These things are actually quite related, though I understand how it might not appear to be that way at first. As noted earlier today, the Fed (yet again) proves it has no idea how global money markets work. They can’t even get federal funds right after two technical adjustments to IOER (the joke). But as esoteric as all that may be, recent corporate statements leave much less doubt at least as to the primary effect....

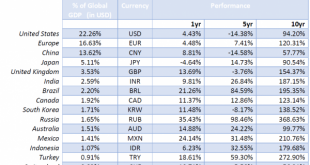

Read More »The Global Monetary System Has Devalued 47 percent Over The Last 10 Years

We have argued the inevitability of Fed-administered hyperinflation, prompted by a global slowdown and its negative impact on the ability to service and repay systemic debt. One of the most politically expedient avenues policy makers could take would be to inflate the debt away in real terms through coordinated currency devaluations against gold, the only monetize-able asset on most central bank balance sheets. To do so they would create new base money with which to purchase gold at...

Read More » Swiss Economicblogs.org

Swiss Economicblogs.org