Update January 10, 2021: Sight Deposits have risen by +1.9 bn CHF, this means that the SNB is intervening and buying Euros and Dollars. We had finally arrived in the inflation scenario I was speaking about before. Inflation is the period, when both the Swiss franc and gold must go up. BUT : U.S. CPI is at 5%, at the highest value since the year 1990 (excluding one outlayer in Summer 2008). But European inflation has gone down to 1.9%., In...

Read More »SNB Sight Deposits: Inflation Fear Decreasing, SNB Selling Euros

Update September 20 2021: SNB Selling Dollars and Euros Sight Deposits have fallen: The change is -0.2 bn. compared to last week, this means the SNB is selling euros and dollars. We had finally arrived in the inflation scenario I was speaking about before. Inflation is the period, when both the Swiss franc and gold must go up. BUT : U.S. CPI is at 5%, at the highest value since the year 1990 (excluding one outlayer in Summer 2008). But European...

Read More »Weekly SNB Sight Deposits and Speculative Positions: SNB selling euros and dollars – March 29, 2021

Update March 29 2021: SNB selling euros and dollars Sight Deposits have fallen: The change is -0.2 bn. compared to last week, this means the SNB is selling euros and dollars. Speculative Positioning: Speculators are long CHF against USD. Since March 13, they have shifted to a long EUR position against USD. The following shows the recent developments. Sight Deposits, i.e. SNB interventions FX rates Speculative positions CHF: Since April, speculators...

Read More »Weekly SNB Intervention Update: Sight Deposits and Speculative Position

Headlines Week January 23, 2017 Who has read Milton Friedman knows that the Trump reflation trade is now showing its positive side. US wages are rising by 2.5%, while inflation is still relatively low. According to Friedman, inflation will increase only later. This implies that speculators are long the dollar and short the Swiss franc and the euro during the weak inflation period. The last ECB meeting showed that the...

Read More »Weekly SNB Intervention Update: Sight Deposits and Speculative Position

Headlines Week December 09, 2016 Who has read Milton Friedman knows that the Trump reflation trade is now showing its positive side. US wages are rising by 2.5%, while inflation is still relatively low. According to Friedman, inflation will increase only later. This implies that speculators are long the dollar and short the Swiss franc and the euro. Last week’s ECB meeting showed that the ECB might be dovish for a...

Read More »SNB Sight Deposits November 7: No interventions, EUR/CHF under 1.08 with political jitters

Headlines Week November 04, 2016: No interventions, EUR/CHF under 1.08 with political jitters Sight Deposits: show that the SNB has not intervened to sustain the euro, that dipped under EUR/CHF 1.08. We considered the 1.08 as line in sand for the SNB. FX: The odds of Trump are rising. This causes fear and demand for Swiss Franc. The EUR/CHF fell to 1.0750. Euro/Swiss Franc FX Cross Rate, November 07(see more posts...

Read More »Weekly SNB Intervention Update: Sight Deposits and Speculative Position

Headlines Second week of February: Speculative position: As expected rise to 7268 x 125k contracts long USD, short CHF.Sight Deposits: SNB intervenes for 0.9 bln. CHF during the bad market conditions; safe haven inflows were directed towards CHF or Swiss did not cover their trade surplus with the purchase of foreign assets.FX: EUR/CHF fell under 1.10 and EUR/USD over 1.12. Background Sight deposits are currently the by far most important means of financing for SNB currency purchases, for...

Read More »Weekly SNB Intervention Update: Sight Deposits and Speculative Position

First week of February: Speculators are closing down their short positions on the euro– both against the dollar and against CHF. The carry trade is breaking down into a reverse carry trade. This leads to a strengthening of the euro versus CHF. Given that US data was better than expected, the speculative USD against CHF position should further augment. It was at 4600 contracts versus CHF.No SNB interventions: Sight deposits decreased slightly by 0.2 billion CHF, this implies that the SNB is...

Read More »Latest SNB Intervention Update: Weekly Sight Deposits

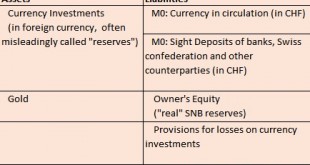

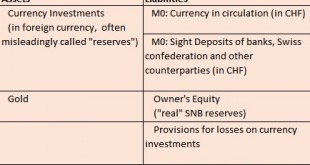

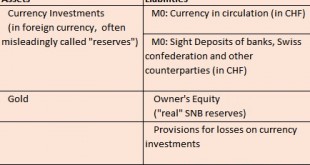

Overview: Sight deposits are currently the by far most important means of financing for SNB currency purchases, for interventions. Sight deposits are assets for commercial banks, the Swiss confederation and other counterparties that deposit money at the SNB, but for the SNB they are liabilities, debt.Sight deposits are always denominated in CHF. The SNB finances itself with Swiss Francs. With a rising CHF the debt relative to assets gets bigger, because the assets lose their value. As...

Read More » Swiss Economicblogs.org

Swiss Economicblogs.org