In fiscal year 2014, which ended September 30 2014, the Federal government of the United States reported a cumulative deficit of US4 billion, while the total debt outstanding increased by more than a trillion dollars. For fiscal year 2015, the difference was negligible because the US Treasury conducted so called emergency measures to adhere to the Congressional imposed debt ceiling. As soon as Congressional leaders agreed among themselves, the debt ceiling was raised and US debt jumped by a staggering US0bn in one single day. Because H.R.1314 – Bipartisan Budget Act of 2015 took place after fiscal year 2015 ended; debt and deficit statistics appear to make more sense. However, it means the discrepancy between the two will be double in fiscal year 2016 as the debt increase covers two years, while deficit statistics only one. In other words, the Federal government is still running trillion dollar deficits on its way to bankruptcy and ruin. In fact, the cumulative change in deficits (including off-budget items) since 2000 lags that of the cumulative change in debt by more than US trillion. Source: US Treasury Direct, Bureau of the Fiscal Service, Bawerk.

Topics:

Eugen von Böhm Bawerk considers the following as important: Bawerk, Economics, Featured, Finance, newsletter, Politics, US

This could be interesting, too:

Investec writes The Swiss houses that must be demolished

Claudio Grass writes The Case Against Fordism

Nachrichten Ticker - www.finanzen.ch writes Die Performance der Kryptowährungen in KW 9: Das hat sich bei Bitcoin, Ether & Co. getan

Nachrichten Ticker - www.finanzen.ch writes Wer verbirgt sich hinter der Ethereum-Technologie?

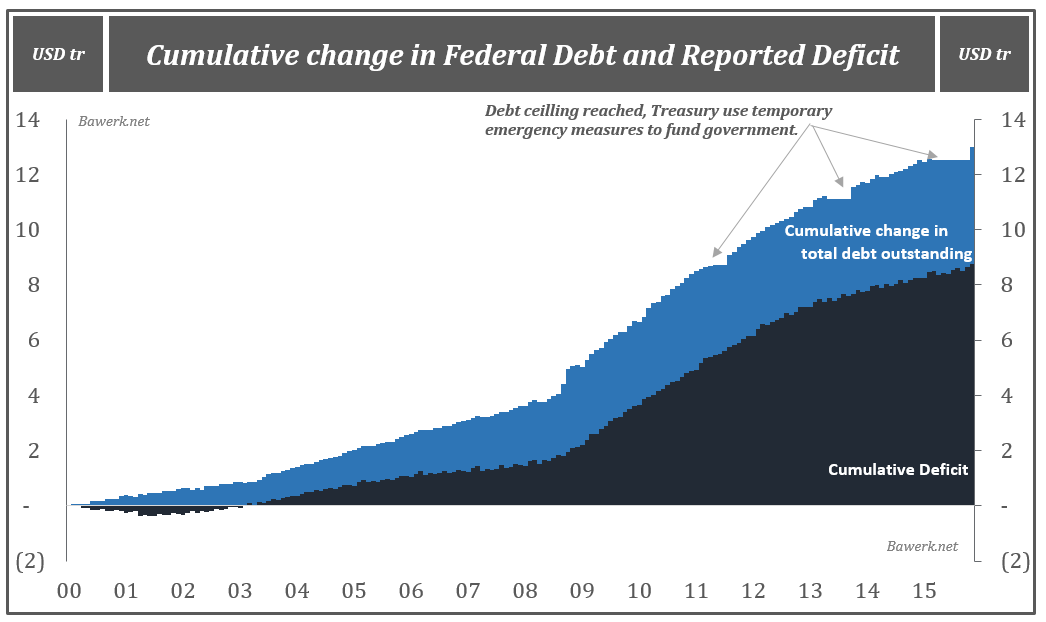

In fiscal year 2014, which ended September 30 2014, the Federal government of the United States reported a cumulative deficit of US$484 billion, while the total debt outstanding increased by more than a trillion dollars. For fiscal year 2015, the difference was negligible because the US Treasury conducted so called emergency measures to adhere to the Congressional imposed debt ceiling. As soon as Congressional leaders agreed among themselves, the debt ceiling was raised and US debt jumped by a staggering US$340bn in one single day. Because H.R.1314 – Bipartisan Budget Act of 2015 took place after fiscal year 2015 ended; debt and deficit statistics appear to make more sense. However, it means the discrepancy between the two will be double in fiscal year 2016 as the debt increase covers two years, while deficit statistics only one. In other words, the Federal government is still running trillion dollar deficits on its way to bankruptcy and ruin.

