The Metals Take Off Photo via sprottmoney.com The price of gold shot up over this week. The price of silver moved up proportionally, gaining over %excerpt%.85. The mood is now palpable. The feeling in the air is that of long suffering suddenly turned to optimism. Big gains, if not the collapse of the price-suppression cartel, are now inevitable. The headlines and articles, screaming for gold to hit ,000 to ,000, are pervasive. Today we won’t dwell on our favorite point that if the price of gold hits ,000 then that means the price of the dollar has collapsed. If you own an ounce of gold, then you may have a lot more dollars. But unfortunately, each of those dollars is worth a lot less. Today, we want to look at this new alleged precious metals bull market. Does it have legs? Are we likely to see silver hit , much less ,000? We will support our analysis with a new graph to show the big picture. Fundamental Developments Let’s look at the only true picture of supply and demand fundamentals. But first, …. Gold and silver prices … here’s the graph of the metals’ prices. Gold and silver prices – click to enlarge. Next, …. Gold: Silver Price Ratio … this is a graph of the gold price measured in silver, otherwise known as the gold to silver ratio. The ratio was down slightly this week. Gold-silver ratio – click to enlarge.

Topics:

Keith Weiner considers the following as important: Featured, Gold, Gold and its price, Monetary Metals, newsletter, Paper Gold, silver

This could be interesting, too:

Nachrichten Ticker - www.finanzen.ch writes Die Performance der Kryptowährungen in KW 9: Das hat sich bei Bitcoin, Ether & Co. getan

Nachrichten Ticker - www.finanzen.ch writes Wer verbirgt sich hinter der Ethereum-Technologie?

Martin Hartmann writes Eine Analyse nach den Lehren von Milton Friedman

Marc Chandler writes March 2025 Monthly

The Metals Take Off

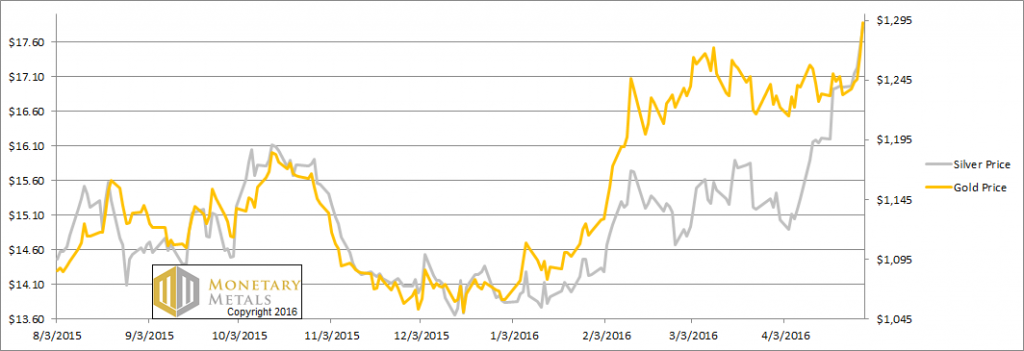

The price of gold shot up over $60 this week. The price of silver moved up proportionally, gaining over $0.85. The mood is now palpable. The feeling in the air is that of long suffering suddenly turned to optimism. Big gains, if not the collapse of the price-suppression cartel, are now inevitable.

The headlines and articles, screaming for gold to hit $10,000 to $50,000, are pervasive. Today we won’t dwell on our favorite point that if the price of gold hits $50,000 then that means the price of the dollar has collapsed. If you own an ounce of gold, then you may have a lot more dollars. But unfortunately, each of those dollars is worth a lot less.

Today, we want to look at this new alleged precious metals bull market. Does it have legs? Are we likely to see silver hit $20, much less $1,000? We will support our analysis with a new graph to show the big picture.

Fundamental Developments

Let’s look at the only true picture of supply and demand fundamentals. But first, ….

Gold and silver prices… here’s the graph of the metals’ prices. |

Next, ….

