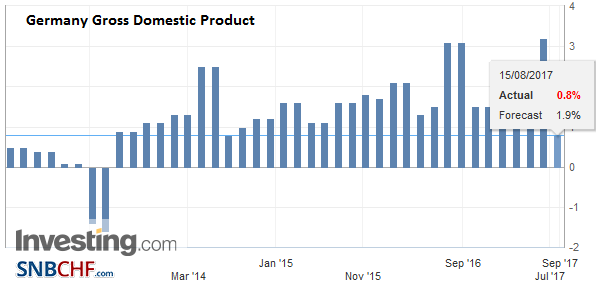

GermanyAgainst the dollar, the euro extended yesterday’s pullback and found support, some perhaps coming from cross demand, near $1.1720. It is the first time since late June that the 20-day moving average has been violated (~$1.1740). Slightly softer than expected revision to German GDP to 0.6% from 0.7% is not particularly significant. That said, we do suspect that German economic momentum may have peaked. There are roughly 1.3 bln euros of options struck between $1.1780 and $1.1785 today, and another 930 mln euros struck at $1.18. |

Germany Gross Domestic Product (GDP) YoY, Q2 2017(see more posts on Germany Gross Domestic Product, ) Source: Investing.com - Click to enlarge |

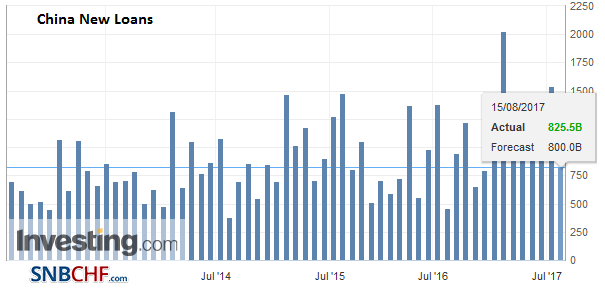

ChinaThe US dollar extends its advance against the Chinese yuan for the third day. Consistent with yesterday’s data, today’s reports also showed some slowing. This increased money supply and new lending. We note that new lending typically slows in July from June, yet the slowing this time was not as greater as expected. The measure announced yesterday about intellectual property was milder than most expected. No actions were taken. No investigation was begun. Instead, US Trade Representative Lighthizer was asked to consider whether to investigate Chinese practices. This is consistent with one of our interpretative points: while the rhetoric may be bombastic, the actual trade actions have been tame, thus far, and not a break from the US traditional positions. |

China New Loans, Jul 2017(see more posts on China New Loans, ) Source: Investing.com - Click to enlarge |

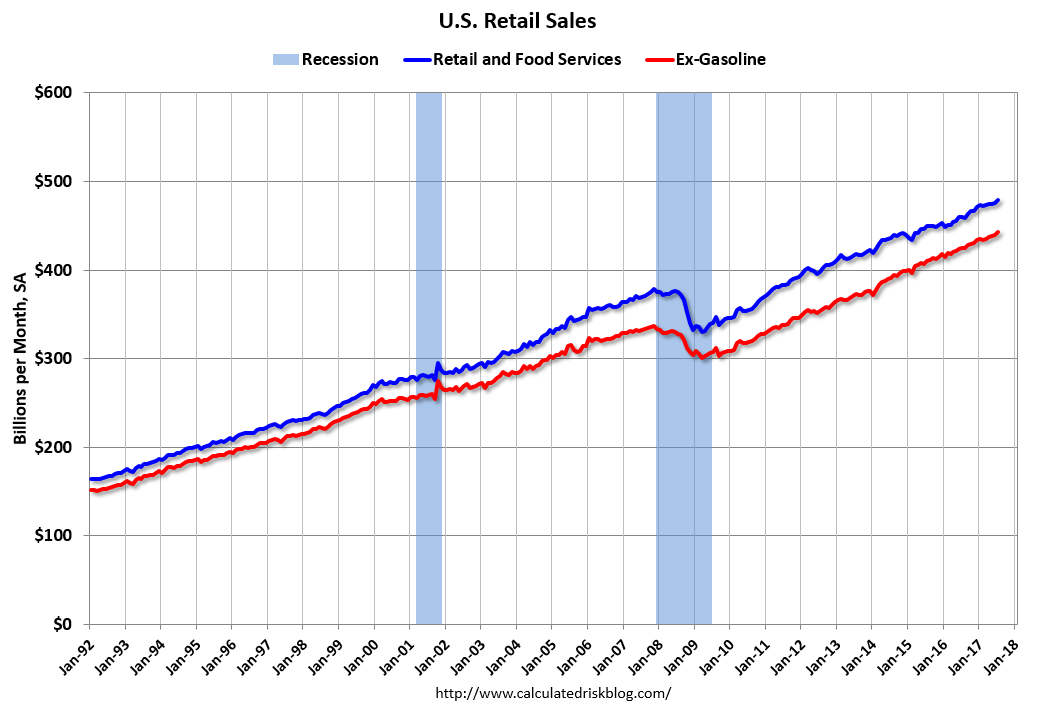

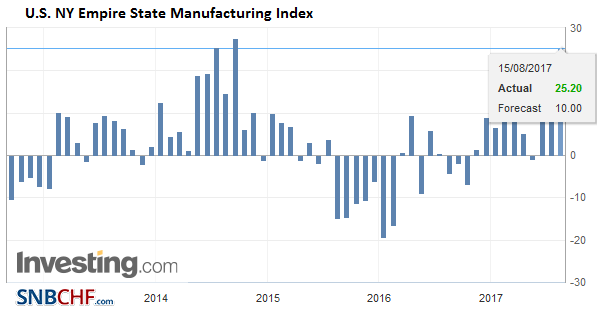

United StatesThe North American session features the US July retail sales and August Empire State manufacturing survey. The Treasury’s International Capital flow report (TIC) will be reported at the close of the equity market, while import and export prices will lose in focus on retail sales. Retail sales are about 40% of consumption as measured by PCE. It has been soft for the past two months and is expected to have begun Q3 on a firm note (0.3%-0.4%). The Empire State survey is still consolidating the big surge in June (to 19.8 from -1.0). |

U.S. Retail Sales, Jul 2017(see more posts on U.S. Retail Sales, ) Source: macro.economicblogs.org/ - Click to enlarge |

| It averaged -2.5 last year and is averaging 10.8 through the first seven months of this year. Not on many calendars today is CBO’s ruling on the impact IF the administration stopped making monthly payments to the Affordable Care Act subsidies. It is difficult to envision any conclusion other than it would trigger more hardship regarding soaring premiums and unstable market. On the margins, this may support Treasury prices. |

U.S. NY Empire State Manufacturing Index, Aug 2017(see more posts on U.S. NY Empire State Manufacturing Index, ) Source: Investing.com - Click to enlarge |

Canada

Canada reports July existing home sales. Canadian homes sales fell each month in Q2 as macro-prudential efforts in the Greater Toronto area bit. Many see the impact of such policies as being temporary. The effect of broadly similar measures in Vancouver last year already appears to be having diminishing results. The Canadian dollar rallied from mid-May through late July, helped by a rate hike. It has corrected lower this month. Important US dollar resistance is seen in the CAD1.2800-CAD.12820 area.

Graphs and additional information on Swiss Franc by the snbchf team.

Tags: #GBP,#USD,$CNY,$EUR,$JPY,$TLT,China New Loans,Featured,Germany Gross Domestic Product,newslettersent,SEK,U.K. Consumer Price Index,U.K. House Price Index,U.S. NY Empire State Manufacturing Index,U.S. Retail Sales