Summary:

When looking at the current state of the Chinese economy it is important to note what happened leading up the ongoing predicament. By managing the USD/CNY exchange rate the Chinese factory worker was essentially funding excess consumption in the United States. One of the many perks enjoyed by global reserve issuer. The factory worker obviously did not do this out of his own volition; on the contrary, he was duped into it by swallowing the propaganda spewed out by party apparatchiks in Beijing. It is all for the common good. Capital inflows emanating from its persistent trade surpluses could and should be allocated more efficiently and obviously equitably, but the party believed that disproved age-old mercantilism was the way to prosperity, and for a very long time it actually appeared to be the case. New emerging markets with semi-dictators gloated as the “Washington Consensus” of the invisible hand seemed to break down in favour of a very visible and state-directed hand. But it was all a charade. The Americans emitted debt throughout the globe and the PBoC essentially issued dollars to maintain the peg. In other words, the deeper Americans went into debt, both private and public, the more China inflated their own currency.

Topics:

Eugen von Böhm Bawerk considers the following as important: Banking, Bawerk, China, commodities, Economics, emerging markets, Featured, newsletter

This could be interesting, too:

When looking at the current state of the Chinese economy it is important to note what happened leading up the ongoing predicament. By managing the USD/CNY exchange rate the Chinese factory worker was essentially funding excess consumption in the United States. One of the many perks enjoyed by global reserve issuer. The factory worker obviously did not do this out of his own volition; on the contrary, he was duped into it by swallowing the propaganda spewed out by party apparatchiks in Beijing. It is all for the common good. Capital inflows emanating from its persistent trade surpluses could and should be allocated more efficiently and obviously equitably, but the party believed that disproved age-old mercantilism was the way to prosperity, and for a very long time it actually appeared to be the case. New emerging markets with semi-dictators gloated as the “Washington Consensus” of the invisible hand seemed to break down in favour of a very visible and state-directed hand. But it was all a charade. The Americans emitted debt throughout the globe and the PBoC essentially issued dollars to maintain the peg. In other words, the deeper Americans went into debt, both private and public, the more China inflated their own currency.

Topics:

Eugen von Böhm Bawerk considers the following as important: Banking, Bawerk, China, commodities, Economics, emerging markets, Featured, newsletter

This could be interesting, too:

Nachrichten Ticker - www.finanzen.ch writes Die Performance der Kryptowährungen in KW 9: Das hat sich bei Bitcoin, Ether & Co. getan

Nachrichten Ticker - www.finanzen.ch writes Wer verbirgt sich hinter der Ethereum-Technologie?