In fact, the cumulative change in deficits (including off-budget items) since 2000 lags that of the cumulative change in debt by more than US$4 trillion.

Source: US Treasury Direct, Bureau of the Fiscal Service, Bawerk.net

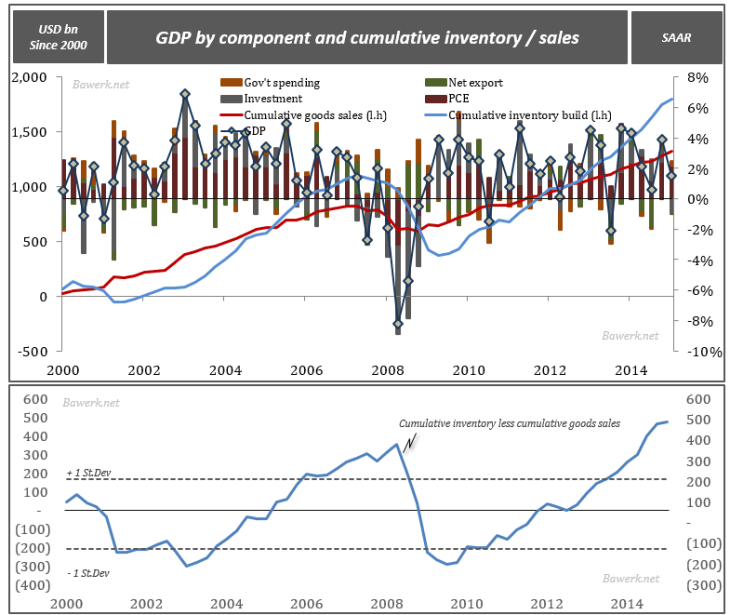

With this massive increase in debt, a weakening economy and the prospect of a tightening cycle from the FOMC we decided to take a closer look on what interest expenses the US government can expect in the next years and how this will change the overall debt and deficit dynamics.

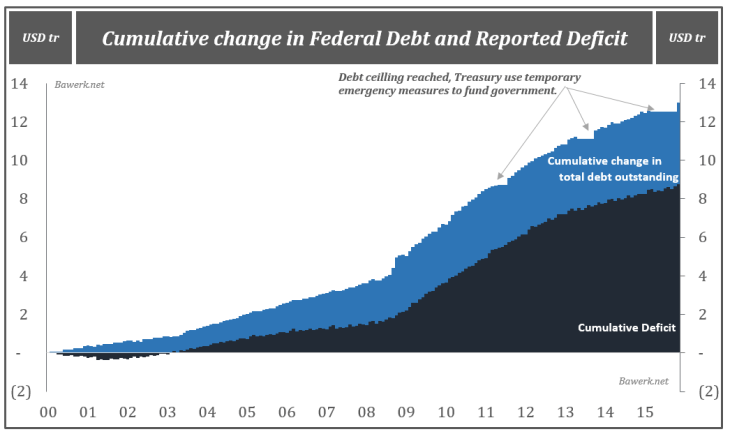

First, based on data from the FRB model (which is by necessity aligned with consensus – See Goebbelnomics for why) we get an idea of where the shorter dated rates are (expected) to be. We also add the so-called shadow rate, which portray the effect QE and forward guidance have had on short-term interest rates, to get a clearer view of the extent ˈstimulusˈ provided during the last years.

