We have argued the inevitability of Fed-administered hyperinflation, prompted by a global slowdown and its negative impact on the ability to service and repay systemic debt. One of the most politically expedient avenues policy makers could take would be to inflate the debt away in real terms through coordinated currency devaluations against gold, the only monetize-able asset on most central bank balance sheets. To do so they would create new base money with which to purchase gold at pre-arranged fixed exchange prices, which would raise the general price levels in their currencies and across the world to levels that diminish the relative burden of debt repayment (while not sacrificing debt covenants). The odds of this occurring seem to have risen, judging by the gold prices. Gold price performance in world currency terms Table 1 looks at gold performance over one, five and ten years in terms of the fifteen currencies representing the fifteen largest economies (about 77% of global GDP). The bold figures at the bottom show gold’s performance weighted for GDP. Gold price performance in world currency terms Gold is mostly quoted in US dollars, but it is also implicitly valued at each point in time in all currencies (as is everything that may be bought or sold across the world), simply by applying cross exchange rates to its USD price.

Topics:

Paul Brodsky considers the following as important: Central Banks, Covenants, Featured, fixed, Gold and its price, gold price, Gold price performance, Hyperinflation, newsletter, Real yield, Swiss Franc, Yuan

This could be interesting, too:

Nachrichten Ticker - www.finanzen.ch writes Die Performance der Kryptowährungen in KW 9: Das hat sich bei Bitcoin, Ether & Co. getan

Nachrichten Ticker - www.finanzen.ch writes Wer verbirgt sich hinter der Ethereum-Technologie?

Martin Hartmann writes Eine Analyse nach den Lehren von Milton Friedman

Marc Chandler writes March 2025 Monthly

We have argued the inevitability of Fed-administered hyperinflation, prompted by a global slowdown and its negative impact on the ability to service and repay systemic debt. One of the most politically expedient avenues policy makers could take would be to inflate the debt away in real terms through coordinated currency devaluations against gold, the only monetize-able asset on most central bank balance sheets. To do so they would create new base money with which to purchase gold at pre-arranged fixed exchange prices, which would raise the general price levels in their currencies and across the world to levels that diminish the relative burden of debt repayment (while not sacrificing debt covenants).

The odds of this occurring seem to have risen, judging by the gold prices.

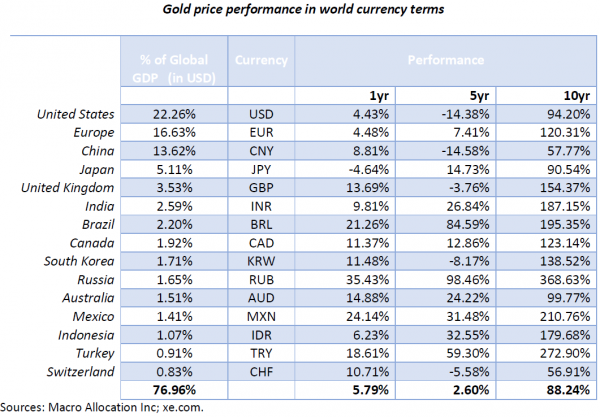

Gold price performance in world currency termsTable 1 looks at gold performance over one, five and ten years in terms of the fifteen currencies representing the fifteen largest economies (about 77% of global GDP). The bold figures at the bottom show gold’s performance weighted for GDP. |

Gold is mostly quoted in US dollars, but it is also implicitly valued at each point in time in all currencies (as is everything that may be bought or sold across the world), simply by applying cross exchange rates to its USD price. Table 1 shows the experience of gold holders around the world has been quite different. A Russian would have had the currency he receives his wages in devalued to gold by almost 370% over the last ten years. Or, he could have generated a 370% gain by converting his ruble savings into gold. Anyone else in the world would also show a 370% gain by having owned gold and having been short the ruble.

Meanwhile, gold in dollar terms, as it is quoted for capital market participants given London and US exchange dominance over fungible gold trading, is up far less – about 94%. (This performance also represents gold performance for currencies pegged to the dollar, like the Saudi Arabian riyal.) Gold in Chinese yuan terms and Swiss franc terms are only about 57% higher over the last ten years.

The wide gap in gold’s performance is due to sharp differences in ongoing currency exchange rates. Gold is a currency hedge – the stable fulcrum around which fiat currencies fluctuate. Gold is not consumed and has no internal rate of return. Changing market quotes for gold – whether for spot gold, gold futures or gold bullion – merely represent currency exchange rates. The performance of gold in Table 1 is not the performance of gold at all, but rather the performance of the currencies in which it is quoted.