Martin Hartmann writes Eine Analyse nach den Lehren von Milton Friedman

Marc Chandler writes March 2025 Monthly

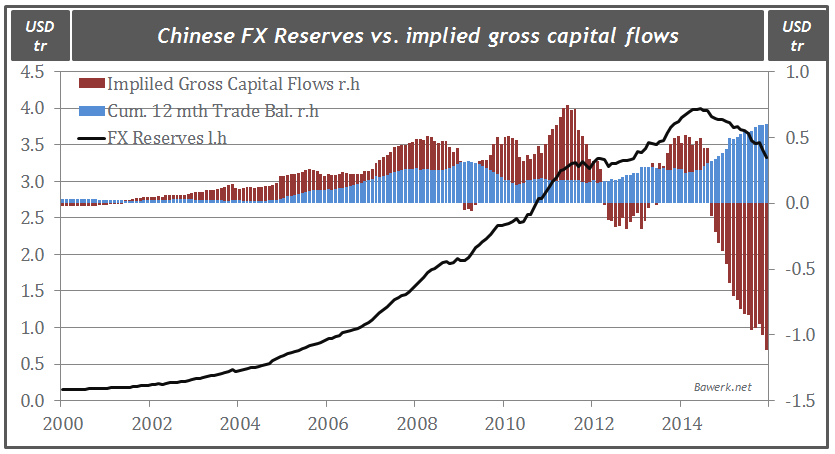

When looking at the current state of the Chinese economy it is important to note what happened leading up the ongoing predicament. By managing the USD/CNY exchange rate the Chinese factory worker was essentially funding excess consumption in the United States. One of the many perks enjoyed by global reserve issuer. The factory worker obviously did not do this out of his own volition; on the contrary, he was duped into it by swallowing the propaganda spewed out by party apparatchiks in Beijing. It is all for the common good. Capital inflows emanating from its persistent trade surpluses could and should be allocated more efficiently and obviously equitably, but the party believed that disproved age-old mercantilism was the way to prosperity, and for a very long time it actually appeared to be the case. New emerging markets with semi-dictators gloated as the “Washington Consensus” of the invisible hand seemed to break down in favour of a very visible and state-directed hand.  But it was all a charade. The Americans emitted debt throughout the globe and the PBoC essentially issued dollars to maintain the peg. In other words, the deeper Americans went into debt, both private and public, the more China inflated their own currency. More specifically, as dollars made its way into China to pay for their manufactured goods, the PBoC issued Yuan to buy dollars and hence kept the peg stable. To avoid runaway inflation the PBoC raised reserve requirements on domestic banks, but needless to say China was in the midst of a massive credit expansion long before 2009. Foreign exchange reserves piled up and were promptly re-circulated back into US capital markets. This parasitical symbiosis was obviously unsustainable and it came crashing down in 2008.

