Gold Surges 15% To £968 Per Ounce – BREXIT Creates EU Contagion Risk – Sterling and euro have fallen sharply on fx markets– Gold bullion surged 20% in sterling to £1,015/oz– Gold now 15% in higher in GBP at £967 per ounce– Gold 8% higher in EUR and 5% higher in USD– Stocks globally are down sharply – FTSE down 9%– European stocks down sharply– Euro Stoxx 50 Futures collapsed over 11% at the open– Bank shares are down 20% to 25%– Cameron has resigned – adding to uncertainty in markets– Record online sales at this time of day for GoldCore– Nearly all buying with a preference for gold over silver– Some selling – with some investors choosing to take profits after sizeable short term gains Markets Today (Finviz) Ramifications– There is the real risk of contagion in the EU– UK leaving the EU increases the risk of the EU disintegrating as it greatly increases the risk of France, Italy, Spain, Netherlands and Greece following the UK– This poses risks to the “single currency,” the euro as these nations may revert to their national currencies– Still fragile UK, French, Italian, Spanish, Greek and Irish banks are coming under pressure– The uncertainty and shock is likely to undermine business and consumer confidence and likely lead to a recession in the UK and will likely impact an already vulnerable Eurozone and global economy– Central banks are likely to embark on further QE and

Topics:

GoldCore considers the following as important: Central Banks, Consumer Confidence, Deutsche Bank, ETC, Eurozone, France, Global Economy, Greece, Ireland, Italy, Lehman, Netherlands, Recession, Sovereigns, Zurich

This could be interesting, too:

investrends.ch writes Bloomberg: DWS stoppt Private-Credit-Geschäft in Asien

investrends.ch writes Deutsche Bank bleibt auf Rekordkurs

investrends.ch writes DWS mit neuem Vertriebsleiter für Institutionelle

investrends.ch writes Deutsche Bank mit Gewinnsprung – Aktie steigt

Gold Surges 15% To £968 Per Ounce – BREXIT Creates EU Contagion Risk

– Sterling and euro have fallen sharply on fx markets

– Gold bullion surged 20% in sterling to £1,015/oz

– Gold now 15% in higher in GBP at £967 per ounce

– Gold 8% higher in EUR and 5% higher in USD

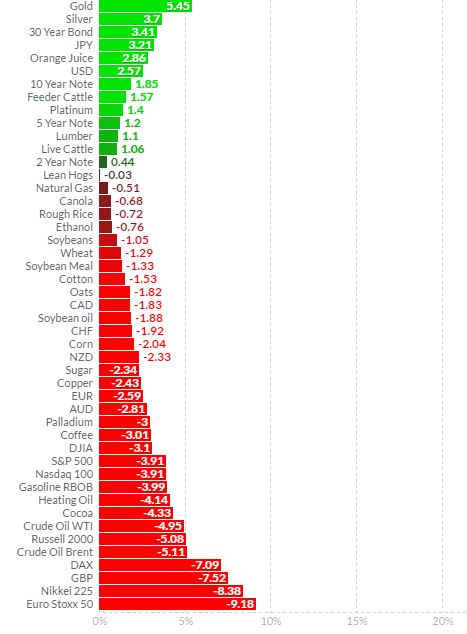

– Stocks globally are down sharply – FTSE down 9%

– European stocks down sharply

– Euro Stoxx 50 Futures collapsed over 11% at the open

– Bank shares are down 20% to 25%

– Cameron has resigned – adding to uncertainty in markets

– Record online sales at this time of day for GoldCore

– Nearly all buying with a preference for gold over silver

– Some selling – with some investors choosing to take profits after sizeable short term gains

Markets Today (Finviz)

Ramifications

– There is the real risk of contagion in the EU

– UK leaving the EU increases the risk of the EU disintegrating as it greatly increases the risk of France, Italy, Spain, Netherlands and Greece following the UK

– This poses risks to the “single currency,” the euro as these nations may revert to their national currencies

– Still fragile UK, French, Italian, Spanish, Greek and Irish banks are coming under pressure

– The uncertainty and shock is likely to undermine business and consumer confidence and likely lead to a recession in the UK and will likely impact an already vulnerable Eurozone and global economy

– Central banks are likely to embark on further QE and further devalue currencies in order to prevent recessions

UK

– The UK is likely to enter recession which will lead to further QE and see sterling devalued more over the long term

– The UK total debt to GDP ratio is over 450% which also poses severe risks to the economy and sterling

– UK banks remain vulnerable and in the event of contagion will likely see bail-ins and deposit confiscation

– British people, companies etc are very exposed to sterling. One way to hedge and protect against that risk is to diversify into physical gold and silver.

