The Swiss National Bank has achieved a profit of 5.7 billion CHF in Q1/2016. The total yield on assets per annum was 3.4%.The main contribution comes from gold with price change of 10% in this quarter, hence a total yield of 48%.The total yield on debt was positive with +0.2% thanks to negative interest rates.The deflationary environment let to rising bond prices. Bonds, make up 74% of the SNB portfolio. Here the details of our calculation: Position Total Positionin bn CHF % of Total...

Read More »Swiss National Bank: Composition of Reserves and Investment Strategy

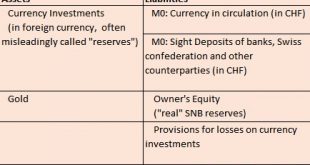

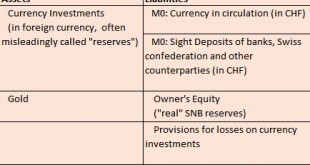

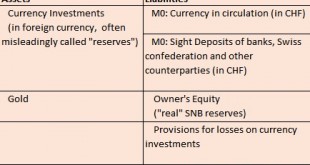

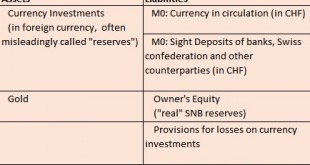

The Q1/2016 update on the SNB investment strategy and its assets. The Swiss National Bank is a passive conservative investor. As opposed to other investors, the exposure in currencies is as important as the strategic asset allocation according asset classes (bonds, equities, cash, real estate). The importance of currencies is one reason why the SNB is often called a hedge fund, the second the volatility of gains and losses.The SNB balance sheet looks as follows: In this post we will...

Read More »April 2016: SNB running suicide again?

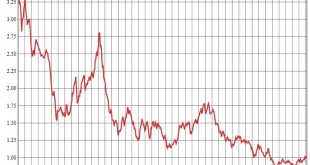

Headlines April 2016 Speculative position: Speculators are even longer CHF: +9410x 125K contracts.Sight Deposits: SNB intervenes for 6.4 bln. CHF in only three weeks. Sight deposits (aka debt) are rising by 1% per month, this is 12% per year. The SNB can never achieve such a yield on investment, her yield is between 1 and 2 percent.6.4 billion is the highest level since January 2016. Why the SNB is driving the EUR/CHF so high is a question, given that both real money and speculators are...

Read More »March 2016: Highest SNB Interventions since January 2015

Headlines March 2016 Speculative position: Strong shift to CHF long: +4967x 125K contracts after the Fed reduced their expectations of rate hikes for this year.Sight Deposits: SNB intervenes for 6.1 bln. CHF during the month of March. This is the higest level since January 2016.FX: EUR/CHF rose over 1.09 and touched 1.10. As I expected last week, the EUR/CHF was not reached. The dollar is getting slowly weaker, at 0.96 CHF currently. Background FX Rates, Balance of Payments and Capital...

Read More »SNB Monetary Policy Assessment and Critique

We examine the SNB monetary assessment statement of March 17 and the Swiss economy. We explain why negative rates may be a “toothless measure” if a central bank wants to weaken a currency. They have rather an inexpected consequence, they slow down GDP growth, in particular for banks and pension funds. The following are the extracts from the monetary policy assessment of Swiss National Bank, 17 March 2016, and my comments.All SNB statements appear in quotes, my comments without quotes....

Read More »SNB Reduced Loss from 50 Billion in June to 23 Billion

According to the latest news release, the Swiss National Bank expects an annual loss of 23 billion CHF, after reporting a loss of 50 billion at the end of June. Primarily thanks to the stronger dollar, the SNB was able to achieve unrealized gains of 27 billion CHF in the second half. This reduced her annual loss to 23 billion. With its rate hike, Fed is helping the SNB: the dollar has appreciated by 6% since July. Balance Sheet The SNB balance sheet looks as follows. In this post we...

Read More »Weekly SNB Intervention Update: Sight Deposits and Speculative Position

Headlines Second week of February: Speculative position: As expected rise to 7268 x 125k contracts long USD, short CHF.Sight Deposits: SNB intervenes for 0.9 bln. CHF during the bad market conditions; safe haven inflows were directed towards CHF or Swiss did not cover their trade surplus with the purchase of foreign assets.FX: EUR/CHF fell under 1.10 and EUR/USD over 1.12. Background Sight deposits are currently the by far most important means of financing for SNB currency purchases, for...

Read More »Monetary assessment meeting Swiss National Bank

#Jordan negative inflation rate only temporary, caused by oil and price adjustments of imported goods, globally also low inflation #CHF #SNB — George Dorgan (@DorganG) December 10, 2015 #jordan Swiss sovereign money initiative means a complete change of financial system, #SNB needs longer evaluation #vollgeld #CHF — George Dorgan (@DorganG) December 10, 2015 #jordan Swiss deflation mostly caused by exchange rate and oil. No deflationary risks #chf #snb — George Dorgan (@DorganG)...

Read More »Weekly SNB Intervention Update: Sight Deposits and Speculative Position

First week of February: Speculators are closing down their short positions on the euro– both against the dollar and against CHF. The carry trade is breaking down into a reverse carry trade. This leads to a strengthening of the euro versus CHF. Given that US data was better than expected, the speculative USD against CHF position should further augment. It was at 4600 contracts versus CHF.No SNB interventions: Sight deposits decreased slightly by 0.2 billion CHF, this implies that the SNB is...

Read More »SNB Reduced Loss from 50 Billion in June to 23 Billion

According to the latest news release, the Swiss National Bank expects an annual loss of 23 billion CHF, after reporting a loss of 50 billion at the end of June. Primarily thanks to the stronger dollar, the SNB was able to achieve unrealized gains of 27 billion CHF in the second half. This reduced her annual loss to 23 billion. With its rate hike, Fed is helping the SNB: the dollar has appreciated by 6% since July. Balance Sheet The SNB balance sheet looks as follows. In this post we...

Read More » Swiss Economicblogs.org

Swiss Economicblogs.org