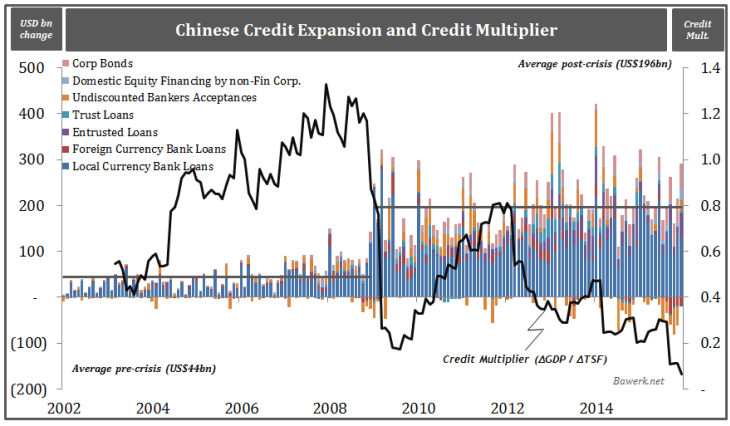

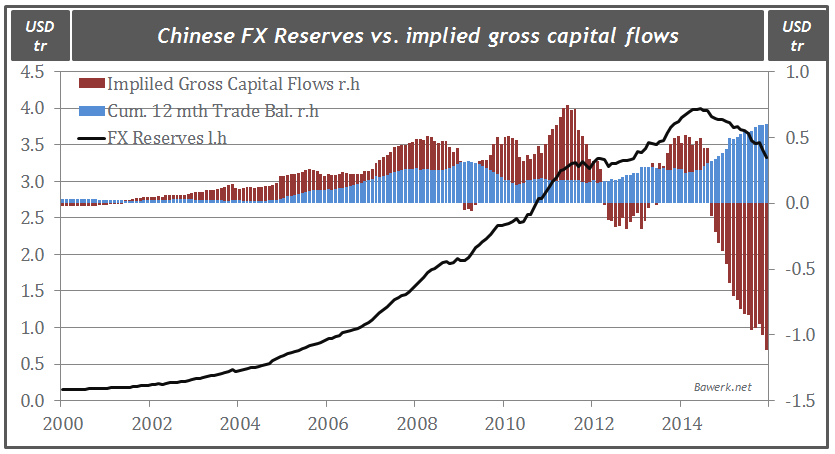

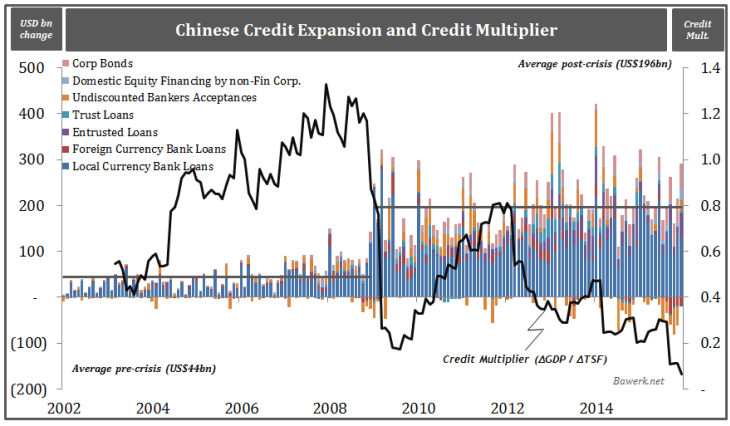

But it was all a charade. The Americans emitted debt throughout the globe and the PBoC essentially issued dollars to maintain the peg. In other words, the deeper Americans went into debt, both private and public, the more China inflated their own currency. More specifically, as dollars made its way into China to pay for their manufactured goods, the PBoC issued Yuan to buy dollars and hence kept the peg stable. To avoid runaway inflation the PBoC raised reserve requirements on domestic banks, but needless to say China was in the midst of a massive credit expansion long before 2009. Foreign exchange reserves piled up and were promptly re-circulated back into US capital markets. This parasitical symbiosis was obviously unsustainable and it came crashing down in 2008.  Source: Bloomberg, Bawerk.net At this point in our history, Chinese authorities enter panic mode because the drop-off in external demand was so swift and dramatic that it threatened internal stability. The solution was a massive spending spree, funded by fiat through a willing state owned banking system. All the imbalances that had been growing as a cancer in the Chinese economy was not fought tooth-and-nail as it should upon the realisation it was eating away at the core of Chinese prosperity, but rather spoon fed exactly what it thrived on in the first place – namely fiat issuance. Already saturated with fixed asset investments, the new spending spree only added to excess capacity with no chance of ever turning a profit. New lending thus funded internal consumption, and paradoxically, just as the hard working factory toiler are allowed to enjoy the fruits of his labour it is done under the the worst possible circumstances. The credit multiplier obviously collapses as consumptive debt issuance consumes scarce capital without providing any value back to the economic system. For each dollar of new loans, GDP now grows by 5 cents. Stated differently, Chinese debt to GDP ratio sky-rockets and are probably in the vicinity of 300 per cent already.

