Bankers Hate It When You Hold Cash In an extraordinary turn of events, last week we were contacted by our local bankers. Since we were turned down for a mortgage in 1982 (our business finances were thought to be “too shaky”), we have had little truck with them. We pay cash. They mind their own business. Too many Benjamins! Photo credit: Andrew Magill / Flickr But for the first time we can recall, not just one but three suits came to visit. Personable and intelligent, they were worried when they saw how much cash we were keeping on hand. No kidding. They came to visit to propose ways we could “put it to use.” “You really should take some of that cash and invest it in municipal bonds” was the motion on the table. “What if the municipalities can’t pay?” we asked. “Don’t worry about that. Historically, the odds of default are extremely remote,” one of them answered. “But what if interest rates turn up? Wouldn’t the default rate go up?” “Well, maybe. But we keep the maturities short and invest only in the most creditworthy municipalities. The risk is very low.” “Oh… but what if we just need some cash.” “No problem. We’ll give you a line of credit.” “Let me get this straight. You’re proposing to put me into debt so that I can keep my money invested in somebody else’s debt?” “Uh… well… yes… and we’ll charge you less interest than you will earn from the municipal bonds.” “Wait.

Topics:

Bill Bonner considers the following as important: Monetary Metals, On Economy, On Politics

This could be interesting, too:

Keith Weiner writes Ukraine and the Next Wave of Inflation, Part II, Can Russia Enact a Gold Standard?

Pater Tenebrarum writes Mapping the Conflict in the Ukraine

Keith Weiner writes What’s In Your Loan?

Antonius Aquinas writes A Look Back at Nixon’s Infamous Monetary Policy Decision

Bankers Hate It When You Hold Cash

In an extraordinary turn of events, last week we were contacted by our local bankers. Since we were turned down for a mortgage in 1982 (our business finances were thought to be “too shaky”), we have had little truck with them. We pay cash. They mind their own business.

Too many Benjamins!

Too many Benjamins!

Photo credit: Andrew Magill / Flickr

But for the first time we can recall, not just one but three suits came to visit. Personable and intelligent, they were worried when they saw how much cash we were keeping on hand. No kidding. They came to visit to propose ways we could “put it to use.”

“You really should take some of that cash and invest it in municipal bonds” was the motion on the table.

“What if the municipalities can’t pay?” we asked.

“Don’t worry about that. Historically, the odds of default are extremely remote,” one of them answered.

“But what if interest rates turn up? Wouldn’t the default rate go up?”

“Well, maybe. But we keep the maturities short and invest only in the most creditworthy municipalities. The risk is very low.”

“Oh… but what if we just need some cash.”

“No problem. We’ll give you a line of credit.”

“Let me get this straight. You’re proposing to put me into debt so that I can keep my money invested in somebody else’s debt?”

“Uh… well… yes… and we’ll charge you less interest than you will earn from the municipal bonds.”

“Wait. You can earn a fee for putting my money in bonds… and earn another fee for lending me money… and I still end up ahead?”

“Yes. We just try to find ways to help clients with their financial needs.”

“Oh.”

If unlucky, you’ll end up with one of these…

If unlucky, you’ll end up with one of these…

Image via scripophily.net

Worse Off

Little by little, day after day, year after year, we connect the dots. At first, it is difficult to make out what we’re looking at. But gradually, after much straining and guesswork, two things are becoming clearer and clearer… at least to us. First, nobody knows anything. Second, nobody has any real money.

Yesterday, we mentioned our persistent puzzlement over the failure of the U.S. economy to make the typical working American richer after accounting for inflation. For all its conceits, swindles, booms, busts, hustles, patents, technologies, investments, PhDs, and central bank chicanery… there seems to be little to show for it.

You can test that assertion easily. All wage and inflation numbers are a little fishy. So, let’s keep it simple. The basic transportation for a working man 40 years ago was the Ford F-150 pickup truck.

1976 Ford F150 pick-up truck – this one set you back $4,600 without discounts.

1976 Ford F150 pick-up truck – this one set you back $4,600 without discounts.

Photo credit: jamessoccer12

In 1976, that truck, the SuperCab model, had a manufacturer’s suggested retail price (MSRP) of $4,600. That was when the average working stiff earned $9,300 a year. So, it took 25 weeks of work to pay for the truck.

Today, the F-150 is still the preferred working man’s wheels. And today, it has a MSRP of $26,600 – or 5.7 times as much. But the average person doesn’t earn 5.7 times as much. The median wage today is $43,600. So now, a prole earning the median wage has to work 30 weeks to pay for the truck.

This man is not better off. He’s worse off. And he’s been made worse off by advanced American crony capitalism. And here are more dots… to be connected! What do we see…?

Harder to Get Ahead

We are not sure how up to date the following figures are. But we doubt that they have changed much.

From MarketWatch:

Approximately 62% of Americans have no emergency savings for things such as a $1,000 emergency room visit or a $500 car repair, according to a new survey of 1,000 adults by personal finance website Bankrate.com. […] What’s more, only 39% of respondents reported having a “rainy day” fund adequate to cover three months of expenses, and only 48% of respondents said that they would completely cover a hypothetical emergency expense costing $400 without selling something or borrowing money.