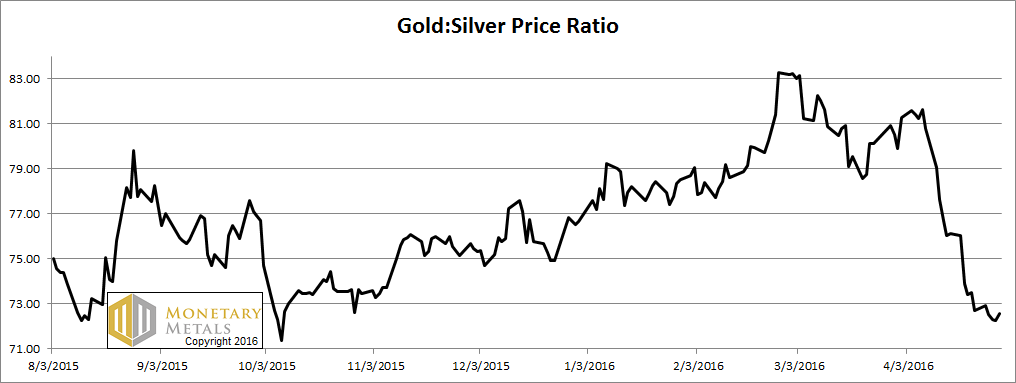

Gold: Silver Price Ratio… this is a graph of the gold price measured in silver, otherwise known as the gold to silver ratio. The ratio was down slightly this week. |

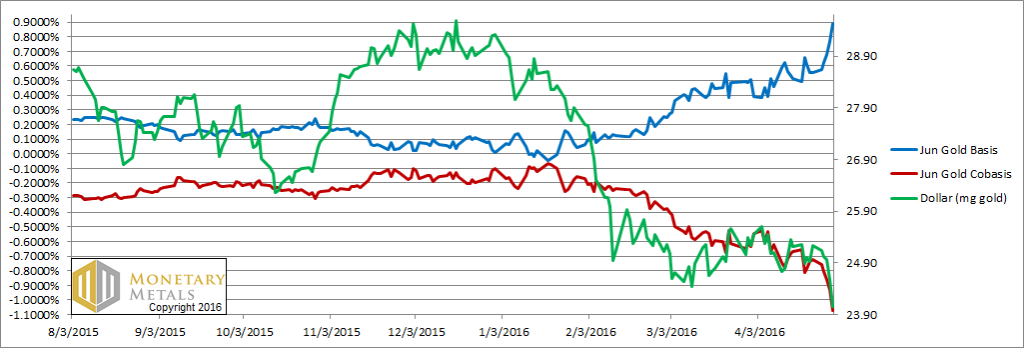

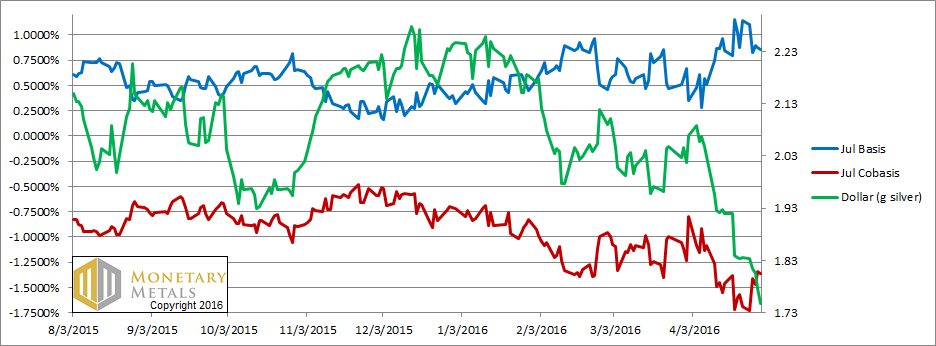

For each metal, we will look at a graph of the basis and cobasis overlaid with the price of the dollar in terms of the respective metal. It will make it easier to provide brief commentary. The dollar will be represented in green, the basis in blue and cobasis in red.

Here is the gold graph.

Gold basis, co-basis and the dollar priceWe actually had to expand the range of both axes. The price of the dollar fell off the bottom, currently about 24mg. The cobasis (which is our measure of the scarcity of gold) also fell off the bottom, while the basis (which is our measure of abundance) rose above the top. |

As the price of gold continues to rise, it becomes more abundant. Indeed, we can hardly say “scarcity” any more with a cobasis below -1%.

Look, the supply and demand fundamentals could change at any time. However, as of this moment, the picture painted by the basis is not $10,000 or $50,000. It’s more like $1,235. More on this below.

First let’s turn to silver.

The Silver Basis and Cobasis and the Dollar Price.The first thing you’ll notice is that the red cobasis line (i.e. scarcity) has not been falling to match the falling price of the dollar measured in silver (i.e. rising price of silver, measured in dollars) the way it has in the gold chart above. However, two factors mitigate this. One, the silver co-basis is much lower on an absolute basis (no pun intended). In gold, the co-basis is -1.1%, whereas for silver it’s -1.4%. |

Two, silver has a much stronger tendency to a falling basis and rising co-basis as each contract nears expiration. In times of greater scarcity, it causes temporary backwardation—each contract tips into backwardation before it goes off the board. This phenomenon begins to distort the silver chart much farther out than in gold, and to a greater (numerical) degree. It has already taken hold in the July silver contract.