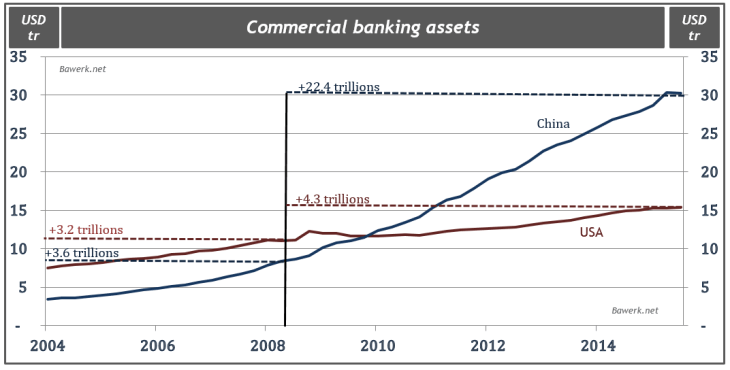

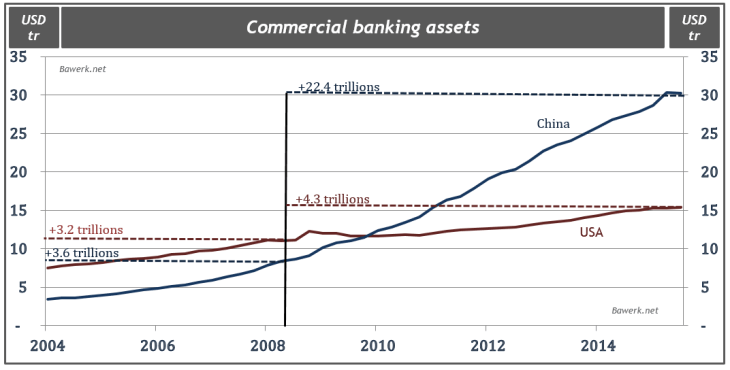

Source: Bloomberg, Bawerk.net At this point in our history, Chinese authorities enter panic mode because the drop-off in external demand was so swift and dramatic that it threatened internal stability. The solution was a massive spending spree, funded by fiat through a willing state owned banking system. All the imbalances that had been growing as a cancer in the Chinese economy was not fought tooth-and-nail as it should upon the realisation it was eating away at the core of Chinese prosperity, but rather spoon fed exactly what it thrived on in the first place – namely fiat issuance. Already saturated with fixed asset investments, the new spending spree only added to excess capacity with no chance of ever turning a profit. New lending thus funded internal consumption, and paradoxically, just as the hard working factory toiler are allowed to enjoy the fruits of his labour it is done under the the worst possible circumstances. The credit multiplier obviously collapses as consumptive debt issuance consumes scarce capital without providing any value back to the economic system. For each dollar of new loans, GDP now grows by 5 cents. Stated differently, Chinese debt to GDP ratio sky-rockets and are probably in the vicinity of 300 per cent already. Source: Bloomberg, Bawerk.net Obviously, the banking system gorges on all the new “assets” being created, adding more than 22 trillion dollar worth in only seven years. The increment alone is more than the entire conventional US banking system. An increase of almost 300 per cent.

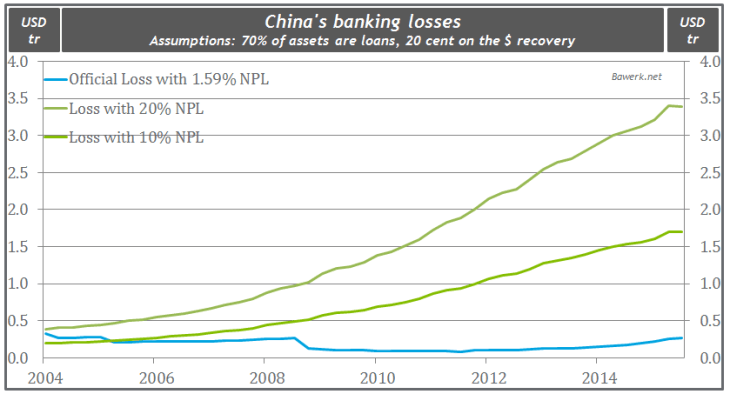

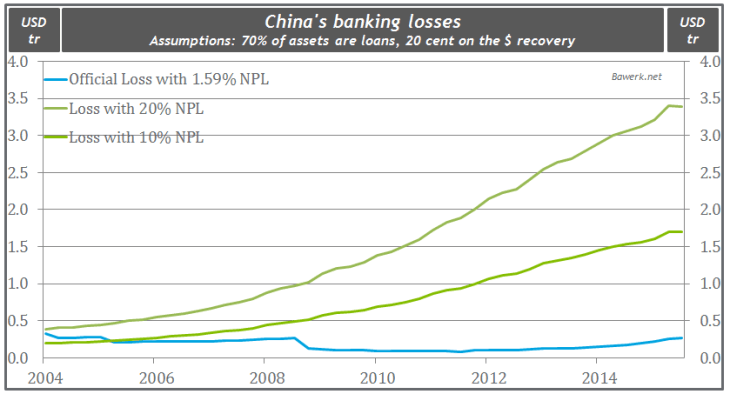

Source: Bloomberg, Bawerk.net Obviously, the banking system gorges on all the new “assets” being created, adding more than 22 trillion dollar worth in only seven years. The increment alone is more than the entire conventional US banking system. An increase of almost 300 per cent.  Source: Bloomberg, Federal Reserve, Bawerk.net It should be abundantly clear that China is heading straight into a banking cycle where NPLs will be increasing to 10 – 20 per cent (minimum). If we assume around 70 per cent of assets are loans and further assuming they will recover 20 cents on the dollar, total losses will be in the trillions. The massive war chest represented by the FX reserves China bulls always seem to be thumping, as the cure to all ills, will be gone before you can say ghost town.

