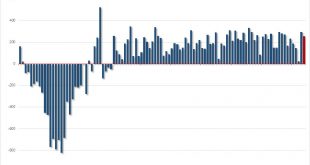

The payroll report for August 2017 thoroughly disappointed. The monthly change for the headline Establishment Survey was just +156k. The BLS also revised lower the headline estimate in each of the previous two months, estimating for July a gain of only +189k. The 6-month average, which matters more given the noisiness of the statistic, is just +160k or about the same as when the Federal Reserve contemplated starting a...

Read More »Constructive US Jobs, but Where Do the Euro Bulls make a Stand?

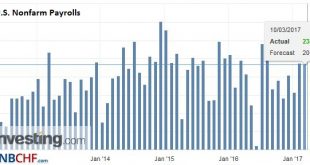

The US created 209k jobs in July and jobs growth in June was revised higher (+9k) to 231k. The underemployment rate was unchanged at 8.6%. United States Nonfarm payrolls The 287k nonfarm payroll growth in June (265k private sector) will ease fears that the US is headed for a recession. That type of jobs growth, and the stronger than expected, service sector ISM earlier this week, are not consistent with a...

Read More »April Jobs Won’t Change Minds

The US created 211k net new jobs in April, a sharp bounce back from the downwardly revised 79k gain in March. It is the third month this year that the US created more than 200k new jobs. United States Nonfarm payrolls Government payrolls increased by 17k. As we noted with the Administration’s federal hiring freeze, the real growth in government employment is on the state and local level. In April the federal...

Read More »Solid US Jobs Report in line with Expectations

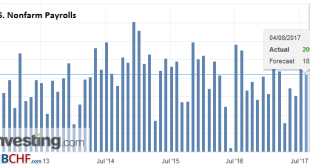

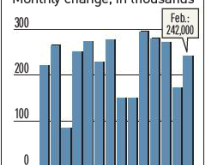

The US jobs report was largely in line with expectations. February was the second consecutive month that the US economy created more than 200k jobs. United States Nonfarm payrolls It is the first time since last June and July. The 235k is just below the revised January 238k gain (initially 227k). U.S. Nonfarm Payrolls, February 2017(see more posts on U.S. Nonfarm Payrolls, ) Source: Investing.com - Click to...

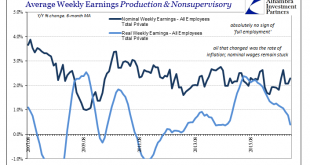

Read More »Real Wages Really Inconsistent

Real average weekly earnings for the private sector fell 0.6% year-over-year in January. It was the first contraction since December 2013 and the sharpest since October 2012. The reason for it is very simple; nominal wages remain stubbornly stagnant but now a rising CPI subtracts even more from them. Consumers receive no significant boost to their incomes, but are starting to pay more (in comparative terms) for things...

Read More »US Jobs Surprise, Canada Disappoints

Summary: Underlying concerns about US labor market ease after two robust reports. Sept Fed views will not change much. Canada’s data is disappointing, BOC optimism may be challenged. United States Nonfarm payrolls The market’s angst over the underlying trend in the US labor market eases with the help of the second consecutive robust report. The 255k rise in non-farm payrolls was well above expectations, and...

Read More »North American Jobs Report and Implications

There is something for everyone in today’s US jobs report, and at the end of the day, it is unlikely to sway opinion about the direction and timing of the next Fed move. The greenback itself may remain range bound after the initial flurry. On the other hand, the disappointing but noisy Canadian data underscores the risk of a more dovish slant to the central bank’s neutral stance next week. United States Nonfarm...

Read More »How you see the Stock Market determines your Profit or Loss!

The key economic note this week was that non-farm payrolls for February was 242,000 versus Wall Street’s expectation of only 190,000; 27% above the consensus target. Wages however fell back by 0.1% from February’s gain of 0.5%. The workforce participation rate moved up to 62.9%. The excellent news on Friday was however received mutely by the market. Excellent news received muted by the market The reason was the likelihood that it will increase the probability of further interest rate rises...

Read More » Swiss Economicblogs.org

Swiss Economicblogs.org