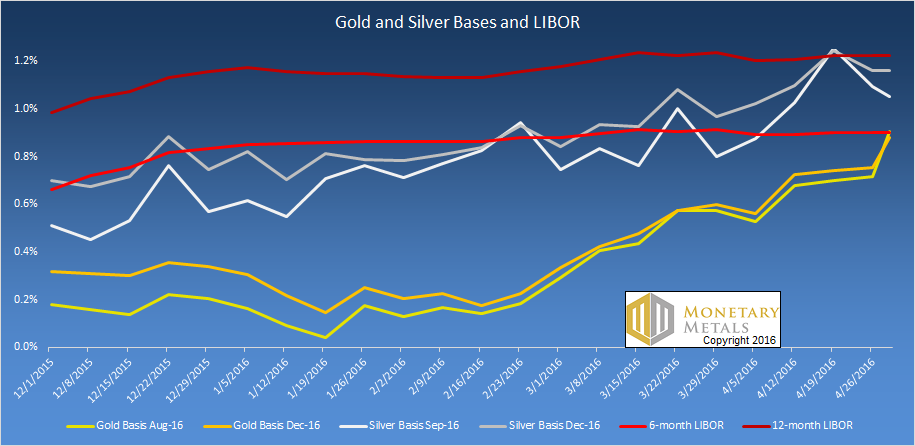

This segues into our next chart, a view new to this Report. We show the August and December gold contracts and the September and December silver contracts. Just the basis only, to make the chart easier to read.

Gold and silver bases and LIBORYou can see another aspect of our previous point. Even this far out, silver contracts show more volatility than gold. And the two different months deviate from one another more than in gold. |

Note the strong rising trend starting around mid-January.

Demand to Carry Metal

So what is this showing, really? The basis is the real-world profit you would make to carry metal. Suppose you buy a bar of metal and simultaneously sell a futures contract, storing the metal in the meantime. You pocket the carry spread. If we quote it in terms of dollars, it’s about 14 cents for December silver. We quote it as an annualized percentage, so that you can easily compare it to other investments (more on this in a moment).

The trend for the past few months is that carrying is more and more profitable. What does that tell us? It means that more and more firms will enter the carry trade. A profit attracts people, for some odd reason or another having to do with wanting to make money or something…

Anyways, we know that more market participants are carrying metal because it’s more profitable than it was. Whatever number of people wanted to do it when the profit was 7 cents, we know that more will do it for 14.

What is this telling us about the state of the market for metal? If more and more metal is going into carry trades, then the marginal buyer of metal is this trader who carries metal—whom we often call the warehouseman. The marginal demand for metal is to be carried. This is a dangerous state, because when it flips around, then this marginal demand disappears and then the marginal supply of metal is coming out of carry trades. This is hardly the picture of a shortage driving a durable bull market.

We included two different LIBOR rates on the chart. It’s interesting to compare the basis to LIBOR. Now, in gold, carrying is about the same as 6-month LIBOR. In silver, the return is above that, and at one point got above 12-month LIBOR.

We have one final point. These traders are carrying metal to earn a small spread, with no price exposure. They are arbitrageurs. The activity of the arbitrageur always causes compression of the spread from which he is profiting. In this case, the carry trade involves buying metal in the spot market and selling it in the futures market. This tends to push up the price of spot metal and pull down the price of futures contracts.

So we have a growing group that’s pushing to compress the basis spread—basis is futures minus spot. Yet the basis is widening despite that. What could cause something to rise, when there’s a powerful and growing force trying to make it fall? What is the even-bigger force at work here?

It is the fast and furious buying of speculators, who bid up futures contracts on leverage. Paper gold is rising, and it’s pulling up gold metal. Paper silver is rising, and it’s pulling up silver metal.

For now.

Charts by: Monetary Metals

Dr. Keith Weiner is the president of the Gold Standard Institute USA, and CEO of Monetary Metals. Keith is a leading authority in the areas of gold, money, and credit and has made important contributions to the development of trading techniques founded upon the analysis of bid-ask spreads. Keith is a sought after speaker and regularly writes on economics. He is an Objectivist, and has his PhD from the New Austrian School of Economics. He lives with his wife near Phoenix, Arizona.

Previous post