If you follow mainstream news media, you might believe that the “recovery continues on track.” Or that earnings are increasing. Or unemployment is falling. But keeping your eyes on these data points blinds you to what is really going on.

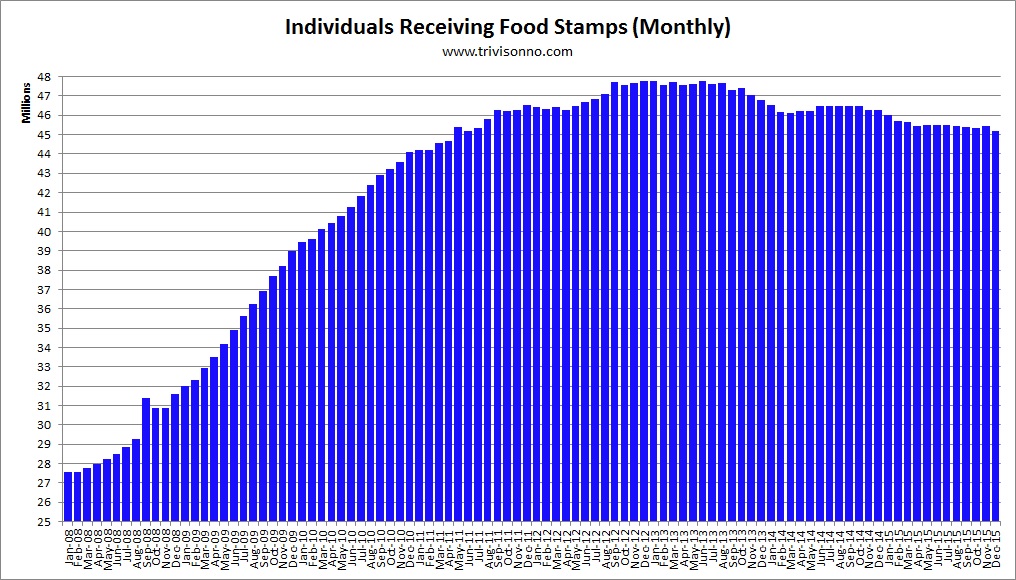

Seven years into the “recovery” there are still more than 45 million people receiving food stamps – click to enlarge.

Seven years into the “recovery” there are still more than 45 million people receiving food stamps – click to enlarge.

People have always struggled to make ends meet. But as the money system changed… so did the typical family’s household finances: It got harder to get ahead.

Yes, most people live better than they did in the 1970s. Technological and commercial progress has improved the quality of the things we live with. There are more choices in the supermarkets… in Walmart… and online.

Today’s F-150 is better, in many ways, than the F-150 from 40 years ago. Houses are bigger and more comfortable. Air conditioning is more widespread. Communication channels and entertainment are better than ever.

But though life is easier and more agreeable for most people, few people have more real money. They have more things. And more credit. But they are deeper in debt… more vulnerable to a downturn… and more dependent on the government and the credit industries.

“Debt Makes Sense”

Your editor recently took up the subject with a recruiting agency.

“I place a lot of accountants and bookkeepers,” began the recruiter.

“Naturally, their employers want a credit check. They want to know how you handle your finances. They also want to avoid people whose financial situation sends up flags. Desperate people are not ideal new hires for the accounting department.

“The people we place earn $60,000 and up. Usually, husband and wife both work, and often they both have MBA or other advanced degrees, so you’re looking at some substantial incomes.

The recruiter continued:

“Usually, they have some student debt, auto debt, and mortgage debt. And they usually have a revolving line of credit, too. These are prudent, well-educated people we’re talking about. They use credit wisely, when they need to make a big-ticket purchase… or pay for private schooling.

Federal loans to students – if one adds the estimated amount of private sudent debt, the total comes to around $1.2 trillion by now. The federal portion alone has risen by 818% since 2007 – using credit “wisely”? Really?

Federal loans to students – if one adds the estimated amount of private sudent debt, the total comes to around $1.2 trillion by now. The federal portion alone has risen by 818% since 2007 – using credit “wisely”? Really?

“What we look for is a clean report. No late payments. The level of debt doesn’t bother us. I mean, the banks wouldn’t lend if they thought there was a problem.

“Besides, everybody uses debt now. It makes sense. With rates this low, it’s better to borrow than to use your own money. Debt is just a financial tool.”

Is that all debt is? A handy tool? We don’t think so…

Charts by: trivisonno.com, advisorperspectives/Doug Short

Chart and image captions by PT

The above article originally appeared as “Why Bankers HATE It When You Hold Cash“ at the Diary of a Rogue Economist, written for Bonner & Partners. Bill Bonner founded Agora, Inc in 1978. It has since grown into one of the largest independent newsletter publishing companies in the world. He has also written three New York Times bestselling books, Financial Reckoning Day, Empire of Debt and Mobs, Messiahs and Markets.

Full story here