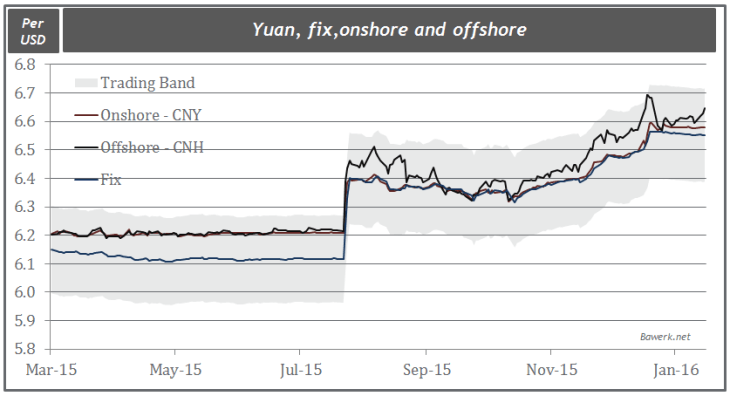

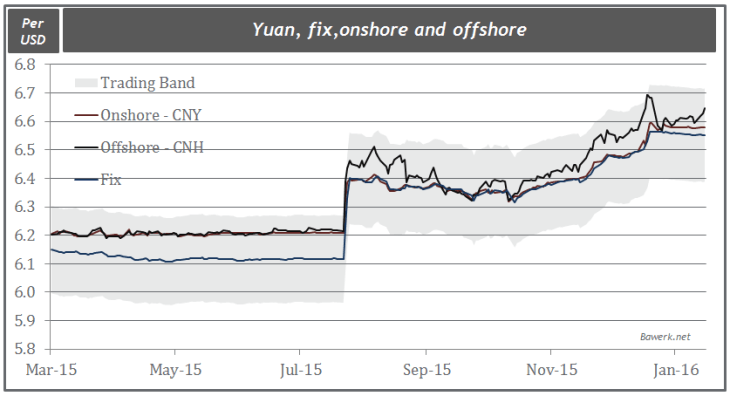

Source: Bloomberg, Federal Reserve, Bawerk.net It should be abundantly clear that China is heading straight into a banking cycle where NPLs will be increasing to 10 – 20 per cent (minimum). If we assume around 70 per cent of assets are loans and further assuming they will recover 20 cents on the dollar, total losses will be in the trillions. The massive war chest represented by the FX reserves China bulls always seem to be thumping, as the cure to all ills, will be gone before you can say ghost town.  Source: Bloomberg, Bawerk.net Within this framework, people are naturally shorting the Yuan. Offshore CNH repeatedly diverge from onshore CNY and the PBoC has found themselves forced to intervene several times in the Hong Kong market, at times driving HIBOR CNH to more than 60 – 70 per cent.

Source: Bloomberg, Bawerk.net Within this framework, people are naturally shorting the Yuan. Offshore CNH repeatedly diverge from onshore CNY and the PBoC has found themselves forced to intervene several times in the Hong Kong market, at times driving HIBOR CNH to more than 60 – 70 per cent. Source: Bloomberg, Bawerk.net Capital controls are not working. A Chinese can move 50.000 dollars abroad every year, but most people do not do that, but they can “sign the paper” for others with more money. Macau “jewelry” sales have been through the roof as people move money abroad. Importers falsify their import bills while exporters chose not to repatriate their earnings. Foreign real estate and business purchases are exempt from capital control rules. In other words, capital moves relatively freely across the Chinese border despite repeated crackdowns. Bitcoin’s seem to respond to positively to every new measure to stop capital from flowing out. Gross outflows, as indicated by the chart above, is probably running close to a trillion dollars on an annualised basis. China is in an untenable situation. Their exports are hurting through a strong dollar (and by extension a strong CNY), while devaluation will increase their import bill and the value of the US$1 trillion dollar denominated corporate bonds outstanding. However, with 1 trillion dollar in gross annual capital outflows it is only a matter of time before they have to act. Rumour has it that only US$1 – 1.5 trillion of Chinese reserves are truly liquid and can thus be used to prop up the Yuan. If that’s the case they will devalue (20 – 40 per cent) before we enter 2017. Unsurprisingly other emerging market find themselves in the same dire situation. The trouble in China, which is a consequence of the global “dollar” collapsing on back of economic imbalances and capital consumption, impact commodity producers directly. They have all been forced into selling FX reserves to essentially provide the “dollar” liquidity needed and prop up their own currencies. Many have given up and devalued, and more will follow suit. Madam Lagarde will soon realise that her itinerary for 2016 be quite different that what she is used to. A flight to Baku to save BP will be her first mission.

