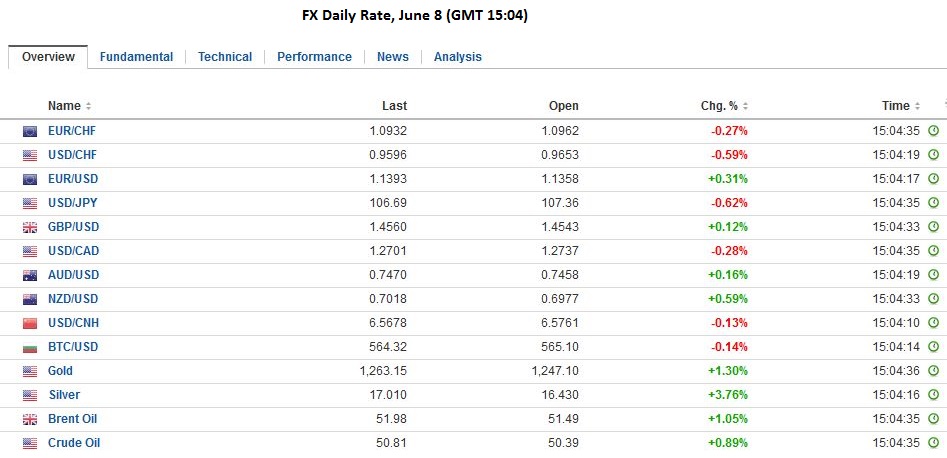

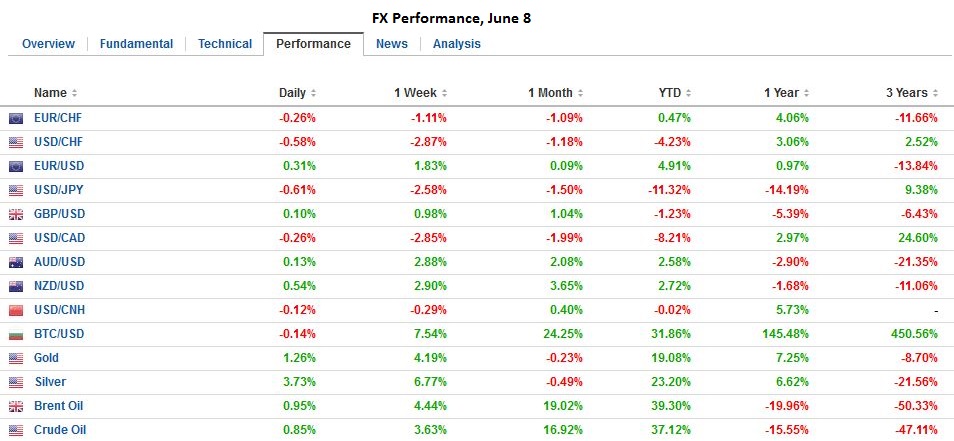

On Swiss Franc Once again the Swiss Franc appreciates both against EUR and USD.The euro topped at 1.1095 shortly before the US payroll data and has fallen to 1.0932. The dollar has fallen from 0.9947 to 0.9596. New CHF trade recommendation by Dennis Gartman: We wish to sell the EUR and to buy the Swiss franc this morning upon receipt of this commentary. As we write, the cross is trading 1.0972:1 and we shall risk the trade only to 1.1045. Should the cross trade below 1.0940 we shall not hesitate but to add to the position, and our target as we move toward the British Referendum… and beyond… is to “parity” once again, knowing full well that the Swiss National Bank shall object to the trade. For us, the problem with this trade, is a SNB intervention at these lower levels. The short was good at 1.11. Click to enlarge Continued by Marc Chandler FX Market The foreign exchange market is quiet. The euro remains confined to the narrow range seen on Monday between .1325 and .1395. We continue to look for higher levels near-term as the drop from May 3 (~.1615) to May 30 (just below .11) is corrected. A move above .1420 would likely spur more buying. The dollar has surrendered yesterday’s gains against the yen that had lifted it to almost JPY108.00. The pullback has been limited to the JPY106.

Topics:

Marc Chandler considers the following as important: AUD, Donald Trump, EUR, Featured, FX Daily, FX Trends, GBP, Hillary Clinton, JPY, newsletter, USD

This could be interesting, too:

Nachrichten Ticker - www.finanzen.ch writes Die Performance der Kryptowährungen in KW 9: Das hat sich bei Bitcoin, Ether & Co. getan

Nachrichten Ticker - www.finanzen.ch writes Wer verbirgt sich hinter der Ethereum-Technologie?