Source: Federal Reserve of St. Louis, Federal Reserve Board, Federal Reserve of Atlanta, Bawerk.net

While the Fed Fund Rate have been pegged at zero since December 2008, the shadow-rate fell precipitously up until May 2014, with a notable exception of Bernanke’s infamous 2013 taper tantrum. However, lost on many pundits and uber-bulls is the fact that the shadow rate have already tightened 250 basis points over the last 18 months. Despite pundits’ cluelessness, markets have had their habitual response to monetary tightening – or QE-off – as we have seen several times past. Dollar and TSY strength while stocks are flat lining. Further tightening from the Fed will assuredly lead to a dramatic sell-off in stocks, as they usually do with an 18-24 month lag. Dollar strength is already taking its toll on emerging markets with FX denominated debt, commodity prices and US exports. Further rises in the dollar from here will obviously exacerbate these trends.

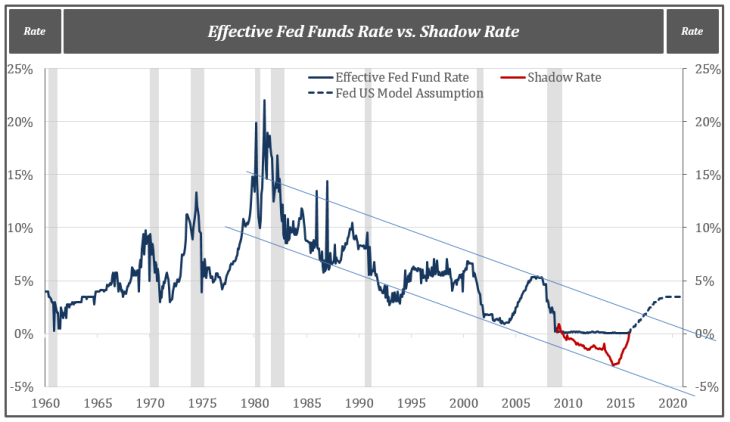

In addition, excess inventory will be liquidated as cost of capital moves up and a manufacturing sector teetering on recession already will surely grind to a halt. Further, the assured yield curve inversion will also help drag the US economy down, as already anaemic bank lending will move into reverse. We would be amiss not to mention to steeply downward trend growth in nominal GDP; with the credit-pushing machine otherwise known as the banking system not fully operational and demand for cash balances remaining high, money incomes are not growing as rapid as they used to. Higher rates of interest will further undermine money income and thus ability to repay debt.

Source: Bureau of Economic Analysis, Bawerk.net

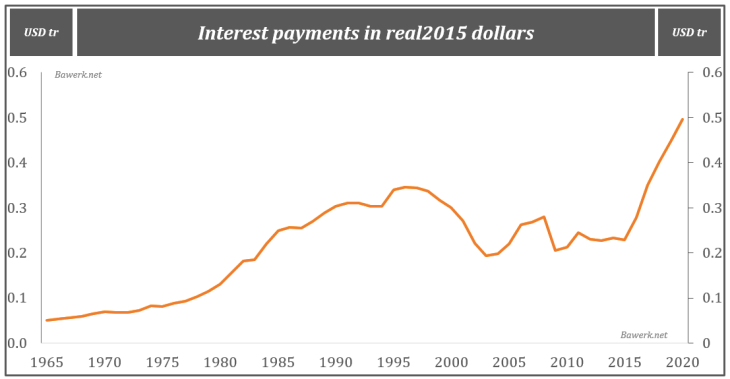

This apply to the government as well. With more than 18 trillion in debt, the Federal Government is highly sensitive to its interest cost. Even with the modest increase in the rate of interest shown in the chart above Federal interest expenses will quickly reach unprecedented levels. With an estimated 17 per cent annual roll over today’s higher rates of interest will be fully baked into the Federal debt by 2022. This means, despite the relatively long average maturity profile on outstanding TSYs, interest expenses will ratchet upward quickly when the rate cycle starts.