The last line of Table 1 shows gold price changes adjusted for the relative importance of currencies, as determined by GDP. It implies that the global monetary system has been devalued against gold by 46.88% over the last ten years (1/1.8824), which was in line with the MSCI ACWI World equity index over this time.) One who produced a good or service anywhere in the world over the last ten years would have been wise to save the fruit of his labor in gold terms.

Central Banks

If we were a central banker overseeing the fiat global monetary regime we would want to treat gold as a market-based indicator of inflation, not as a potential competitor to the currencies we established and promote. We would build econometric models in which we would define the relationships linking credit growth to demand growth, demand growth to production growth, and production growth to inflation and employment. We would establish economic mandates, like stable prices and full employment, and then we would model conditional scenarios and reaction functions in which to proceed.

We would be very transparent in our communications policies, sharing assumptions and data from our models and our economic projections based on them. It would appear to all the world that we would be applying thoughtful, best efforts science to the vagaries of irrational human animal spirits – the irrationality of mass consumption and investment or the irrationality of short term decision making over what would be more sustainable. We would blanket our science in pedantic academic rhetoric and debate nuance with others interested in the same discipline.

We would not question the moral nature of our pursuits because science is amoral. Nor would we question whether our models and actions might be unduly harmful because our position is clearly defined and its roadmap conditional and usually marked with precedent. We would not question our reason for being because we would be the very foundation upon which economies sit. We would not separate economics from finance because, well, because it would not reconcile with everything else we do.

When asked about gold, we would testify before our congresses and parliaments that we hold it on our balance sheets merely as tradition, and that its relevance in our scientifically managed domestic economies and coordinated, financial-centric global economies is de minimus. Gold would be an afterthought to us, and most serious economists, politicians, policy makers and market observers.

Those clinging to the relevancy of the barbarous relic would be generally perceived as sour pessimists, economic losers unwilling to change with the times, malcontents clinging to regressive social mores, Chicken Littles seeking to undermine centrist politics and policy in the face of contrary economic indicators, druids unwilling or incapable of using leveraged financial assets to save, provincial patriots unwilling to strive to live in a peaceful and prosperous international community.

Ironically, it is this last point that holds the key to gold’s relevancy in modern times. The fact that gold remains on the balance sheets of central banks and is being aggressively bought by them suggests it is gaining, not losing, relevancy as a monetary asset. The fact that it can be used as the fulcrum against which to devalue currencies gives it purpose. The fact that allocations to gold and gold-related assets remains less than 3% of investment portfolios makes it a superior risk-adjusted portfolio allocation.

Expectations

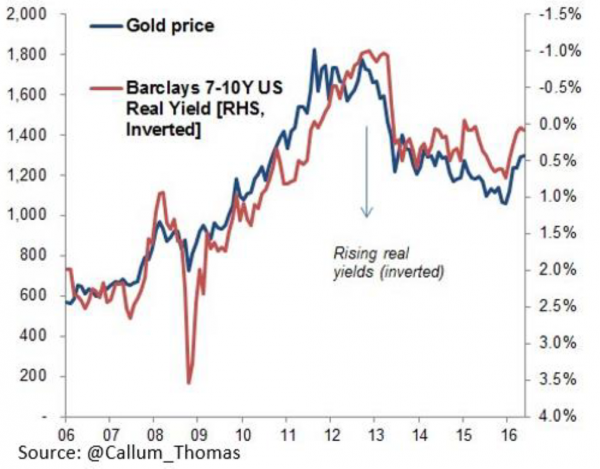

Gold price, Barclays 7-10Y US Real YieldGraph 1, shows the relationship of US real yields and the USD gold price. Real (inflation adjusted) yields and gold have been tightly correlated. Non-income producing gold ebbs and flows inversely with yields available on financial assets. This is understandable, but ask yourself this: what happens now that global sovereign interest rates must go negative to give the impression that credit is becoming easier? |

The sound reasoning behind the tight correlation should break down if/when no amount of central bank stimulus, other than QE, produces inflation, and that inflation is limited to asset inflation. Then, the system would break and global monetary authorities would have to re-work it.

Our view is that there will not be a switch to a fully-reserved banking system or even a reversion to a fixed exchange rate; however, there will be a significant increase in global currency devaluations against gold, and that it will be coordinated by monetary authorities.

Previous post