Martin Hartmann writes Eine Analyse nach den Lehren von Milton Friedman

Marc Chandler writes March 2025 Monthly

On Swiss FrancOnce again the Swiss Franc appreciates both against EUR and USD.

For us, the problem with this trade, is a SNB intervention at these lower levels. The short was good at 1.11. |

|

Continued by Marc Chandler

FX MarketThe foreign exchange market is quiet. The euro remains confined to the narrow range seen on Monday between $1.1325 and $1.1395. We continue to look for higher levels near-term as the drop from May 3 (~$1.1615) to May 30 (just below $1.11) is corrected. A move above $1.1420 would likely spur more buying. The dollar has surrendered yesterday’s gains against the yen that had lifted it to almost JPY108.00. The pullback has been limited to the JPY106.75 area. The intraday technicals are slightly positive for the dollar, but a return to yesterday’s highs may be too much to expect. Sterling is little changed. It is consolidating at the upper end of yesterday’s range and is a bit softer against the euro. The Australian dollar is also in a tight range near yesterday’s best levels. The Aussie advanced about 2.5 cents over the last five sessions. The $0.7500 is the next important barrier. The Canadian dollar is extending its recovery for the fourth consecutive session, and the greenback is approaching CAD1.27. A convincing break targets CAD1.25. |

Asian equities were mostly higher. Gains in Japan, Korea, Taiwan offset weakness in several other centers to lift the MSCI Asia Pacific Index about 0.5%, for the fourth consecutive advancing session. MSCI Emerging Market Index is up about 0.3% to extended the rally into the fifth session. European bourses have seen profit-taking. The Dow Jones Stoxx 600 is off about 0.5% near midday in London. The only sectors gaining today are energy and utilities.

Bond yields are mostly softer, though Germany Bund yields are pinned near record lows and Gilts are steady. The ECB has officials launched its corporate bond buying program. It will provide overall holdings every Monday, while the details of its holdings will be published monthly starting July 18. Newswires are reporting some of the issues bought today.

The program is expected to begin off gradually and increase over time. Given liquidity conditions, purchases are expected to be below five bln euros a month, at least at the beginning. Purchasing less than three bln euros a month would be seen as disappointing, according to some market participants. Some see the drop in the average German yield into negative territory, and the record low 10-year bund yield as evidence of a shortage of German paper. On the other hand, part of the demand for German bunds may also be tied to the angst surrounding the UK referendum. German assets ostensibly may also serve as a call option amid fears that a Brexit vote could spark an EMU crisis.

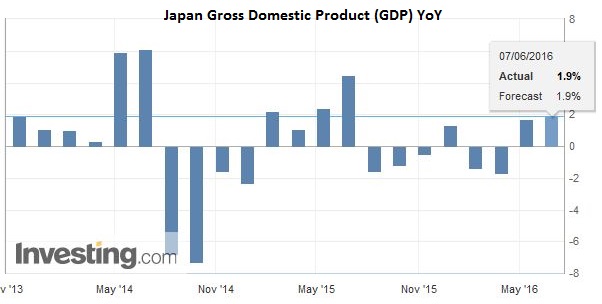

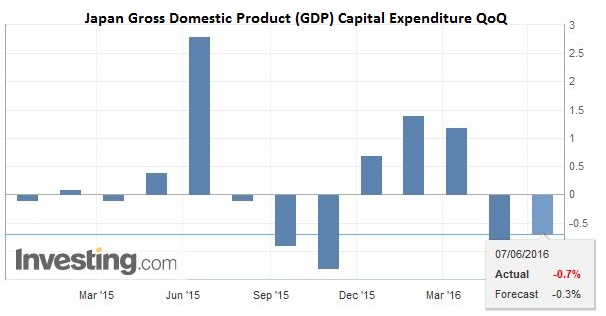

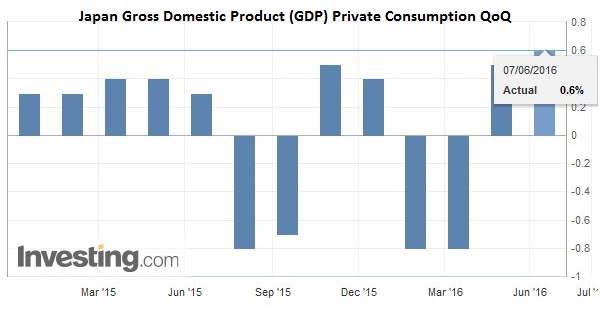

JapanThere are four main macro developments today. First, just like US and eurozone Q1 GDP was revised higher, so was Japan’s. Japan’s Q1 GDP was revised to 1.9% (annualized) from 1.7% due to stronger consumption and less of a drag from private investment. These fully offset the drop in inventories and public investment. |