Source: Office of Budget Management, Bureau of Economic Analysis, Bawerk.net

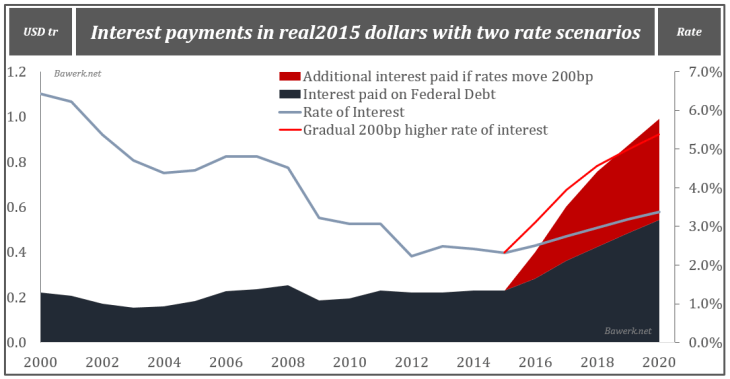

What happens if, say, measured consumer price inflation accelerate upwards and the FOMC once again find themselves hopelessly behind the curve? We did a simple exercise whereby interest paid on outstanding debt – assuming 17 per cent rollover gradually moved 200 basis point above current consensus estimates. Note that this only pushes the 10-year yield to 5.8 per cent, far below its level as recently as 2000. In this exercise we assume shorter dated rates to be lower than longer dated. Needless to say, if 10-year yields would climb inexorably from here that would not be the case as the US economy would be in recession before long and expectations of an abrupt reversal from the Fed would push longer dated yields down below shorter dated.

Anyways, just to get an impression of rate sensitivity on the ZLB consider the following chart;

Source: Office of Budget Management, Bureau of Economic Analysis, Bawerk.net

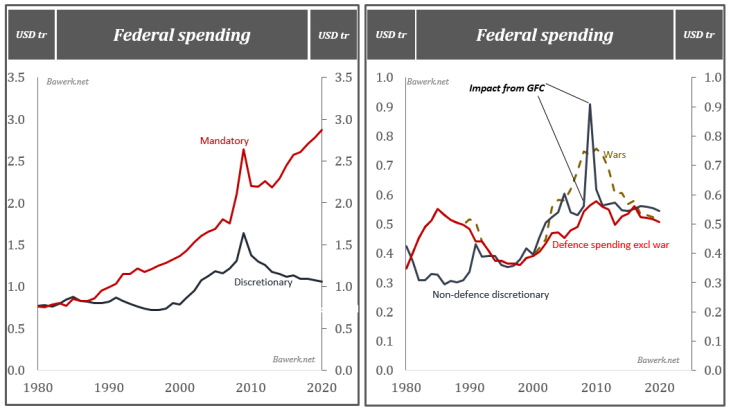

A “normal” rate environment is destined to crush the Federal budget, as they would rake up a trillion in extra debt just to cover their interest expenses. Alternatively dramatic cuts in spending would be necessary, but given the fact that discretionary spending in 2020 is expected to be equal to interest spending in the high-rate scenario there is little room for manoeuvre. The recently passed ˈneutralˈ Bipartisan Budget Act actually increases discretionary spending with all savings expected in 2025. We all know, if market allows, that that can will be kicked down the road when times come. Mandatory spending reform is the most prudent way to minimize the upcoming disaster, but that remain a pipe-dream as a House divided cannot agree on how to address that issue. Tax hikes will drain the productive sector of investable capital and will be as hard as mandatory spending reform to get through the political process.

Source: Office of Budget Management, Congressional Research Service, Bawerk.net

Give the precarious situation, the preferred political route will be inflation and continued low interest rates. The Fed might try to raise rates, but the ramifications on emerging markets, global financial markets, the US main-street economy, inventory liquidation and as shown above Federal finances are so huge that any attempt will be short lived. The FOMC may try 25, 50 or even 75 basis points, but that will be it. FOMC officials should actually cross their fingers for deflation, cause if they are forced to act, suddenly, to counter inflation all hell will break loose.

And that is how the Fed gave away its own independence to the fiscal authority.