Source: Bloomberg, Bawerk.net Capital controls are not working. A Chinese can move 50.000 dollars abroad every year, but most people do not do that, but they can “sign the paper” for others with more money. Macau “jewelry” sales have been through the roof as people move money abroad. Importers falsify their import bills while exporters chose not to repatriate their earnings. Foreign real estate and business purchases are exempt from capital control rules. In other words, capital moves relatively freely across the Chinese border despite repeated crackdowns. Bitcoin’s seem to respond to positively to every new measure to stop capital from flowing out. Gross outflows, as indicated by the chart above, is probably running close to a trillion dollars on an annualised basis. China is in an untenable situation. Their exports are hurting through a strong dollar (and by extension a strong CNY), while devaluation will increase their import bill and the value of the US$1 trillion dollar denominated corporate bonds outstanding. However, with 1 trillion dollar in gross annual capital outflows it is only a matter of time before they have to act. Rumour has it that only US$1 – 1.5 trillion of Chinese reserves are truly liquid and can thus be used to prop up the Yuan. If that’s the case they will devalue (20 – 40 per cent) before we enter 2017. Unsurprisingly other emerging market find themselves in the same dire situation. The trouble in China, which is a consequence of the global “dollar” collapsing on back of economic imbalances and capital consumption, impact commodity producers directly. They have all been forced into selling FX reserves to essentially provide the “dollar” liquidity needed and prop up their own currencies. Many have given up and devalued, and more will follow suit. Madam Lagarde will soon realise that her itinerary for 2016 be quite different that what she is used to. A flight to Baku to save BP will be her first mission.  Source: Bloomberg, Bawerk.net All the FX selling have the opposite effect than that of QE, notably dubbed quantitative tightening or QT for short. With the FOMC hiking into the QT cycle the effect is compounded and that is why we see the FOMC now guiding Fed funds lower. NY Fed President Dudley said recently that there will be no hike in March and Goldman concurred. Fed funds futures have made an abrupt about turn and as we have said for quite some time now, there will be no more hikes in 2016. As a matter of fact we would not be surprised to see a cut and lower dollar, which cet par is good for commodities (as recent dollar collapse – oil rally proves all too well)

Source: Bloomberg, Bawerk.net All the FX selling have the opposite effect than that of QE, notably dubbed quantitative tightening or QT for short. With the FOMC hiking into the QT cycle the effect is compounded and that is why we see the FOMC now guiding Fed funds lower. NY Fed President Dudley said recently that there will be no hike in March and Goldman concurred. Fed funds futures have made an abrupt about turn and as we have said for quite some time now, there will be no more hikes in 2016. As a matter of fact we would not be surprised to see a cut and lower dollar, which cet par is good for commodities (as recent dollar collapse – oil rally proves all too well)

But it was all a charade. The Americans emitted debt throughout the globe and the PBoC essentially issued dollars to maintain the peg. In other words, the deeper Americans went into debt, both private and public, the more China inflated their own currency. More specifically, as dollars made its way into China to pay for their manufactured goods, the PBoC issued Yuan to buy dollars and hence kept the peg stable. To avoid runaway inflation the PBoC raised reserve requirements on domestic banks, but needless to say China was in the midst of a massive credit expansion long before 2009. Foreign exchange reserves piled up and were promptly re-circulated back into US capital markets. This parasitical symbiosis was obviously unsustainable and it came crashing down in 2008.

