In the spring of 2015 we showed something unexpected: one of the biggest buyers, and holders, of AAPL stock was none other than the already quite troubled – in the aftermath of its disastrous Swiss Franc peg which ended up costing it tens of billions in losses – largest hedge fund in Switzerland, its central bank, the Swiss National Bank. What is curious is that unlike the Fed, the hedge fund also known as the Swiss National Bank not only proudly admits it purchases stocks, ETFs and virtually anything else on a daily basis, but every quarter it discloses the composition of its equity holdings, which at 18% of its 0 billion in foreign currency reserves, amounted to just over 0 billion. Conveniently, the SNB also discloses the breakdown of its long US equity book in a 13-F and according to the latest filing we now know that in a year in which AAPL not only entered a bear market, but dropped to multi-year lows, the SNB almost doubled its total AAPL holdings, which as of December 31, 2015 amounted to 10.4 million shares, up from 5.6 million a year earlier, which means that at least one of the bigger AAPL bagholders, with a position amounting to just under billion, was happy to add to its AAPL position as the stock was tumbling. Too bad not everyone else can literally print money and buy stocks.

Topics:

Tyler Durden considers the following as important: Bear Market, Central Banks, Featured, newsletter, None, Swiss Franc, Swiss National Bank, Switzerland, zerohedge

This could be interesting, too:

Nachrichten Ticker - www.finanzen.ch writes Die Performance der Kryptowährungen in KW 9: Das hat sich bei Bitcoin, Ether & Co. getan

Nachrichten Ticker - www.finanzen.ch writes Wer verbirgt sich hinter der Ethereum-Technologie?

Martin Hartmann writes Eine Analyse nach den Lehren von Milton Friedman

Marc Chandler writes March 2025 Monthly

In the spring of 2015 we showed something unexpected: one of the biggest buyers, and holders, of AAPL stock was none other than the already quite troubled – in the aftermath of its disastrous Swiss Franc peg which ended up costing it tens of billions in losses – largest hedge fund in Switzerland, its central bank, the Swiss National Bank.

What is curious is that unlike the Fed, the hedge fund also known as the Swiss National Bank not only proudly admits it purchases stocks, ETFs and virtually anything else on a daily basis, but every quarter it discloses the composition of its equity holdings, which at 18% of its $560 billion in foreign currency reserves, amounted to just over $100 billion.

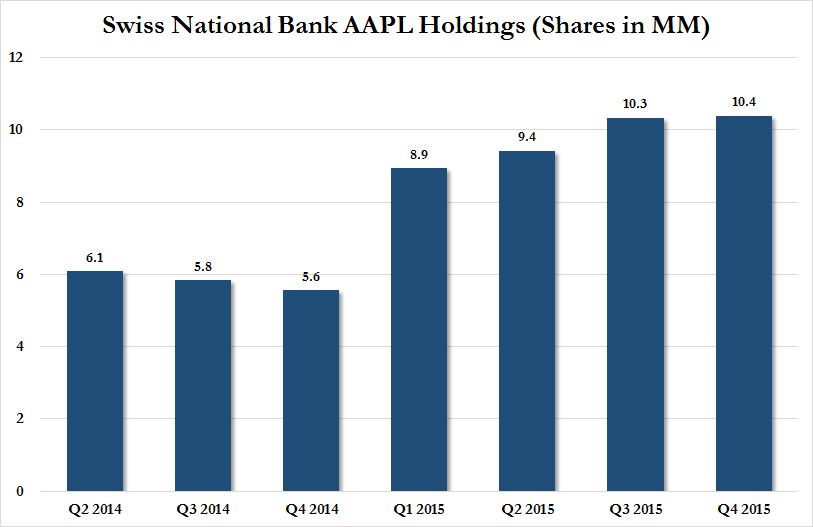

Conveniently, the SNB also discloses the breakdown of its long US equity book in a 13-F and according to the latest filing we now know that in a year in which AAPL not only entered a bear market, but dropped to multi-year lows, the SNB almost doubled its total AAPL holdings, which as of December 31, 2015 amounted to 10.4 million shares, up from 5.6 million a year earlier, which means that at least one of the bigger AAPL bagholders, with a position amounting to just under $1 billion, was happy to add to its AAPL position as the stock was tumbling. Too bad not everyone else can literally print money and buy stocks.

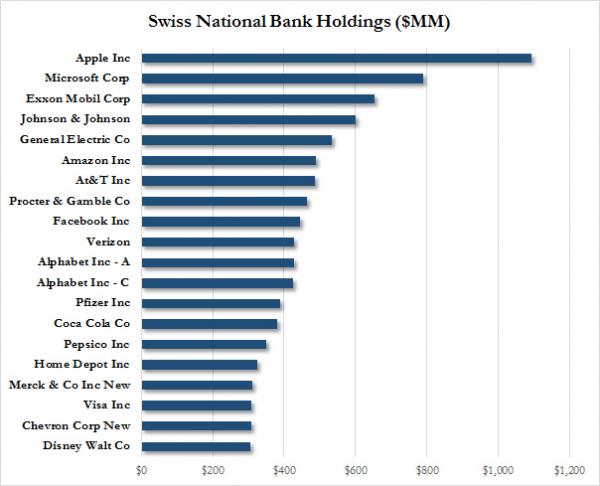

AAPL, however, while the SNB’s largest holding, is only the tip of the iceberg. Here are the Swiss hedge fund’s Top 20 holdings…

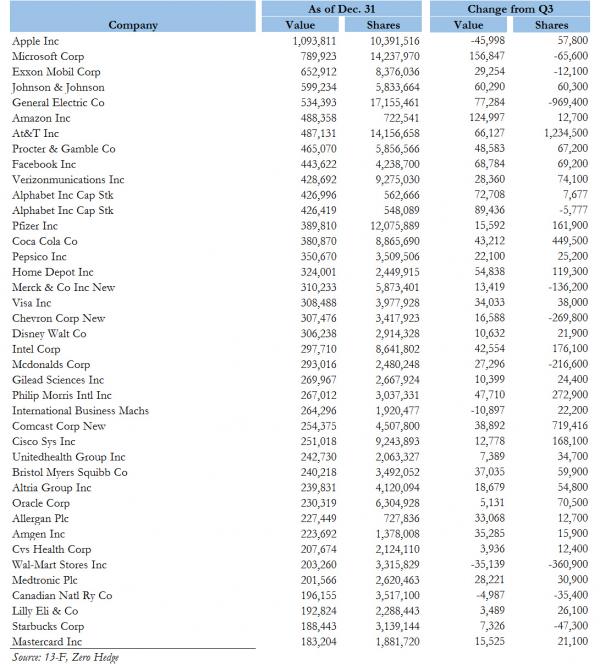

… and its Top 40 positions showing the change from last quarter.

We wonder if central banks, like mere mortals, are also subject to margin calls?