Conclusion

– The Brexit vote underlines the importance of owning gold as vital financial insurance in these uncertain times. The degree of risk means that investors should consider having higher allocations of 25% to 30% to physical gold and silver coins and bars.

Gold Prices (LBMA AM)

24 June: USD 1,313.85, EUR 1,181.28 & GBP 945.58 per ounce

23 June: USD 1,265.75, EUR 1,112.22 & GBP 850.96 per ounce

22 June: USD 1,265.00, EUR 1,122.31 & GBP 862.98 per ounce

21 June: USD 1,280.80, EUR 1,129.67 & GBP 866.72 per ounce

20 June: USD 1,283.25, EUR 1,132.08 & GBP 877.49 per ounce

17 June: USD 1,284.50, EUR 1,142.05 & GBP 899.41 per ounce

16 June: USD 1,307.00, EUR 1,161.14 & GBP 922.01 per ounce

15 June: USD 1,282.00, EUR 1,141.49 & GBP 903.04 per ounce

Silver Prices (LBMA)

24 June: USD 18.04, EUR 16.32 & GBP 13.18 per ounce

23 June: USD 17.29, EUR 15.16 & GBP 11.61 per ounce

22 June: USD 17.20, EUR 15.23 & GBP 11.72 per ounce

21 June: USD 17.36, EUR 15.34 & GBP 11.78 per ounce

20 June: USD 17.34, EUR 15.30 & GBP 11.85 per ounce

17 June: USD 17.37, EUR 15.43 & GBP 12.19 per ounce

16 June: USD 17.71, EUR 15.79 & GBP 12.54 per ounce

15 June: USD 17.41, EUR 15.51 & GBP 12.26 per ounce

Gold News and Commentary

GoldCore experienced record online sales for the time of day and may have to restrict trading to existing clients if demand remains high (Bloomberg via Business Times Singapore)

Elderly customer fearing economic collapse asked if she could invest all of her life’s savings in gold, despite the recommended investment level of 15% (WSJ)

Gold Sees Biggest Gain Since 2008 in Rush for Havens From Brexit (Bloomberg)

Gold Soars as Investors Seek Haven Following ‘Brexit’ (WSJ)

‘Buy gold’ searches soar 500pc after Britain votes to leave EU: here’s how to get your hands on the yellow metal (Telegraph)

Pound Plunges to Lowest in More Than 30 Years as Brexit Looms (Bloomberg)

Deutsche Bank to shut 188 German branches, cut 3,000 staff (CNBC)

Gold Soars Most In 42 Years For British Buyers (Zero Hedge)

Britain Votes to Leave E.U., Stunning the World (NY Times)

EU Referendum Live (Telegraph)

U.K. votes for Brexit: Latest on the fallout from the EU referendum (Marketwatch)

Britain votes leave: Don’t panic – this is an opportunity (Money Week)

Read More Here

Recent Market Updates

– BREXIT Day – Markets Becalmed – Gold Panic Prelude – Trading Hours

– Gold Lower Despite “Panic” Due To “Supply Issues” In Inter Bank Gold Market

– Gold Slips Despite UK Gold Demand Surging – Investors “Seek Stability”

– Gold Prices Surge to Highest in Nearly Two Years On FED and Brexit Haven Demand

– Gold Bullion Has Little Downside, Brexit Or Not, Says HSBC

– Central Bank of Ireland Warns Risks are Debt, Brexit, Geopolitical Tensions and Migration

– Gold In Euros Surges 6.5% In June and 17% YTD On BREXIT Concerns

– Soros Buying Gold On BREXIT, EU “Collapse” Risk

– UK Gold Demand Rises On BREXIT “Nerves”

– Pensions Timebomb in “Slow Motion Detonation” In UK, EU, U.S.

– Silver – Perfect Storm Brewing in the Market

– Martin Wolf: There Will Be Another “Huge” Financial Crisis

Note

– There has been record online sales on the GoldCore website for this time of day and the phones are ringing off the hook. We have had more sales than during the Lehman crisis and at the height of the Eurozone debt crisis. It is nearly all buying with a preference for gold over silver. We may have to restrict trading to existing clients if we continue to see this level of demand.

– We are seeing more selling then expected and seeing some clients choosing to take profits after the very sizeable short term capital gains. As a percentage of overall trading though, sellers are vastly outnumbered by buyers.

– Bullion inventories had already been increased to record levels and we are confident that the UK leaving the EU will lead to a sustained increase in coin and bar buying in the coming months.

– Sales of Britannias and Sovereigns which are CGT free for UK buyers have been very high and we are replenishing coin inventories this morning.

– We are seeing demand for legal tender British coins, both for delivery to clients in the UK but also for storage in Zurich.

– We are not selling out of any products and do not anticipate we will in the short term unless high net worth clients buy coins and bars in volume.