But it was all a charade. The Americans emitted debt throughout the globe and the PBoC essentially issued dollars to maintain the peg. In other words, the deeper Americans went into debt, both private and public, the more China inflated their own currency. More specifically, as dollars made its way into China to pay for their manufactured goods, the PBoC issued Yuan to buy dollars and hence kept the peg stable. To avoid runaway inflation the PBoC raised reserve requirements on domestic banks, but needless to say China was in the midst of a massive credit expansion long before 2009. Foreign exchange reserves piled up and were promptly re-circulated back into US capital markets. This parasitical symbiosis was obviously unsustainable and it came crashing down in 2008.  Source: Bloomberg, Bawerk.net At this point in our history, Chinese authorities enter panic mode because the drop-off in external demand was so swift and dramatic that it threatened internal stability. The solution was a massive spending spree, funded by fiat through a willing state owned banking system. All the imbalances that had been growing as a cancer in the Chinese economy was not fought tooth-and-nail as it should upon the realisation it was eating away at the core of Chinese prosperity, but rather spoon fed exactly what it thrived on in the first place – namely fiat issuance. Already saturated with fixed asset investments, the new spending spree only added to excess capacity with no chance of ever turning a profit. New lending thus funded internal consumption, and paradoxically, just as the hard working factory toiler are allowed to enjoy the fruits of his labour it is done under the the worst possible circumstances. The credit multiplier obviously collapses as consumptive debt issuance consumes scarce capital without providing any value back to the economic system. For each dollar of new loans, GDP now grows by 5 cents. Stated differently, Chinese debt to GDP ratio sky-rockets and are probably in the vicinity of 300 per cent already.

Source: Bloomberg, Bawerk.net At this point in our history, Chinese authorities enter panic mode because the drop-off in external demand was so swift and dramatic that it threatened internal stability. The solution was a massive spending spree, funded by fiat through a willing state owned banking system. All the imbalances that had been growing as a cancer in the Chinese economy was not fought tooth-and-nail as it should upon the realisation it was eating away at the core of Chinese prosperity, but rather spoon fed exactly what it thrived on in the first place – namely fiat issuance. Already saturated with fixed asset investments, the new spending spree only added to excess capacity with no chance of ever turning a profit. New lending thus funded internal consumption, and paradoxically, just as the hard working factory toiler are allowed to enjoy the fruits of his labour it is done under the the worst possible circumstances. The credit multiplier obviously collapses as consumptive debt issuance consumes scarce capital without providing any value back to the economic system. For each dollar of new loans, GDP now grows by 5 cents. Stated differently, Chinese debt to GDP ratio sky-rockets and are probably in the vicinity of 300 per cent already. Source: Bloomberg, Bawerk.net Obviously, the banking system gorges on all the new “assets” being created, adding more than 22 trillion dollar worth in only seven years. The increment alone is more than the entire conventional US banking system. An increase of almost 300 per cent.

Source: Bloomberg, Bawerk.net Obviously, the banking system gorges on all the new “assets” being created, adding more than 22 trillion dollar worth in only seven years. The increment alone is more than the entire conventional US banking system. An increase of almost 300 per cent.  Source: Bloomberg, Federal Reserve, Bawerk.net It should be abundantly clear that China is heading straight into a banking cycle where NPLs will be increasing to 10 – 20 per cent (minimum). If we assume around 70 per cent of assets are loans and further assuming they will recover 20 cents on the dollar, total losses will be in the trillions. The massive war chest represented by the FX reserves China bulls always seem to be thumping, as the cure to all ills, will be gone before you can say ghost town.

Source: Bloomberg, Federal Reserve, Bawerk.net It should be abundantly clear that China is heading straight into a banking cycle where NPLs will be increasing to 10 – 20 per cent (minimum). If we assume around 70 per cent of assets are loans and further assuming they will recover 20 cents on the dollar, total losses will be in the trillions. The massive war chest represented by the FX reserves China bulls always seem to be thumping, as the cure to all ills, will be gone before you can say ghost town.  Source: Bloomberg, Bawerk.net Within this framework, people are naturally shorting the Yuan. Offshore CNH repeatedly diverge from onshore CNY and the PBoC has found themselves forced to intervene several times in the Hong Kong market, at times driving HIBOR CNH to more than 60 – 70 per cent.