Daily Economic Data |

| Japan Investments

Some argued that these revisions reduce the pressure for more fiscal or monetary efforts. We are less convinced and note the public investment slumped 0.7% in Q1 rather than advance 0.3% as the initial report estimated. |

|

| Japan Private Consumption

The Abe government is already committed to a fiscal stimulus package, and the postponement of the sales tax increase was only a part. Many look for more details of the package ahead of the upper house election on July 10. The BOJ meets next week, but few expect a change in policy. Some suggest it is too close to the election. The focus appears to be more on the late-July BOJ meeting as a more likely window for additional measures. |

|

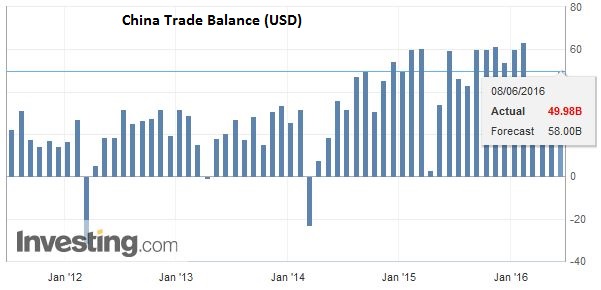

ChinaSecond, China’s May trade surplus stood at $49.98 bln. This is larger than April’s $45.56 bln surplus but less than the median expectation of $55.7 bln). Exports fell 4.1% year-over-year, which was a touch more than expected and follows a 1.8% decline in April. Imports were more surprising. They were off only 0.4%. The market had been looking for a 4% fall after dropping 10.9% in April. |

|

| There are at least two important takeaways from the Chinese trade figures. Imports have been contracting since October 2014. The 0.4% decline is the smallest in more than a year and a half. The news seems too good to believe. Consider that imports from Hong Kong reportedly increased by $2.48 bln. This is the most since 1999 and represents more than a 240% increase from a year ago. The suspicion is that this reflects over-invoicing to disguise capital exports. |

The other important takeaway is that China’s steel exports rose 3.7% in May and in the first five months are running 6.4% above year ago levels. The US and EU are already taking action to deter a further surge of Chinese steel imports. China’s surplus capacity is likely to be a source of tensions for years to come.

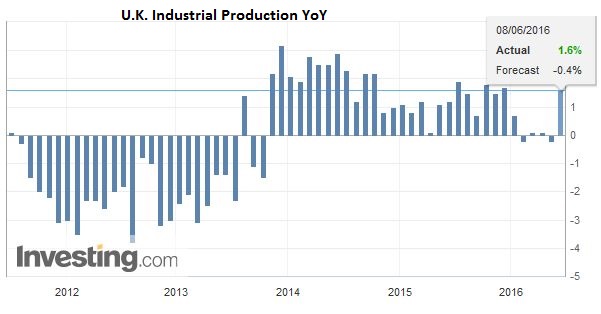

The third macro development today is the unexpectedly strong UK industrial output report. The market had expected a flat report in April, in part due to the below 50 reading of the manufacturing PMI. Instead, UK industrial output jumped 2.0%, the biggest increase in four years. Manufacturing production itself rose 2.3%. Pharmaceutical output surged 8.6%, and auto production (ostensibly for domestic demand) rose. There was a 3.9% rise in gas and electricity production, though oil and gas extraction fell 1.3%.

United KingdomThe UK referendum is overshadowing the economic data. The local press is not leading with last night’s Cameron/Farge interviews. The media focus is escalating. It may take a few days for the polls to detect the impact. We suspect that at this juncture, more of the same rhetoric is unlikely to change many minds. |

Fourth, Clinton did unexpectedly well in yesterday’s primaries. She appears to have won handily in California where some polls had shown a tight race. Typically, when a candidate secures their party’s nomination, they experience a bump in the polls. This has not been a particularly good period for Trump. His recent comments have been criticized by many Republican officials, including those who have recently endorsed him. Both parties will hold their conventions next month. The focus shifts toward the vice-president candidates, and on the Democrat side, how Clinton will reach out to Sanders’ support is important as well.

The North American session features the JOLTS report on the labor market, which some Fed officials have cited in the past. Note that the new Federal Reserve Labor Market Index fell sharply in May after the April series was revised sharply lower. API estimated that oil inventories fell 3.56 mln barrels last week. The median estimate is that the DOE estimate will show a 3.1 mln barrel draw. Oil prices are firm with Brent testing $52 and WTI near $51.

Graphs and additional information on Swiss Franc by the snbchf team

Previous post