Source: Bloomberg, Bawerk.net Within this framework, people are naturally shorting the Yuan. Offshore CNH repeatedly diverge from onshore CNY and the PBoC has found themselves forced to intervene several times in the Hong Kong market, at times driving HIBOR CNH to more than 60 – 70 per cent. Source: Bloomberg, Bawerk.net Capital controls are not working. A Chinese can move 50.000 dollars abroad every year, but most people do not do that, but they can “sign the paper” for others with more money. Macau “jewelry” sales have been through the roof as people move money abroad. Importers falsify their import bills while exporters chose not to repatriate their earnings. Foreign real estate and business purchases are exempt from capital control rules. In other words, capital moves relatively freely across the Chinese border despite repeated crackdowns. Bitcoin’s seem to respond to positively to every new measure to stop capital from flowing out. Gross outflows, as indicated by the chart above, is probably running close to a trillion dollars on an annualised basis. China is in an untenable situation. Their exports are hurting through a strong dollar (and by extension a strong CNY), while devaluation will increase their import bill and the value of the US$1 trillion dollar denominated corporate bonds outstanding. However, with 1 trillion dollar in gross annual capital outflows it is only a matter of time before they have to act. Rumour has it that only US$1 – 1.5 trillion of Chinese reserves are truly liquid and can thus be used to prop up the Yuan. If that’s the case they will devalue (20 – 40 per cent) before we enter 2017. Unsurprisingly other emerging market find themselves in the same dire situation. The trouble in China, which is a consequence of the global “dollar” collapsing on back of economic imbalances and capital consumption, impact commodity producers directly. They have all been forced into selling FX reserves to essentially provide the “dollar” liquidity needed and prop up their own currencies. Many have given up and devalued, and more will follow suit. Madam Lagarde will soon realise that her itinerary for 2016 be quite different that what she is used to. A flight to Baku to save BP will be her first mission.

Source: Bloomberg, Bawerk.net Capital controls are not working. A Chinese can move 50.000 dollars abroad every year, but most people do not do that, but they can “sign the paper” for others with more money. Macau “jewelry” sales have been through the roof as people move money abroad. Importers falsify their import bills while exporters chose not to repatriate their earnings. Foreign real estate and business purchases are exempt from capital control rules. In other words, capital moves relatively freely across the Chinese border despite repeated crackdowns. Bitcoin’s seem to respond to positively to every new measure to stop capital from flowing out. Gross outflows, as indicated by the chart above, is probably running close to a trillion dollars on an annualised basis. China is in an untenable situation. Their exports are hurting through a strong dollar (and by extension a strong CNY), while devaluation will increase their import bill and the value of the US$1 trillion dollar denominated corporate bonds outstanding. However, with 1 trillion dollar in gross annual capital outflows it is only a matter of time before they have to act. Rumour has it that only US$1 – 1.5 trillion of Chinese reserves are truly liquid and can thus be used to prop up the Yuan. If that’s the case they will devalue (20 – 40 per cent) before we enter 2017. Unsurprisingly other emerging market find themselves in the same dire situation. The trouble in China, which is a consequence of the global “dollar” collapsing on back of economic imbalances and capital consumption, impact commodity producers directly. They have all been forced into selling FX reserves to essentially provide the “dollar” liquidity needed and prop up their own currencies. Many have given up and devalued, and more will follow suit. Madam Lagarde will soon realise that her itinerary for 2016 be quite different that what she is used to. A flight to Baku to save BP will be her first mission.  Source: Bloomberg, Bawerk.net All the FX selling have the opposite effect than that of QE, notably dubbed quantitative tightening or QT for short. With the FOMC hiking into the QT cycle the effect is compounded and that is why we see the FOMC now guiding Fed funds lower. NY Fed President Dudley said recently that there will be no hike in March and Goldman concurred. Fed funds futures have made an abrupt about turn and as we have said for quite some time now, there will be no more hikes in 2016. As a matter of fact we would not be surprised to see a cut and lower dollar, which cet par is good for commodities (as recent dollar collapse – oil rally proves all too well)

Source: Bloomberg, Bawerk.net All the FX selling have the opposite effect than that of QE, notably dubbed quantitative tightening or QT for short. With the FOMC hiking into the QT cycle the effect is compounded and that is why we see the FOMC now guiding Fed funds lower. NY Fed President Dudley said recently that there will be no hike in March and Goldman concurred. Fed funds futures have made an abrupt about turn and as we have said for quite some time now, there will be no more hikes in 2016. As a matter of fact we would not be surprised to see a cut and lower dollar, which cet par is good for commodities (as recent dollar collapse – oil rally proves all too well)